Ant, HSBC and Swift Advance Tokenised Deposits Using ISO 20022

A major proof-of-concept by Ant International, HSBC, and Swift demonstrates how tokenised deposits can interoperate across networks using the ISO 20022 messaging standard. The initiative showcases how banks could move regulated tokenised value at scale while maintaining compliance and interoperability across rails. This marks a meaningful step toward the institutional adoption of digital money and cross-border settlement modernisation. For a fintech audience, the experiment is notable because it signals both regulatory readiness and industry alignment—two major hurdles for real-world deployment. The PoC also reflects the accelerating convergence of traditional finance, blockchain infrastructure, and payments standards. Its outcomes will likely steer future pilots, standards-setting, and bank-to-bank settlement innovation.

Video of the Day

Insight of the Day

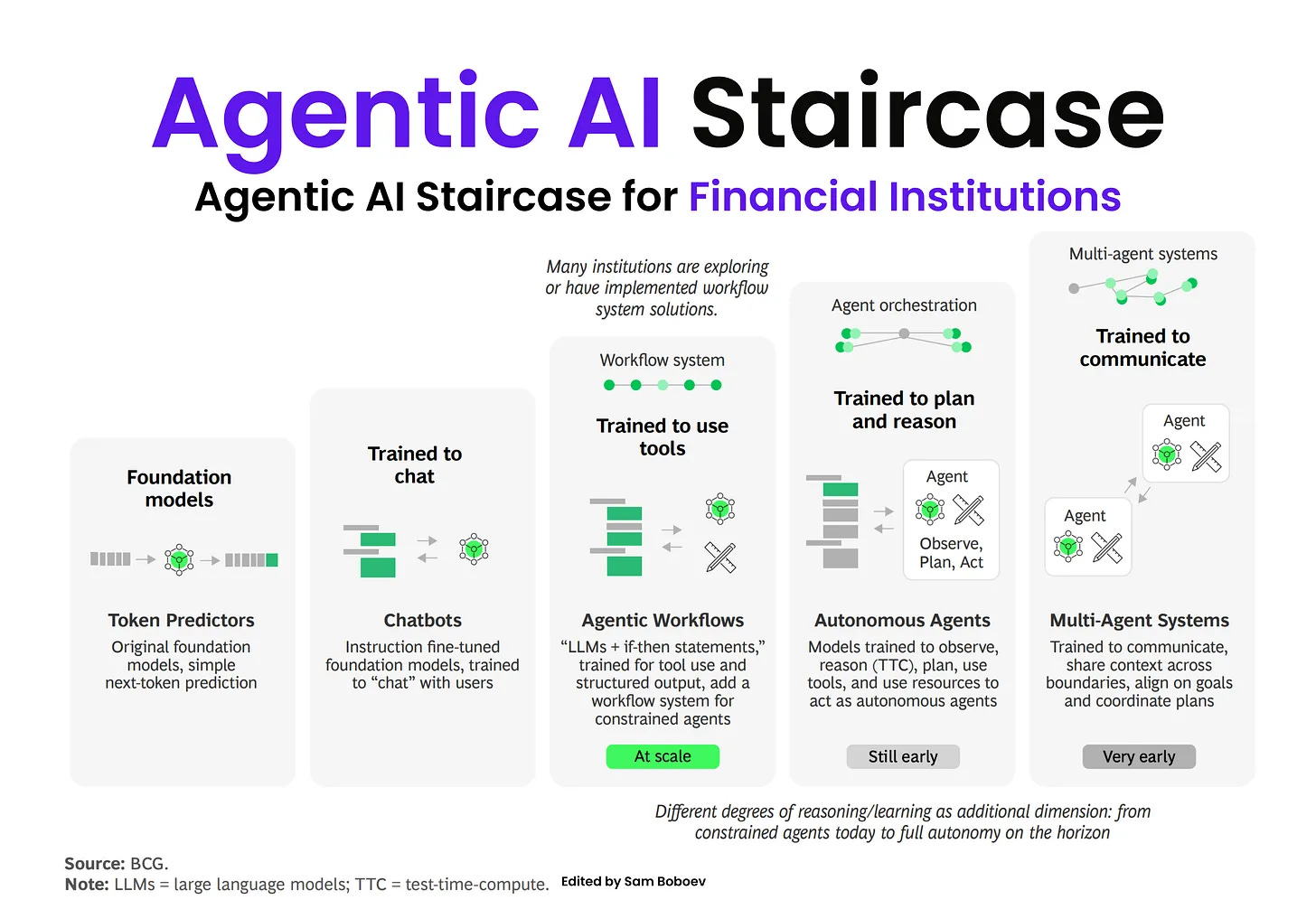

𝐇𝐨𝐰 𝐈 𝐄𝐱𝐩𝐥𝐚𝐢𝐧 𝐭𝐡𝐞 𝐀𝐠𝐞𝐧𝐭𝐢𝐜 𝐀𝐈 𝐒𝐭𝐚𝐢𝐫𝐜𝐚𝐬𝐞 𝐭𝐨 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐓𝐞𝐚𝐦𝐬

