Alpaca Raises $150M at $1.15B Valuation to Build Global Brokerage Infrastructure

Brokerage infrastructure provider Alpaca has raised $150 million at a $1.15 billion valuation as it accelerates its push to become the global standard for embedded trading and investing. The funding underscores strong investor conviction in fintech infrastructure plays, even amid selective capital markets. Alpaca powers trading capabilities for fintechs, banks, and wealth platforms looking to offer stocks, ETFs, and other assets without building in-house systems. The round positions the company to expand internationally and deepen product capabilities across compliance, clearing, and execution. As more financial platforms move toward embedded finance models, scalable brokerage infrastructure is becoming critical. The raise highlights where capital is still flowing in fintech: foundational platforms with global ambition.

Video of the Day

Insight of the Day

Breaking Down Shopify and Google’s Universal Commerce Protocol

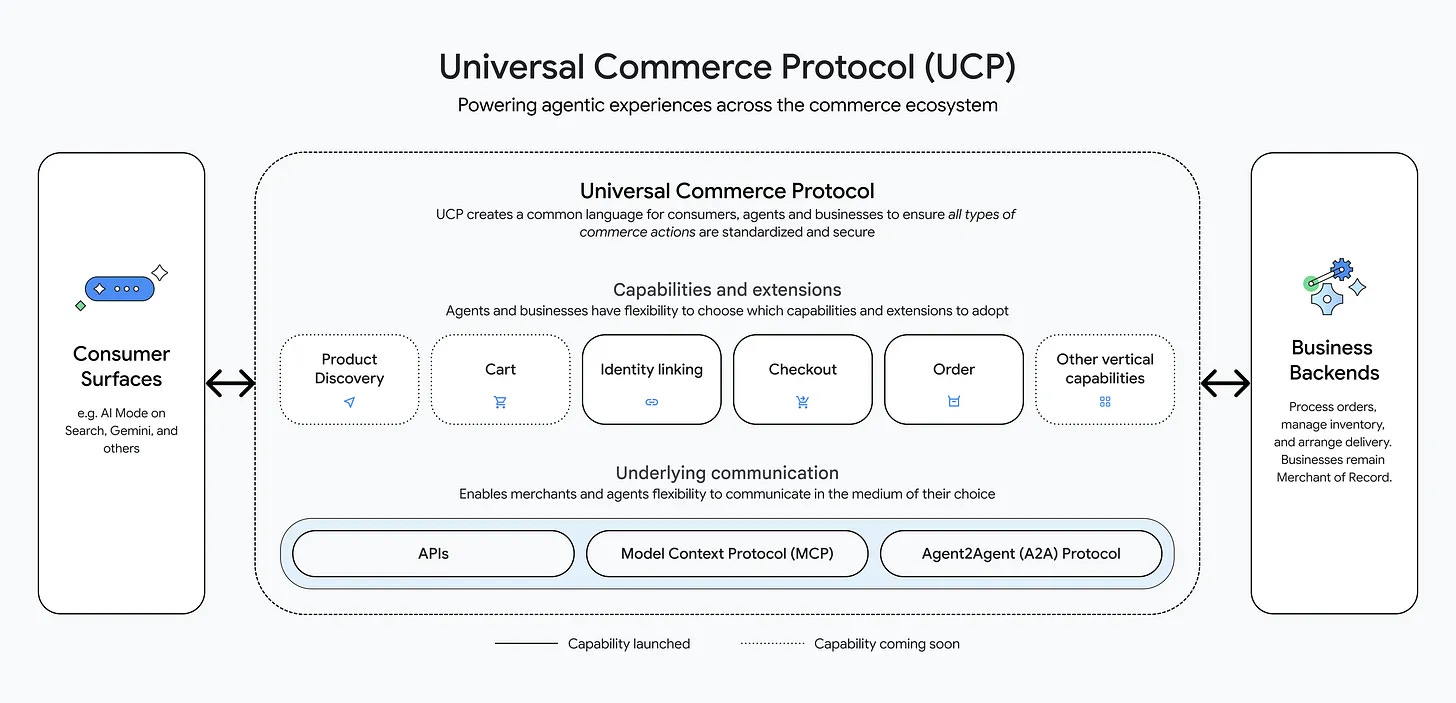

Commerce is messy and complex. The Universal Commerce Protocol (UCP) tackles that complexity head-on by defining a common language for any AI agent to transact with any merchant. Co-developed by Shopify and Google (with backing from 20+ retailers and platforms), UCP is an open standard built to make integrations fast and flexible. In this deep dive, I break down UCP’s architecture, how agents and merchants negotiate capabilities, Shopify’s embedded checkout approach, and how this protocol is powering AI-native commerce across ChatGPT, Google’s Gemini, Microsoft Copilot, and beyond. I also examine how Shopify’s Agentic Catalog opens this ecosystem to every merchant. Let’s get into it.

