BNPL for car repairs, Bumper bags $11m

A BNPL fintech for car servicing and repairs has raised $11m in an equity funding round. Called Bumper, the Sheffield and London-based startup has raised the funds in a Series B extension.

A BNPL fintech for car servicing and repairs has raised $11m in an equity funding round. Called Bumper, the Sheffield and London-based startup has raised the funds in a Series B extension.

The funding round was led by Autotech Ventures, with investment from a raft of leading names in the car industry. These include Jaguar Land Rover’s InMotion Ventures, Suzuki Global Ventures, Porsche Ventures and Shell Ventures.

Bumper, founded in 2013, aims to tackle what it says is a big pain point in motoring: unexpected repair bills. Be it a failed MOT or accident damage, it says many drivers face bills of £500 or more with no warning. Bumper's proposition allows customers to split the costs into interest-free payments through their dealership or garage.

Bumper will use the funding to scale its BNPL service for drivers across Europe, while expanding its offering to dealers and original equipment manufacturers (OEMs). Bumper has expanded to Spain, Germany, the Netherlands and Ireland, with further expansion planned.

Bumper has relationships with 5,000 dealerships and garages and works with leading automotive brands, including Volkswagen, Ford, Nissan, Volvo, Seat, Audi, Skoda, Jaguar Land Rover and Porsche.

Bumper carried out a £40m funding round in January last year. It is thought to have raised around $85m in total.

