Britain Explores Visa Rival to Safeguard Payments Sovereignty

The UK government is reportedly exploring the creation of a domestic alternative to Visa amid concerns that geopolitical tensions could disrupt critical payments infrastructure. The discussions reflect growing anxiety over reliance on US-based card networks and the systemic risk tied to cross-border political dynamics. A UK-backed scheme could reshape competitive dynamics in card acquiring and issuing, while strengthening national resilience. However, building a viable network would require scale, merchant acceptance, and regulatory alignment. The move also signals a broader trend of countries reassessing control over financial rails. If pursued, it could mark one of the most significant shifts in UK payments strategy in decades.

Video of the Day

Insight of the Day

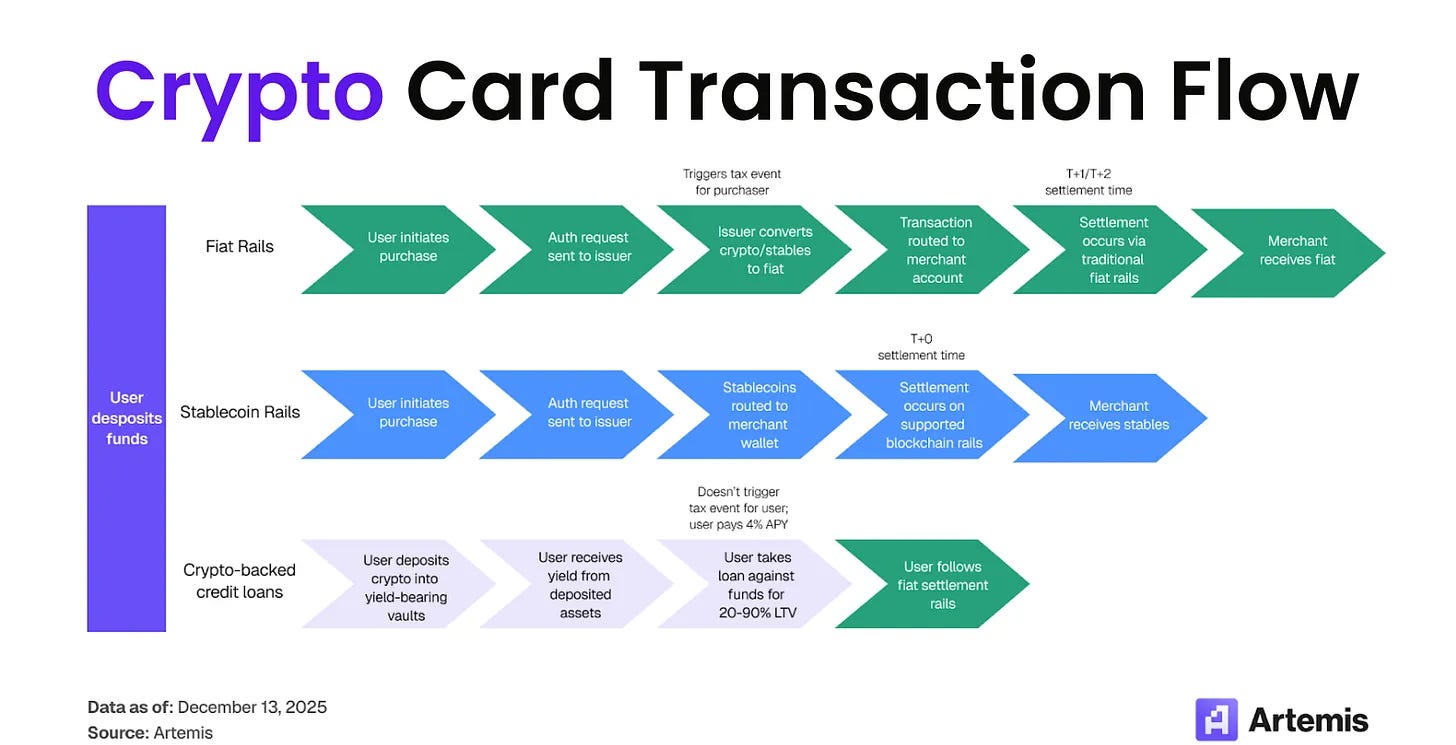

Crypto Card Transaction Flow Mechanics

Crypto cards are payment cards—prepaid, debit, or credit—that enable users to spend cryptocurrency or stablecoin balances at traditional merchant locations through existing card network infrastructure. When a user holds stablecoins in a wallet or Bitcoin on an exchange and wants to buy coffee, pay rent, or shop online, a crypto card bridges that digital asset balance to the global network of merchants that accept Visa and Mastercard.

When a user swipes a crypto card at a merchant terminal, what actually happens to the money? The answer depends on the card’s underlying infrastructure. Three distinct settlement flows exist in the market today, each with different technical architectures, counterparty relationships, and implications for the broader payments ecosystem.

The vast majority of crypto card volume today settles via fiat rails. This remains the default because it requires no merchant integration. The crypto-to-fiat conversion happens before settlement to the payment network level, making the transaction indistinguishable from any other card payment by the time it reaches the network. Importantly, typical program managers a la Baanx’s Crypto Life and Bridge, do not handle settlement to their desired payment network, instead partnering with issuing banks such as Lead Bank and Cross River Bank who handle settlement, respectively. Full-stack issuance platforms like Rain handle settlement directly to Visa by liquidating stablecoins or crypto assets to the Visa network, which then routes the amount to the acquiring bank’s desired fiat currency. For the vast majority of crypto card usage, nothing from the merchant’s perspective changes.

