Capital One to Acquire Brex in $5.15B Fintech Mega-Deal

Capital One has announced plans to acquire fintech Brex for $5.15 billion, marking one of the most significant fintech M&A deals in recent years. The acquisition underscores how traditional banks are accelerating efforts to modernise corporate banking through technology-led platforms. Brex’s expense management, cards, and startup-focused tooling give Capital One immediate scale in serving modern businesses. For the fintech sector, the deal signals a maturation phase where category leaders become acquisition targets rather than disruptors. It also reflects growing pressure on banks to compete with fintech-native user experiences. Regulators and competitors alike will closely watch how this integration unfolds. Overall, the move highlights deepening convergence between Big Tech-style fintechs and incumbent financial institutions.

Video of the Day

Insight of the Day

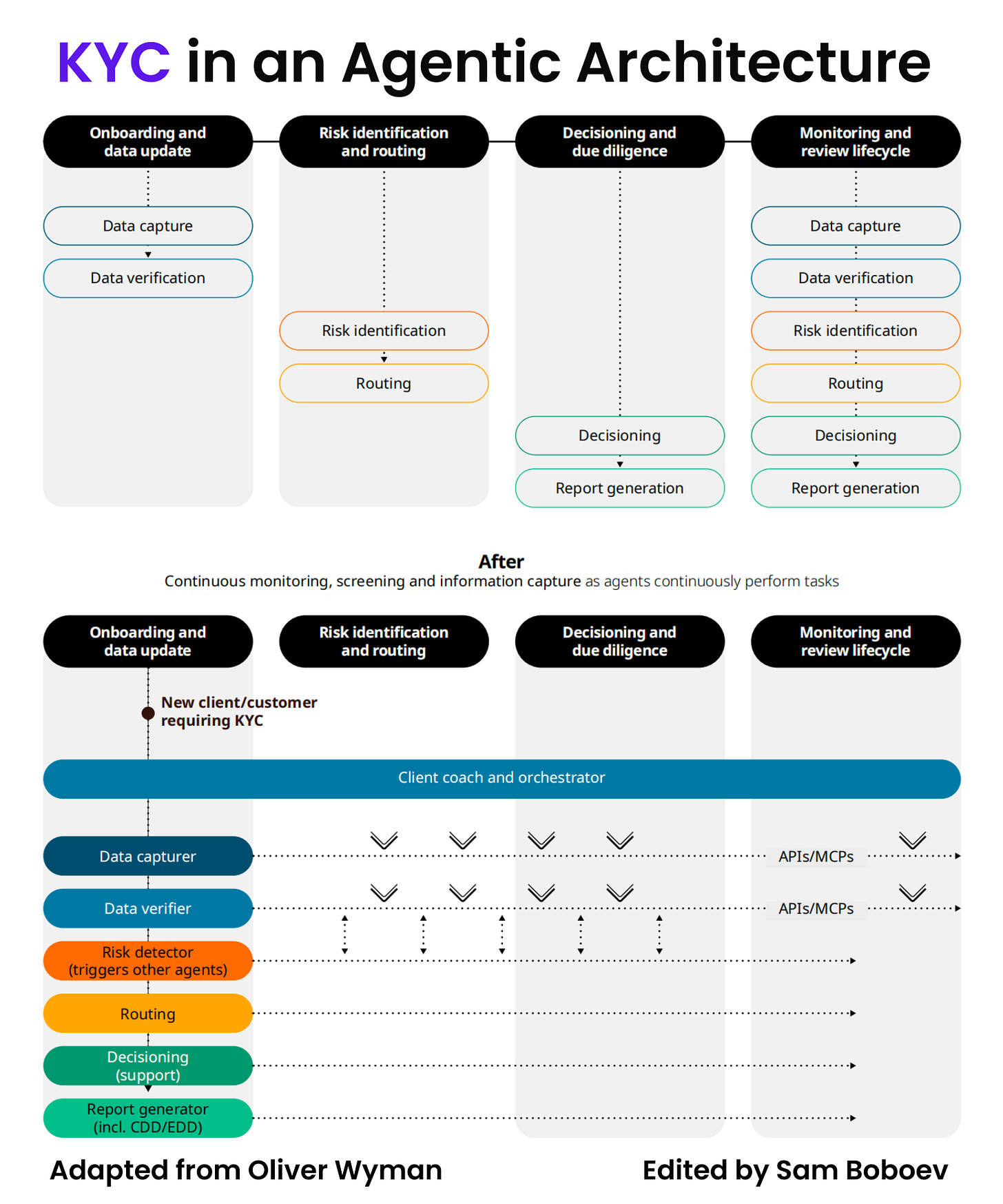

𝐊𝐘𝐂 𝐢𝐧 𝐚𝐧 𝐀𝐠𝐞𝐧𝐭𝐢𝐜 𝐀𝐫𝐜𝐡𝐢𝐭𝐞𝐜𝐭𝐮𝐫𝐞

Today, KYC in most financial institutions is still linear and episodic.

A customer is onboarded.

Data is captured.

Data is verified.

Risk is assessed.

A decision is made.

Then nothing happens… until the next scheduled review.

____

What changes with agentic AI

In an agentic architecture, KYC is no longer a sequence.

It is a set of always-on agents, continuously working in parallel.

Instead of periodic reviews, you get trigger-based reviews.

Instead of static workflows, you get orchestration.

____

Here is the shift.

Before

- KYC runs at onboarding and fixed review intervals

- Each step is handled by a separate system or team

- Risk is assessed at a point in time

- Monitoring is reactive

After

- KYC runs continuously

- Specialized agents handle specific tasks

- Risk detection triggers action instantly

- Monitoring, screening, and due diligence never stop

____

How the agentic KYC model works

At the center is a client coach and orchestrator. This orchestrator does not do the work. It coordinates it.

