Google and PayPal Forge Multiyear Partnership to Revolutionize Commerce

Google and PayPal have entered a long-term strategic partnership to redefine digital commerce, combining PayPal’s payment ecosystem with Google’s advanced technology. The collaboration will expand PayPal’s reach across Google services, providing consumers and merchants with more seamless, secure, and efficient payment experiences. The deal underscores the growing convergence of Big Tech and fintech players, as both companies aim to capture a larger share of global digital transactions. For Google, the move strengthens its payments play against Apple and Amazon. For PayPal, it signals a major step in rebuilding momentum after years of competition and shifting market trends. This partnership could set a new standard for how tech and fintech integrate to serve both businesses and end-users.

Insight of the Day

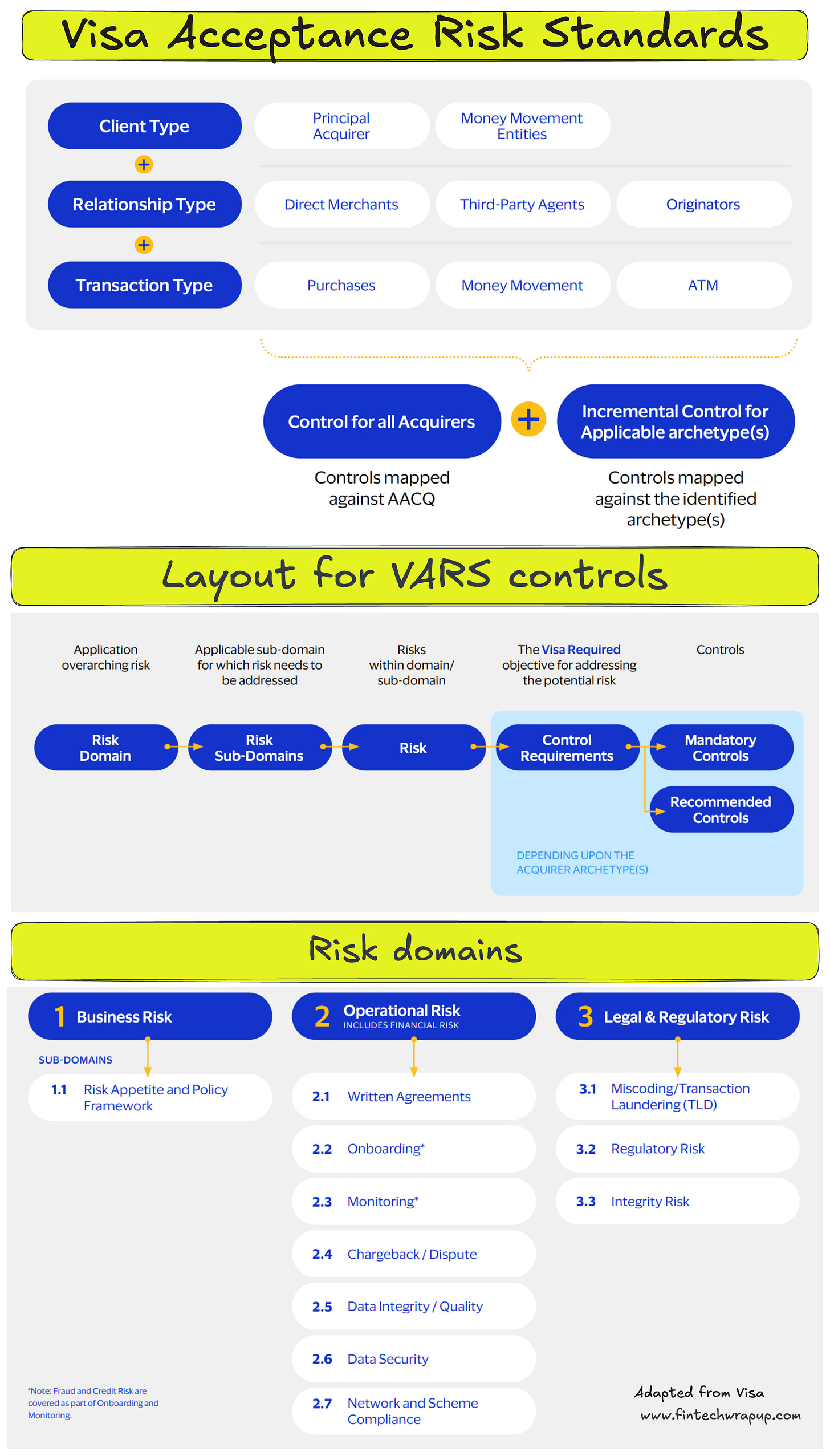

Visa Acceptance Risk Standards

The Visa Acceptance Risk Standards (VARS) is a risk control framework designed to help safeguard the Visa payment system.

All participants involved in the Visa Payments System, either directly or indirectly, share the responsibility of minimizing risks to ensure customer trust and safety. Direct participants include Acquiring entities and Money Movement Entities, and indirect participants include Third-Party Agents (e.g., Payment Facilitators, ISOs), Merchants, and Third-Party Reviewers.

Complying with VARS helps Acquirers, their Third-Party Agents, and their Merchants develop strategies and tools to monitor risk events, while promoting innovation, and encouraging business growth.

