Banks Could Lose $170B to AI Disruption, McKinsey Warns

A new McKinsey report warns that AI-driven automation and shifting customer expectations could erode up to $170 billion in bank profits annually. While AI adoption can significantly reduce costs and improve decision-making, many banks remain burdened by legacy technology and slow transformation cycles. The consultancy says winners will be those that aggressively redesign processes around AI rather than simply layering tools on top of outdated systems. Customer-facing areas like lending, fraud prevention and personalized engagement are expected to see the most value creation. However, banks that fail to keep pace could see margins compress as fintechs and digital-first competitors move faster. The report emphasizes that urgency, not experimentation, will define competitive advantage. In the end, AI won’t just improve banking — it will separate leaders from laggards.

Video of the Day

Insight of the Day

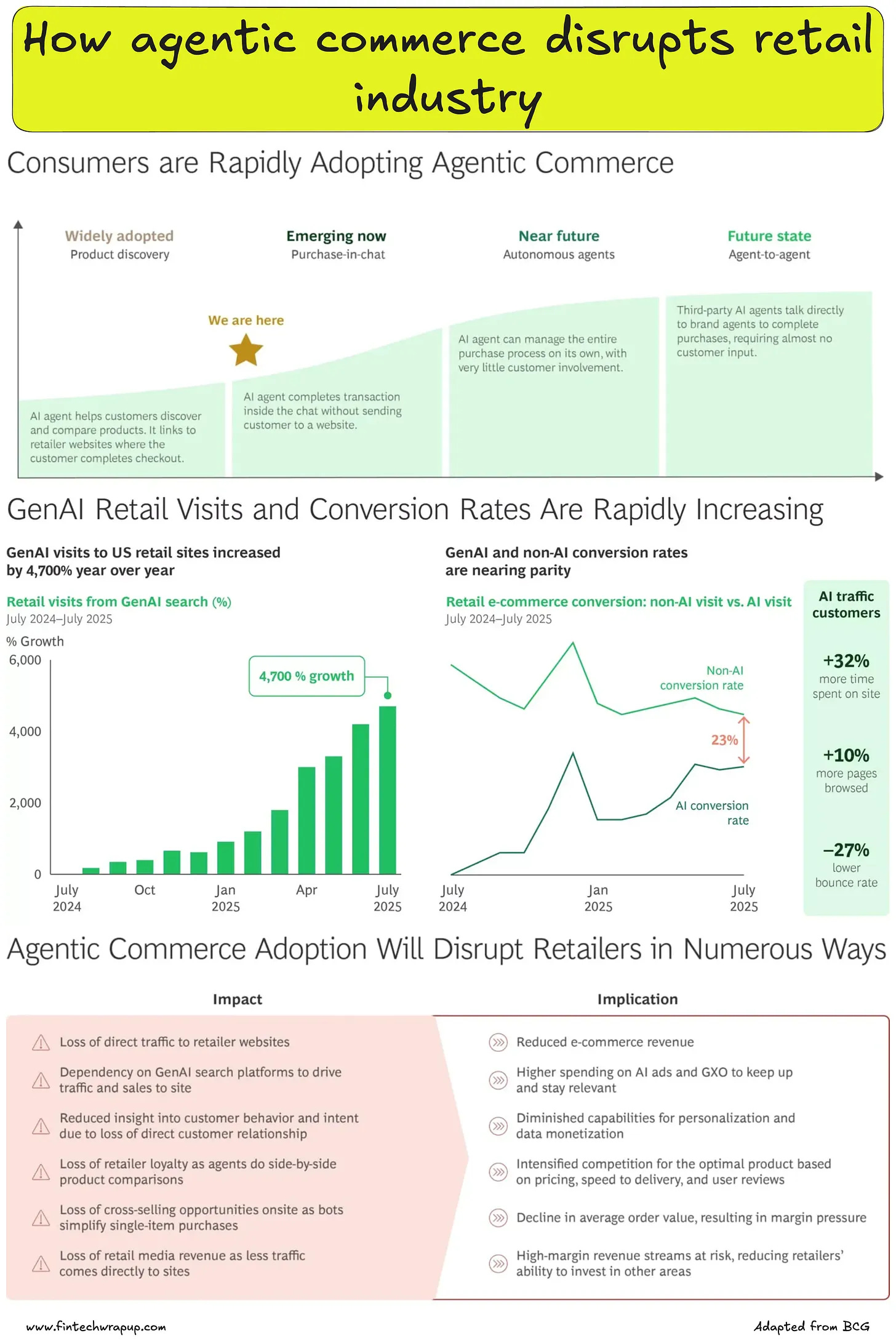

The rise of agentic commerce and threats to retailers

AI shopping agents are reshaping digital commerce by automating what once required active consumer effort. Instead of manually searching and comparing, users now rely on agents that scan multiple platforms, filter results by preferences, compare prices and features, and make context-aware recommendations.

As trust grows, these agents are starting to complete transactions—checking delivery times, applying stored payment details, and finalizing purchases autonomously. The result? A frictionless, conversational shopping experience requiring minimal human input.

Adoption is accelerating fast. Traffic to U.S. retail sites from GenAI browsers and chat services surged 4,700% year-over-year in July 2025, per Adobe. These users also engage more—spending 32% more time, viewing 10% more pages, and showing a 27% lower bounce rate.

