EU Probes Alleged Collusion Between Deutsche Börse & Nasdaq

The European Commission has launched a wide-ranging antitrust investigation into whether Deutsche Börse and Nasdaq coordinated their commercial practices to limit competition across key market infrastructure services. Regulators are examining whether the exchanges jointly restricted access, manipulated pricing structures, or engaged in behavior that reduced transparency for trading and clearing participants. If proven, such collusion could have far-reaching consequences for how market data, clearing services, and trading technology are governed across Europe. The case is significant because the two companies serve as foundational infrastructure for banks, asset managers, and fintechs building capital-markets products. A ruling against them could trigger structural remedies, new compliance requirements, or even forced separation of certain business units. It also reflects the EU’s increasingly assertive stance on competition in digital financial markets, where a handful of incumbents hold substantial power. The outcome of this investigation may set a precedent shaping the future of European market infrastructure for years to come.

Video of the Day

Insight of the Day

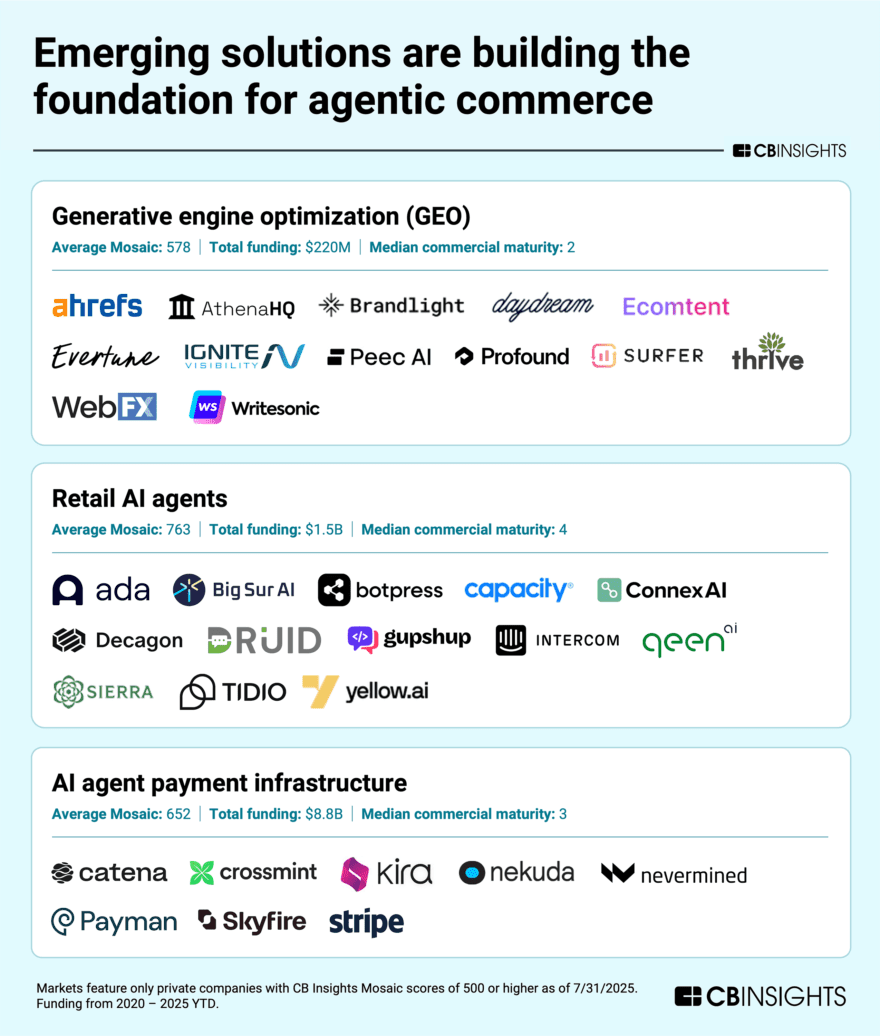

3 Markets Fueling the Shift to Agentic Commerce

Let me breakdown how AI agents are changing the commerce and payments

I’ve been tracking the evolution of agentic commerce for a while now — and CB Insights’ latest report, “3 Markets Fueling the Shift to Agentic Commerce,” finally ties the pieces together.

It’s becoming clear: we’re moving from a world of clicks and searches to one of conversations and autonomy — where AI agents, not humans, initiate, manage, and even complete transactions.

Here are the three trends shaping that shift 👇

1. Generative Engine Optimization (GEO) — the new SEO.

AI is quietly rewriting the rules of digital visibility.

With Google AI Overviews and ChatGPT Shopping now steering e-commerce discovery, brands are losing traffic but gaining a new channel — AI-native visibility.

Startups like Profound are already helping companies understand how AI “sees” their brand, optimize responses, and improve their ranking inside generative engines.

Nearly 40% of GEO players launched in just the last two years. That tells you everything about where attention is shifting next.

If SEO was about algorithms, GEO is about influence in AI reasoning — and every brand will soon need a strategy for it.

2. Retail AI agents — from chatbots to co-shoppers.

The next generation of retail isn’t about better chatbots.

It’s about AI agents that act as personal shoppers, support agents, and product advisors rolled into one.

Companies like Decagon (working with Gopuff, Oura, and Curology) are showing what this future looks like — where agents learn preferences, handle billing, and anticipate needs.

