Family Offices Continue to Avoid Crypto Despite Market Hype, JPMorgan Finds

Family offices remain largely on the sidelines when it comes to crypto investing, with 89% holding no digital assets, according to JPMorgan Private Bank. Despite ongoing geopolitical uncertainty and persistent industry hype, most wealthy families continue to favor traditional asset classes. Concerns around volatility, regulation, custody, and valuation remain key barriers to adoption. The findings challenge the narrative that institutional money is broadly embracing crypto. They also highlight a widening gap between retail speculation and long-term capital allocation. For crypto firms seeking institutional legitimacy, the data underscores the need for stronger risk frameworks and clearer regulation. Ultimately, the report suggests that mainstream adoption among the ultra-wealthy is still a long way off.

Video of the Day

Insight of the Day

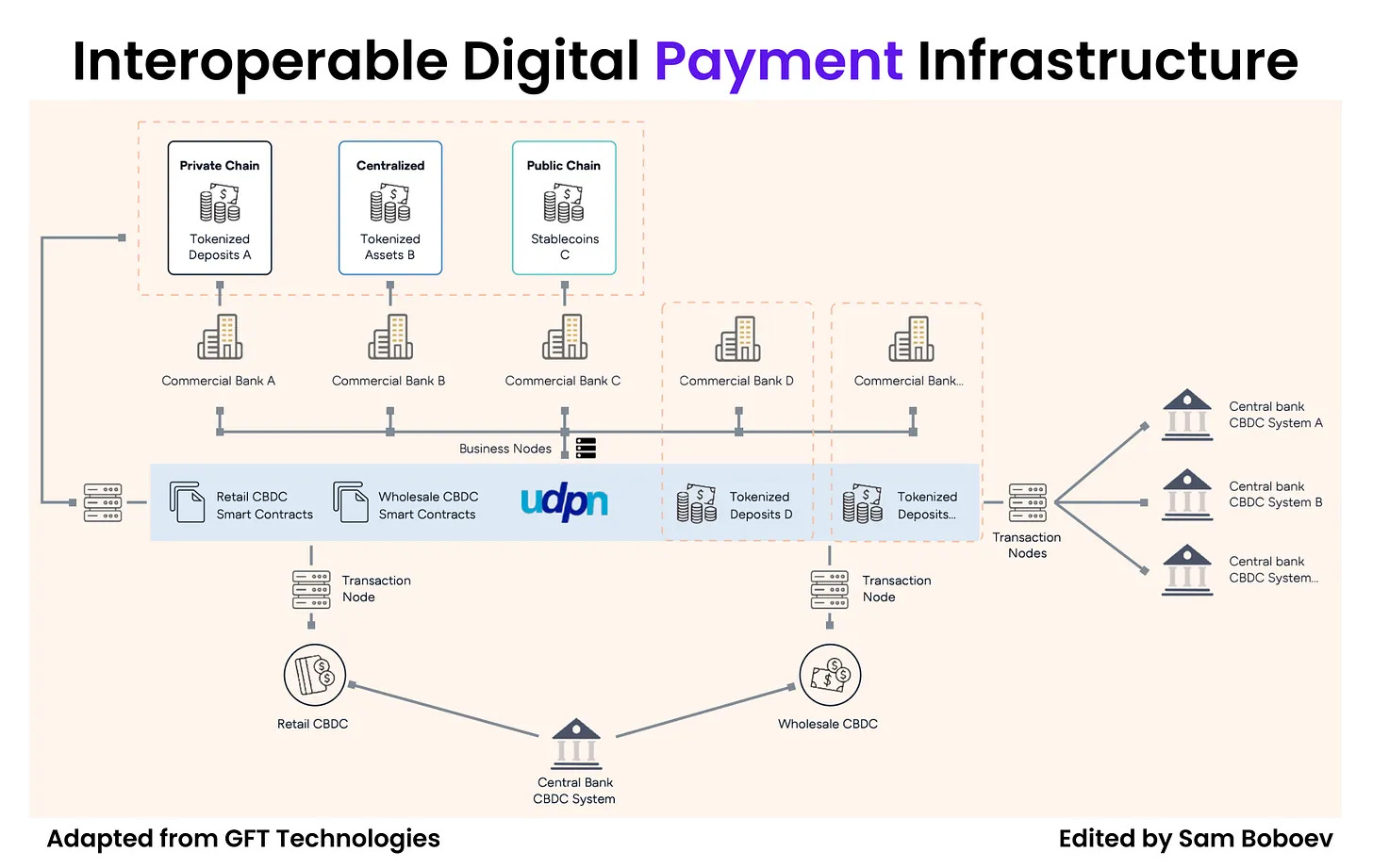

𝐇𝐨𝐰 𝐭𝐨 𝐃𝐞𝐬𝐢𝐠𝐧 𝐈𝐧𝐭𝐞𝐫𝐨𝐩𝐞𝐫𝐚𝐛𝐥𝐞 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐈𝐧𝐟𝐫𝐚𝐬𝐭𝐫𝐮𝐜𝐭𝐮𝐫𝐞

I’ve been studying how institutional stablecoin infrastructure is actually being built, not marketed.

GFT’s work on the Universal Digital Payments Network (UDPN) is a clear signal of where the real problem sits: interoperability, not token issuance.

The stablecoin market is fragmented by design. Different chains. Different regulatory regimes. Different compliance requirements. UDPN does not try to force convergence at the asset layer. It tries to standardize coordination instead.

____

Key observations.

