Coinbase Pushes Stablecoins Into the Enterprise Mainstream

Coinbase has launched “Stablecoin-as-a-Service,” enabling businesses to issue and manage their own branded stablecoins without building blockchain infrastructure from scratch. The move positions Coinbase as a core B2B infrastructure provider, extending beyond trading into payments, treasury, and embedded finance use cases. This offering significantly lowers the barrier for enterprises exploring tokenized money, loyalty, and cross-border settlement. It also signals growing confidence that stablecoins are transitioning from crypto-native tools into mainstream financial plumbing. For fintechs, this raises competitive pressure to offer programmable money capabilities. For banks and platforms, it accelerates the convergence of traditional finance and blockchain rails.

Video of the Day

Insight of the Day

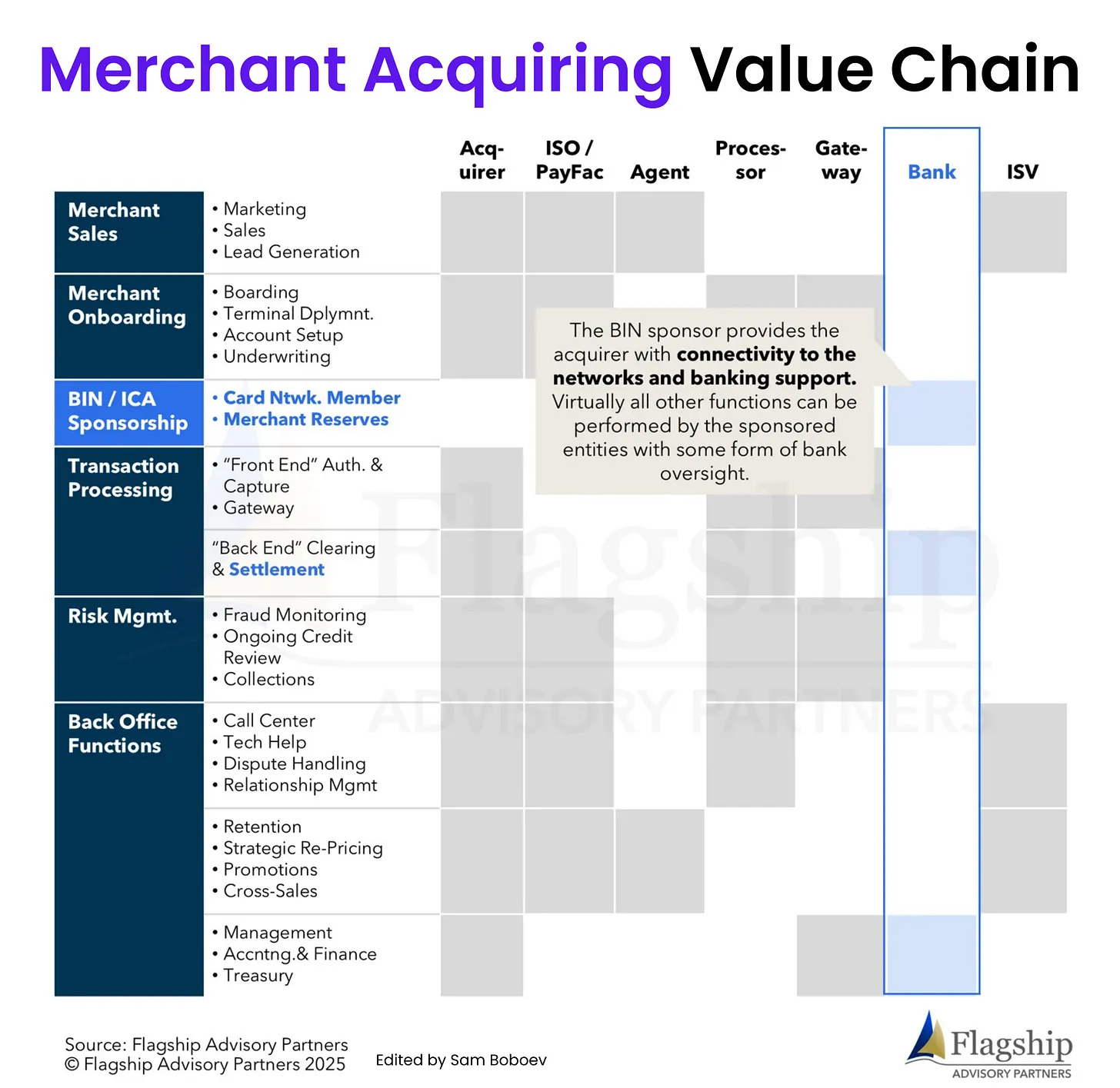

𝐄𝐱𝐩𝐥𝐨𝐫𝐢𝐧𝐠 𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭 𝐀𝐜𝐪𝐮𝐢𝐫𝐢𝐧𝐠 𝐕𝐚𝐥𝐮𝐞 𝐂𝐡𝐚𝐢𝐧 𝐛𝐲 𝐅𝐥𝐚𝐠𝐬𝐡𝐢𝐩 𝐀𝐝𝐯𝐢𝐬𝐨𝐫𝐲 𝐏𝐚𝐫𝐭𝐧𝐞𝐫𝐬

