Coinbase Launches Bitcoin Rewards Credit Card Nationwide

Coinbase has officially rolled out its Bitcoin rewards credit card across the U.S., allowing users to earn BTC on everyday purchases. The move expands crypto-based consumer finance, enabling seamless spending while integrating digital assets into mainstream payment habits. Cardholders can choose to earn rewards in Bitcoin or other cryptocurrencies, linking the card directly with their Coinbase wallets. This launch marks another milestone in Coinbase’s strategy to bridge traditional finance and crypto ecosystems. It also positions the exchange competitively against fintechs like PayPal and traditional reward programs. Analysts view it as a strong signal of consumer crypto adoption moving into practical use cases.

Video of the Day

Insight of the Day

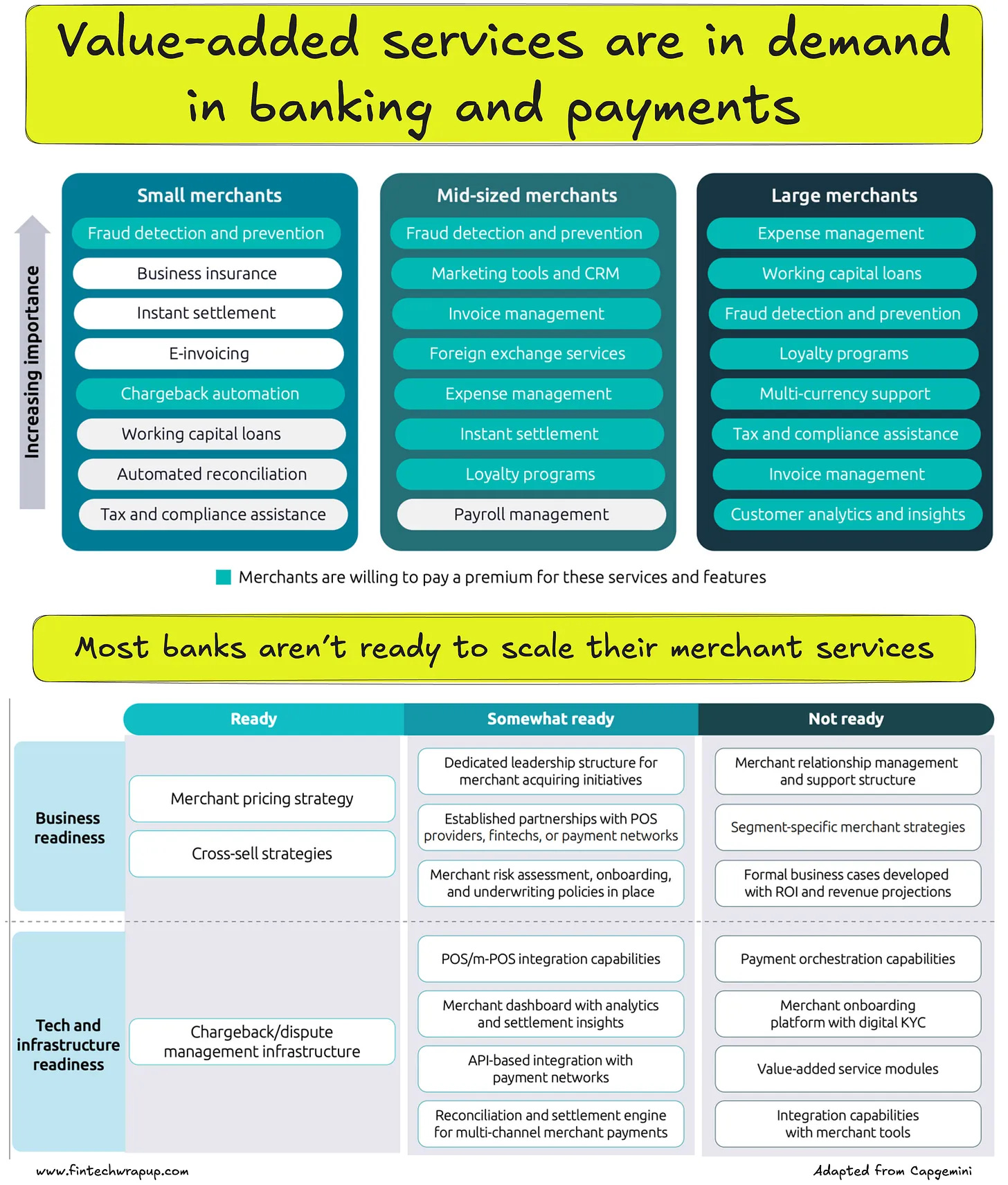

Merchants Are Demanding More — and Banks Need to Catch Up

👉 The merchant services game has changed.

Value-added services (VAS) are no longer nice-to-haves — they’re non-negotiables. From fraud protection to instant settlement and working capital access, merchants now expect their payment partners to deliver beyond basic transactions. But what they’re willing to pay for depends heavily on size and maturity.

👉 Small merchants crave simplicity, liquidity, and protection.

Their world runs on thin margins and unpredictable cash flow — so fraud detection, chargeback automation, and working capital loans top the list. Business insurance and lending tools aren’t luxuries; they’re lifelines for navigating daily volatility. These merchants will pay for peace of mind.

Mid-sized merchants want control, not complexity.