I’ve been spending time with BCG’s Retail Banking Report, and Exhibit 7 — the Agentic AI Staircase — is the clearest framework I’ve seen for understanding where banks actually sit today and what AI-first banking really means.

____

Here’s how I explain it when I’m advising teams.

🔹 𝐌𝐨𝐬𝐭 𝐛𝐚𝐧𝐤𝐬 𝐚𝐫𝐞 𝐬𝐭𝐢𝐥𝐥 𝐨𝐧 𝐭𝐡𝐞 𝐟𝐢𝐫𝐬𝐭 𝐭𝐰𝐨 𝐬𝐭𝐞𝐩𝐬

At the bottom, we’re dealing with simple prediction models and chat interfaces. They help answer questions, draft text, and support service teams, but they don’t change how banking works.

A small step up brings tool-enabled models that can pull data, fill forms, or categorize documents. They deliver efficiency, but the operating model stays the same.

These steps are useful, but they don’t move the needle.

____

🔹 𝐑𝐞𝐚𝐥 𝐯𝐚𝐥𝐮𝐞 𝐛𝐞𝐠𝐢𝐧𝐬 𝐰𝐢𝐭𝐡 “𝐀𝐠𝐞𝐧𝐭𝐢𝐜 𝐖𝐨𝐫𝐤𝐟𝐥𝐨𝐰𝐬”

This is the first step where things actually shift. Agents move from helping to doing. They can:

- observe a workflow

- reason about what’s happening

- take the next action using internal systems

Instead of automating tiny tasks, banks start automating entire journeys like onboarding, credit checks, disputes, or KYC case assembly.

This is where banks finally see measurable impact in cycle time, cost, and customer experience.

____

🔹 𝐓𝐡𝐞 𝐫𝐞𝐚𝐥 𝐭𝐫𝐚𝐧𝐬𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧 𝐡𝐚𝐩𝐩𝐞𝐧𝐬 𝐨𝐧 𝐭𝐡𝐞 𝐥𝐚𝐬𝐭 𝐭𝐰𝐨 𝐬𝐭𝐞𝐩𝐬

When banks reach the next stage — Autonomous Agents — agents can operate end-to-end with human oversight. They escalate exceptions, learn continuously, and adapt workflow logic over time.

At the very top sit Multi-Agent Systems, where several agents share context and coordinate across departments. Here’s what changes:

- operations become near-zero marginal cost

- products become continuously adaptive

- the bank shifts from AI-enabled to AI-first

This is the point where cost structure, service model, and competitive advantage reset.

____

🔹 𝐇𝐨𝐰 𝐈 𝐡𝐞𝐥𝐩 𝐭𝐞𝐚𝐦𝐬 𝐠𝐞𝐭 𝐬𝐭𝐚𝐫𝐭𝐞𝐝

Curated News

💳 Payments

Mondu Secures €100M in Debt from J.P. Morgan Payments

Mondu has raised a €100 million debt facility from J.P. Morgan Payments, strengthening its B2B BNPL expansion across Europe. The partnership enhances Mondu’s capital base and signals growing institutional confidence in the B2B payments segment.

Source

Zilch Obtains Payments Licence

Zilch has secured a payments licence, broadening its ability to offer services beyond BNPL and strengthening its regulatory footing in the UK and EU. This positions the company for deeper product expansion and potential new revenue lines.

Source

Mastercard and TenPay Enable Global Remittances to Weixin Pay

Mastercard and TenPay Global have partnered to allow users worldwide to send digital remittances directly to Weixin Pay wallets. The collaboration expands cross-border payment options and strengthens remittance access for China’s massive mobile payments ecosystem.

Source

Apple Pay and Klarna Expand Partnership to France and Italy

Apple Pay and Klarna have expanded their integration to additional European markets, enabling shoppers in France and Italy to use Klarna’s BNPL services within Apple Pay. The move streamlines checkout experiences and broadens BNPL availability in high-spending retail markets.

