DXC and Ripple Team Up to Bring Crypto Payments and Custody to Banks

DXC Technology has partnered with Ripple to offer banks a framework for crypto payments and digital asset custody, marking a significant step toward institutional adoption of blockchain infrastructure. The collaboration aims to simplify how financial institutions integrate crypto services while meeting regulatory and operational requirements. By combining DXC’s enterprise technology reach with Ripple’s blockchain expertise, the offering targets banks looking to move beyond pilots into production use cases. This signals growing confidence among incumbents that crypto rails can coexist with traditional banking systems. For regulators and market participants, it reflects a shift from speculative crypto use toward structured financial infrastructure. The partnership also underscores how crypto custody and payments are becoming competitive necessities rather than optional innovations. Overall, it highlights the accelerating convergence of enterprise IT, banking, and blockchain.

Video of the Day

Insight of the Day

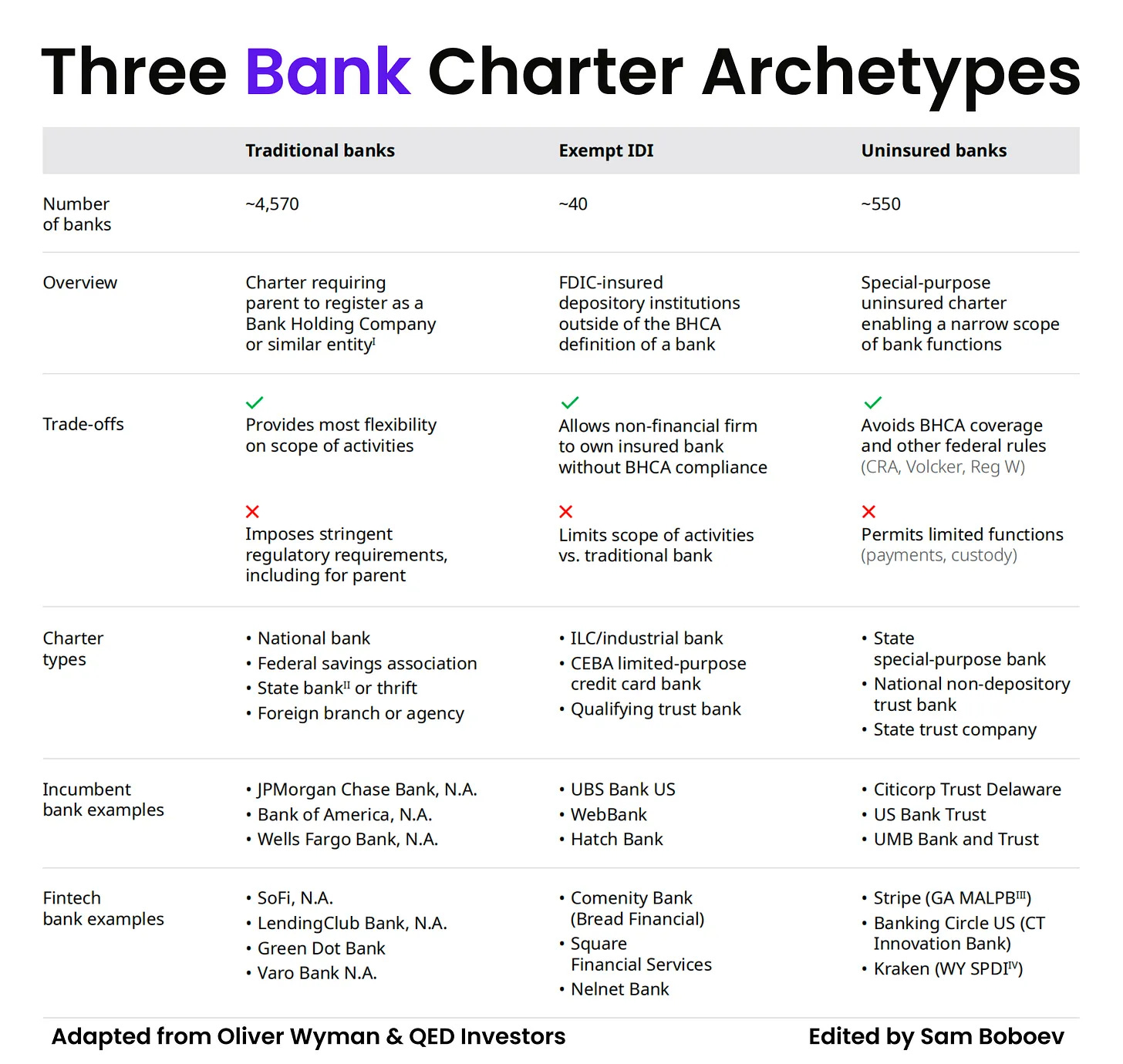

𝐀𝐭 𝐢𝐭𝐬 𝐜𝐨𝐫𝐞, 𝐚 𝐛𝐚𝐧𝐤 𝐜𝐡𝐚𝐫𝐭𝐞𝐫 𝐢𝐬 𝐧𝐨𝐭 𝐣𝐮𝐬𝐭 𝐚 𝐥𝐢𝐜𝐞𝐧𝐬𝐞

I keep getting asked why so many fintechs are suddenly talking about bank charters. So here is how I think about it.

Banks are the only entities that can take deposits and reinvest them into loans. That alone is massive. But charters unlock much more. Access to FDIC insurance. Direct access to Federal Reserve payment systems. Eligibility for direct Visa and Mastercard membership. Exemptions from state money transmitter licensing. The ability to borrow from the Fed’s discount window. And now, after the Genius Act, the ability to issue stablecoins via a ringfenced subsidiary.

That is why charters matter.

____

What often gets missed is that not all bank charters are the same. In practice, fintechs are choosing between three very different paths.

Traditional bank charters mean becoming a bank. Full powers, but also full Bank Holding Company oversight, capital requirements, and tight regulatory scrutiny.

Exempt insured depository institutions, like ILCs or credit card banks, mean owning a bank without becoming a bank holding company. The parent stays outside direct Fed supervision, but the bank itself faces narrower activity limits and tighter constraints on deposits.

