Ant International Launches the World’s First Iris-Authenticated Smart Glasses Payment Solution

Ant International has unveiled a world-first payment innovation that integrates iris recognition technology into smart glasses, redefining how users authenticate payments. The new solution allows people to make transactions simply by looking at a payment terminal, blending wearable tech with biometric verification for a seamless, secure experience. This development could mark a turning point in contactless payments, eliminating the need for cards or phones entirely. It also reflects Ant’s ambition to expand its global footprint beyond mobile wallets and super apps, moving into hardware-driven financial ecosystems. The technology could prove especially useful for accessibility, enabling secure payments for users unable to use mobile devices. It comes amid rising demand for frictionless, privacy-focused payment methods and underscores Ant’s position at the forefront of biometric fintech innovation.

Video of the Day

Insight of the Day

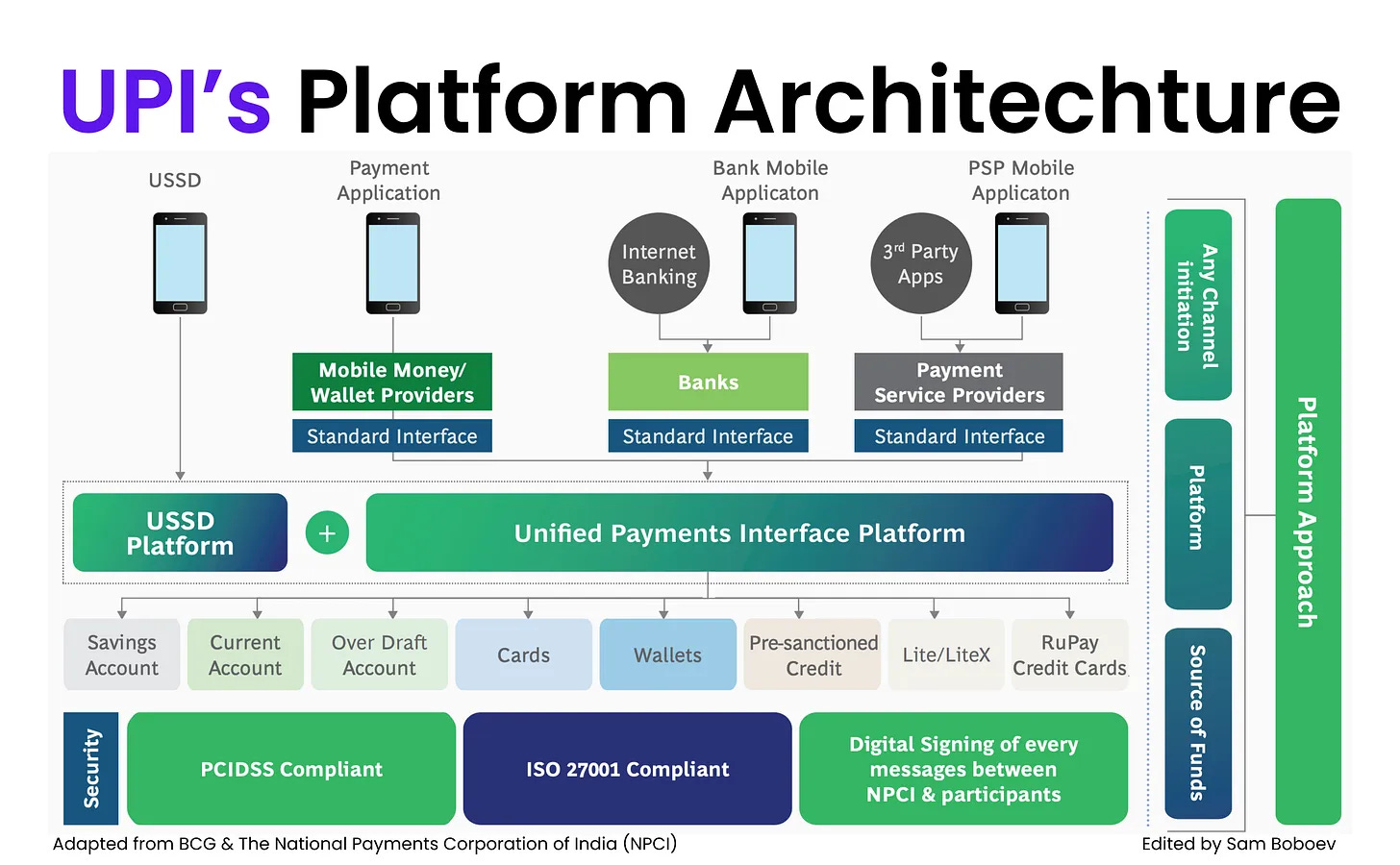

𝐇𝐨𝐰 𝐈𝐧𝐝𝐢a𝐬’𝐬 𝐔𝐏𝐈’𝐬 𝐩𝐥𝐚𝐭𝐟𝐨𝐫𝐦 𝐚𝐫𝐜𝐡𝐢𝐭𝐞𝐜𝐭𝐮𝐫𝐞 𝐢𝐬 𝐛𝐮𝐢𝐥𝐭

Let’s dive in: 👇

🔹 1. Built for Scale

Most payment systems evolve reactively — scaling after demand grows. UPI was built the other way around — for the future, not the present.

Its Active–Active–Active (AAA) architecture runs across three data centers, each capable of handling 200% of live transaction volume.

That means if one site fails, the system doesn’t even flinch — transactions auto-route instantly.

Every node is monitored, self-healing, and horizontally scalable — making it ready to handle a billion transactions per day without breaking a sweat.

🔹 2. Security You Don’t See — But Always Feel

UPI’s design eliminates traditional vulnerabilities like card skimming or data leaks.

Every transaction validates your device + SIM as the first factor, and your UPI PIN as the second.

Under the hood, NPCI runs ML models (random forests, boosting, auto-encoders) to detect anomalies in real time — and even uses graph technology to map and predict fraud patterns across the network.

The result?