UDPN treats interoperability as a messaging problem, not a bridging problem. Assets stay on their native rails. A standardized messaging backbone coordinates settlement, compliance signals, and transaction intent across stablecoins, CBDCs, and tokenized deposits. This removes cross-chain security risk and operational complexity.

____

Compliance is embedded, not bolted on. On-chain AML, jurisdiction-specific rules engines, and lifecycle management are part of the stablecoin management stack. A single stablecoin adapts to multiple regulatory regimes without being reissued or re-engineered.

____

Institutional adoption assumes legacy persistence. UDPN integrates into existing bank cores and enterprise systems. No greenfield fantasy. No core replacement rhetoric. This is how regulated institutions actually move.

____

Longer term, the direction is unavoidable: token-based core banking. A unified ledger where fiat deposits, stablecoins, and tokenized assets are native objects. Reconciliation collapses. End-of-day closing disappears. Programmability becomes a first-order property.

____

The hard problems are not ignored. Fiat representation. Regulatory accounting. Capital treatment. Operational resilience. These are unresolved at scale, and pretending otherwise is irresponsible. Token-based systems force a rewrite of accounting logic, not just infrastructure diagrams.

____

The takeaway is structural. The future of digital payments is heterogeneous by default. Multiple currencies, multiple networks, multiple jurisdictions. The winning layer is the one that lets them interoperate without pretending they are the same system.

Infrastructure over issuance. Coordination over dominance.

Curated News

💳 Payments

Intuit Turns to Affirm to Power BNPL Expansion

Intuit is partnering with Affirm to expand buy now, pay later capabilities across its ecosystem. The move signals growing demand for embedded credit options within business and consumer financial tools.

Source

🏦 Banking

NatWest Confirms 32 More UK Branch Closures

NatWest has revealed plans to close an additional 32 branches across the UK. The move reflects accelerating customer migration to digital banking channels.

Source

Santander Pushes Ahead With Branch Network Transformation

Santander has announced further changes to its branch network as part of its long-term transformation strategy. The bank continues to rebalance physical presence with digital services.

Source

Varo Bank Secures Growth Investment

Varo Bank has raised new growth capital led by Coliseum Capital Management. The funding supports continued expansion and product development.

Source

Lunar Raises Capital to Fuel Nordic Expansion

Nordic challenger bank Lunar has secured fresh capital to support regional growth. The funding strengthens its position across key European markets.

Source

🪙 Crypto

Bitcoin Hits 10-Month Low as Hong Kong Investors Turn Cautious

Bitcoin has fallen to a 10-month low, dampening sentiment among Hong Kong-based crypto investors. The downturn reflects broader market uncertainty and risk aversion.

Source

Crypto Funds See $1.7B in ETF Outflows to Start 2026

Bitcoin and Ethereum ETFs have flipped negative for 2026 after $1.7 billion in outflows. The shift highlights weakening institutional sentiment toward crypto assets.

Source

Bitcoin Enters ‘Extreme Fear’ Territory

Market indicators suggest Bitcoin has entered a phase of extreme fear. Analysts remain divided on how much further prices could fall.

Source

Chinese Crypto Networks Moved $16.1B in Illicit Funds in 2025

A new report estimates that Chinese crypto networks facilitated $16.1 billion in illicit transactions last year. The findings renew concerns around enforcement and compliance gaps.

Source

Strategy Adds $75M in Bitcoin to Balance Sheet

Strategy has purchased 855 bitcoins for $75.3 million, reinforcing its long-term crypto accumulation strategy. The move comes amid broader market weakness.

Source

Founder of Russia’s Largest Bitcoin Miner Arrested

The founder of Russia’s biggest bitcoin mining firm has been arrested for tax evasion. The company is also reportedly facing bankruptcy proceedings.

Source

📊 WealthTech

Mine Raises $14M to Launch AI Money Agent for Young Adults

Mine has secured $14 million to launch an AI-powered money agent aimed at younger consumers. The product focuses on improving financial confidence and decision-making.

Source

🧠 Fintech

Novum Secures UK Pension Fund Backing

UK fintech startup Novum has secured backing from a UK pension fund. The investment signals growing institutional interest in domestic fintech innovation.

Source

Apax Spins Out Finastra Treasury Business as Teciem

Apax has spun out Finastra’s treasury and capital markets unit into a new firm called Teciem. The move sharpens strategic focus on treasury technology.

Source

Incard Raises £10M Series A

Incard has raised £10 million in Series A funding to expand its financial platform for high-growth digital companies. The capital will support product development and scaling.

Source

Bleap Raises $6M Seed Round

Bleap has closed a $6 million seed round to support platform growth. The startup is focused on modern financial services infrastructure.

Source

⚖️ Regulation

APP Reimbursement Now Covers 88% of Claims

Reimbursement rates for authorised push payment fraud now cover 88% of claims. The increase reflects stronger consumer protection standards.

Source

TSB Warns of Rising Romance Scams

TSB has reported a spike in romance scams targeting customers. The bank is urging greater awareness and preventative measures.

Source

📌 Other

Equifax Launches ML Tool to Detect First-Party Fraud

Equifax has introduced a machine-learning product designed to detect first-party fraud. The solution aims to reduce losses for lenders.

Source

Equifax Rolls Out Credit Abuse Risk Model

Equifax has launched a new credit abuse risk model to help lenders manage rising fraud exposure. The tool targets early identification of risky borrower behavior.

Source

Gr4vy Launches Silent Mode for Risk Management

Gr4vy has introduced “Silent Mode” to enhance risk management without disrupting customer experiences. The feature allows behind-the-scenes fraud controls.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.

Spot on. Messaging over bridging is genius. How is coordination standardized?