Goldman Sachs: Regulation Will Drive the Next Wave of Institutional Crypto Adoption

Goldman Sachs believes clearer global regulation will be the primary catalyst for large-scale institutional adoption of crypto assets. According to the firm, regulatory certainty is reducing perceived risk and unlocking participation from banks, asset managers, and pension funds. This shift is expected to accelerate capital inflows, product innovation, and market maturity. Rather than stifling growth, regulation is increasingly seen as an enabler of trust and scalability. The view reflects a broader change in institutional sentiment toward digital assets. As compliance frameworks solidify, crypto is moving closer to the financial mainstream.

Video of the Day

Insight of the Day

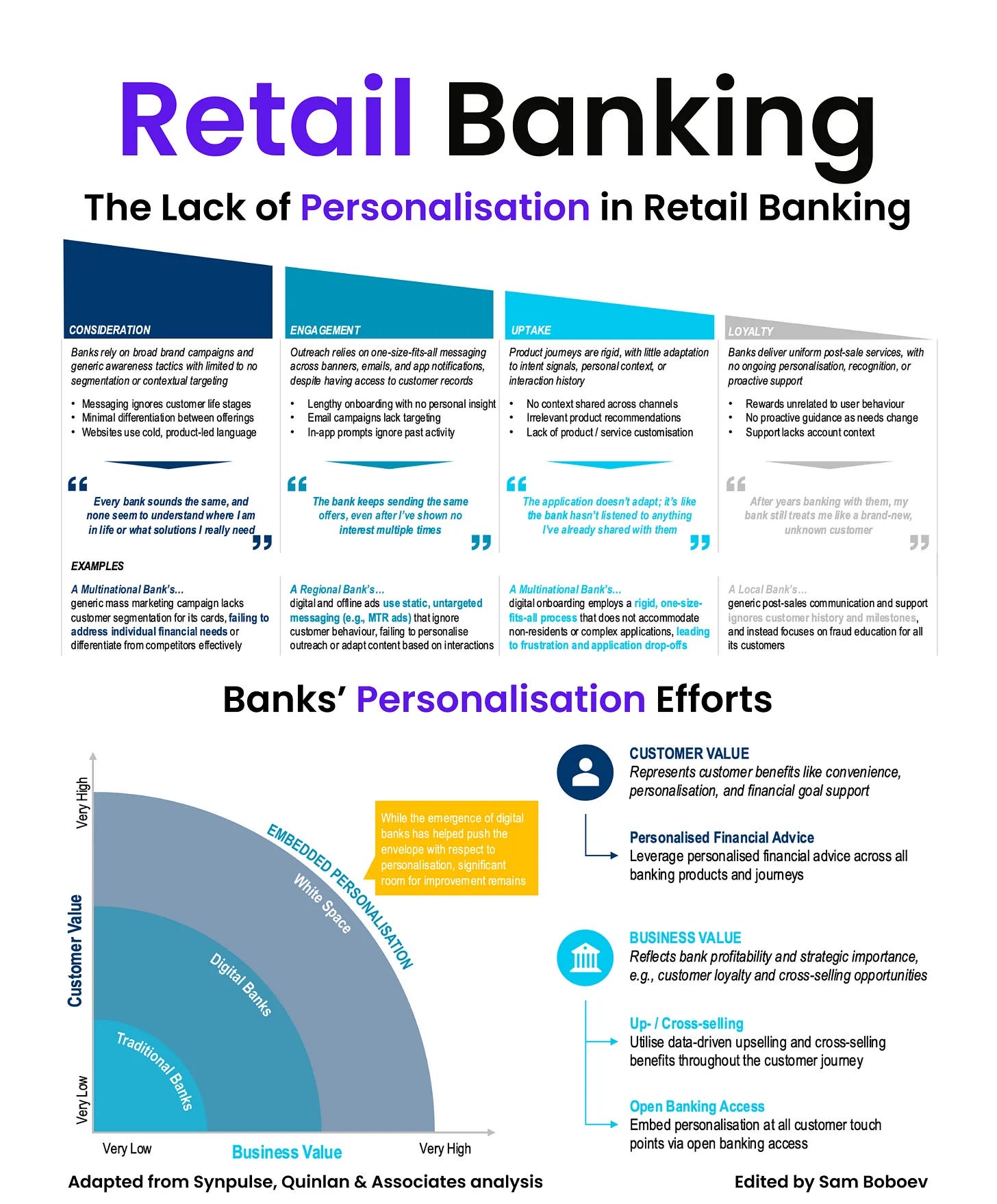

𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐓𝐡𝐞 𝐋𝐚𝐜𝐤 𝐨𝐟 𝐏𝐞𝐫𝐬𝐨𝐧𝐚𝐥𝐢𝐬𝐚𝐭𝐢𝐨𝐧 𝐢𝐧 𝐑𝐞𝐭𝐚𝐢𝐥 𝐁𝐚𝐧𝐤𝐢𝐧𝐠

Most banks think they are doing personalisation. Customers strongly disagree.

I have been digging into recent research from Quinlan & Associates and Synpulse, and the data makes one thing very clear. The personalisation is measurable, widening, and expensive.

✅ Start with expectations.

Around 74 percent of retail banking customers say personalisation is important or critical to their banking experience. Yet only 44 percent say they have actually experienced any form of personalised service. And even among those, 52 percent say they were not satisfied with what they received.

That means more than 70 percent of customers who care about personalisation either never experienced it or were disappointed when they did.