A fraud detection framework that’s faster, smarter, and cheaper than traditional card systems — with no compromise on user experience.

🔹 3. Open Source

UPI was built on open-source software and APIs, giving fintechs a free, level playing field. No licensing fees. No vendor lock-in.

That’s why you now see banks, wallets, and even small fintech startups building layers on top of UPI — from credit and insurance to gaming and investments.

This open architecture is what fuels the innovation flywheel. When infrastructure is open, creativity compounds.

Curated News

💳 Payments

Mastercard Expands Stablecoin Payouts with Thunes Partnership

Mastercard has partnered with Thunes to expand stablecoin payout options for global digital wallets, enhancing the speed and reach of cross-border transactions. The move strengthens Mastercard’s blockchain strategy and signals growing momentum for crypto-enabled payments.

Source

Wise and Wealthsimple Partner to Power Global Transfers

Wise Platform is teaming up with Wealthsimple to offer faster, cheaper international transfers for Canadians. The partnership integrates Wise’s multi-currency infrastructure directly into Wealthsimple’s platform, streamlining cross-border payments.

Source

Liquid Group and TerraPay Partner on QR Code Interoperability

Liquid Group and TerraPay are joining forces to enable cross-border QR payment interoperability across Africa and Asia. The initiative aims to expand access to seamless digital payments across regional ecosystems.

Source

🏦 Banking

Cash App Evolves into an Everyday Digital Bank

Cash App is transitioning from a peer-to-peer platform to a comprehensive digital bank, integrating savings, investing, and credit products. This evolution strengthens its position as a leading neobank alternative to traditional financial institutions.

Source

Finmo and Standard Chartered Introduce Global Currency Accounts

Finmo and Standard Chartered are collaborating to launch multi-currency accounts for global businesses. The service simplifies cross-border treasury management, helping firms handle international payments more efficiently.

