BNY Launches On-Chain Digital Cash, Signaling the Future of Tokenized Bank Deposits

BNY has launched on-chain digital cash as the first step toward tokenized bank deposits and real-time settlement. The initiative positions one of the world’s most systemically important banks at the forefront of blockchain-based financial infrastructure. By enabling instant settlement on its digital assets platform, BNY is addressing long-standing inefficiencies in payments and capital markets. The move also signals growing institutional confidence in tokenization beyond pilots and proofs of concept. As regulators and banks explore programmable money, BNY’s approach could become a blueprint for deposit-based digital cash.

Video of the Day

Insight of the Day

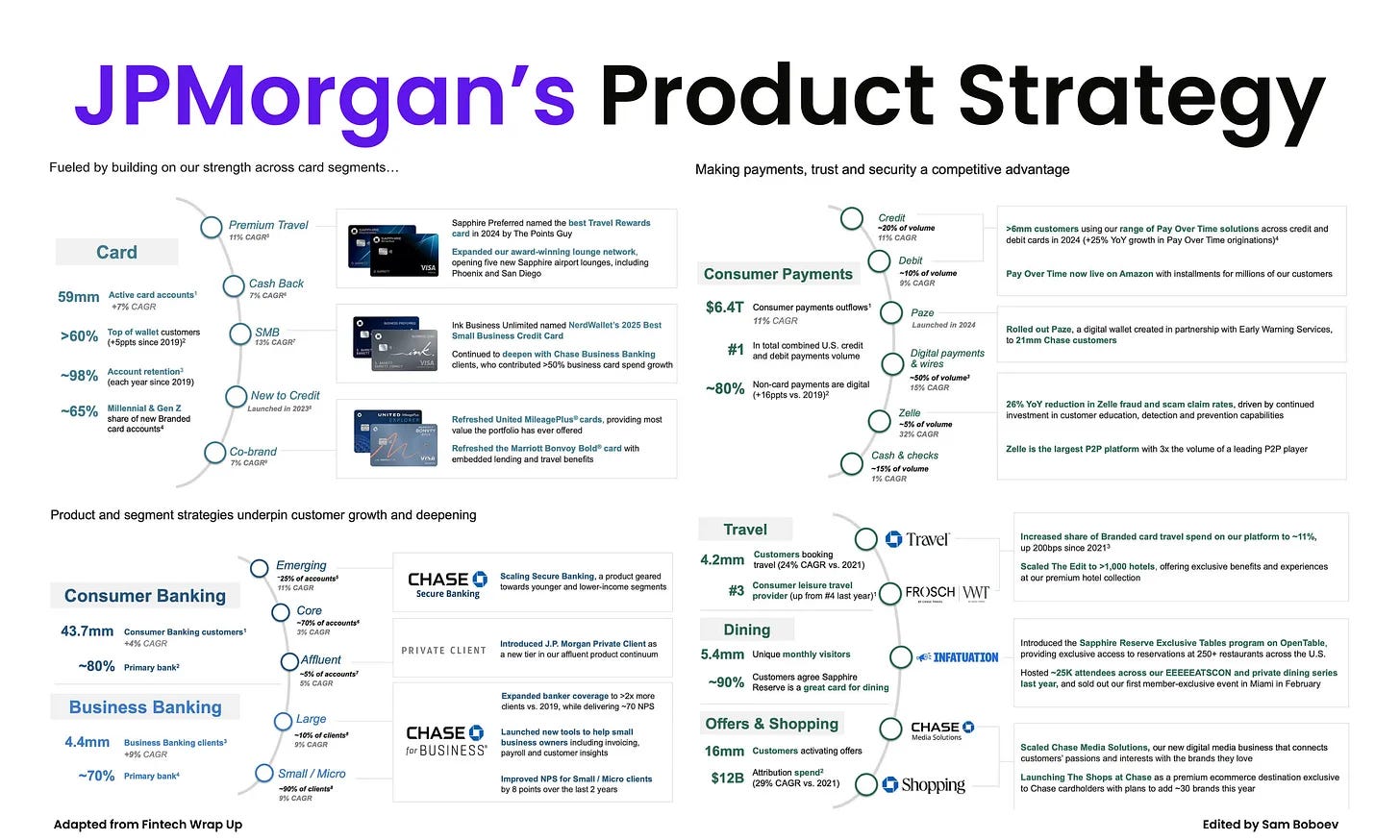

𝐉𝐏𝐌𝐨𝐫𝐠𝐚𝐧’𝐬 𝐑𝐞𝐚𝐥 𝐀𝐝𝐯𝐚𝐧𝐭𝐚𝐠𝐞 𝐈𝐬 𝐏𝐥𝐚𝐭𝐟𝐨𝐫𝐦 𝐂𝐨𝐦𝐩𝐨𝐮𝐧𝐝𝐢𝐧𝐠

What stands out to me about JPMorgan right now is not that it is “going digital.” It is that it already won distribution and is now compounding it through product and platform design.

Customer expectations keep rising. Retail users compare banks to fintech apps. Businesses expect integrated, global systems that just work. JPMorgan’s response is not a single big bet, but thousands of small ones layered across products, channels, and platforms.

____

On the consumer side, the philosophy is simple: improve everything, all the time. That approach is working even at massive scale. Chase now serves roughly 44 million consumer banking customers, and around 80 percent of them treat Chase as their primary bank. Net Promoter Score sits around 65, up about five points since 2019, with gains across both digital experiences and in-branch interactions.

____

Product innovation is the main lever. Pay in 4 is a good example. It is not positioned as a standalone BNPL product, but as a native feature inside the Chase ecosystem. Despite being relatively new, it already has an NPS above 90. The same logic applies to Freedom Rise for new-to-credit customers, which launched to bring more people into the credit system and delivered an NPS above 80 in its first year. These products work because they are embedded into everyday money moments, not pushed as separate apps.