✅ This is not because banks lack data.

Most banks already hold years of transaction history, life-stage signals, product usage data, and behavioural patterns. Despite that, customer journeys are still largely generic. Marketing campaigns remain broad. Emails and push notifications ignore past behaviour. Product onboarding is rigid. Post-sale engagement barely changes whether someone has been a customer for six months or six years.

The result is that every bank sounds the same and treats customers the same, regardless of context.

Digital banks have made progress, but even there, the ceiling is low. Many offer surface-level personalisation like tailored dashboards or basic insights. Truly embedded personalisation, where products, pricing, advice, and support dynamically adapt to the customer’s situation, is still rare.

And the consequences show up in loyalty.

Retail banking retention now averages roughly 76 percent over a three-year period, compared to more than 82 percent across non-banking industries. Since COVID, customer loyalty in banking has declined further, while other sectors have recovered faster. This is a meaningful structural disadvantage, not a temporary fluctuation.

What makes this even more striking is the upside banks are leaving on the table.

The same research suggests that effective personalisation could increase:

• customer acquisition likelihood by 63 percent

• engagement with products and services by 36 percent

• product purchase likelihood by 94 percent

• customer retention by 69 percent

These are not marginal gains. These are step-change improvements across the entire customer funnel.

Personalisation can no longer sit in marketing or CRM teams as a campaign lever. It needs to become part of core banking infrastructure. Embedded into onboarding, product discovery, pricing logic, financial advice, rewards, and support. Context-aware, behaviour-driven, and continuous.

Banks that keep treating personalisation as optional will continue to see declining loyalty and shrinking relevance. Banks that operationalise it end to end will compound value over time.

Curated News

💳 Payments

Flutterwave Acquires Mono to Deepen African Open Banking Capabilities

Flutterwave has acquired Mono, a leading African open banking platform, strengthening its data and infrastructure layer. The deal positions Flutterwave to expand beyond payments into lending, analytics, and embedded finance across key African markets.

Source

Fiserv Integrates Mastercard Agent Pay for AI-Driven Commerce

Fiserv has embedded Mastercard’s Agent Pay into its merchant platform, enabling AI agents to initiate and complete transactions. This marks a significant step toward autonomous and conversational commerce at scale.

Source

AFS Rolls Out Tap-to-Phone Payments Across Egypt

Arab Financial Services has launched a SoftPOS solution across Egypt following approval from the Central Bank. Merchants can now accept contactless payments using smartphones, accelerating cashless adoption.

Source

QNB and Mastercard Expand Digital Payments in Syria

QNB and Mastercard are extending card payment services in Syria to support electronic transactions and financial inclusion. The partnership enhances access to secure payment infrastructure in the region.

Source

🏦 Banking

Telcoin Launches eUSD Stablecoin for Digital Asset Banking

Telcoin has begun digital asset banking operations with the launch of its eUSD stablecoin. The initiative blends blockchain-based payments with regulated financial services.

Source

Bank NXT Partners with IBM to Build Next-Gen Digital Banking Platform

Australia’s Bank NXT has partnered with IBM and Inspire to modernise its digital banking infrastructure. The collaboration focuses on scalability, resilience, and improved customer experience.

Source

📊 Fintech

Experian Enhances Ascend Platform with Commercial Credit Data

Experian has integrated commercial data into its Ascend platform to support more accurate credit decisioning. The update strengthens risk assessment for SME and enterprise lenders.

Source

Convr AI Partners with Zurich to Automate Insurance Underwriting

Convr AI has teamed up with Zurich North America to improve underwriting efficiency using AI-driven workflows. The partnership aims to reduce processing time and enhance risk accuracy.

Source

WAMID Launches Advanced Market Analytics Platform

WAMID has unveiled a new analytics suite providing deep market insights and data tools. The platform targets exchanges and institutional market participants.

Source

🪙 Crypto

Japan Signals Support for Crypto Trading on Stock Exchanges

Japan’s finance minister has expressed support for allowing crypto trading on traditional stock exchanges. The move would further integrate digital assets into regulated capital markets.

Source

Strategy Buys Another $116M Worth of Bitcoin

Strategy has added $116 million in Bitcoin to its balance sheet, reinforcing its long-term crypto conviction. The purchase underscores continued corporate adoption of Bitcoin as a treasury asset.

Source

Ledger Confirms Customer Data Breach via E-commerce Partner

Ledger has confirmed a data breach linked to its Global-e e-commerce platform. While wallets were not compromised, exposed customer data raises ongoing security concerns.

Source

Bitget Launches TradFi Trading for All Users

Crypto exchange Bitget has rolled out traditional finance trading features following a successful beta. The move reflects increasing convergence between crypto and traditional markets.

Source

💰 WealthTech

DailyPay Secures $195M Credit Facility to Support Expansion

DailyPay has announced a $195 million revolving credit facility to fuel growth and product expansion. The funding strengthens its on-demand pay offering amid rising employer adoption.

Source

⚖️ Regulation

Hong Kong Unveils Fintech 2030 Strategy Focused on AI and Tokenisation

Hong Kong has launched its Fintech 2030 roadmap, prioritising AI, tokenisation, and digital infrastructure. The initiative aims to maintain the city’s position as a global fintech hub.

Source

Indonesia to Access E-Wallet and Crypto Data Under New Tax Rules

Indonesia will begin accessing e-wallet and crypto transaction data under tax rules effective in 2025. The move signals tighter regulatory oversight of digital financial activity.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.