Uninsured bank charters are the lightest option. They allow a narrow slice of banking activity, like custody, acquiring, or payments access, without FDIC insurance and without the full federal banking rulebook.

____

Why is this conversation heating up now?

First, fintechs are growing up. Many scaled fintech lenders have reached the point where deposit funding, net interest margin, and balance sheet control matter more than staying asset light. At scale, the benefits of a charter compound, while the regulatory burden becomes more manageable.

Second, there is a regulatory window. Both the OCC and FDIC have publicly signaled openness to fintech charter applications. Approvals feel more achievable today than they did a few years ago, especially for newer business models and digital assets. That window may not stay open forever.

Third, there is growing discomfort with the sponsor bank model. The 2023 and 2024 crackdown on Banking as a Service, combined with the Synapse collapse, exposed how dependent fintechs are on third parties for critical infrastructure. Even though the environment has stabilized, many fintech leaders now see a charter as a way to regain control over their destiny.

____

The pattern is becoming clear.

- Early stage fintechs start as nonbanks.

- Scaled fintechs hit the limits of sponsorship.

- The biggest ones eventually graduate into banks.

A bank charter is not right for everyone. But for mature fintechs, it is increasingly less about ambition and more about resilience, control, and long term economics.

Curated News

💳 Payments

Europe’s Payment Sovereignty Hinges on Pay by Bank, Says ETTPA

The European Third Party Providers Association argues that Pay by Bank is critical to Europe’s payment sovereignty. The push reflects growing efforts to reduce reliance on global card networks and strengthen open banking rails.

Source

Mercuryo and Visa Enable Real-Time Crypto Off-Ramping

Mercuryo and Visa are enabling real-time crypto off-ramping, allowing users to convert digital assets into fiat instantly. The partnership highlights rising demand for seamless crypto-to-fiat payment experiences.

Source

Falcon Finance Launches Fiat Off-Ramp for USDf

Falcon Finance has introduced a fiat off-ramp for the USDf stablecoin. The service improves liquidity and real-world usability for stablecoin holders.