Around it, you have always-on agents:

- A data capture agent that continuously updates customer information

- A data verification agent that rechecks documents and attributes when signals change

- A risk detection agent that monitors behavior, transactions, and external signals

- A routing agent that decides what needs human review, enhanced due diligence, or automated approval

- A decision support agent that assists compliance teams

- A report generation agent that produces CDD and EDD outputs on demand

Each agent can trigger others. No waiting for calendar-based reviews. No blind spots between cycles.

____

Financial crime does not operate on quarterly schedules. Risk does not politely wait for annual reviews.

Agentic KYC aligns compliance with how money actually moves today:

- Faster risk detection

- Fewer false positives

- Less manual rework

- Better use of human compliance teams

- Stronger regulatory posture

KYC becomes continuous, contextual, and adaptive. That is the real promise of agentic AI in financial services.

Curious how this model could reshape AML, transaction monitoring, or ongoing due diligence next.

Curated News

💳 Payments

Regions Partners with Worldpay to Enhance Business Payments

Regions Bank has partnered with Global Payments’ Worldpay to upgrade its business payment services. The collaboration strengthens Regions’ merchant capabilities while highlighting banks’ reliance on fintech infrastructure providers.

Source

Klarna and OnePay Test Post-Purchase BNPL Conversion Model

Klarna and OnePay are piloting a post-purchase BNPL conversion model that allows consumers to split payments after checkout. The experiment reflects ongoing innovation as BNPL providers seek higher engagement and flexibility.

Source

Gr4vy and Ecommpay Simplify Payments via Single Integration

Gr4vy and Ecommpay have partnered to deliver multiple payment methods through one integration. The move reduces complexity for merchants operating across regions and payment preferences.

Source

Thunes and UnionPay Enable Instant Transfers to China

Thunes and UnionPay International have launched instant money transfers to mainland China. The service improves cross-border payment speed and accessibility for global senders.

Source

Indonesia Expands Digital Payments to China and South Korea

Indonesia plans to expand its digital payment connections to China and South Korea by Q1 2026. The initiative supports regional interoperability and cross-border commerce growth.

Source

🏦 Banking

SMBC to Wind Down US Digital Bank Jenius

SMBC is winding down its US-based digital banking unit, Jenius Bank. The decision highlights challenges foreign banks face scaling standalone digital banks in competitive US markets.

Source

Thisbank Launches as UK Branchless Challenger

Thisbank has launched in the UK as a branchless bank promising competitive savings rates and a human-centric approach. The entrant targets customers seeking simplicity without sacrificing support.

Source

Thai Consortium Plans AI-Powered Virtual Bank

SCBX, KakaoBank, and WeBank are planning an AI-powered virtual bank in Thailand. The initiative reflects rising regional interest in AI-native banking models.

Source

💼 Fintech

PayPal to Acquire Cymbio to Boost AI Commerce Capabilities

PayPal is set to acquire Cymbio to strengthen its AI-driven commerce and marketplace integrations. The move reinforces PayPal’s push beyond payments into intelligent commerce infrastructure.

Source

ZBD Raises $40M to Bring Payments into Gaming

Gaming fintech ZBD has raised $40 million in Series C funding to embed real-money payments and rewards directly into video games. The round highlights growing convergence between gaming and fintech.

Source

Treasury Prime Expands Embedded Finance Bank Network

Treasury Prime has added two new institutions to its banking network, accelerating embedded finance growth. The expansion strengthens infrastructure for fintech–bank partnerships.

Source

Noah and Picnic Enable USD Payroll in Brazil

Noah and Picnic are bringing USD-native payroll and settlement services to Brazil’s global workforce. The solution addresses currency volatility and cross-border pay challenges.

Source

Montran Opens Dubai Office

Payments infrastructure provider Montran has opened a new office in Dubai. The expansion supports growing demand for real-time payments across the Middle East.

Source

🪙 Crypto

Flutterwave Partners with Turnkey on Stablecoin Wallets

Flutterwave has partnered with Turnkey to power secure stablecoin wallets for its customers. The move highlights increasing stablecoin adoption in emerging markets.

Source

Four Risks Emerge in Strategy’s Bitcoin Fortress

Analysts have outlined four potential fault lines in Strategy’s Bitcoin-heavy treasury approach. The assessment highlights ongoing risks tied to corporate crypto exposure.

Source

📊 WealthTech

LendInvest Renews £300M Warehouse Deal with Major Banks

LendInvest has renewed a £300 million warehouse financing facility with HSBC, Barclays, and BNP Paribas. The deal signals continued institutional confidence in private credit platforms.

Source

⚖️ Regulation

Trump Sues JPMorgan for $5B Over Debanking Claims

Donald Trump has filed a $5 billion lawsuit against JPMorgan over alleged debanking. The case reignites debate around financial access, political risk, and bank compliance obligations.

Source

South Korea Launches Sovereign AI for Finance

South Korea’s central bank and Naver have launched a sovereign AI system. The move reflects growing regulatory focus on data sovereignty and domestic AI infrastructure.

Source

🧩 Other

Mastercard Launches Inclusion Hub with Accessibility Focus

Mastercard has unveiled an Inclusion Hub co-designed with autistic Australians. The initiative underscores rising focus on inclusivity within financial infrastructure.

Source

Payoneer Expands Workforce Management in Europe

Payoneer has deepened its workforce management capabilities in Europe through the acquisition of Boundless. The move strengthens Payoneer’s position in global contractor and payroll services.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.