Source

Ebury Launches App for Global Cash Flow Management

Ebury has launched a new mobile app that helps clients manage global payments, collections, and FX from anywhere. The solution brings real-time visibility and control to business finances.

Source

Nationwide Pledges to Keep Branches Open Until 2030

UK’s Nationwide Building Society has committed to keeping all its branches open through 2030, standing out in a sector that’s rapidly digitizing. The move reinforces its community and customer-first banking model.

Source

💰 Fintech

Zilch Raises $175 Million to Accelerate Growth

BNPL provider Zilch has secured over $175 million to expand operations and develop new products. The round underscores investor confidence in responsible credit innovation amid tighter fintech regulation.

Source

Addi Secures $71 Million Credit Line for Expansion

Latin American fintech Addi has raised a $71 million credit facility from Goldman Sachs, Fasanara Capital, and BBVA Spark. The funding supports its buy-now-pay-later and merchant financing growth.

Source

District Cover Raises $6M to Insure Urban Businesses

Insurtech startup District Cover has raised $6 million to expand digital insurance access for small urban businesses. Its tech-driven approach helps streamline policy management and claims.

Source

UK Banks Lag Behind Fintechs in AI Adoption

A new study finds 80% of UK banks believe fintechs are outpacing them in AI innovation. The gap highlights rising competitive pressure on incumbents to modernize.

Source

🪙 Crypto

Telcoin Becomes First Regulated Digital Asset Bank in the U.S.

Telcoin has become the first company approved to operate a regulated digital asset bank in the United States. The milestone bridges traditional banking and blockchain, paving the way for crypto-native institutions.

Source

Discovery Bank Integrates Crypto via Luno Partnership

Discovery Bank has partnered with Luno to bring crypto trading directly to its users. The move signals growing mainstream adoption of digital assets in South Africa.

Source

Circle Launches On-Chain FX Engine for Stablecoin Trading

Circle has introduced an on-chain FX engine on its Arc Network, enabling faster and more transparent cross-border stablecoin conversions. The tool strengthens Circle’s role in the tokenized payments infrastructure.

Source

Nasdaq-Listed Solana Firm to Tokenize Shares via Superstate

A Nasdaq-traded Solana company plans to tokenize its shares using Superstate’s blockchain technology, bridging traditional equity markets and digital asset ecosystems.

Source

💼 WealthTech

Profile Software Expands Axia Suite for Affluent Investors

Profile Software has upgraded its Axia Suite with next-generation wealth management features tailored to retail and mass-affluent clients. The move reflects growing demand for digitally personalized investment tools.

Source

⚖️ Regulation

MAS and Deutsche Bundesbank Collaborate on Tokenisation Framework

The Monetary Authority of Singapore (MAS) and Deutsche Bundesbank have signed an MoU to advance tokenisation and cross-border settlement projects. The collaboration could establish interoperable standards for digital asset markets across continents.

Source

MAS Releases AI Risk Management Guidelines

Singapore’s MAS has issued comprehensive AI risk management guidelines for financial institutions, emphasizing fairness, transparency, and accountability. It’s part of a broader effort to ensure ethical AI use in finance.

Source

🌐 Other

Southeast Asia’s Digital Economy on Track for $1 Trillion by 2030

A new report projects Southeast Asia’s digital economy will surpass $1 trillion by 2030, driven by fintech, e-commerce, and rapid digital adoption. The region remains a leading hub for financial innovation and inclusion.

Source

Central Banks Collaborate on Synchronised FX Settlement

The central banks of England, Thailand, and Singapore are working together to test synchronised FX settlements, aiming to reduce transaction risks and delays in global transfers.

Source

Visa Develops Trust Protocol for Agentic Commerce

Visa is developing a trust protocol for AI-driven agentic commerce, setting new standards for transparency and security in autonomous digital transactions.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.