CredAbility Launches AI-Powered Credit Score Builder

CredAbility has unveiled a first-of-its-kind credit score builder designed to help millions improve their credit standing. Using personalized, data-driven insights, the tool empowers consumers to make smarter financial decisions and strengthen their borrowing potential. Unlike traditional models, it leverages behavioral data to provide real-time guidance, helping users understand exactly how actions affect their score. This launch comes at a time when demand for inclusive credit solutions is growing rapidly. The product aims to support underbanked individuals and those seeking to recover from financial challenges. If successful, it could reshape how consumers engage with credit health in the digital era.

Source

Insight of the Day

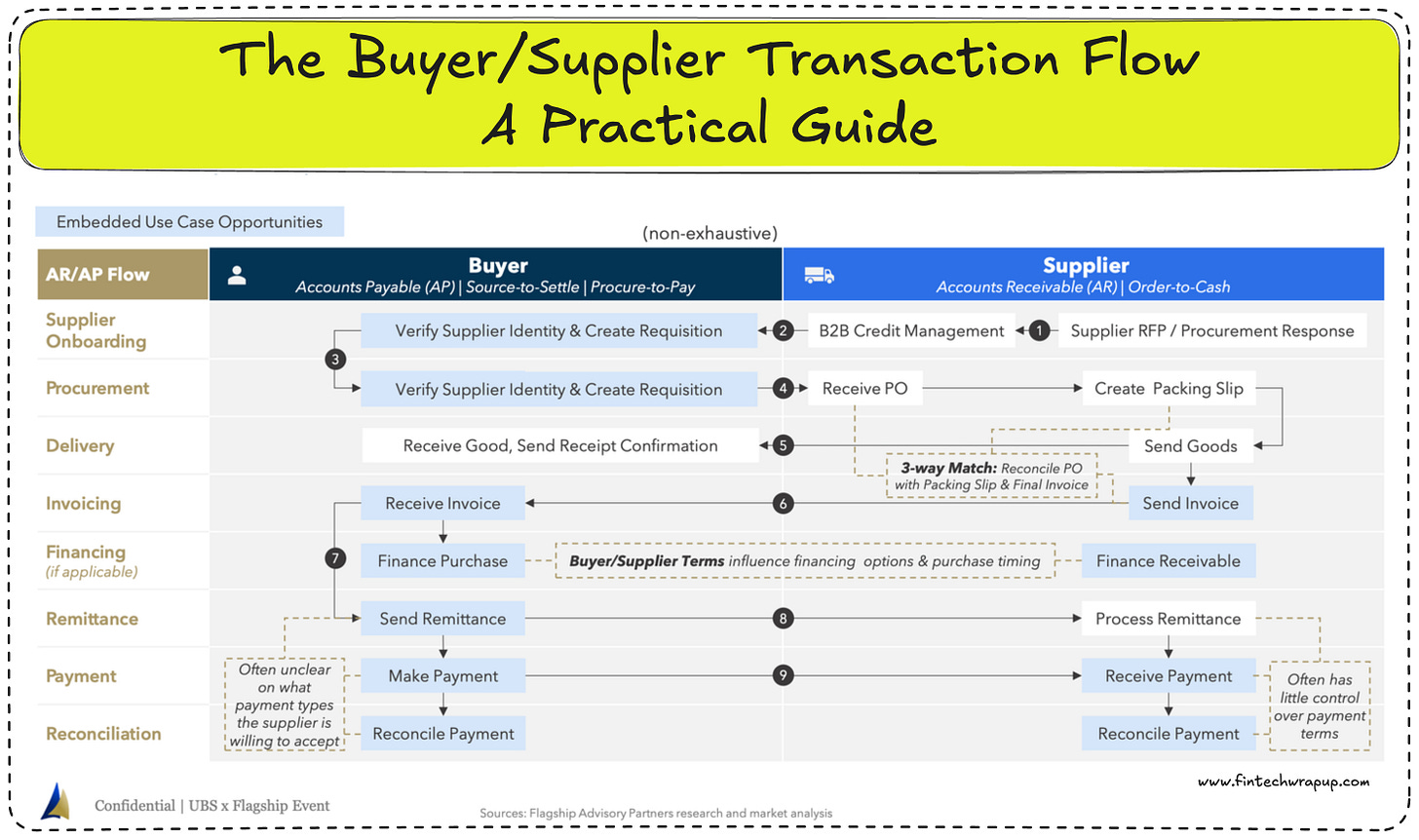

The Buyer/Supplier Transaction Flow — A Practical Guide

The Buyer/Supplier Transaction Flow covers the journey from first supplier contact to payment reconciliation.

For buyers, it’s Accounts Payable (AP) or procure-to-pay; for suppliers, it’s Accounts Receivable (AR) or order-to-cash.

