Binance Secures First Global Crypto License Under ADGM Framework

Binance has become the first cryptocurrency exchange to obtain a global license under Abu Dhabi Global Market’s (ADGM) regulatory framework, marking a major milestone for crypto regulation. The license allows Binance to operate across jurisdictions under a robust, regulator-backed digital asset regime. This move strengthens Binance’s credibility with institutions and policymakers alike, while positioning ADGM as a leading hub for compliant crypto innovation. It also signals increasing regulatory clarity for global crypto markets at a time when many exchanges are struggling with fragmented oversight. For the broader industry, this sets a new benchmark for licensing and governance standards worldwide.

Video of the Day

Insight of the Day

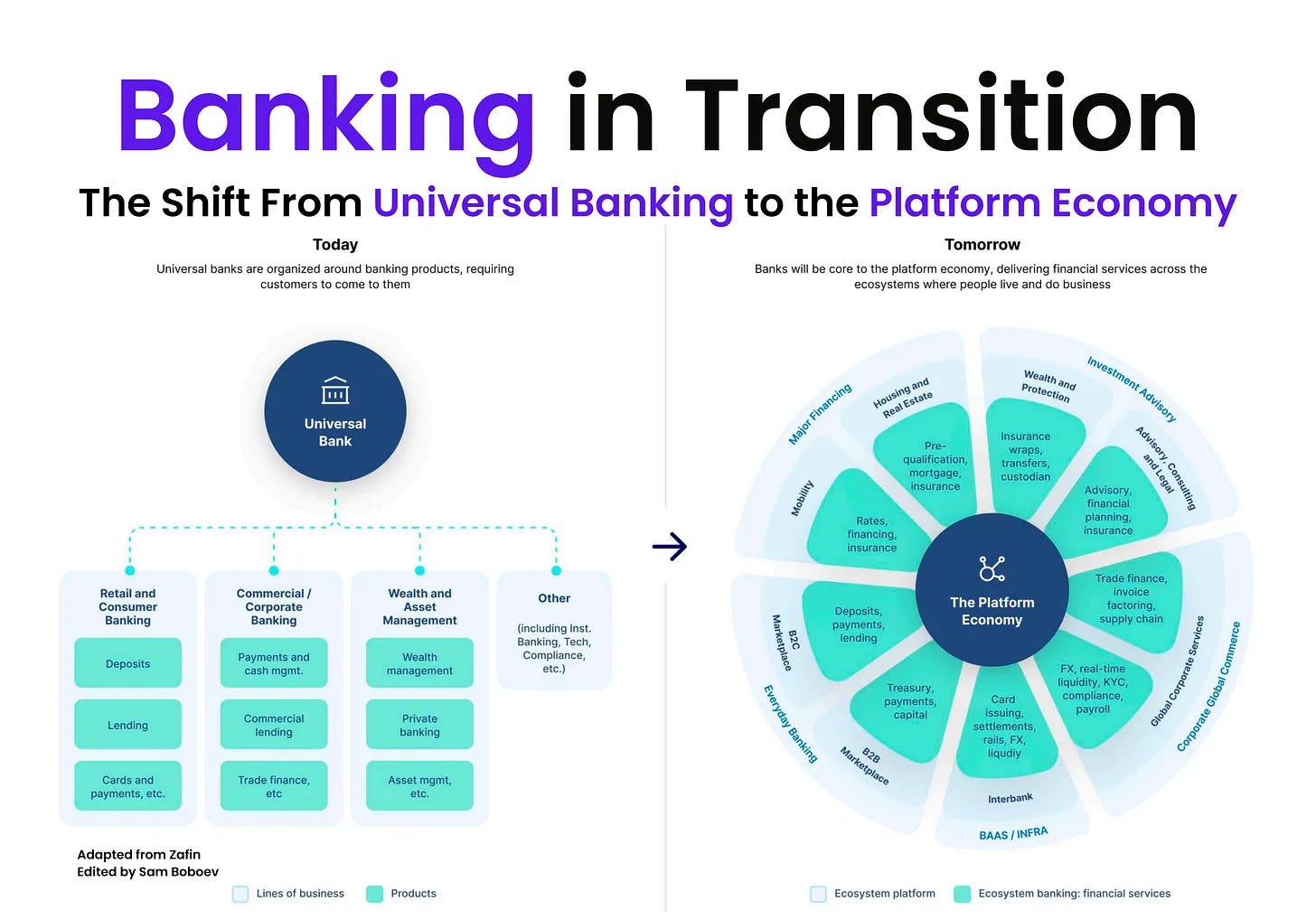

𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐭𝐡𝐞 𝐬𝐡𝐢𝐟𝐭 𝐟𝐫𝐨𝐦 𝐮𝐧𝐢𝐯𝐞𝐫𝐬𝐚𝐥 𝐛𝐚𝐧𝐤𝐢𝐧𝐠 𝐭𝐨 𝐭𝐡𝐞 𝐩𝐥𝐚𝐭𝐟𝐨𝐫𝐦 𝐞𝐜𝐨𝐧𝐨𝐦𝐲

I have been thinking a lot about how financial services are changing. The biggest shift today is not only about technology. It is about where value gets created. We are moving from institutions that owned products to platforms that orchestrate outcomes.

You can see this everywhere.

In consumer finance, platforms already lead the experience. Chime for deposits. Venmo for payments. Wise for cross-border. Robinhood for investing.

In business finance, software is becoming the front door. Toast, Jane, Brex and Ramp embed payments, cards and credit directly into workflows. Stripe and Adyen have turned acquiring, issuing and treasury into API-first building blocks.

Banks still power the regulated rails behind all this. Deposits, lending, settlement. But the customer relationship is shifting to the platforms that own the journey. Finance used to be a destination. Today it is embedded in apps, marketplaces and conversations.