Curated News

💳 Payments

UK Court Upholds Regulator’s Power to Cap Cross-Border Card Fees

The UK High Court has ruled in favor of the regulator’s authority to cap cross-border card interchange fees. The decision reinforces regulatory oversight of card networks and could lead to lower costs for merchants. It also sets an important precedent for future payments pricing disputes.

Source

PhotonPay Expands UK Payment Rails via ClearBank

PhotonPay has partnered with ClearBank to expand access to UK local payment rails. The collaboration strengthens PhotonPay’s infrastructure for faster and more reliable domestic payments. It highlights growing demand for embedded banking partnerships in cross-border payments.

Source

FTC Blasts Payments Processor Cliq

The US Federal Trade Commission has taken action against payments processor Cliq, alleging deceptive practices. The case underscores increasing scrutiny of payments intermediaries and their compliance obligations. It serves as a warning to fintechs operating in high-risk merchant segments.

Source

🏦 Banking

TBC Uzbekistan Launches TBC Plus Subscription Service

TBC Uzbekistan has introduced TBC Plus, a subscription-based banking service offering bundled financial benefits. The launch reflects a broader shift toward recurring-revenue models in digital banking. It also shows how banks in emerging markets are innovating on customer engagement.

Source

Standard Chartered Completes Digital Bank Guarantee via Komgo

Standard Chartered has executed its first digital bank guarantee using ICC-Swift API standards through Komgo. The transaction demonstrates how standardized APIs can modernize trade finance workflows. It marks a step toward faster, paperless global trade operations.

Source

💼 Fintech

Portage Takes Over Assets from Point72 Ventures’ Fintech Portfolio

Portage has entered an agreement to manage select fintech assets previously held by Point72 Ventures. The move reflects portfolio realignment as venture firms reassess exposure to fintech. It also positions Portage as a more active operator-investor in the sector.

Source

Harvard Federal Credit Union Modernizes Digital Sales with Alkami

Harvard Federal Credit Union has adopted Alkami’s digital sales and service platform to unify member experiences. The deployment aims to streamline onboarding and servicing across channels. It illustrates how credit unions are investing in enterprise-grade fintech platforms.

Source

🪙 Crypto

Nexo Becomes Audi Revolut F1 Team Sponsor

Crypto lender Nexo has signed a four-year sponsorship deal with the Audi Revolut Formula 1 team. The partnership signals renewed confidence in brand-building within crypto after a volatile period for the sector. It also highlights crypto’s continued alignment with global sports marketing.

Source

Nasdaq Warns Bitcoin Miner Canaan Over Delisting

Nasdaq has warned Bitcoin hardware maker Canaan that it risks delisting for failing to meet listing requirements. The development underscores ongoing financial and governance pressures facing crypto-linked public companies. It may further dampen investor sentiment toward mining firms.

Source

Cake Wallet Adds Zcash with Shielded Transactions by Default

Cake Wallet has integrated Zcash with shielded transactions enabled by default. The move strengthens privacy-focused crypto adoption for everyday users. It also reignites debate around privacy coins and regulatory oversight.

Source

Citrea Launches ctUSD Stablecoin with MoonPay

Citrea has announced ctUSD, a new stablecoin issued by MoonPay and powered by M0. The launch reflects continued experimentation with stablecoin infrastructure despite regulatory uncertainty. It also highlights MoonPay’s expanding role beyond fiat on-ramps.

Source

📊 WealthTech

Robinhood Introduces Prediction Market “Custom Combos”

Robinhood has launched “Custom Combos” for its prediction markets, allowing users to bundle outcomes. While the firm avoids calling them parlays, the feature blurs lines between investing and gamified speculation. It raises fresh questions around investor protection and product design.

Source

Cathie Wood Says Bitcoin Is a Better Scarce Asset Than Gold

ARK Invest’s Cathie Wood has reiterated the case for Bitcoin as a superior scarce asset compared to gold. She points to programmability and fixed supply as key advantages. The comments reinforce Bitcoin’s positioning within long-term portfolio allocation debates.

Source

🧠 Other

Hawk Launches Analytics Studio for AI-Driven Fraud and AML

Hawk has unveiled Analytics Studio, a new platform to help financial institutions manage the full lifecycle of AI models for fraud and AML. The tool aims to improve transparency, performance, and governance. It reflects rising demand for explainable and regulator-ready AI.

Source

Feedzai and Matrix USA Partner on AI Crime Prevention

Feedzai and Matrix USA have announced a global partnership to modernize financial crime prevention. The collaboration combines AI-native defenses with enterprise-scale deployment. It signals continued consolidation in the fraud and risk technology space.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.