Stablecoin settlement is growing rapidly but remains nascent. Visa’s stablecoin-linked card spend reached a $3.5 billion annualized run rate in Q4 FY2025—approximately 460% year-over-year growth—but still represents approximately 19% of total crypto card settlement volume by our estimates.

Curated News

💳 Payments

Bluefin and Basis Theory Unify Tokenization Across Channels

Bluefin and Basis Theory have partnered to enable unified tokenization for both digital and in-person payments. The collaboration aims to reduce PCI scope and enhance security by centralising sensitive data protection across omnichannel environments.

Source

Payoneer Launches Stablecoin Capabilities for Global Businesses

Payoneer is introducing stablecoin-powered payment capabilities through Bridge to provide always-on digital money movement. The move positions stablecoins as a mainstream treasury and cross-border settlement tool for global SMBs.

Source

Quantoz and Visa Make Stablecoins Spendable

Quantoz has partnered with Visa to enable real-world spending of stablecoins. The collaboration bridges blockchain-based value with traditional card acceptance infrastructure, expanding stablecoin utility.

Source

UnionPay Expands UK ATM Access Through NCR Atleos

UnionPay cardholders can now withdraw cash at NCR Atleos Cashzone ATMs across the UK. The rollout improves international card acceptance and cross-border access for Chinese travellers and residents.

Source

Medius and Adyen Launch Corporate Expense Cards in Europe

Medius has partnered with Adyen to introduce corporate expense cards and cashback rewards across Europe. The initiative integrates spend management with embedded payments to streamline enterprise finance operations.

Source

Mastercard and Visa Pilot Agentic Payments with Banks

Mastercard and Visa are working with banks to test agentic payment models, enabling autonomous AI-driven transactions. The pilots could redefine commerce by allowing software agents to initiate and complete payments on behalf of users.

Source

🏦 Banking

NatWest Signals AI-Driven Transformation Ahead

NatWest reported progress after investing £1.2bn in technology last year but acknowledged that its true AI transformation is still forthcoming. The bank is shifting from foundational upgrades toward intelligence-led automation and productivity gains.

Source

Bank of Beirut UK Goes Live with Temenos Core Platform

Bank of Beirut UK has deployed Temenos core banking and payments technology to accelerate corporate banking growth. The upgrade enhances scalability, real-time processing, and product agility.

Source

Mintos Pursues ECB Banking Licence

Mintos is seeking a European Central Bank banking licence to expand its product offering and regulatory standing. Approval would strengthen its transition from marketplace platform to fully regulated banking entity.

Source

🧩 Fintech

Mastercard and Cloudflare Form Cyber Defence Alliance

Mastercard and Cloudflare have partnered to enhance cyber resilience across digital payments infrastructure. The collaboration focuses on mitigating fraud, DDoS attacks, and evolving network threats.

Source

Gr4vy Embeds Fraud and AML Controls from Sardine

Gr4vy is integrating fraud and AML capabilities from Sardine directly into its payment orchestration platform. The move strengthens compliance automation and real-time risk monitoring.

Source

Paytently Enhances AML and Fraud Monitoring via SEON

Paytently has partnered with SEON to bolster fraud detection and AML compliance. The integration improves identity verification and risk scoring for digital merchants.

Source

Sphinx Raises $7.1M to Automate Compliance Functions

Sphinx has secured $7.1 million to develop AI-driven compliance solutions aimed at becoming financial institutions’ “last compliance hire.” The funding reflects growing demand for automated regulatory intelligence tools.

Source

ACI Connetic Expands Cloud-Native Payments Integration

ACI Connetic is accelerating adoption by enabling UK banks to unify SWIFT, CHAPS, and Faster Payments on one platform. The cloud-native solution aims to streamline connectivity and reduce infrastructure fragmentation.

Source

Tangible Raises $4.3M to Build Debt Capital Infrastructure

Tangible has secured $4.3 million in seed funding to create scalable debt capital stacks for hardtech companies. The platform targets improved capital access for asset-intensive startups.

Source

🪙 Crypto

Gemini Shares Slide After Executive Departures

Gemini’s stock fell 10% following the departure of its COO, CFO, and Chief Legal Officer months after its IPO. The leadership changes raise governance and stability concerns at a critical stage of public market scrutiny.

Source

Abu Dhabi Funds Boost BlackRock Bitcoin ETF Exposure

Abu Dhabi investment funds increased their exposure to BlackRock’s Bitcoin ETF to $1 billion by the end of 2025. The move highlights sustained institutional appetite for regulated crypto investment vehicles.

Source

BlackRock and Coinbase Set Ethereum Staking Revenue Terms

BlackRock and Coinbase will retain 18% of Ethereum staking revenue within a new ETF structure. The model blends traditional ETF design with on-chain yield mechanics.

Source

Bitdeer Surpasses MARA in Hash Rate Lead

Bitdeer has overtaken MARA in total hash rate, according to JPMorgan analysis. The shift signals changing competitive dynamics in the Bitcoin mining sector.

Source

Ethereum Address Poisoning Attacks Resurface

A new wave of Ethereum address poisoning scams has led to renewed user losses. The incidents highlight persistent security vulnerabilities in wallet-based transaction verification.

Source

💼 WealthTech

Stake Raises $31M Series B Led by Emirates NBD

Stake has closed a $31 million Series B round led by Emirates NBD to expand its digital real estate investment platform. The funding supports regional expansion and product development.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.