____

What I find even more strategic is how JPMorgan is building its own commerce ecosystem. Millions of customers now engage with Chase beyond traditional banking. About 4.2 million customers booked travel through Chase last year, making it one of the largest consumer leisure travel platforms in the U.S. Sixteen million customers activated merchant offers, driving roughly $12 billion in attributed spend. These are not side features. They are becoming meaningful engagement and revenue drivers.

____

Payments tie everything together. Chase processed about $6.4 trillion in consumer payment flows last year, growing at double-digit rates. Roughly 80% of non-card payments are now digital, up more than 15% points in five years. On the credit side, over 6 million customers are already using Pay Over Time features across credit and debit, with volumes growing more than 25% year over year.

The real advantage is speed. When JPMorgan launches something new, it does not need to fight for distribution. It can reach tens of millions of existing customers almost instantly through its app and data infrastructure.

This is what platform compounding looks like in financial services. Not flashy. Not noisy. Just relentless execution at scale.

Curated News

💳 Payments

FIS Launches Agentic Commerce Platform to Redefine AI-Driven Card Payments

FIS has unveiled an agentic commerce platform designed for issuing banks, enabling AI-powered agents to initiate and complete card transactions on behalf of consumers. The platform aims to reduce checkout friction and keep banks central to AI-led payment flows.

Source

PhonePe Introduces ‘PG Bolt’ for One-Click Card Payments

PhonePe Payment Gateway has launched PG Bolt, enabling one-click Visa and Mastercard transactions for merchants. The solution targets faster checkout and reduced drop-off rates in India’s fast-growing digital payments market.

Source

Zand Adopts XDC Network for Blockchain-Based Payments

UAE-based digital bank Zand has adopted the XDC Network to support blockchain-powered payments. The move highlights increasing bank interest in blockchain infrastructure for cross-border settlement.

