Coinbase Seeks National Trust Charter to Expand Institutional Services

Coinbase has filed an application to become a national trust company, a move that could give it more regulatory clarity and flexibility in offering custody and asset management services. This step would enable the company to operate under federal oversight rather than a patchwork of state regulations. The charter could strengthen its appeal to institutional clients looking for secure and compliant crypto services. It also signals growing integration between crypto and traditional financial systems. If approved, this would mark a significant milestone for mainstream adoption of digital assets.

Insight of the Day

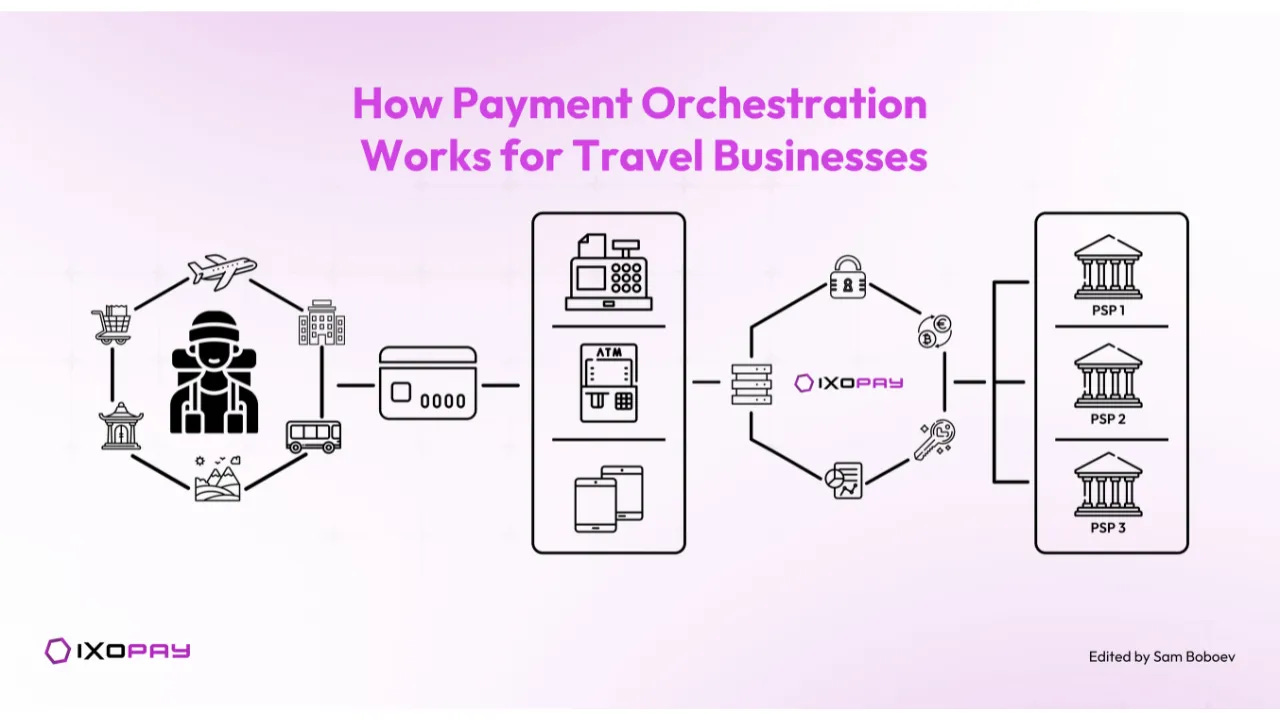

How Payment Orchestration Powers Frictionless Travel Experiences by Ixopay

When travelers book a flight, reserve a hotel, or hop on a rideshare, they expect the process to be instant and effortless. In reality, what feels seamless to the traveler often requires complex orchestration behind the scenes.

A declined card or missing local option doesn’t just cost revenue. It risks loyalty in an industry where customer experience is everything.

This is where payment orchestration comes in.

For travel businesses, payments aren’t just a back-office function. They directly impact customer experience, conversion rates, and even loyalty. A clunky checkout, failed transaction, or limited payment method can quickly turn excitement into frustration (and lost revenue).

🗺️ How Payment Orchestration Works for Travel Businesses

Think of orchestration as the unseen travel guide for every payment journey. It:

🔹 Connects multiple PSPs and acquirers so you always have a backup if one route fails.

🔹 Adapts to local markets, offering region-specific payment methods to boost conversions.

🔹 Optimizes routing to improve authorization rates and reduce costs.

🔹 Keeps token data independent so you avoid processor lock-in and stay in control.

🔹 Ensures compliance across borders, easing the burden of managing regulations.