Insight of the Day

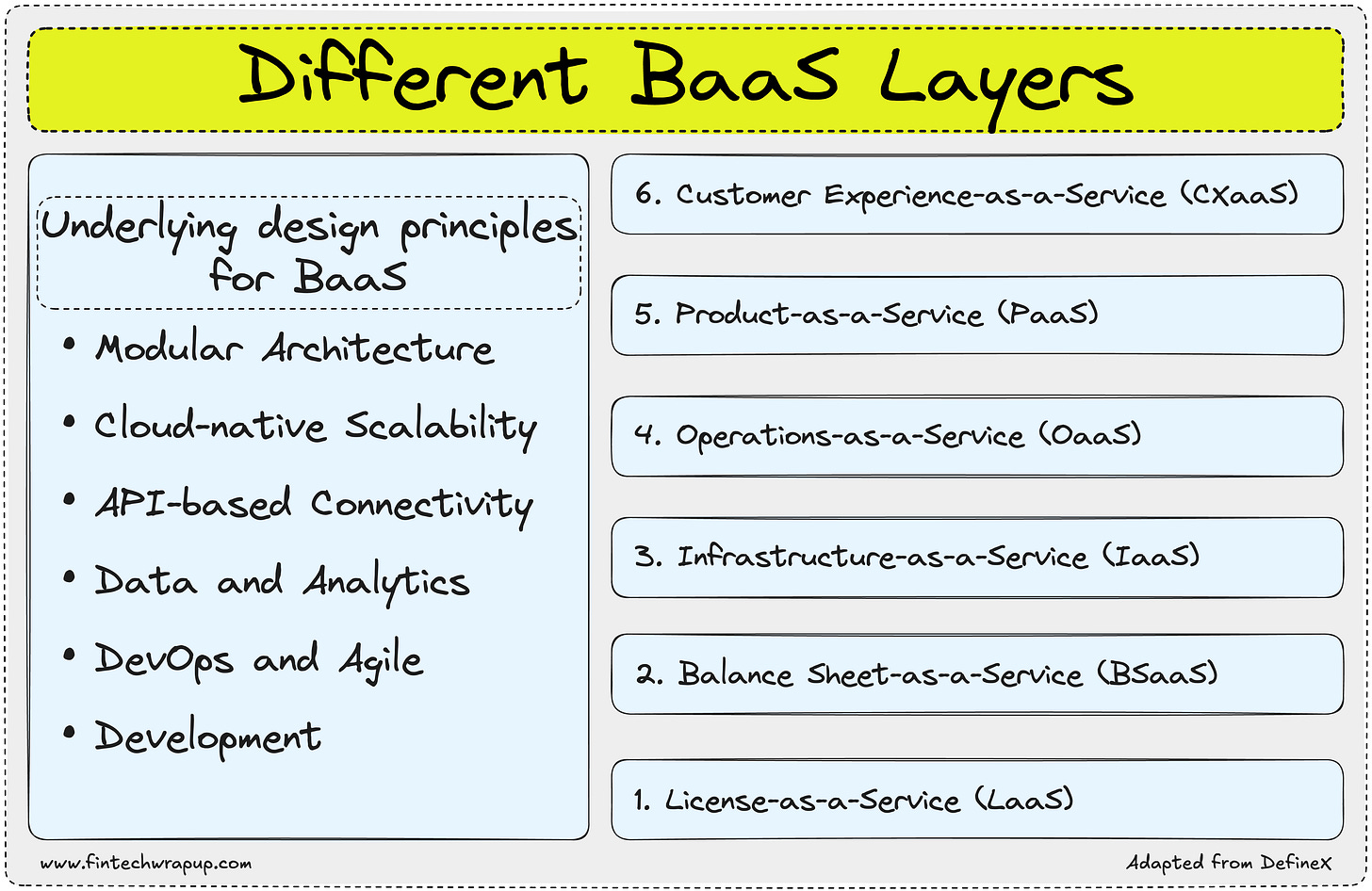

Understanding the BaaS Service Offering

The modular BaaS (Banking-as-a-Service) service offering might contain the following elements:

🔹 License-as-a-Service (LaaS): Offers access to regulated banking licenses, enabling non-financial companies to embed financial products.

🔹 Balance Sheet-as-a-Service (BSaaS): Provides lending and deposit capacity without requiring extensive balance sheet management.

🔹 Infrastructure-as-a-Service (IaaS): Offers core banking software and payment gateways, enabling scalable, secure solutions.

🔹 Operations-as-a-Service (OaaS): Covers key operational functions like compliance, risk management, and customer onboarding.

🔹 Product-as-a-Service (PaaS): Supplies pre-built, modular financial products to accelerate market entry.

🔹 Customer Experience-as-a-Service (CXaaS): Provides tailored digital engagement, supporting AI-enhanced customer interactions.

This approach, built on modular design principles, allows brands to pick and choose the services they need—from compliance to customer experience—enabling them to create customized financial offerings without managing the complexity of full banking operations.

👉 Key Benefits of the BaaS Stack

🔹 Embedded finance acceleration: Businesses can launch financial products in weeks instead of years.

🔹 Compliance & security: Pre-built regulatory infrastructure reduces compliance burdens for fintechs and brands.

🔹 Cost efficiency & scalability: Eliminates the need for in-house banking technology, regulatory teams, and operational overhead.

By leveraging the BaaS stack, brands, fintechs, and financial institutions can rapidly innovate and scale financial products, making financial services more accessible, personalized, and integrated into everyday digital experiences.

👉 A New Concept Born: Composable Banking

Composable banking refers to an approach where banks leverage modular, interchangeable technology components built around an internal core banking engine.

👉 Key Contrasts Between Composable Banking and BaaS

🔹 Core engine base:

Composable banking: Built around an internal core banking engine.

BaaS: Built on top of a third-party bank’s core engine.

🔹 Parties/vendors involved:

Composable banking: Integrates multiple business-function components from various vendors.

BaaS: Typically involves a single banking service from a bank or fintech.

🔹 Target customers:

Composable banking: Primarily banks and financial institutions.

BaaS: Fintechs and non-bank entities.

🔹 License holding:

Composable banking: Clients hold their own banking or financial operating license.

BaaS: Customers rely on third-party licenses.

🔹 Integration options:

Composable banking: Extensive integration options with multiple vendor partners.

BaaS: Limited customization options due to reliance on external providers.

Curated News

📈 FINTECH NEWS

FinTechs Confront Escalating Fraud as Losses Soar 65%

Distinguishing legitimate transactions from increasingly sophisticated fraud attempts places FinTech companies, with their digital-first infrastructure and seamless consumer experiences, at the vanguard of the ongoing battle against identity theft and financial deception

Fed to scrap program devoted to policing banks on crypto, fintech activities

Distinguishing legitimate transactions from increasingly sophisticated fraud attempts places FinTech companies, with their digital-first infrastructure and seamless consumer experiences, at the vanguard of the ongoing battle against identity theft and financial deception.

Federal Reserve removes massive hurdle for crypto bankers

The Federal Reserve has ended its “novel activities” supervision program, folding crypto and fintech oversight back into normal bank supervision.

💳 PAYMENTS

Mastercard and Zand Team to Modernize Cross-Border Payments in UAE

Mastercard has partnered with Zand, a United Arab Emirates-based, artificial intelligence-driven FinTech and financial services group.

RBC and BMO explore $2bn sale of Moneris payments business

Royal Bank of Canada and Bank of Montreal are looking to offload payments processing joint venture Moneris for up to $2 billion, according to Reuters.

