Airwallex Acquires OpenPay to Compete with Stripe Billing

Airwallex has acquired OpenPay in a strategic move to expand its global payments ecosystem and directly challenge Stripe Billing. The acquisition strengthens Airwallex’s recurring payments and invoicing capabilities, positioning it as a stronger competitor in the subscription economy. With the rise of SaaS and digital-first businesses, this move gives Airwallex a broader product suite to attract enterprise clients. It also signals further consolidation in the payments and billing sector as fintechs race to offer end-to-end infrastructure. Analysts note this acquisition enhances Airwallex’s global reach, particularly in markets where Stripe is dominant. The deal underscores the increasing importance of integrated billing solutions in fintech’s next growth phase.

Insight of the Day

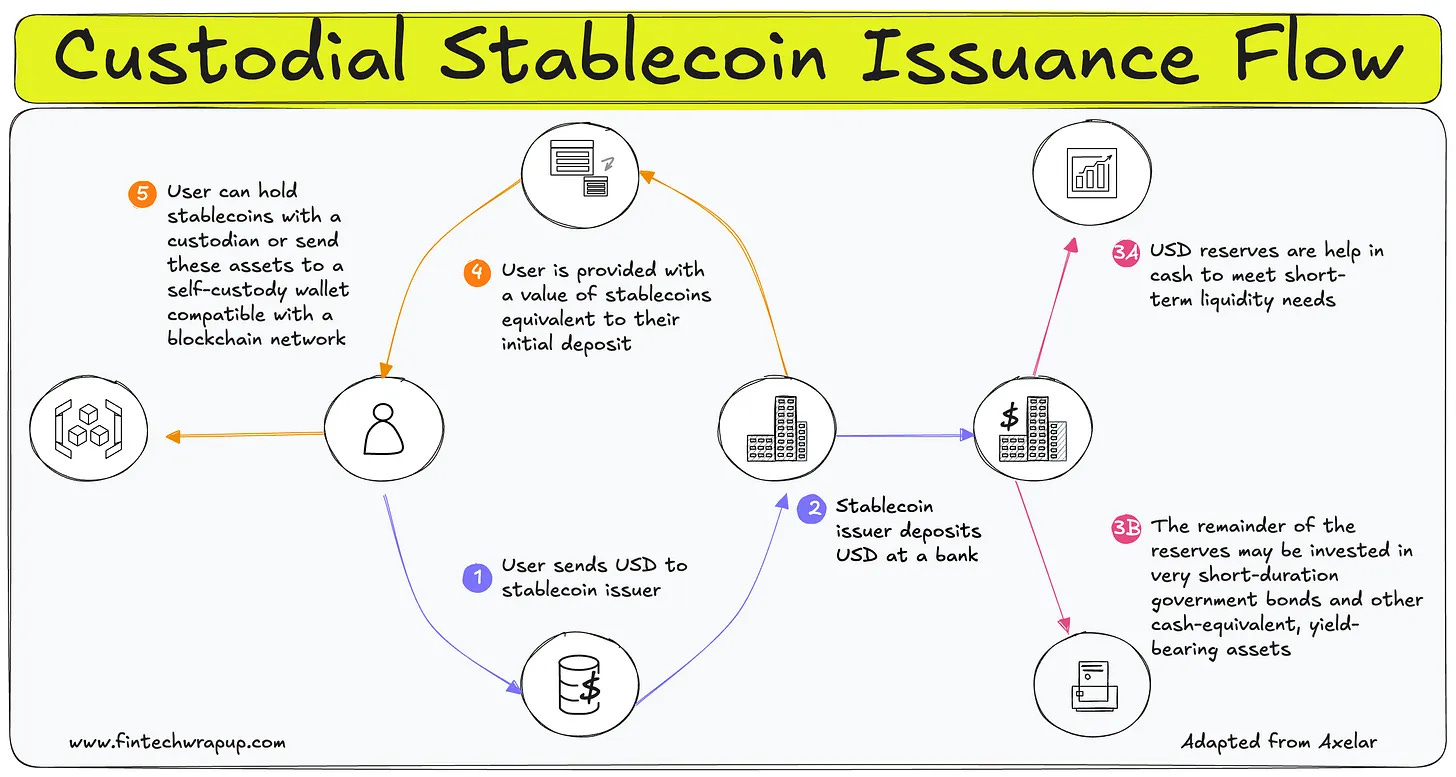

Issuance Flow for Custodial Stablecoins: How It Works

Stablecoins have become one of the most widely used innovations in digital finance, bridging the gap between traditional money and blockchain networks. At their core, custodial stablecoins are digital tokens backed 1:1 by fiat reserves, most often U.S. dollars, held by a regulated issuer. But what does the actual issuance process look like? Let’s break down the flow.

