Ant International, Standard Chartered, and Swift Join Forces on Bank-to-Wallet Payments

Ant International, Standard Chartered, and Swift have announced a strategic collaboration to streamline bank-to-wallet payments worldwide. The partnership aims to bridge gaps between traditional banking systems and digital wallets, offering users faster, more secure, and cost-effective cross-border transactions. By leveraging Swift’s global network, Ant’s Alipay+ wallet reach, and Standard Chartered’s banking infrastructure, the initiative is expected to drive greater financial inclusion across emerging markets. The move underscores a growing trend of interoperability between banks and fintechs, reflecting demand for seamless global money movement. It also signals heightened competition among providers seeking dominance in cross-border payments. Analysts believe the initiative could challenge incumbents like Visa and Mastercard while empowering smaller financial institutions to tap into new corridors.

Insight of the Day

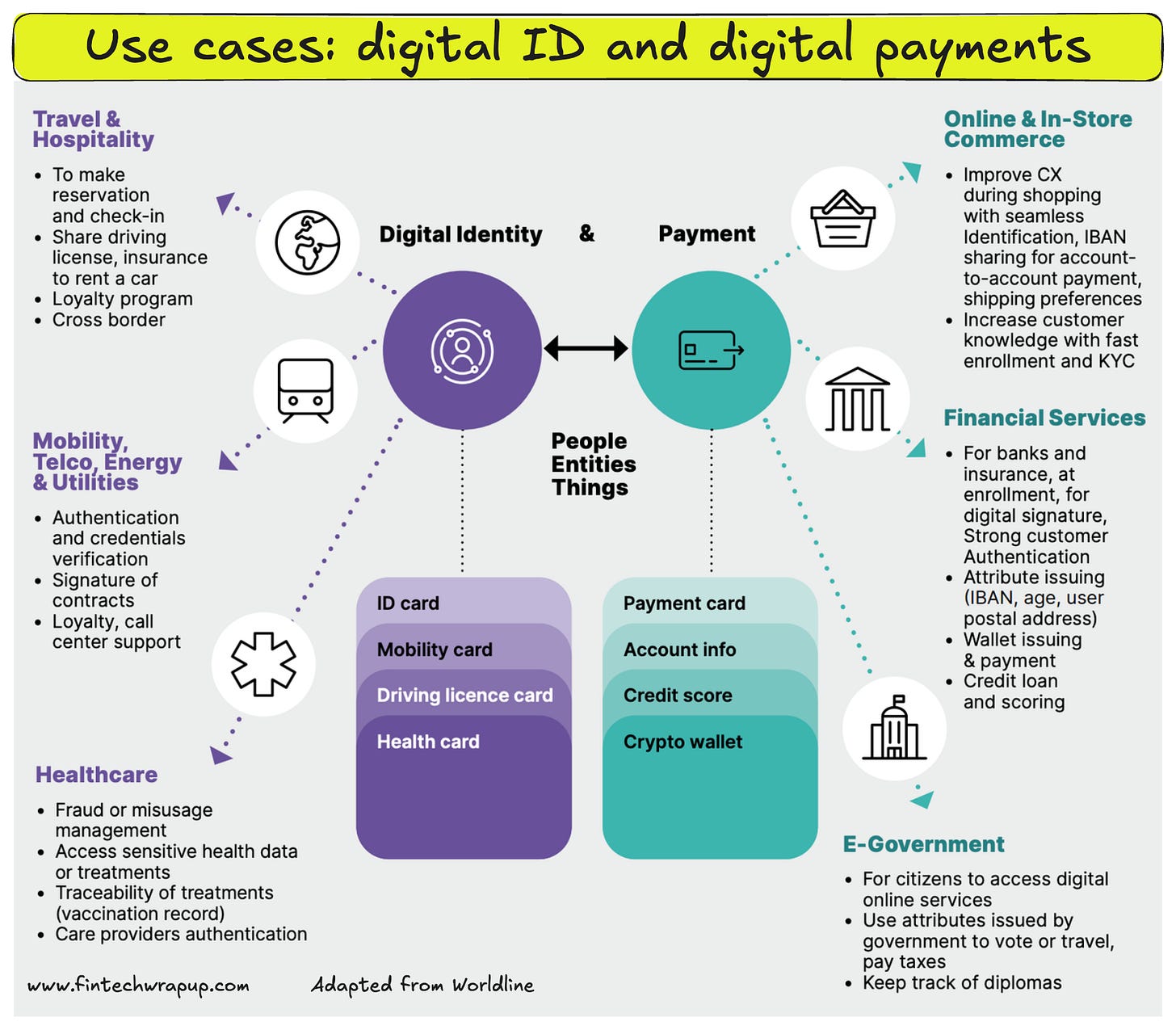

Can Digital Identification Enable Seamless, Secure and Borderless Digital Services and Payments?

The rapid evolution of the global digital society is unstoppable. With it comes a tremendous demand for secure digital identification—a foundation that touches every sector, from banking and healthcare to retail and mobility. The challenge is balancing two opposing forces: offering a frictionless user experience that boosts conversion rates, while maintaining robust security to fight fraud.

Today, identity still takes many forms: paper, plastic, QR codes, and increasingly, biometrics. But the question is—what comes next? Will digital identification unlock standardisation, cross-border acceptance, and universal adoption? And more importantly, are we ready for it—whether as consumers, businesses, or regulators?