🏦 BANKING & Embedded Finance

Embedded Payments Turn Weeks-Long B2B Cycles Into Real Time

In an era when real-time is the standard, many B2B payment cycles still stretch across weeks or even months.But a shift is underway. A new breed of financial infrastructure, embedded payments and AP payments-as-a-service, promises to abstract away the complexity of business transactions and replace it with seamless integration, speed and strategic value.

Street Wallet Secures $350K to Bring Cashless Payments to South Africa’s Informal Economy

Street Wallet, a South African fintech empowering informal traders and service providers with accessible, low-cost digital payment solutions, has successfully raised US$350,000 (R6.2 million) in a funding round that values the business at US$2 million (R35.5 million). The fresh capital will be leveraged to deepen market penetration, fuel higher sales growth, and expand the company’s footprint across South Africa.

Network International Expands Portfolio With Absa Bank

Network International, a leading enabler of digital commerce in the Middle East and Africa, has been chosen by Absa Business Banking, one of Africa’s leading business banks, as its digital payments technology partner.

Columbia Banking System's $0.36 Dividend: A Strategic Bet on Stability and Growth in a Shifting Market

Columbia Banking System (NASDAQ: COLB) has long been a stalwart for income-focused investors, offering a blend of consistent dividends and disciplined growth. Its recent quarterly dividend declaration of $0.36 per share, payable on September 15, 2025, underscores this reputation.

💰 WEALTH TECH

BNPL for car repairs Bumper bags $11m

A BNPL fintech for car servicing and repairs has raised $11m in an equity funding round. Called Bumper, the Sheffield and London-based startup has raised the funds in a Series B extension.

HBM Sells 30% Stake in Copper World to Mitsubishi for $600M

Hudbay Minerals Inc. HBM has entered into a joint venture agreement with Mitsubishi Corporation that will help advance its Copper World project in Arizona. Under the agreement, Mitsubishi will acquire a 30% minority stake for an initial cash contribution of $600 million.

💰 Funding & M&A

Worldpay and Regtech Trulioo to Provide Safeguards for Agent-led Digital Commerce

Worldpay, a global enabler of payment technology, announced they are partnering with Trulioo, the global digital identity platform, to introduce new safeguards for AI-powered agent-led commerce.

🧠 AI & Infrastructure

Fear of Going ‘Off Script’ Keeps CFOs From Agentic AI

Even as artificial intelligence reshapes corporate finance, a trust gap is emerging around its most autonomous form, agentic AI, among the very executives poised to benefit most from its potential.

OpenAI staff looking to sell $6 billion in stock to SoftBank, others, source says

Current and former employees of OpenAI are looking to sell nearly $6 billion worth of the ChatGPT maker's shares to investors including SoftBank Group and Thrive Capital, a source familiar with the matter told Reuters on Friday.

🧾 Crypto & Blockchain

Why Digital Currency Group Is Suing Its Own Subsidiary Over $1.1 Billion Loan

Digital Currency Group has sued its subsidiary, crypto lender Genesis, in the latest twist of a saga that's been unfolding since 2022.

Winklevoss twins’ crypto company Gemini files for IPO

Another crypto company is headed for the public markets. This time, it’s Gemini Space Station Inc., the New York-based crypto exchange and custodian bank founded by billionaire twins Cameron and Tyler Winklevoss.

Whale Investment Shift: Chainlink Retreats as Mutuum Finance Rises

It seems like we're witnessing a major shift in whale investments, with Chainlink (LINK) taking a backseat to the rising star that is Mutuum Finance (MUTM). The crypto market is never short of surprises, and this one might just be the most interesting yet. The transition of these large holders not only signals a confidence in new financial models but also illustrates changing priorities within decentralized autonomous organizations (DAOs).

📰 OTHERS

Why Goldman Sachs says the 'Goldilocks' stock market may get hit

After months of ideal market conditions, Goldman Sachs (GS) warns that underlying risks could send stocks tumbling. The current backdrop of stable economic growth, moderate inflation, and a strong earnings season — fueled by Big Tech's AI spend and hopes for an interest rate cut — has created a summer of rally.

The bond market is signaling that a September cut from the Fed is no longer locked in

The S&P 500 remains near its high, however, and is banking on a cut. While a 0.25% cut remains the most likely outcome, it no longer looks guaranteed. Globally, European and Asian equities are mixed. S&P 500 futures are flat this morning.

DeFi Development Corp. buys $22 million in Solana tokens

DeFi Development Corp. (DFDV) acquired 110,000 SOL tokens at an average price of $201.68, representing a total purchase value of approximately $22 million, the company announced August 15.

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a "Source: [Name]" attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.