Barclays Invests in Stablecoin Settlement Firm Ubyx to Advance Tokenised Payments

Barclays has taken a strategic equity stake in Ubyx, a stablecoin settlement company aiming to make digital currencies interoperable with traditional banking infrastructure. The investment signals growing confidence among global banks that stablecoins will play a core role in future payment and settlement rails. Ubyx is focused on enabling banks to issue, redeem, and settle stablecoins at scale, reducing fragmentation across networks. For Barclays, the move strengthens its position in institutional digital assets and programmable money. It also reflects a broader industry shift from experimentation toward real-world deployment of tokenised cash. As regulatory clarity improves, partnerships like this could accelerate stablecoin adoption across cross-border and wholesale payments.

Video of the Day

Insight of the Day

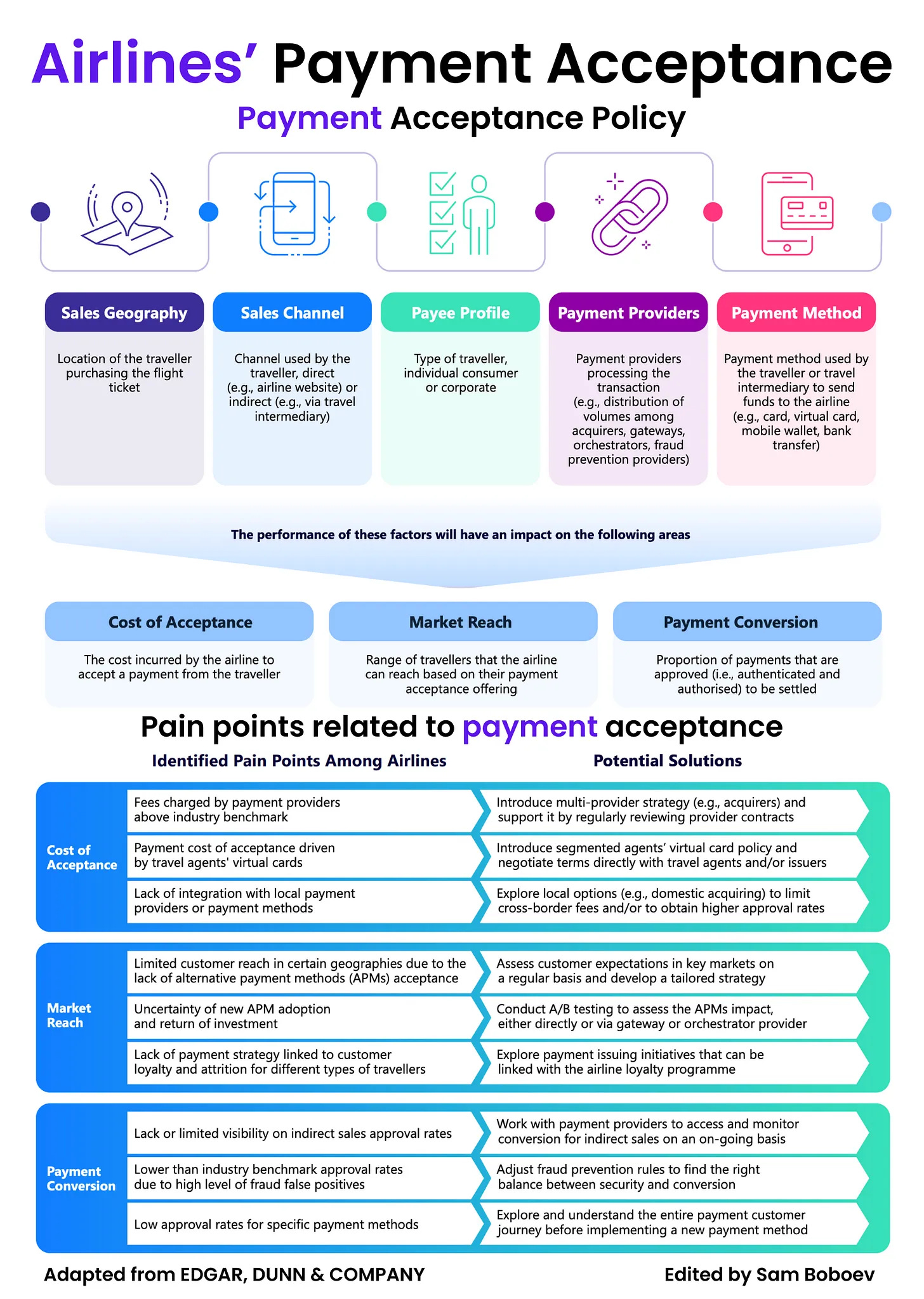

𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐀𝐜𝐜𝐞𝐩𝐭𝐚𝐧𝐜𝐞 𝐈𝐬 𝐍𝐨𝐰 𝐚 𝐒𝐭𝐫𝐚𝐭𝐞𝐠𝐢𝐜 𝐋𝐞𝐯𝐞𝐫 𝐟𝐨𝐫 𝐀𝐢𝐫𝐥𝐢𝐧𝐞𝐬

Over the past few years, especially following COVID, airlines have significantly changed how they approach payment acceptance. What was once treated as a back-office function is now recognised as a strategic capability that directly affects revenue, cost, and market reach.

Historically, most airlines optimised payments mainly for direct channels such as their website or mobile app. Today, that approach is no longer sufficient. A rising share of airline sales flows through indirect channels, including online travel agencies, travel management companies, and GDS or NDC connections. This shift has increased complexity and pushed airlines to manage payment acceptance more proactively across channels and markets.

I came across EDC very recently. Through its work with airlines globally, EDC observes a clear move away from one-size-fits-all payment acceptance policies. Airlines increasingly account for sales geography, customer and payee profiles, preferred local payment methods, and the payment providers processing transactions. This flexibility is essential, as payment acceptance policies underpin the airline’s broader payments strategy and directly influence cost of acceptance, conversion rates, and market coverage.

---

Despite differences in size, region, and business model, similar pain points appear consistently across airlines.