Understanding it improves efficiency, cash flow, and relationships.

1. Supplier OnboardingBuyer: Verifies supplier identity, performs compliance checks, creates requisition.

Supplier: Responds to RFPs or procurement requests.

Curated News

💳 Payments

Zum Rails Rolls Out Mastercard-Powered Business Card Programs

Zum Rails launched new Mastercard-powered card programs in Canada to streamline B2B payments across multiple industries. The initiative strengthens its foothold in embedded finance and enhances flexibility for businesses.

Source

Cash App and Afterpay Expand Retail Partnership with Caleres

Cash App and Afterpay extended their collaboration with footwear retailer Caleres to enhance flexible payment options for shoppers. The move underscores BNPL’s role in boosting consumer choice during retail transactions.

Source

Finity Adds Advanced Salaried Payroll Feature

Finity introduced an enhanced payroll feature designed to provide complete salary processing functionality. This strengthens its offering in the paytech space by catering to businesses seeking streamlined workforce payments.

Source

Stripe Expands Product Suite in Asia for Global Growth

Stripe announced new product updates aimed at empowering businesses in Asia with scalable payment solutions. The updates are designed to support global expansion and cross-border commerce.

Source

BLIK Transactions Surpass €47 Billion in H1 2025

Poland’s BLIK payment system reported over €47 billion in transactions in the first half of 2025, marking strong adoption and usage growth. The figures highlight BLIK’s growing dominance in Europe’s digital payments landscape.

Source

🏦 Banking

Grasshopper Bank Leverages AI Insights via Narmi MCP

Grasshopper Bank adopted Narmi’s Multi-Channel Platform (MCP) server to unlock AI-driven insights for business banking. The integration aims to improve decision-making and enhance customer engagement.

Source

Sygnum and Incore Deepen B2B Digital Asset Banking Partnership

Sygnum and Incore Bank expanded their collaboration to scale and future-proof digital asset services for B2B clients. The move strengthens infrastructure for institutional crypto and tokenization banking.

Source

Shawbrook Scales SME Lending with Thought Machine’s Vault Core

Shawbrook Bank deployed Vault Core by Thought Machine to power its commercial SME lending products. The upgrade supports scalability and flexibility in delivering digital-first financial services.

Source

💸 Fintech

Brex Pursues EU Expansion with Partnerships

Brex revealed its strategy to crack the European market through a partnership-led approach. The move signals its ambitions to replicate U.S. success and compete in Europe’s fintech ecosystem.

Source

Priority Secures $50M Financing Facility

Payments and fintech platform Priority secured a $50 million financing facility to support growth and new product development. The funding strengthens its capital position in a competitive market.

Source

MoneyMe Enhances Fraud Prevention with SEON

Australian fintech MoneyMe selected SEON to boost fraud prevention and credit decisioning. The partnership aims to safeguard lending while improving operational efficiency.

Source

SDK.finance Achieves ISO 27001:2022 Certification

SDK.finance obtained ISO 27001:2022 certification, underscoring its leadership in fintech information security. This milestone strengthens its trust credentials for global clients.

Source

🪙 Crypto

MetaMask Introduces Native Stablecoin

MetaMask launched its own native stablecoin, marking a significant expansion beyond wallet services. The move positions MetaMask to compete in the growing stablecoin sector.

Source

Kraken Acquires Trading Automation Firm Capitalise.ai

Kraken acquired Capitalise.ai to strengthen its trading automation and AI capabilities. The deal highlights the exchange’s push to enhance advanced trading tools for users.

Source

Loop Crypto Raises Funding Led by VanEck and Fabric Ventures

Loop Crypto secured a funding round led by VanEck and Fabric Ventures to scale its blockchain infrastructure solutions. The investment underscores continued VC interest in crypto infrastructure.

Source

Tether and Circle to Meet South Korea’s Banking Leaders

Stablecoin giants Tether and Circle will meet with South Korea’s top banking CEOs amid growing adoption momentum. The talks could shape regulatory and banking integration in Asia’s stablecoin market.

Source

📈 WealthTech

Klarna Secures $1.6B Warehouse Financing Facility

Klarna announced a $1.6 billion warehouse financing facility to support its growth strategy. The move bolsters its capital resources for BNPL expansion and future scaling.

Source

📊 Other

Figma Stock Gets Buy Rating After Post-IPO Dip

Figma received a buy rating despite its stock pullback following the IPO, reflecting investor confidence in long-term growth. Analysts cite strong fundamentals and product adoption.

Source

Anthropic in Talks to Raise $10B

AI firm Anthropic is reportedly seeking to raise up to $10 billion in new funding. The raise would further intensify competition in the AI space and support large-scale R&D.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a "Source: [Name]" attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.