These systems don’t just automate; they build trust loops.

Retailers adopting agents today are essentially training their data and operations for the moment when AI can transact autonomously.

Curated News

💳 Payments

Worldline Seeks €500M Capital Injection Amid Strategic Reset

Worldline plans to raise €500M from French banks to stabilize operations and support restructuring after a difficult period. The move boosts liquidity and helps the firm reposition in the competitive European payments sector.

Source

U.S. Bank Launches Auto-Installment Credit Card

U.S. Bank introduced a credit card that automatically converts eligible purchases into installments, blending traditional credit with BNPL functionality. The feature responds to consumer demand for more flexible repayment options.

Source

Nuvei Integrates Visa Direct for Faster Account Payouts

Nuvei has added Visa Direct to its payout stack, allowing businesses to push funds directly to bank accounts in real time. This strengthens Nuvei’s offering for merchants needing fast global disbursements. Source

Devengo Raises €2M Backed by Spanish Banks for A2A Payments

A2A payments startup Devengo secured €2M in pre-seed funding from major Spanish banks. The capital will support expansion of instant account-to-account payment solutions across Europe.

Source

Payit by NatWest Rolls Out to True Potential for Real-Time Payments

True Potential now offers NatWest’s Payit solution, enabling secure and instant A2A payments. The rollout reflects growing momentum behind A2A alternatives to traditional card rails.

Source

Modernising UK B2B Payments Could Unlock £55B in Productivity

A new report claims that upgrading B2B payment processes in the UK could generate £55B in economic value. By replacing slow, manual payments with modern rails, businesses could significantly increase efficiency.

Source

🏦 Banking

Lloyds Launches UK’s First Multi-Feature AI Financial Assistant

Lloyds has launched an AI-driven assistant for its 21M mobile customers, offering budgeting insights, alerts, and personalized financial guidance. This marks one of the most advanced AI deployments in UK retail banking.

Source

Starling Adds AI and Integrated Tax Tools for SMEs

Starling Bank introduced new AI features and tax software integrations to help SMEs prepare for the UK’s Making Tax Digital rollout. The upgrades streamline financial administration and expand the bank’s business-focused capabilities.

Source

💡 Fintech

Zest AI Secures Funding to Scale ML-Driven Lending Tools

Zest AI raised strategic investment to expand adoption of its machine-learning underwriting technology among lenders. The company aims to improve decision accuracy and support more inclusive credit access.

Source

Investa Raises £1M on Crowdcube for Property Investment Platform

Investa secured £1M to scale its fractional property investment marketplace. Funds will support product development and user growth in the expanding proptech investment space.

Source

CWAN Deploys 800+ AI Agents Overseeing $10T in Assets

CWAN launched more than 800 AI agents to automate workflows and research for asset managers handling $10T in client assets. The tools aim to streamline operations across large financial institutions.

Source

LSEG and Nasdaq Partner to Expand Private Markets Data

LSEG and Nasdaq announced a partnership enabling broader distribution of private-market valuation and benchmark data. The collaboration strengthens both firms’ positions in the growing private-assets information ecosystem.

Source

Peak XV Leads $40M in Lighthouse Canton Funding Round

Lighthouse Canton raised $40M led by Peak XV to expand its wealth and fund-management services. The investment supports the firm’s growth in Asia’s rapidly developing wealth market.

Source

Groww IPO Fully Subscribed Within Two Days

Indian brokerage Groww saw strong investor demand with its IPO fully subscribed by day two. The success highlights the surge in retail participation and trust in digital investment platforms in India.

Source

🪙 Crypto

Ripple Raises $500M to Accelerate Stablecoin & Payments Expansion

Ripple secured $500M to support global growth, particularly around its stablecoin and cross-border payments initiatives. The raise represents one of the largest crypto fundings of the year.

Source

Ripple & Mastercard Bring RLUSD Stablecoin to Card Payments

Ripple partnered with Mastercard to make RLUSD usable in card-based transactions. The integration marks a significant step in connecting stablecoins with mainstream payments infrastructure.

Source

Ripple Says It Has No IPO Plans

Ripple’s president confirmed the company has no current plans to go public despite recent fundraising. The focus remains on product adoption and regulatory engagement.

Source

Spain Eyes Selling Bitcoin Gains to Fund Quantum Research

A Spanish council is considering selling Bitcoin holdings that appreciated more than 1,000x, using proceeds to support quantum technology research. This highlights an emerging link between public-sector innovation funding and crypto gains.

Source

South Korea Mulls Sanctions on North Korea After US Crypto Crackdown

Seoul is exploring new sanctions on North Korea following U.S. actions against illicit crypto operations. The measures target digital channels used for sanctions evasion.

Source

WisdomTree and Chainlink Bring On-Chain NAV Data for Tokenized Credit Fund

WisdomTree partnered with Chainlink to place NAV data for its CRDT tokenized private credit fund directly on-chain. This boosts transparency and supports the growth of tokenized real-world assets. Source

📜 Regulation

Alpha Ladder Appoints Veteran Leader as Group CCO

Alpha Ladder Group hired a seasoned compliance executive with experience at HSBC, PayPal, ByteDance, and Aspire to lead global compliance. The appointment supports the firm’s efforts to strengthen governance as it expands.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.