Think about Uber. Drivers can hold and spend earnings inside the app without touching a traditional bank. Or Starbucks, where customers preload billions of dollars that behave like deposits. These platforms do not simply process payments. They own the experience and the data.

👉 𝐇𝐞𝐫𝐞 𝐢𝐬 𝐭𝐡𝐞 𝐬𝐡𝐢𝐟𝐭 𝐢𝐧 𝐬𝐢𝐦𝐩𝐥𝐞 𝐭𝐞𝐫𝐦𝐬.

Today, most banks are organised around internal products. Deposits, lending, payments, wealth. Customers come to the bank to use them.

Tomorrow, the same capabilities will be distributed across platforms. Financial services will show up inside the digital places where people live and work.

👉 𝐓𝐡𝐢𝐬 𝐢𝐬 𝐰𝐡𝐚𝐭 𝐈 𝐜𝐚𝐥𝐥 𝐞𝐜𝐨𝐬𝐲𝐬𝐭𝐞𝐦 𝐛𝐚𝐧𝐤𝐢𝐧𝐠.

Ecosystem banking is how banks use their scale and trust to create and capture value in the platform economy. It means delivering financial capabilities directly inside the experiences that customers already use.

𝐓𝐡𝐞 𝐦𝐨𝐝𝐞𝐥 𝐬𝐢𝐭𝐬 𝐨𝐧 𝐚 𝐬𝐩𝐞𝐜𝐭𝐫𝐮𝐦.

• White-labeled infrastructure providers power services behind the scenes.

• Branded partners provide visible, integrated services inside external platforms.

• Full platform owners combine both the financial capability and the customer experience.

Curated News

💳 Payments

Visa to Relocate European Headquarters to Canary Wharf

Visa plans to move its European headquarters to London’s Canary Wharf, reinforcing the UK’s position as a major global payments hub post-Brexit. The move reflects Visa’s long-term commitment to Europe and signals continued investment in regional innovation and partnerships.

Source

Worldline Sells Swedish Payments Platform CoreOrchestration

Worldline has sold its Swedish payments platform CoreOrchestration as part of its portfolio optimization strategy. The divestment allows Worldline to sharpen its focus on core growth areas while streamlining operations.

Source

Socure Acquires Qlarifi to Enable Real-Time BNPL Credit Decisions

Socure has acquired Qlarifi to create what it calls the first real-time BNPL credit system. The deal aims to reduce fraud, improve affordability checks, and make BNPL safer and cheaper for both consumers and merchants.

