Broadridge to Acquire CQG in Major Market Infrastructure Deal

Broadridge has announced its acquisition of CQG, a leading provider of futures and options trading technology, in a move that significantly expands its global market infrastructure footprint. The deal strengthens Broadridge’s position across derivatives, clearing, and institutional trading workflows. By integrating CQG’s real-time data and execution capabilities, Broadridge aims to offer end-to-end solutions across front, middle, and back office operations. The acquisition reflects growing consolidation in financial market infrastructure as firms race to modernize legacy systems. It also highlights rising demand for scalable, resilient trading platforms amid increased market volatility. For banks, brokers, and exchanges, the deal promises deeper integration and operational efficiency. Strategically, it underscores how fintech and capital markets infrastructure are converging at scale.

Video of the Day

Insight of the Day

Citi’s Strategy to Dominate Institutional Payments

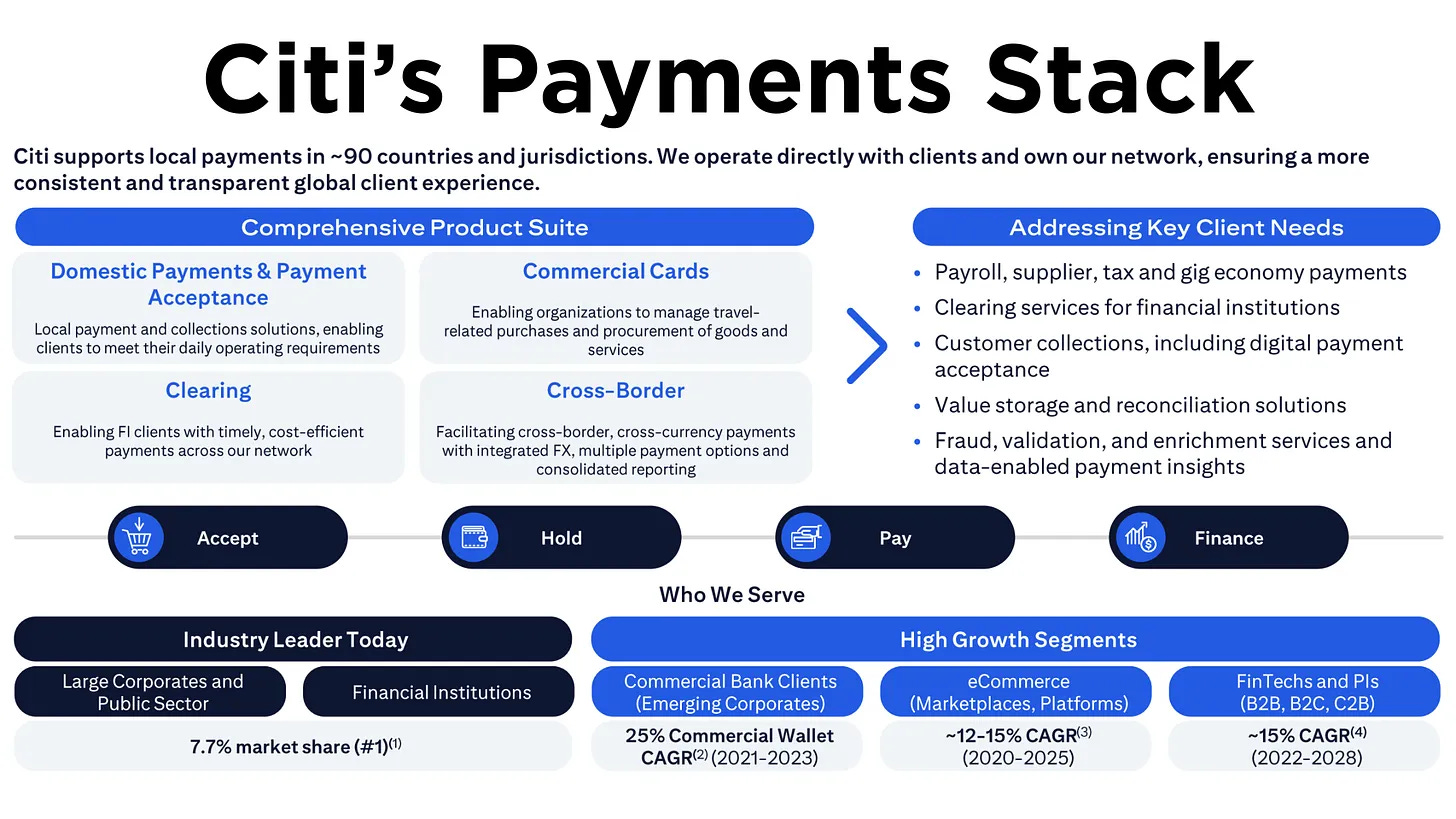

Citi’s core payments thesis is blunt: own and integrate the entire payments value chain globally to stay on top. The bank touts a #1 global market position in institutional payments with an estimated 7.7% market share. That leadership is underpinned by scale and reach. Citi supports local payment flows in ~90 countries through its proprietary network. In practice, this means Citi directly connects to domestic payment systems around the world (290+ clearing system links, by its count) instead of relying solely on partner banks. The thesis is that by “owning the network” end-to-end, Citi can offer clients a more consistent, transparent service globally and capture a disproportionate share of volumes.