Major players like Perplexity, ChatGPT, and Google Gemini are racing to embed commerce features. Perplexity launched Buy with Pro, enabling in-chat purchases, and integrated Firmly AI, connecting merchants directly. A partnership with PayPal now powers seamless checkout inside the chat.

ChatGPT introduced Instant Checkout, letting users complete purchases within the chat window—starting with Etsy and expanding to Shopify merchants soon. Meanwhile, Google’s AI Mode is evolving beyond browsing and comparison to include price tracking and direct checkout via Google Pay.

Curated News

💳 Payments

Finix & Interac Expand Merchant Payment Options in Canada

Finix teams up with Interac to broaden digital payment capabilities for merchants across Canada, improving transaction flexibility and customer choice. This could strengthen Finix’s North American footprint as competition intensifies.

Source

Worldpay Adds Tap to Pay on iPhone for SwipeSimple Merchants

Worldpay now enables SwipeSimple merchants to accept contactless payments directly on iPhones, removing the need for additional hardware. The move supports continued mobile-first growth among small businesses.

Source

Worldpay Integrates Affirm for SaaS Embedded Payments

By bringing Affirm’s BNPL option into its embedded payments suite, Worldpay is helping SaaS platforms offer flexible consumer financing at checkout. The integration may boost conversion and broaden merchant adoption.

Source

Alchemy Pay & dLocal Enable Instant Bank Transfers in Argentina

Alchemy Pay partners with dLocal to roll out fast, bank-based payments in Argentina, tackling local FX and infrastructure constraints. This helps global merchants reach Latin American customers more effectively.

Source

Finzly Deploys Agentic AI Across Payments Operations

Finzly is embedding agentic AI into its products to automate payment workflows and reduce manual intervention. The upgrade aims to increase speed and accuracy for financial institutions modernizing their infrastructure.

Source

🏦 Banking

Citigroup’s Jane Fraser Becomes Chair, Receives $25M Stock Award

Citi CEO Jane Fraser is now also chair of the board, consolidating leadership as the bank continues restructuring. The stock package signals confidence in her long-term turnaround strategy.

Source

Pave Bank Raises $39M to Build First “Programmable Bank”

Pave aims to architect infrastructure that enables smart contract-based banking services, blending compliance with Web3 functionality. The raise supports product build-out and regulatory go-to-market execution.

Source

FintechOS Hits 50% ARR Growth, Expands in Banking & Insurance

FintechOS reports continued international expansion and rising ARR, driven by banks modernizing digital experiences. Its low-code approach helps institutions accelerate transformation while containing costs.

Source

Grasshopper Bank Launches Innovator Term Loan for SMB Growth

Grasshopper introduces a new credit product designed to fuel capital access for growing small businesses in innovation-led sectors. The offering positions the digital bank to capture more commercial lending demand.

Source

Bizcap Acquires AI-Driven Funding Platform

Australian lender Bizcap has purchased an AI-powered underwriting platform to expand its ability to serve riskier SME borrowers. The acquisition strengthens data-driven lending capabilities.

Source

🪙 Crypto

Canadian Regulator Fines Cryptomus C$177M

A major Canadian watchdog has issued a C$177M penalty against crypto payments firm Cryptomus for compliance failures. The enforcement highlights increasing global scrutiny of crypto AML controls.

Source

Fireblocks Acquires Dynamic to Expand Web3 Developer Tools

Fireblocks is broadening its developer stack through the acquisition of Dynamic, enabling more seamless authentication and MPC wallet infrastructure for on-chain apps. This accelerates enterprise-grade blockchain tooling adoption.

Source

Hong Kong Approves First Solana ETF

Hong Kong regulators have greenlit the first Solana-based ETF, expanding institutional access beyond Bitcoin and Ethereum. It signals further diversification in regulated crypto investment products.

Source

Melania-Coin Wallets Receive $1.2M Airdrop

Wallets tied to the “Melania Trump” meme coin unexpectedly received $1.2M worth of Meteora tokens via airdrop. The episode underscores the unpredictable — and sometimes lucrative — nature of meme-economics.

Source

📈 WealthTech

Plynk Launches Military-Focused Investing Services

Plynk introduces a new initiative supporting active-duty military and veterans with education-backed investing tools. The company aims to close financial literacy gaps in underserved communities.

Source

🧩 Fintech

LSEG Invests in Post-Trade Solutions

The London Stock Exchange Group is partnering and investing in Post Trade Solutions to enhance clearing, risk management, and post-trade efficiencies. It supports modernization efforts amid rising volumes and regulatory demand.

Source

Riverchain Raises $5M to Scale Across Southeast Asia

Hong Kong fintech Riverchain secures fresh capital to expand its operational footprint into Southeast Asia. The company focuses on blockchain-anchored trade and supply chain solutions.

Source

Domino Helps Enterprises Scale AI ROI

Domino launches a solution designed to help enterprise IT maximize the impact of AI investments while reducing operational costs. The platform targets organizations struggling with AI deployment at scale.

Source

📜 Regulation

NYDFS Publishes Guidance on Third-Party Cyber Risks

New York regulators have issued fresh guidance requiring financial institutions to strengthen oversight and risk controls over technology vendors. The update underscores growing concern over supply-chain vulnerabilities.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.