Source

TenPay Global and Mastercard Partner on Cross-Border Weixin Pay Remittances

TenPay Global and Mastercard have partnered to enable faster international remittances into Weixin Pay wallets. The collaboration improves cross-border payment speed and security for users sending money into China.

Source

🏦 Banking

Airwallex Targets ‘Borderless’ Banking as Valuation Reaches $8B

Airwallex is doubling down on its borderless banking vision following a valuation jump to $8 billion. The fintech is positioning itself as a global alternative to traditional cross-border banking services for businesses.

Source

CommBank Launches National AI and Cyber Skills Program for SMEs

Commonwealth Bank has launched a nationwide initiative to boost AI, cybersecurity, and digital skills for one million small businesses. The program reflects growing recognition that SME digital capability is critical to economic resilience.

Source

Aldermore Bank Undertakes Cloud-Native Treasury Transformation

Aldermore Bank has partnered with Publicis Sapient and Murex to modernize its treasury operations using cloud-native technology. The transformation aims to improve scalability, risk management, and operational efficiency.

Source

🪙 Crypto

UK Targets Crypto Sanctions Evasion in New Anti-Corruption Strategy

The UK government has unveiled a new anti-corruption strategy that explicitly targets crypto-based sanctions evasion. The move highlights increasing scrutiny of digital assets in national security and financial crime enforcement.

Source

Coinbase Reopens India Access, Targets Cash-to-Crypto by 2026

Coinbase has reopened access to its platform in India, signaling renewed confidence in the market. The exchange aims to support cash-to-crypto onramps by 2026 amid growing local adoption.

Source

Strategy Makes $1B Bitcoin Purchase in Largest Buy in Months

Strategy has invested nearly $1 billion in Bitcoin, marking its biggest BTC acquisition in several months. The move reinforces institutional confidence in Bitcoin as a long-term treasury asset.

Source

Robinhood Eyes Indonesia as Crypto Adoption Surges

Robinhood is considering expansion into Indonesia, driven by rapidly increasing crypto adoption in the country. Southeast Asia continues to emerge as a key growth region for digital asset platforms.

Source

Bybit and Circle Partner to Expand Global USDC Access

Bybit and Circle have partnered to increase global access to the USDC stablecoin. The collaboration supports broader stablecoin usage in trading, payments, and cross-border transactions.

Source

📈 WealthTech

Groww Secures License for Online Bond Distribution in India

Indian investment platform Groww has reportedly received a license to distribute bonds online. The approval expands retail investor access to fixed-income products in one of the world’s fastest-growing markets.

Source

Moneybox Partners with Amundi to Launch Low-Cost Pension Funds

Moneybox has teamed up with Amundi to launch three low-cost investment funds for pension customers. The move strengthens Moneybox’s long-term savings and retirement offering.

Source

📜 Regulation

FCA Unveils Package to Boost UK Investment Culture

The UK’s Financial Conduct Authority has announced a landmark reform package aimed at encouraging greater retail investment. The measures are designed to improve access, confidence, and participation in financial markets.

Source

🧩 Other

Tuhk Raises $6M Seed Round to Scale Operations

Tuhk has raised $6 million in seed funding to accelerate product development and market expansion. The round highlights continued investor appetite for early-stage fintech innovation.

Source

Noah and Portal Bring Bank Accounts and Payouts to Wallets

Noah and Portal have partnered to embed bank accounts and payout capabilities directly into digital wallets. The integration blurs the line between traditional banking and Web3 infrastructure.

Source

Poor Data Quality Poses Risk to AI Ambitions in Fintech

A new report warns that poor data quality is undermining AI initiatives across payments and fintech firms. The findings stress that clean, structured data is critical for successful AI deployment.

Source

YouLend and Upwork Expand Financing Access for U.S. Freelancers

YouLend and Upwork have partnered to improve access to financing for U.S. freelancers, funding $1 million in the first few months. The collaboration addresses cash-flow challenges in the growing gig economy.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.