Fiserv Brings Crypto Payments to the UK for the First Time

Fiserv has launched the UK’s first crypto payment acceptance capability through its merchant network, marking a significant step in mainstreaming digital assets. The move allows businesses to accept crypto seamlessly at the point of sale without direct exposure to price volatility. By embedding crypto into existing payments infrastructure, Fiserv is positioning digital assets as a practical payment option rather than a speculative tool. The rollout reflects growing institutional confidence in regulated crypto use cases. It also signals increased competition among payment processors to own the future of alternative payments. For UK merchants, the launch lowers barriers to crypto adoption while maintaining familiar settlement processes. More broadly, it highlights how incumbents are shaping crypto’s integration into everyday commerce.

Video of the Day

Insight of the Day

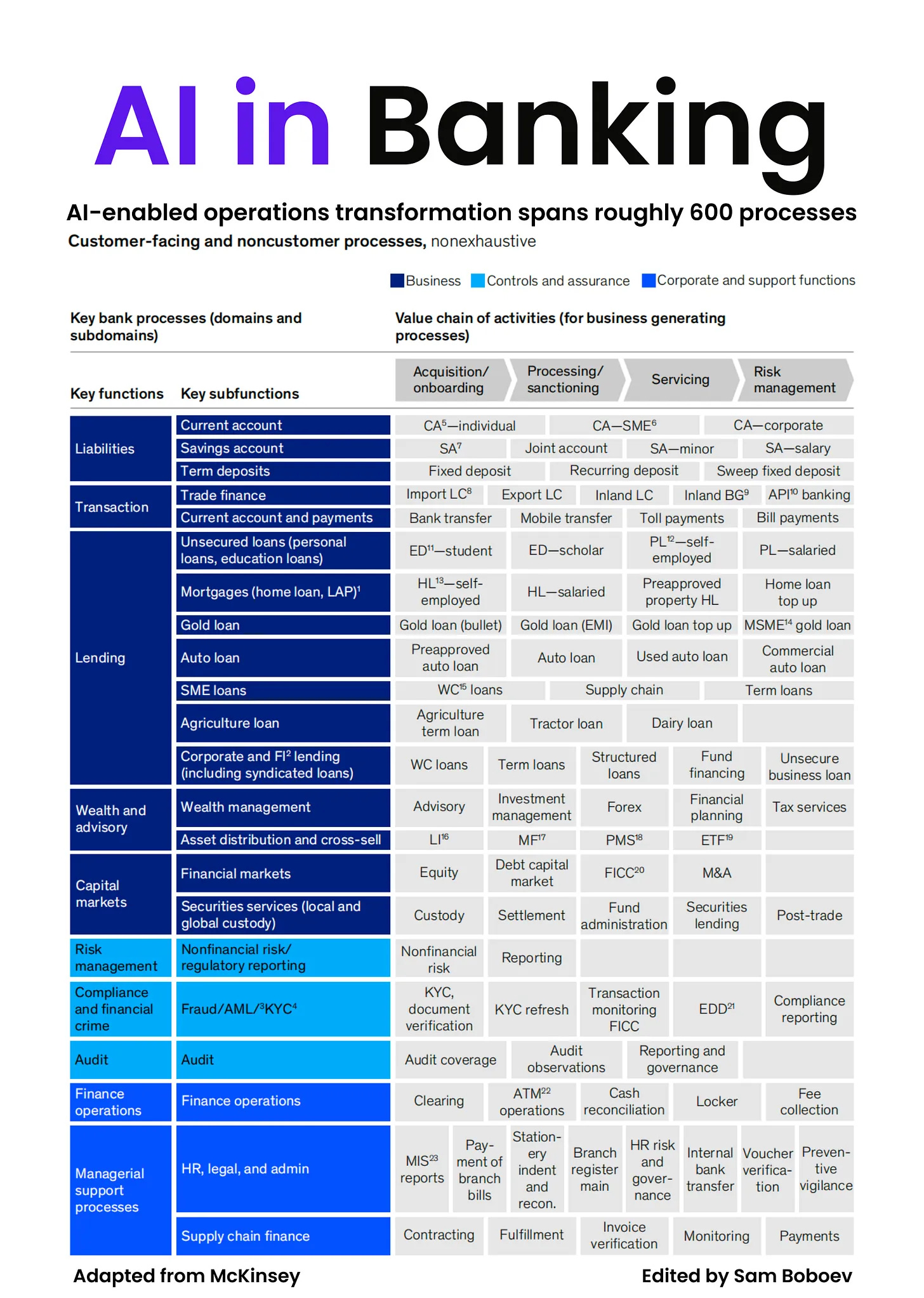

𝐖𝐡𝐲 𝐀𝐈 𝐅𝐚𝐢𝐥𝐬 𝐢𝐧 𝐁𝐚𝐧𝐤𝐬

Most banks do not fail with AI because the models are weak. They fail because the work is mis-specified.

Look at the actual operating surface of a bank. Hundreds of processes across deposits, payments, lending, wealth, markets, risk, compliance, finance, and support. Each process decomposes into the same four stages: onboarding, processing, servicing, risk. Each stage reuses the same decisions under different names.

