CaixaBank Enables Apple Pay Installments in Spain

CaixaBank has introduced installment payment options directly within Apple Pay, making it the first Spanish bank to roll out this feature. Customers can now split purchases into manageable payments at checkout, enhancing flexibility and accessibility. This move reflects the growing demand for embedded financing solutions in digital wallets. By combining convenience with financial control, CaixaBank strengthens its position as an innovator in payments. The integration also aligns with broader trends toward seamless, consumer-friendly digital banking. This could inspire other European banks to follow suit as competition in embedded finance intensifies.

Insight of the Day

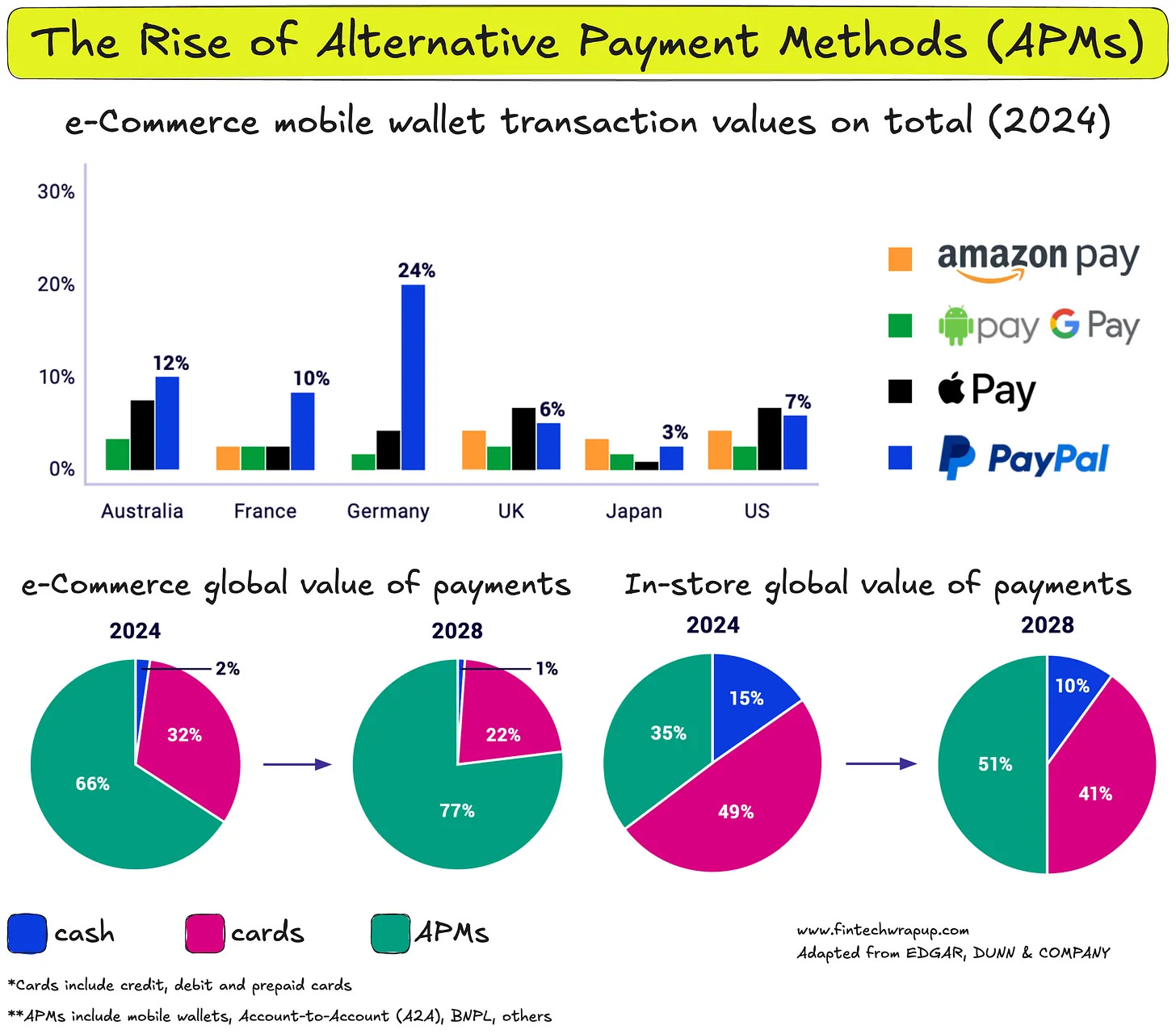

The Rise of Alternative Payment Methods (APMs)

APMs are dominating global e-commerce transactions

APMs refer to any means of making a payment other than cash or credit/debit/prepaid cards from major card networks.

They include:

- Mobile wallets

- Buy Now, Pay Later (BNPL)

- Bank-to-bank transfers

- Cash-based payments (e.g., Boleto in Brazil)

- Cryptocurrencies

The main benefits of APMs are convenience, higher conversion rates, transaction speed, and enhanced security.

APMs have been gaining popularity worldwide and are expected to continue growing, reducing the share of payment cards in both transaction volumes and values. They already hold a dominant position in the global e-commerce landscape and are projected to reach 77% of global transaction value by 2028.