The process begins when a user sends U.S. dollars (USD) to a stablecoin issuer. This could be done through a wire transfer, ACH, or card payment. The issuer is typically a regulated entity, such as Circle (USDC) or Paxos (USDP), which guarantees that each token is fully backed.

Next, the issuer deposits the user’s USD into a bank account. This bank account is typically segregated from the issuer’s own operating funds and managed under strict oversight to ensure transparency and security.

Curated News

💳 Payments

Majority of UK Adults Go Wallet-Free

A new report finds most UK adults no longer carry a wallet or purse, highlighting the rapid adoption of digital payments. The shift underscores the mainstreaming of contactless, mobile, and wearable payment methods.

Source

Stripe Expands with Terminal Launch in Japan

Stripe has rolled out its Terminal product in Japan, enabling businesses to unify in-person and online payments. This marks a major expansion for Stripe in Asia’s third-largest economy.

Source

UK SMEs Lose £6.15bn to Fraud Concerns

UK small businesses lost over £6bn last year due to customer fears of fraud impacting digital transactions. The report highlights the urgent need for stronger fraud prevention and consumer confidence measures.

Source

Safello Adds Trustly as Payment Option

Crypto broker Safello has integrated Trustly, giving users another secure and seamless payment method. The move aims to improve accessibility for retail crypto investors.

Source

🏦 Banking

Chase to Use Nova Credit Cash Flow Data

Chase has partnered with Nova Credit to leverage its cash flow underwriting solutions. This will allow better credit assessments for underserved consumers.

Source

nCino & FullCircl Launch ProBanker in the UK

nCino and FullCircl introduced ProBanker, a solution designed to help UK lenders identify new opportunities while managing portfolio risk. It strengthens digital transformation in commercial banking.

Source

Eltropy Launches AI Voice Agents for Banks

Eltropy introduced AI-powered voice agents to modernize community bank call centers. The tech aims to reduce operational costs and improve customer service.

Source

Odeabank Deploys MX.3 for Risk Compliance

Odeabank successfully implemented MX.3 to meet Fundamental Review of the Trading Book (FRTB) requirements. The move enhances its risk management and compliance infrastructure.

Source

Afin Bank Taps Wolters Kluwer for RegTech

Afin Bank partnered with Wolters Kluwer to enhance its SaaS-based regulatory reporting and risk management. The collaboration strengthens compliance efficiency and scalability.

Source

tbi bank Modernizes Deposits and Credit

tbi bank announced upgrades to its deposit and credit services, aiming to deliver a next-generation customer experience. The revamp reflects a broader push toward digital-first banking.

Source

Amplifi Capital Expands with Open Banking Partner

Amplifi Capital partnered with D•One to enhance its open banking offerings. The collaboration aims to provide more seamless and transparent financial services.

Source

Tesco Expands Access to Cash Across the UK

Tesco Insurance and Money Services renewed partnerships with Loomis and NCR Atleos to expand cash access nationwide. This comes amid ongoing concerns about financial inclusion.

Source

CIMB Vietnam Migrates 1M Cards to Cloud

CIMB Bank Vietnam migrated nearly one million cards to Episode Six’s cloud-native platform in under seven months. The move highlights rapid digital infrastructure adoption in Southeast Asia.

Source

💡 Fintech

PayPal Backs AI Startup Kite

PayPal led a funding round in Kite, an AI startup focused on agentic AI solutions. The investment reflects PayPal’s push into AI-driven fintech innovation.

Source

Kapital Becomes Latin America’s First AI Unicorn

Kapital doubled its valuation to $1.3B, making it the region’s first AI-powered fintech unicorn. The milestone underscores Latin America’s growing fintech ecosystem.

Source

0TO9 Emerges to Build 1,000 Fintechs

Stealth startup 0TO9 has unveiled plans to create 1,000 fintech companies globally by 2045. Its ambitious model aims to accelerate innovation at scale.

Source

Flagright to Strengthen OWNY’s AML Controls

Flagright will enhance OWNY’s anti-money laundering and risk monitoring systems. The partnership underscores the importance of compliance in fintech scaling.

Source

🪙 Crypto

HK Insurer Yunfeng Buys $44M in Ether

Hong Kong insurer Yunfeng, backed by Jack Ma, invested $44 million into Ethereum. The move signals growing institutional adoption of crypto in Asia.

Source

Kea Raises €6M for Crypto-Friendly Banking

Kea secured €6M in an extended seed round at a €40M valuation to grow its crypto-integrated core banking platform. The funding will accelerate its European expansion.

Source

📈 WealthTech

Pave Finance Raises $14M Seed Round

Pave Finance, an AI-powered wealth management software provider, closed a $14M oversubscribed seed round. The platform delivers institutional-grade, personalized investment tools.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a "Source: [Name]" attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.