One common challenge is limited visibility into payment performance data. Without detailed insights, airlines struggle to identify where revenue is being lost. In several cases, deeper analysis revealed significant card decline issues in specific markets that had gone unnoticed.

Another recurring issue is insufficient collaboration with payment providers. Payment problems require close coordination with acquirers, issuers, and processors. Airlines that maintain strong, proactive relationships with these partners are better positioned to resolve issues quickly and stabilise approval rates.

A third challenge is the need for more client-centric payment strategies. Customer expectations vary widely between leisure travelers, small businesses, and corporate buyers. Meeting these expectations requires internal payments expertise, modern technology, and the ability to adapt rapidly to changing conditions.

---

EDC’s experience shows that payment acceptance is not a set-and-forget capability. Airlines that continuously review and refine their payment acceptance approach are better equipped to optimise costs, protect revenue, and unlock new growth opportunities.

Payment acceptance may operate behind the scenes, but when managed effectively, it becomes a powerful driver of airline performance.

Curated News

💳 Payments

Aevi and Verifone Team Up to Scale In-Person Payments Worldwide

Aevi and Verifone have announced a global partnership to simplify and scale in-person payment experiences for merchants. The collaboration combines Verifone’s hardware footprint with Aevi’s software platform to accelerate innovation at the point of sale.

Source

Blink Payment Launches Card-Present API for In-Store Transactions

Blink Payment has introduced a new Card Present API designed to help businesses integrate in-person payments more easily. The launch targets merchants looking to unify online and offline payment experiences with less development effort.

Source

Indonesia’s QR Code Payments on Track to Reach 17 Billion Transactions

QR code payments in Indonesia are projected to hit 17 billion transactions by 2026, highlighting rapid adoption of account-to-account payments. The growth underscores Southeast Asia’s leadership in mobile-first payment innovation.

Source

🏦 Banking

Bunq Reapplies for US Banking Licence

Dutch neobank Bunq has reapplied for a US banking licence after previously withdrawing its application. The move signals renewed ambition to expand internationally and tap into the US fintech market.