Source

🏦 Banking

Nationwide Taps AWS to Personalise CX for 17M Members

Nationwide has selected AWS and Amazon Connect to personalise customer experiences for 17 million members. The move highlights how cloud and AI tools are becoming core to large-scale retail banking.

Source

Australian Digital Bank in1bank to Shut Down

Australian digital bank in1bank is set to cease operations. The closure underscores ongoing challenges facing challenger banks in achieving sustainable scale.

Source

US Bancorp CEO Warns on Impact of Credit Card Interest Cap

The CEO of US Bancorp has warned that a proposed credit card interest rate cap could significantly impact customers. The comments highlight growing tension between consumer protection proposals and banking economics.

Source

💼 Fintech

ClearScore Expands Into Mortgages with Acre Acquisition

ClearScore Group has acquired mortgage platform Acre, moving deeper into the home-buying journey. The deal strengthens ClearScore’s ambition to become a full-service financial marketplace.

Source

Barclays Expands Demo Directory for Startup–Corporate Connections

Barclays has expanded its Demo Directory to help founders connect directly with corporates for investment and commercial partnerships. The initiative supports fintech scaling through enterprise collaboration.

Source

1fs Wealth and S&W Form Strategic Wealth Intelligence Partnership

1fs Wealth and S&W have announced a strategic partnership focused on wealth intelligence technology. The collaboration aims to modernise advisory and planning capabilities.

Source

🪙 Crypto

Riyad Bank’s Jeel and Ripple Test Blockchain Payments in Saudi Arabia

Riyad Bank’s Jeel unit has partnered with Ripple to test blockchain-based cross-border payments in a sandbox environment. The initiative highlights growing Middle Eastern interest in regulated blockchain adoption.

Source

Japan Expected to Approve Crypto ETFs by 2028

Japan is expected to approve crypto ETFs by 2028, according to reports. The move would mark a major milestone for regulated crypto investment products in Asia.

Source

Gold Hits Record High as Tether’s Gold Token Outpaces USDT Growth

Gold prices have reached record highs as Tether reports faster growth in its gold-backed token than USDT. The trend highlights rising investor interest in asset-backed digital tokens.

Source

Stablecoin Outflows Signal Capital Leaving Crypto Markets

Stablecoin outflows suggest capital is exiting crypto markets as Bitcoin trades flat. The data points to cautious sentiment among traders and investors.

Source

River Token Surges 1,900% in a Month

The River crypto token has surged 1,900% over the past month. The spike raises questions around speculation, liquidity, and sustainability.

Source

📊 WealthTech

S&W Selects 1fs Wealth for Technology Upgrade

Professional services firm S&W has selected 1fs Wealth to upgrade its technology stack. The move reflects rising demand for data-driven wealth intelligence tools.

Source

⚖️ Regulation

BIS Warns on Financial Stability Risks from AI and Digital Finance

The Bank for International Settlements has outlined potential financial stability risks linked to AI and digital finance. The speech highlights growing regulatory focus on systemic risk from emerging technologies.

Source

South Korea Delays Virtual Asset Law Amid Stablecoin Debate

South Korea has delayed its virtual asset legislation due to disagreements over stablecoin regulation. The delay underscores global uncertainty around crypto oversight frameworks.

Source

Regulator Extends Probe Into Coupang Pay Data Leak

South Korea’s regulator has extended its investigation into a data leak at Coupang Pay. The case highlights increasing scrutiny around fintech data protection.

Source

Trading 212 Sold Crypto-Linked Securities Without Approval

Trading 212 has been found to have sold crypto-linked securities without proper authorisation. The incident highlights compliance risks as platforms expand crypto offerings.

Source

🧩 Other

AXA XL Launches Alternative Risk Solutions Team in the Americas

AXA XL has created a dedicated Alternative Risk Solutions team for the Americas. The move strengthens its capabilities in complex and non-traditional risk coverage.

Source

Embedded Insurance Meets EV Innovation with Octopus EV Partnership

Root, Admiral Pioneer, and Octopus EV have partnered to deliver embedded insurance for electric vehicles. The collaboration highlights growing convergence between mobility, insurance, and fintech.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.

Couldn't agree more, it's wild how fast this is movin', so where do you see AI fitting into this new financial architecure, your insights are always spot on!