Acquiring BIN sponsors primarily perform these functions: implementing settlement and funding procedures, overseeing the ongoing activities of partners and ensuring compliance, liaising with the card networks, and establishing oversight policies / processes (e.g., merchant application guidelines, partners’ merchant underwriting approaches, fraud monitoring, etc.).

Many of the roles and responsibilities of an acquiring BIN sponsor are similar to existing functions at most banks. At the highest level, establishing and managing a sponsorship program requires:

____

👉 𝐈𝐧𝐯𝐞𝐬𝐭𝐦𝐞𝐧𝐭 𝐢𝐧 𝐓𝐢𝐦𝐞 𝐚𝐧𝐝 𝐑𝐞𝐬𝐨𝐮𝐫𝐜𝐞𝐬:

Acquiring BIN sponsorship requires commitments. The direct costs for establishing and running a program can vary significantly, but overall monetary costs are not prohibitive. The time and resource requirements include:

→ Establishing the foundation of a program (policies, procedures, reporting capabilities, risk management functions, technical integrations with networks, underwriting guidelines, governance approach guidelines, etc.)

→ Staffing of appropriate resources to operate the program

→ Recruiting and performing diligence on sponsored partners and

→ Overseeing the performance and compliance of your sponsored partners and the program

____

👉 𝐂𝐨𝐦𝐟𝐨𝐫𝐭 𝐰𝐢𝐭𝐡 𝐇𝐞𝐢𝐠𝐡𝐭𝐞𝐧𝐞𝐝 𝐑𝐞𝐠𝐮𝐥𝐚𝐭𝐨𝐫𝐲 𝐚𝐧𝐝 𝐂𝐚𝐫𝐝 𝐍𝐞𝐭𝐰𝐨𝐫𝐤 𝐒𝐜𝐫𝐮𝐭𝐢𝐧𝐲:

Sponsoring third parties will result in additional scrutiny from both bank regulators and card networks. This only becomes an issue if the program is performing poorly or out of compliance, but the bank needs to be comfortable with accepting additional scrutiny.

____

👉 𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐲 𝐊𝐧𝐨𝐰𝐥𝐞𝐝𝐠𝐞 𝐚𝐧𝐝 𝐄𝐱𝐩𝐞𝐫𝐭𝐢𝐬𝐞:

Selecting the right partners, setting up the optimal infrastructure, and managing the program requires specialized skills.

____

Absent scale, meaning a portfolio of numerous sponsored third parties or massive amounts of card volume, banks primarily utilize existing resources (fractional employees) to manage acquiring BIN sponsorship programs. Banks may only need one or two additional FTEs for oversight, compliance, business development, and liaising with the card networks.

Curated News

💳 Payments

Contactless Payments Set for More Flexible Spending Limits

Regulators are moving toward greater flexibility in how future contactless payment limits are set. The change aims to balance convenience with fraud prevention as digital payments volumes continue to grow. This could enable issuers and merchants to better tailor limits to customer behavior.

Source

FAB Introduces Virtual Card Numbers for UAE Businesses

First Abu Dhabi Bank has launched Mastercard’s Virtual Card Number solution in the UAE. The product enhances security and control for B2B payments, particularly in procurement and supplier management. It reflects rising demand for tokenized and automated corporate payments in the region.

Source

🏦 Banking

Mercury Moves Closer to Becoming a National Bank

Mercury has applied for a U.S. OCC national bank charter, signaling a major step toward vertical integration. If approved, the fintech would gain greater control over deposits, lending, and compliance. The move underscores a broader trend of fintechs seeking full-stack banking capabilities.

Source

Post Office Secures Five-Year Extension to Run UK Banking Hubs

The UK Post Office will continue operating shared Banking Hubs for another five years. These hubs provide essential in-person banking services in communities affected by branch closures. The extension highlights ongoing challenges around financial inclusion and access to cash.

Source

Superbank Turns Profitable Ahead of Schedule

Digital lender Superbank reported a $7.3 million profit by November 2025. The milestone signals improving unit economics and operational discipline among challenger banks. Profitability strengthens its position amid tighter funding conditions.