KYC is not one thing. It appears in account opening, loan origination, trade finance, corporate onboarding, and periodic reviews. Credit assessment is not a lending function. It shows up in overdrafts, cards, SME facilities, structured loans, and collections. Reconciliation is not a finance task. It exists in payments, custody, ATM ops, securities, and internal transfers.

____

Banks keep automating these as if they are unique.

That is why AI initiatives stall. Teams deploy models inside products instead of extracting the decision logic into shared services. The same eligibility rules, risk thresholds, and exception handling are rebuilt dozens of times. Governance breaks because no one owns decisions end to end.

____

Agentic AI becomes useful only when decisions are separated from workflows.

Atomic agents should own stable decision primitives: identity confidence, sanctions risk, credit appetite, pricing bands, servicing next-best-action, exception severity. Orchestration agents then compose these primitives across onboarding, transaction processing, servicing, and risk.

____

This is not theoretical. It directly changes cost, risk, and speed.

Upstream identity confidence reduces downstream fraud handling. Shared credit logic reduces overrides and post-approval remediation. Early exception classification reduces service center load and audit findings. Reusable decision agents eliminate model sprawl.

The outcome is not “AI transformation.” It is fewer handoffs, fewer reconciliations, fewer controls added after the fact.

If AI does not change how decisions are owned, reused, and orchestrated across the value chain, it will never move bank-level economics.

Curated News

💳 Payments

Visa Adds Tap to Pay on iPhone to Acceptance Platform

Visa has expanded its Acceptance Platform to include Tap to Pay on iPhone. The update enables merchants to accept contactless payments using only a smartphone, reducing hardware dependency.

Source

Visa Direct and UnionPay Team Up on Cross-Border Payments into China

Visa Direct has partnered with UnionPay to enable faster cross-border money movement into China. The collaboration strengthens global remittance and payout capabilities.

Source

Paysafe Powers FuturePay’s Expansion Across Latin America

Paysafe is supporting FuturePay’s expansion in Latin America with a localized payments suite. The partnership enables access to regional payment methods and improves checkout conversion.

Source

One Inc Links AI Assistants With Insurance Payments

One Inc has launched a new protocol that connects corporate AI assistants directly with insurance payment workflows. The solution aims to automate claims and billing processes.

Source

🏦 Banking

PayPal Shares Slide After CEO Exit and Weak 2026 Outlook

PayPal shares fell following the announcement of the CEO’s departure and a disappointing 2026 profit forecast. The news has raised questions about leadership stability and growth strategy.

Source

Varo Bank Secures Fresh Growth Capital

Varo Bank has raised new funding led by Coliseum Capital Management. The investment supports continued growth and product development.

Source

Oracle Launches Agentic Banking Platform for the AI Era

Oracle has unveiled a new agentic banking platform designed for AI-driven operations. The platform aims to modernize core banking and decision-making processes.

Source

🪙 Crypto

Bitcoin Jumps Above $78,500 After 4.2% Rally

Bitcoin surged 4.2% to climb above $78,500. The move suggests renewed short-term optimism despite recent volatility.

Source

Galaxy Digital Shares Sink After $482M Quarterly Loss

Galaxy Digital shares fell sharply following the disclosure of a $482 million quarterly loss. The results reflect ongoing pressure across crypto trading and investment businesses.

Source

Standard Chartered Cuts Near-Term Solana Forecast

Standard Chartered has lowered its near-term Solana price forecast while maintaining a bullish long-term outlook. The bank now sees potential for $2,000 by decade’s end.

Source

YC Startups Can Now Raise Capital in Stablecoins

Y Combinator startups are now able to receive investments in stablecoins. The move simplifies cross-border fundraising and treasury management.

Source

📊 WealthTech

Bolt Adds Embedded Investing via Atomic

Bolt has integrated Atomic’s embedded investing capabilities into its financial app. The move allows users to invest directly within the platform.

Source

🧠 Fintech

Taurus Selects Capco as European Implementation Partner

Digital asset firm Taurus has chosen Capco as its implementation partner across Europe. The partnership supports institutional deployment of digital asset infrastructure.

Source

AI Fraud Platform Darwinium Appoints Leadership Team

Darwinium has appointed a new leadership team to support growth of its AI-powered fraud prevention platform. The hires signal scaling ambitions.

Source

Klarna Backs Google’s Universal Commerce Protocol

Klarna has endorsed Google’s Universal Commerce Protocol to enable agentic commerce across platforms. The move supports automated, AI-driven transactions.

Source

⚖️ Regulation

Regulators Name First Firms Joining Scale-Up Unit

UK regulators have announced the first companies to join the Scale-up Unit. The initiative aims to support high-growth firms navigating regulatory complexity.

Source

Fintech Founder Charged With Fraud

A fintech founder has been formally charged with fraud. The case highlights ongoing governance and accountability challenges in the sector.

Source

Sumsub Brings Travel Rule Compliance to Fireblocks

Sumsub has integrated Travel Rule compliance tools into the Fireblocks platform. The move strengthens regulatory readiness for digital asset firms.

Source

📌 Other

MENA Startup Funding Reaches $563M in January

Startup funding across the MENA region hit $563 million in January 2026. The figures point to continued investor confidence in the region.

Source

Huatai Securities Plans $1.3B Convertible Bond Raise

China’s Huatai Securities is planning to raise $1.3 billion through convertible bonds. The capital will support expansion and balance sheet strength.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.