Curated News

💳 Payments

NPCI Rolls Out Biometric UPI Authentication

NPCI has launched fingerprint and facial recognition authentication for UPI transactions, replacing traditional PIN-based verification. This upgrade enhances security and speeds up payments, potentially boosting digital payment adoption in India.

Source

Biometric Authentication Coming to UPI Real-Time Payments

UPI will soon support biometric authentication methods for real-time transactions, improving user convenience and fraud prevention. This step aligns with global trends in secure digital payment innovation.

Source

fumopay & Big Issue Partner to Expand Open Banking Payments

Big Issue sellers will now be able to accept instant open banking payments thanks to a new partnership with fumopay. The initiative is designed to boost financial inclusion and make transactions faster and cheaper.

Source

Teya Launches Tap to Pay on iPhone Across Europe

Teya has introduced Tap to Pay on iPhone for European merchants, enabling them to accept contactless payments without extra hardware. The move lowers barriers for small businesses and aligns with the growing shift to mobile-first commerce.

Source

Checkout.com Taps Microsoft Azure to Power Next-Gen Payments

Checkout.com will leverage Microsoft Azure to modernize its global payments infrastructure. This collaboration aims to deliver faster, more secure, and scalable payment solutions for merchants worldwide.

Source

🏦 Banking

NatWest Backs JS Group to Strengthen Student Financial Support

NatWest has invested in JS Group to enhance financial tools for students. The partnership aims to expand services that improve financial well-being and affordability for the UK student population.

Source

Royal Bank of Scotland to Launch IP-Backed Loans for Scottish Innovation

RBS is preparing to offer IP-backed loans to support growth and innovation among Scottish businesses. The program aims to make intangible assets a more powerful financing tool.

Source

Baselane Raises $34M to Expand AI Banking for Real Estate Investors

Baselane secured $34 million in funding to enhance its AI-powered banking and bookkeeping solutions for real estate investors. The capital will fuel product innovation and customer growth.

Source

💸 Fintech

OpenAI Acquires Investment Start-Up Roi

OpenAI has acquired investment platform Roi to integrate personalized wealth and finance tools into its AI ecosystem. The deal underscores AI’s growing role in retail investing and financial planning.

Source

Solvrays and Penn River Partner to Digitize Life & Annuities Operations

The companies will use AI orchestration to automate back-office processes in life and annuities. This collaboration aims to increase operational efficiency and accelerate product innovation.

Source

Juniper Square Acquires Tenor Digital to Expand Private Credit Solutions

Juniper Square’s acquisition of Tenor Digital enhances its capabilities in private credit management for general partners. This move strengthens its footprint in the alternative investment ecosystem.

Source

CMG Financial Automates Mortgage Loan Processing with GenAI

CMG Financial has chosen Fisent BizAI to automate mortgage loan processing using applied generative AI. This is expected to significantly reduce costs and turnaround times.

Source

Moneyhub Pushes for Personalized Finance Experiences

Moneyhub has launched tools to help financial institutions move away from one-size-fits-all solutions. The platform aims to deepen customer engagement through tailored insights and services.

Source

DXC Technology Launches AI-Powered SaaS for Insurance Brokers

DXC has unveiled Assure Broking Essentials, a SaaS solution for small and mid-sized brokers. The product uses AI to streamline processes and reduce operational burdens.

Source

📊 WealthTech

Lemonade Appoints PayPal CMO to Its Board

Lemonade has added PayPal’s Chief Marketing Officer to its board of directors. The appointment signals a strategic focus on scaling customer engagement and fintech partnerships.

Source

🧾 Regulation

EuroCTP Partners with DataBP for EU Consolidated Tape Licensing

EuroCTP will work with DataBP to manage licensing for the EU’s consolidated tape initiative. This is a key step in enhancing transparency and access to market data across Europe.

Source

SmartSearch Acquires Credas to Boost AML Compliance

SmartSearch has acquired Credas to expand its anti-money laundering capabilities in the UK. The deal aims to provide financial institutions with stronger identity verification tools.

Source

🧠 Other

Moody’s Warns on Slow AI Adoption

Moody’s has warned that firms delaying AI integration risk losing market share and seeing shrinking margins. The report underlines how AI readiness is becoming a key competitive factor.

Source

Nikolay Storonsky Leaves London Amid Tax Changes

The billionaire CEO of Revolut has left London following recent tax reforms affecting ultra-wealthy individuals. The move reflects growing concerns among founders about the UK’s shifting fiscal landscape.

Source

Sumsub Named Leader in IDC MarketScape for Identity Verification

Sumsub has been recognized as a global leader in identity verification solutions for financial services. This strengthens its position in the fast-growing digital identity market.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.