🔹 Standardisation of Identity

Several countries have already launched national digital ID programs. The European Union is leading the charge with eIDAS 2.0, a regulation that will grant every EU citizen access to a digital identity wallet under their control. This wallet will store trusted attributes such as a driver’s licence, age, or diploma, usable across both public and private services. Acceptance by service providers will be mandatory, creating a harmonised framework across all Member States.

Curated News

💳 Payments

Tazapay Secures Ripple and Circle Investment for Cross-Border Expansion

Tazapay raised strategic backing from Ripple and Circle to enhance its cross-border payments platform. The funding signals growing confidence in digital-first solutions for global commerce, particularly for SMEs.

Source

Aspire Slashes Payroll Transfer Fees for Singapore Firms

Aspire has reduced payroll transfer costs to help local businesses lower operational expenses. The move is expected to support SMEs managing tight margins amid rising competition.

Source

PayNearMe Expands into Texas with Dallas Office

PayNearMe opened a new office in Dallas’ business district to strengthen its U.S. presence. The expansion reflects its commitment to scaling payment solutions for enterprises and government agencies.

Source

🏦 Banking

HSBC and First Direct Apps Go Down, Locking Out Customers

A technical outage left HSBC and First Direct customers unable to access accounts via mobile apps. The disruption highlights the fragility of digital banking infrastructure and its impact on customer trust.

Source

NatWest Manager Spared Jail After Stealing £344k from ATM

A NatWest bank manager who embezzled £344,000 from a cash machine avoided jail time. The case raises questions over internal controls and fraud prevention at major banks.

Source

Relay Steps in to Serve SMB Banking Needs

Relay is targeting small and mid-sized businesses overlooked by traditional banks. The company’s tailored digital solutions aim to close the service gap left by larger institutions.

Source

Malaysia Launches Ryt Bank, the World’s First AI-Powered Bank

Malaysia has unveiled Ryt Bank, a fully AI-driven institution positioned as the world’s first. The bank aims to revolutionize customer service and risk management through automation.

Source

📊 Fintech

Zopa Invests in Workforce Upskilling for GenAI Era

UK-based Zopa is launching a company-wide upskilling program to prepare staff for generative AI adoption. The initiative reflects the sector’s race to harness AI-driven efficiencies.

Source

WEX Partners with Trulioo for Fraud-Proof Onboarding

WEX has teamed up with Trulioo to enhance digital onboarding and fraud prevention across Europe. The collaboration strengthens trust and compliance in cross-border financial services.

Source

Unit21 Launches “Build Your Own Agents” to Fight Financial Crime

Unit21 has unveiled customizable AI-powered agents to help firms detect and prevent fraud. The tool gives compliance teams greater flexibility in combating evolving threats.

Source

VANTIR Debuts with Mission to Transform Prop Trading

Prop trading startup VANTIR launched with a focus on transparency and trader trust. Its platform promises fairer terms and innovative tools for professional traders.

Source

🪙 Crypto

Circle and Finastra Form Stablecoin Alliance for Banks

Circle and Finastra have partnered to integrate stablecoin payments into banking systems. The collaboration aims to accelerate blockchain adoption in cross-border finance.

Source

Hemi Labs Raises $15M to Expand Bitcoin Programmability

Hemi Labs secured $15 million in funding to advance its blockchain network focused on Bitcoin programmability. The project could unlock new applications and DeFi use cases on Bitcoin.

Source

Rain Enables Yield-Bearing Stablecoin Spending in LATAM

Crypto exchange Rain added support for Dinari’s USD+, letting users spend a yield-bearing stablecoin across Latin America. The move reflects the region’s growing appetite for crypto-based financial products.

Source

Gemini Introduces Staking Services in UK

Gemini has launched crypto staking for UK customers, expanding access to passive income opportunities in digital assets. The move strengthens its competitive positioning in Europe.

Source

Google Prepares ‘Universal Ledger’ Blockchain Rivaling Circle and Stripe

Google is developing a Layer-1 blockchain, dubbed the “Universal Ledger,” while Circle and Stripe plan competing chains. The move signals big tech’s deepening push into financial infrastructure.

Source

💰 WealthTech

Cyrannus Expands VC Platform with Investor Access

Cyrannus has enhanced its venture capital platform by adding new investor access features. This upgrade aims to improve funding efficiency and broaden participation in early-stage deals.

Source

lemon.markets and Pleo Launch Embedded Treasury Investment Account

lemon.markets and Pleo have partnered to offer an “Investment Account” feature for corporates. The product helps companies earn returns on unused treasury funds while keeping liquidity accessible.

Source

eToro Brings Nordic Stocks to Global Users in Real Time

eToro became the first non-Nordic broker to provide real-time access to Nasdaq Nordic stocks. The move enhances its offering for international retail investors.

Source

📜 Regulation

Nearly 500 Victims Caught in Fake FCA Recovery Scams in 2025

Nearly 500 individuals fell victim to fraudsters posing as FCA recovery agents this year. The scams highlight persistent challenges regulators face in combating financial crime.

Source

💼 Other

Temasek’s SeaTown Raises $612M for Private Credit Fund

SeaTown, an affiliate of Temasek, closed its third private credit fund at $612 million. The fund underscores growing investor appetite for alternative lending strategies.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a "Source: [Name]" attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.