Source

BIS and Central Banks Test Post-Quantum Payments Security

The BIS and several central banks have launched tests exploring post-quantum cryptography for payments infrastructure. The research aims to ensure financial systems remain secure against future quantum threats, marking a strategic investment in long-term infrastructure resilience.

Source

HBX Group and Mastercard Launch Virtual Payment Programme for Travel

HBX Group and Mastercard are rolling out a virtual payments solution tailored to travel intermediaries, enhancing settlement efficiency and fraud reduction in a high-risk industry. The programme supports global travel commerce by digitising operational and financial workflows.

Source

Mastercard and TerraPay Expand Global Wallet Acceptance

Mastercard and TerraPay have partnered to broaden acceptance for digital wallets worldwide, allowing wallet holders to transact across Mastercard’s network. This bridges closed-loop wallets with global acceptance rails, strengthening financial inclusion and payment interoperability.

Source

MoneyHash and WalaOne Partner on Loyalty and Rewards in Saudi Arabia

MoneyHash and WalaOne are teaming up to expand loyalty and rewards infrastructure for Saudi merchants. The collaboration enhances customer engagement tools as digital commerce accelerates across the region.

Source

🏦 Banking

Bank of England Seeks Business Input on Digital Pound Design

The Bank of England is inviting businesses to contribute feedback on the development of a potential digital pound. The consultation aims to ensure commercial viability and broad industry alignment as the UK evaluates CBDC deployment.

Source

Tandem Bank Appoints New CTO

Tandem Bank has named a new Chief Technology Officer to lead its digital transformation and enhance its technology stack. The appointment reinforces its strategy to scale tech-driven lending and savings products.

Source

Mollie Nears GoCardless Acquisition

Mollie is reportedly close to completing its acquisition of GoCardless, a move that would create one of Europe’s largest bank-to-bank payments providers. The deal would consolidate market share and accelerate product integration across SEPA and open banking rails.

Source

🪙 Crypto

Bitcoin Falls Despite Fed Rate Cuts

Bitcoin is declining even after the US Federal Reserve’s rate cut, driven by profit-taking, market corrections, and broader risk-off sentiment. The movement highlights volatility persistence despite supportive macro signals.

Source

Bhutan Launches Gold-Backed Sovereign Token on Solana

Bhutan has introduced a state-backed digital token on Solana, collateralised by the nation’s gold reserves. The initiative blends sovereign monetary strategy with blockchain infrastructure, signalling emerging-market experimentation with tokenised assets.

Source

Bitcoin Drops Below $90k Amid Tech Market Weakness

Bitcoin has dipped under $90,000 as tech equities face declining forecasts and investor sentiment weakens. The correlation between digital assets and tech sector momentum remains strong, influencing short-term volatility.

Source

💼 Fintech

RockFlow Secures Tens of Millions in New Funding

Singapore-based RockFlow has raised tens of millions of dollars to grow its AI-driven wealth and trading platform. The funds will support product scaling and expansion in Asia’s fast-growing retail investing market.

Source

Airwallex Invests $590M to Expand UK Operations

Airwallex is committing $590 million over five years to deepen its UK and regional footprint, strengthening its cross-border payments and global financial infrastructure capabilities. The investment underscores the UK’s role as a strategic fintech hub.

Source

Ecommpay Achieves Full Digital Accessibility Certification

Ecommpay has received complete approval from the Digital Accessibility Centre for its website and product interfaces. The certification supports inclusive design and aligns with rising regulatory expectations around accessibility in financial services.

Source

PRISM by Pepper Advantage Goes Live

Pepper Advantage has launched PRISM, its new credit and mortgage servicing platform designed to enhance data visibility and automation for lenders. The platform aims to modernise servicing operations and improve portfolio efficiency.

Source

📈 WealthTech

Syfe Achieves Q4 Profit with $2B in Client Returns

Syfe has posted a profitable quarter supported by strong client investment performance amounting to $2 billion in returns. The results demonstrate the resilience of digital wealth platforms amid shifting market dynamics.

Source

📜 Regulation

FIS Research Shows Consumers Feel AI in Finance Is Moving Too Fast

New research from FIS indicates over one-third of UK consumers believe AI adoption in financial services is advancing too quickly. The findings highlight a growing need for consumer education and responsible deployment frameworks.

Source

🏢 Other

Simply Asset Finance Reaches £2B in Loan Originations

Simply Asset Finance has surpassed £2 billion in total loan origination, marking a significant milestone in its SME lending journey. The growth reflects ongoing demand for flexible credit solutions among UK businesses.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.