APM usage trends vary significantly across markets

APM adoption differs across regions and countries.

Curated News

💳 Payments

dLocal and Cleeng Boost Subscriptions in Emerging Markets

dLocal and Cleeng are teaming up to provide localized payment solutions to accelerate digital subscription growth in developing economies. The partnership aims to reduce friction for users and help platforms scale faster.

Source

Corpay Cross-Border Partners With SKsoft for Global Payments

Corpay has joined forces with SKsoft to streamline international payments. The collaboration enhances businesses’ ability to move money seamlessly across borders.

Source

Zelle Launches “When It Counts” Brand Campaign

Zelle has unveiled a new brand platform showcasing how its $1 trillion in processed payments connects to meaningful life moments. The initiative emphasizes Zelle’s ubiquity and relevance in U.S. payments.

Source

MariBank Introduces Anti-Phishing Safeguards

MariBank has added new in-app protections to tackle rising phishing scams. The features are designed to boost user confidence and security in digital banking.

Source

🏦 Banking

Munify Raises $3M to Serve Egyptian Diaspora

Y Combinator–backed Munify secured $3 million to expand its digital banking services tailored for Egyptians abroad. The startup aims to solve cross-border financial challenges for migrant communities.

Source

Northmill Bank Eyes EU Expansion

Swedish challenger bank Northmill announced plans to expand across Europe. The move signals aggressive growth in a crowded neobank market.

Source

💸 Fintech

Expensify Integrates With DoorDash for Receipt Management

Expensify now syncs directly with DoorDash for Business, automating expense reporting for food orders. This integration saves time for finance teams managing corporate expenses.

Source

Workday Partners With Zuora on Billing Precision

Workday and Zuora are collaborating to enhance billing accuracy for enterprises. The integration targets finance teams seeking more precise recurring revenue management.

Source

Lendbuzz Prepares for Nasdaq IPO

US-based fintech lender Lendbuzz is gearing up for a Nasdaq listing. The IPO could provide fresh capital for scaling its AI-driven auto finance solutions.

Source

Sola Raises $8M to Build Integrated Insurtech Platform

Insurtech startup Sola secured $8 million in Series A funding to create the first vertically integrated digital insurer. The company seeks to streamline underwriting and claims through tech-driven processes.

Source

🪙 Crypto

CFTC Reaffirms Support for U.S. Crypto Trading

The CFTC reiterated its commitment to enabling regulated crypto asset trading in the U.S. The move provides reassurance for digital asset markets amid global regulatory uncertainty.

Source

Bluprynt Verifies USDC Under KYI Framework

Bluprynt announced the first KYI (Know Your Issuer) verification of USDC, a global stablecoin. The step boosts transparency and trust in stablecoin issuers.

Source

Ant Group Uses JPMorgan’s Kinexys for FX Settlement

Ant Group is leveraging JPMorgan’s Kinexys blockchain network for real-time foreign exchange settlements. The collaboration highlights the growing institutional use of blockchain in global finance.

Source

Aleo Joins Global Dollar Network for Privacy Payments

Aleo has joined the Global Dollar Network to enhance privacy in stablecoin transactions. The partnership focuses on balancing compliance with consumer protection.

Source

Circle Rules Out Korean Won Stablecoin

Circle executives confirmed no plans to issue a won-backed stablecoin during a recent visit to Korea. The announcement underscores Circle’s focus on USD Coin as its primary product.

Source

📈 WealthTech

Groww Wins Approval for $1B IPO

Indian investment platform Groww has secured approval for a $1 billion IPO. The listing marks a major milestone for India’s fast-growing digital wealth sector.

Source

📜 Regulation

FCA’s Targeted Support Proposal Sparks Debate

The UK FCA’s new proposal on “targeted support” is raising questions about the boundaries of financial advice and accessibility. Critics argue it could blur lines between regulated advice and guidance.

Source

💼 Other

CrediaBank Adopts Risk & Compliance Solution

CrediaBank has gone live with Profile Software’s risk and compliance platform. The rollout enhances the bank’s ability to manage regulatory and operational risks.

Source

AI Tools Give Finance Teams “X-Ray Vision” Into Risk

A new wave of AI solutions is helping finance teams better analyze and predict customer risks. This innovation supports smarter decision-making and improved cash flow management.

Source

BILL and nCino Surge on SMB Growth and AI

Public fintechs BILL and nCino saw strong market performance, driven by SMB growth trends and AI adoption. Investors view both firms as well positioned in digital finance infrastructure.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a "Source: [Name]" attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.

Embeded financing in digital wallets is the logical next step after standalone BNPL reached saturation. CaixaBank integrating directly into Apple Pay's checkout flow removes friction at the exact moment customers are deciding whether to proceed with a purchase. The key differentiator is that this isn't bolted on fintech but native bank functionality, which should mean better unit economics and tighter risk managment compared to third party BNPL providers. If other European banks follow suit, it could seriously pressure standalone players like Klarna who lack direct wallet integration.