Source

💼 Fintech

SaveLend Exits Billecta Stake for SEK 117 Million

SaveLend Group has sold its shareholding in Billecta, generating SEK 117 million in proceeds. The divestment strengthens SaveLend’s balance sheet and allows sharper focus on its core lending operations. It also reflects continued M&A and portfolio optimization across fintech.

Source

TCS BaNCS Integrates AI Across Banking Platform

TCS BaNCS has rolled out AI enhancements aimed at improving automation and decision-making for banks. The upgrade focuses on operational efficiency, risk management, and customer experience. It reinforces how AI is becoming table stakes in core banking platforms.

Source

Finastra Expands with New U.S. and India Offices

Finastra has opened new offices in the U.S. and India as part of its global expansion strategy. The move supports closer customer engagement and access to talent. It reflects sustained enterprise demand for core banking and financial infrastructure software.

Source

Nirvana Insurance Raises $100M for AI-Driven Trucking Coverage

Commercial trucking insurer Nirvana has raised $100 million to scale its AI-based underwriting platform. The funding highlights strong investor appetite for applied AI in specialty insurance. It also underscores continued innovation in commercial insurtech.

Source

🪙 Crypto

Klarna and Coinbase Team Up on Institutional Stablecoin Funding

Klarna has partnered with Coinbase to enable stablecoin-based funding for institutional use. The collaboration signals growing acceptance of crypto rails within large-scale payments and liquidity management. It also blurs the line between traditional fintech and digital assets.

Source

ABN AMRO Secures MiCAR License, Executes Smart Derivative Trade

ABN AMRO has obtained a MiCAR license and completed its first smart derivative transaction. The milestone demonstrates how European banks are operationalizing digital asset regulation. It positions ABN AMRO as an early mover in regulated on-chain finance.

Source

Hong Kong Eyes Tougher Capital Charges for Crypto Exposure

Hong Kong regulators are proposing stricter risk charges for insurers investing in digital assets. The move reflects heightened regulatory caution as traditional institutions explore crypto markets. It could slow adoption while increasing systemic safeguards.

Source

Bitget Wallet and Alchemy Pay Launch Zero-Fee USDC On-Ramp

Bitget Wallet and Alchemy Pay have introduced a zero-fee USDC on-ramp backed by Coinbase. The initiative aims to reduce friction for users entering crypto ecosystems. It highlights intensifying competition around fiat-to-crypto infrastructure.

Source

Bitcoin Holds Near $89K as Macro Signals Diverge

Bitcoin remained near $89,000 as gold hit record highs and Asian equities advanced. The price action reflects ongoing macro uncertainty and portfolio rebalancing. Crypto continues to trade as both a risk asset and inflation hedge.

Source

📈 WealthTech

Peak XV Backs PowerUp Money in $12M Funding Round

Indian wealthtech startup PowerUp Money has raised $12 million led by Peak XV. The platform focuses on modernizing retail investing and financial planning. The deal signals continued growth in emerging-market wealthtech.

Source

Clearwater Analytics Set for $8.4B Take-Private Deal

Permira and Warburg Pincus are nearing an $8.4 billion acquisition of Clearwater Analytics. The deal underscores strong private equity interest in financial data and analytics platforms. Scale and recurring revenue remain highly attractive in WealthTech.

Source

⚖️ Regulation

UK Payments Regulator Targets Card Scheme Fee Transparency

The PSR has announced actions to improve governance and transparency around card scheme and processing fees. The measures aim to enhance competition and protect merchants. This could have material implications for issuers, acquirers, and networks.

Source

Banking Rules and Tech Linked to Rising Economic Abuse Risks

New research highlights how banking regulations and digital tools can unintentionally enable economic abuse. The findings call for more inclusive product design and policy oversight. Fintechs and banks face growing responsibility to address these risks.

Source

🧩 Other

Indonesian Banks Strengthen Cybersecurity After $11.9M Fraud Case

Indonesian banks are ramping up cybersecurity investments following a major payment fraud incident. The response highlights increasing exposure to sophisticated digital fraud. Cyber resilience is becoming a strategic priority across emerging markets.

Source

FINNY Raises $17M to Scale AI for Advisor Marketing

FINNY has closed a $17 million Series A to expand its AI-powered prospecting and marketing platform for financial advisors. The funding reflects growing demand for data-driven client acquisition tools. AI continues to reshape front-office wealth operations.

Source

BBVA Invests in Olea to Expand Trade Finance Capabilities

BBVA has made a strategic investment in Olea to strengthen its global trade finance offering. The partnership enhances risk mitigation and liquidity solutions for international trade. It reflects banks’ renewed focus on digitizing trade finance infrastructure.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.