They’re growing fast, juggling operations, and looking for tools that scale — invoice management, expense tracking, and fraud prevention are top priorities. But there’s a notable shift: increasing appetite for marketing tools and CRM platforms. These aren’t vanity purchases; they’re investments in loyalty, retention, and long-term brand value.

Curated News

💳 Payments

PayPal Partners with Rokt to Deliver AI-Powered Post-Transaction Ads

PayPal has announced a partnership with Rokt to integrate AI-driven personalized advertising into post-transaction experiences. The collaboration aims to help merchants increase engagement and revenue through tailored offers at checkout.

Source

Verituity and Sagent Modernize Mortgage Servicing Payments

Verituity and Sagent are teaming up to digitize and secure mortgage servicing payments. The partnership leverages Verituity’s verified payment platform to enhance transaction efficiency and fraud prevention in the mortgage ecosystem.

Source

Shift4 Acquires Worldline’s North American Subsidiaries

Shift4 is acquiring Worldline’s North American operations, expanding its global payment processing reach. The move strengthens Shift4’s presence in the enterprise payments space, aligning with its strategy for international growth.

Source

Clay Taps GoCardless to Streamline Loan Payments

Clay has selected GoCardless to automate loan disbursements and repayments at scale. The integration will enhance efficiency for lenders and borrowers, reducing friction in digital lending operations.

Source

OpenPayd Expands Global Currency Account Access

OpenPayd has tripled its multi-currency account access, enabling businesses to operate in more regions with faster settlements. The expansion supports global fintech growth and cross-border payment efficiency.

Source

🏦 Banking

Allica Bank Acquires Kriya to Power £1B SME Financing Push

Allica Bank has acquired fintech Kriya to deliver £1 billion in SME working capital finance by 2028. The acquisition strengthens Allica’s digital lending capabilities and its focus on supporting UK small businesses.

Source

Superbank Posts $4.9 Million Q3 Profit

Superbank has reported a $4.9 million profit in Q3, signaling steady growth in its digital banking operations. The results highlight its success in customer acquisition and cost efficiency.

Source

💸 Fintech

CloudWalk Hits $1.2B in Annualized Revenue on AI-Driven Growth

Brazil-based payments firm CloudWalk has surpassed $1.2 billion in annualized revenue, fueled by AI innovation and rapid expansion. The company attributes its profitability surge to automation and data-driven financial services.

Source

Riverchain Raises $5M to Expand Across Southeast Asia

Hong Kong fintech Riverchain has secured $5 million to scale its blockchain-based solutions across Southeast Asia. The firm aims to enhance transparency and efficiency in cross-border transactions.

Source

Moniepoint Secures $200M to Drive Financial Inclusion in Africa

African fintech Moniepoint has closed a $200 million Series C round to expand its digital banking and payment services. The funding will accelerate its mission to bring financial access to underserved markets.

Source

Bizcap Acquires AI Funding Platform

Australian lender Bizcap has purchased an AI-powered funding platform to enhance its credit decisioning and automation. The move signals a growing trend of AI integration in alternative lending.

Source

U.S. Bank Avvance Launches Embedded Financing Product

U.S. Bank’s Avvance has introduced a customizable embedded finance solution, enabling merchants to offer flexible payment options at checkout. The launch underscores the bank’s commitment to fintech innovation and customer-centric lending.

Source

🪙 Crypto

UK Regulator Sues HTX Over Unlawful Promotions

The UK’s Financial Conduct Authority has filed a lawsuit against crypto exchange HTX for alleged unlawful marketing activities. The case underscores growing regulatory pressure on crypto advertising compliance.

Source

Cybrid Raises $10M to Expand Stablecoin Infrastructure

Cybrid has secured $10 million in funding to strengthen its stablecoin infrastructure for banks and payment providers. The investment highlights growing institutional interest in blockchain-based payment rails.

Source

Bluwhale Secures $10M Series A to Bring AI Agents to Blockchain

Bluwhale has raised $10 million to integrate autonomous AI agents into blockchain ecosystems. The company aims to build intelligent, self-executing systems that improve network efficiency and smart contract automation.

Source

💼 WealthTech

Mako Financial and Trulioo Streamline KYC for Advisors

Mako Financial Technologies has partnered with Trulioo to automate KYC processes for wealth advisors across North America. The collaboration enhances onboarding efficiency and regulatory compliance.

Source

Tradu Enables UK Traders to Bet Directly via TradingView

Tradu now allows UK traders to place spread bets directly from TradingView charts. This integration simplifies trading workflows and brings professional-grade tools to retail investors.

Source

⚖️ Regulation

New York Issues Third-Party Cybersecurity Guidance

New York’s financial regulator has released new cybersecurity guidelines for third-party providers. The framework aims to bolster supply chain security and protect financial institutions from systemic risk.

Source

🧠 Other

Consumers Increasingly Concerned About AI Scams

A recent survey reveals growing public concern over AI-generated scams, particularly deepfake fraud and impersonation attacks. The findings highlight the urgent need for better digital identity protection and AI regulation.

Source

Smarsh Expands Partnership with Jefferies

Smarsh has extended its collaboration with Jefferies to enhance communications compliance and supervision capabilities. The deal reflects rising demand for advanced surveillance tools in financial institutions.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.