This strategy is driven by the structural shift to digital commerce and real-time finance. As transactions move online and instantaneously, Citi is positioning itself as the go-to infrastructure for institutional money movement. Payments already contribute the bulk of Citi’s Treasury and Trade Solutions (TTS) business, roughly three-quarters of TTS non-interest revenue, growing ~13% annually in recent years. The bank processed $358 B in cross-border FX payments in 2023, up from $280 B in 2021 (13% CAGR). It also handled 157 million USD clearing transactions in 2023 and saw explosive growth in instant payments (from ~2 million to ~10 million daily transactions, ~120% CAGR over 2021–2023). In short, Citi’s payments franchise is huge and on an upswing, a high-growth profit engine in an otherwise mature banking landscape.

Citi’s thesis is to double down on this momentum by meeting clients’ evolving needs across every leg of a payment’s journey. That journey spans accepting payments, holding liquidity, paying out, and financing transactions. Citi’s strategy explicitly breaks this into “Accept, Hold, Pay, Finance,” ensuring the bank has offerings at each step. The underlying bet: if Citi can embed itself at each link in the chain from checkout to treasury to disbursement, and FX clients will find it compelling to consolidate their flows through Citi’s ecosystem. And with the global footprint already in place, Citi can capture the worldwide shift to electronic payments, e-commerce, and instant funds movement at scale.

Curated News

💳 Payments

Visa Launches Platform to Support US Small Businesses

Visa has introduced a new platform designed to help U.S. small businesses access digital tools, financing, and payment solutions. The move reinforces Visa’s strategy to expand beyond payments into SME enablement.

Source

Affirm and Virgin Media O2 Bring Flexible Financing to Customers

Affirm has partnered with Virgin Media O2 to offer installment payment options for telecom services. The deal expands BNPL into subscription-based consumer spending.

Source

PhotonPay Scales Global Payments With Stripe Partnership

PhotonPay has teamed up with Stripe to enhance global online payment acceptance. The partnership supports international expansion and modern checkout experiences.

Source

Equiti Group Partners With Checkout.com for Global Payments

Equiti Group has selected Checkout.com to strengthen worldwide payment processing. The collaboration improves speed, reliability, and cross-border reach.

Source

Zip US Launches Pay in 2 for Flexible Checkout

Zip has launched “Pay in 2” in the U.S., offering consumers a shorter-term BNPL option. The product targets simpler, lower-commitment purchases.

Source

🏦 Banking

NatWest Targets 50,000 Members in Accelerator Community

NatWest plans to expand its Accelerator network to 50,000 entrepreneurs by 2026. The initiative strengthens its long-term SME engagement strategy.

Source

CommBank Moves to Ease Customer Concerns Around AI

Commonwealth Bank is focusing on transparency and education to build trust in AI-driven banking services. Governance and explainability remain central themes.

Source

Barclays Uses GenAI to Enhance Customer Service

Barclays has deployed generative AI tools to improve customer support efficiency and responsiveness. The rollout reflects broader AI adoption across tier-one banks.

Source

Amplify Credit Union Modernises Account Opening With MANTL

Amplify Credit Union has partnered with MANTL to streamline digital account opening. The upgrade improves onboarding speed and customer experience.

Source

🧠 Fintech

Cleo Relaunches AI-Powered Money Management App in the UK

Cleo has returned to the UK market with its AI-driven personal finance app. The relaunch reflects renewed consumer appetite for conversational financial tools.

Source

GCash Secures $30M ADB Facility to Support MSMEs

GCash has obtained a $30 million facility from the Asian Development Bank to expand MSME lending. The funding supports financial inclusion across the Philippines.

Source

🪙 Crypto

Tether Invests $100M in Regulated Crypto Bank Anchorage Digital

Tether has made a $100 million strategic investment in Anchorage Digital. The move strengthens ties between stablecoin issuers and regulated crypto infrastructure.

Source

Crypto Stocks Rebound as Bitcoin Stabilizes

Shares of major crypto-linked firms rebounded as Bitcoin prices stabilized. The move reflects improving short-term market sentiment.

Source

China Formalizes Ban on Yuan Stablecoins and RWA Tokenization

China has officially banned yuan-backed stablecoins and real-world asset tokenization. The decision reinforces its restrictive crypto stance.

Source

📊 WealthTech

Clearwater Analytics Integrates With TreasurySpring

Clearwater Analytics has partnered with TreasurySpring to enhance fixed-term cash management. The integration improves liquidity visibility for institutional clients.

Source

⚖️ Regulation

India’s NSE Board Approves IPO Plan

India’s National Stock Exchange board has approved long-awaited IPO plans. The move could unlock one of the country’s most significant market listings.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.