Source

🏦 Banking

Checkout.com Secures US Bank Charter to Enter Acquiring Market

Checkout.com has obtained a Georgia bank charter, allowing it to operate its own US acquiring business. This strengthens its control over the payment value chain and intensifies competition with incumbent acquirers.

Source

Nationwide Rolls Out Call Checker to Fight Impersonation Fraud

Nationwide has launched a call-checking service that allows customers to verify whether calls are genuinely from the bank. The tool responds to rising impersonation fraud across phone-based banking channels.

Source

🧠 Fintech

Walmart and Google Partner on Agent-Led Commerce

Walmart has teamed up with Google to promote agent-led commerce, allowing AI agents to guide product discovery and checkout. The partnership reflects how large retailers are embedding payments into AI-driven shopping journeys.

Source

PayPal and Google Enable Trusted AI Checkout

PayPal is supporting Google’s AI-powered checkout experience, enabling seamless transitions from search to payment. The collaboration reinforces PayPal’s role as a trusted payments layer for AI commerce.

Source

Open Banking UK Marks Eight Years of Progress

Open Banking UK is celebrating its eighth anniversary, highlighting steady adoption and ecosystem growth. The milestone underscores open banking’s role as core financial infrastructure in the UK.

Source

MoneyHash and Spare Partner to Expand Open Banking

MoneyHash and Spare have announced a strategic partnership to accelerate open banking adoption in the region. The collaboration focuses on improving access to account-to-account payments and financial data.

Source

🪙 Crypto

Bitcoin and Ethereum ETFs Lose 2026 Gains

Bitcoin and Ethereum ETFs have erased most of their 2026 gains as interest rate cut expectations faded. The decline highlights crypto’s continued sensitivity to macroeconomic signals.

Source

BitGo Targets $2B Valuation in US IPO Filing

Crypto custody firm BitGo has filed for a US IPO targeting a valuation close to $2 billion. The filing signals renewed public market ambitions for mature crypto infrastructure providers.

Source

UK Lawmakers Push to Ban Crypto Political Donations

UK committee chairs are calling for a ban on political donations made using crypto assets. The proposal reflects growing regulatory focus on transparency and influence in digital finance.

Source

📈 WealthTech

Atomic Invest Acquires Dutch Advisory Firm Groene Hart

Atomic Invest has acquired Groene Hart Financial Diensten, expanding its presence in the European wealth advisory market. The deal supports Atomic’s broader international growth strategy.

Source

⚖️ Regulation

Economists Urge EU to Back Digital Euro Despite Lobbying

Leading economists have urged the EU to push ahead with a digital euro despite lobbying pressure. They argue it is essential for monetary sovereignty and long-term payments resilience.

Source

Bank Shares Fall on Trump Card Fee Cap Proposal

Bank stocks declined following proposals linked to Donald Trump to cap card fees. Investors fear reduced interchange revenue could materially impact bank earnings.

Source

🌍 Other

Atome Raises $345M in Debt as SEA Fintechs Avoid Equity

Buy-now-pay-later firm Atome has secured $345 million in debt financing amid a regional shift away from equity fundraising. The move reflects tougher capital markets and a focus on sustainable growth.

Source

Astra Shuts Down Digital Lender Maucash

Astra has shut down its digital lending unit Maucash as part of a strategic realignment. The closure highlights ongoing consolidation in Southeast Asia’s fintech sector.

Source

Bluecopa Raises $7.5M Series A for AI-Native Finance

Bluecopa has raised $7.5 million in Series A funding to scale its AI-native finance platform. Investor interest remains strong in AI-first financial infrastructure.

Source

PhotonPay Raises Series B to Build Stablecoin Infrastructure

PhotonPay has raised tens of millions in Series B funding to develop stablecoin-centric financial infrastructure. The round reflects growing institutional demand for stablecoin payment rails.

Source

BlackOpal Raises $200M to Tokenize Brazilian Receivables

BlackOpal has secured $200 million to tokenize Brazilian credit card receivables. The initiative aims to reduce credit risk while unlocking emerging market yield for global investors.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.