Source

Zilch Acquires Lithuanian Lender to Secure EU Banking Licence

BNPL provider Zilch has acquired a Lithuanian lender to obtain a European banking licence. The deal strengthens Zilch’s regulatory footing and supports its expansion beyond payments into broader financial services.

Source

Revolut in Talks to Acquire Turkish Lender FUPS

Revolut is reportedly in discussions to acquire Turkish fintech lender FUPS. The potential deal would deepen Revolut’s presence in emerging markets and enhance its local banking capabilities.

Source

Starling Bank Highlights Key Habit of Britain’s Best Savers

Starling Bank has revealed research identifying a simple money habit shared by the UK’s most successful savers. The findings reinforce the role of behavioural nudges and digital tools in personal finance outcomes.

Source

🧠 Fintech

Modulr Expands into the US Through Strategic FIS Partnership

Payments fintech Modulr is entering the US market via a partnership with FIS. The move enables Modulr to bring its account-to-account payment capabilities to US businesses at scale.

Source

CaixaBank Launches Dedicated Artificial Intelligence Office

CaixaBank has created a centralized AI Office to accelerate adoption of artificial intelligence across the bank. The initiative aims to improve efficiency, risk management, and customer experience.

Source

SmartSearch Acquires Credas to Strengthen Digital Compliance

SmartSearch has completed the acquisition of Credas, expanding its digital identity and compliance capabilities. The deal reflects continued consolidation in RegTech as firms seek end-to-end compliance solutions.

Source

Marqeta Appoints Patti Kangwankij as CFO

Marqeta has named Patti Kangwankij as its new Chief Financial Officer. The appointment comes as the payments platform focuses on profitability and disciplined growth.

Source

Zeitro Launches Scenario AI for Mortgage Origination

Mortgage fintech Zeitro has unveiled Scenario AI, a tool designed to improve borrower qualification and loan structuring. The product highlights growing AI adoption in lending workflows.

Source

🪙 Crypto

Lloyds Executes First UK Tokenised Deposit on Public Blockchain

Lloyds has completed the UK’s first tokenised deposit transaction on a public blockchain. The milestone demonstrates how traditional banks are testing blockchain for real-world settlement use cases.

Source

JPMorgan Expands JPM Coin onto the Canton Network

JPMorgan is launching JPM Coin on the Canton Network, a blockchain designed for institutional finance. The move strengthens on-chain settlement for wholesale and cross-border transactions.

Source

Bitcoin ETFs See $243M Outflows as Market Rally Slows

Bitcoin ETFs recorded $243 million in outflows as the recent crypto rally cooled. The data points to cautious sentiment among institutional investors.

Source

Metaplanet Confirms $451M Bitcoin Treasury Investment

Japanese firm Metaplanet has confirmed a $451 million Bitcoin purchase for its corporate treasury. The move mirrors a growing trend of companies using crypto as a balance-sheet asset.

Source

Kontigo Reimburses Users After $340K USDC Hack

Venezuela-focused neobank Kontigo has repaid customers following a $340,000 USDC hack. The response underscores the operational and security risks facing crypto-enabled neobanks.

Source

💰 WealthTech

Raindrop Reunites UK Savers with £675M in Lost Pension Pots

Pension-tracing platform Raindrop helped UK savers recover more than £675 million in lost pensions last year. The figures highlight the growing impact of WealthTech on long-term savings outcomes.

Source

🏛️ Regulation

Zilch and Bunq Pursue Banking Licences to Strengthen Regulatory Standing

Recent licence applications by Zilch and Bunq underscore how fintechs are prioritising regulatory approval to unlock growth. Banking licences remain a key strategic asset for scaling financial platforms.

Source

🌍 Other

Brazilian Fintech PicPay Files for US IPO

Brazil’s PicPay has filed for a US IPO, marking a significant milestone for Latin American fintech. The listing reflects continued investor interest in high-growth emerging market platforms.

Source

Indonesian Job Platform Pintarnya Secures $14M Credit Facility

Pintarnya has raised a $14 million credit facility to support growth of its job-matching platform. The deal shows how embedded finance is supporting non-financial digital platforms.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.