👉 The VARS is designed to help Acquirers:

• Understand their accountabilities and responsibilities to the Visa payment system.

• Implement required controls and consider adopting recommended controls

where applicable.

• Manage and control their relationships with Merchants and TPAs.

• Effectively and efficiently mitigate risks related to payment security (fraud) and integrity

👉 Defining Acquirer Archetypes

To reflect different business models, Visa has defined Acquirer archetypes. These are based onthe type of Visa Client, Acquirer Relationship, and Transactions, as seen in the graphic below.

Curated News

💳 Payments

PayNearMe Raises $50M to Expand Non-Commerce Payments

PayNearMe secured $50 million in funding to grow its platform for non-traditional payments, such as bills, rent, and government fees. The investment will fuel innovation in simplifying payment experiences outside of retail.

Source

Bluefin and VGS Partner for Omnichannel Payment Management

Bluefin and Very Good Security announced a partnership to deliver end-to-end payment management across multiple channels. The collaboration aims to improve security, flexibility, and compliance for businesses handling diverse transactions.

Source

Adyen and LVMH Redefine Luxury Payments

Adyen is deepening its partnership with LVMH to bring innovative payment solutions tailored for the luxury retail sector. The collaboration highlights the role of personalized, frictionless payments in enhancing high-end shopping experiences.

Source

Volante Exec Reappointed to Faster Payments Council Board

Volante Technologies’ Deepak Gupta has been reappointed to the U.S. Faster Payments Council Board Advisory Group. His continued leadership will help guide industry-wide strategies for accelerating adoption of instant payments.

Source

Marqeta Research: Payment Platforms Gain from Smarter Finance Demand

A new Marqeta study finds that consumers and SMBs increasingly expect smarter financial solutions, opening opportunities for payment platforms. The research underscores a shift toward integrated, flexible, and data-driven payment ecosystems.

Source

DailyPay Launches Perks for Employee Savings

DailyPay introduced “Perks,” a new feature designed to help employees save money on recurring expenses such as utilities and subscriptions. The move expands its mission beyond earned wage access to broader financial wellness.

Source

Thredd and Reap Partner to Expand Global Card Programs

Thredd and Reap announced a strategic partnership to scale global card issuance and payment solutions. The collaboration targets fintechs and enterprises seeking flexible, borderless card programs.

Source

🏦 Banking

AI Research in Banking Dominated by Five Major Players

A new study reveals that two-thirds of AI research in the banking sector is being driven by just five banks. This concentration raises questions about innovation access and competitive advantage within financial services.

Source

Singapore to Ban Banking Access for Convicted Scammers

Singapore will introduce tough new penalties, including banning convicted scammers from using banking services and mobile phones. The move reflects growing efforts to protect consumers and deter financial fraud.

Source

Broadcom Expands Multi-Year Partnership with Lloyds Banking Group

Broadcom and Lloyds have extended their tech partnership to accelerate digital transformation. The agreement focuses on improving banking infrastructure, customer experience, and operational efficiency.

Source

FIS Redefines Banking Modernization Strategy

FIS unveiled a new approach to banking modernization, emphasizing client-centric innovation. The strategy highlights flexibility and efficiency as banks adapt to changing customer expectations.

Source

Personetics Launches Cognitive Banking Solution PrimacyEdge

Personetics introduced PrimacyEdge, a cognitive banking solution designed to help banks deepen relationships and drive primacy. The platform leverages AI to deliver hyper-personalized engagement.

Source

💸 Fintech

PayPal-Backed Modulr Grows Revenues, Scales Back on Crypto Clients

Modulr, backed by PayPal, reported strong revenue growth but is pulling back from serving crypto businesses. The move underscores regulatory pressures and a strategic pivot toward more traditional fintech opportunities.

Source

Tuum to Power Bank CenterCredit’s BaaS Proposition

Tuum will provide core banking infrastructure to support Bank CenterCredit’s Banking-as-a-Service (BaaS) offering. This partnership highlights the growing demand for modular fintech platforms.

Source

nCino Unveils Integration Gateway for Fintech Partnerships

nCino introduced its Integration Gateway, designed to streamline data connectivity between financial institutions and fintechs. The solution aims to accelerate collaboration and innovation across ecosystems.

Source

🪙 Crypto

MoneyGram Launches Stablecoin-Powered App in Colombia

MoneyGram rolled out a new app in Colombia powered by stablecoins, expanding digital remittances and payments. The launch reflects stablecoins’ growing role in improving cross-border transactions.

Source

UK’s FCA Seeks Feedback on Crypto Consumer Protection Rules

The UK’s Financial Conduct Authority (FCA) is consulting on how consumer protection rules should apply to crypto. The move signals regulatory momentum in safeguarding retail investors in digital assets.

Source

📈 WealthTech

Splash Financial Secures $70M in Series C

Splash Financial raised more than $70 million in Series C funding to scale its lending and wealth management offerings. The company aims to expand its footprint and strengthen its product suite.

Source

Auquan Debuts AI Agent for Credit and Deal Analysis

Auquan launched its first AI-powered agent tailored for financial credit and deal analysis. The solution promises to enhance accuracy and efficiency in investment decision-making.

Source

⚖️ Regulation

Themis Launches AI Investigator for Financial Crime Defense

Themis introduced AI Investigator, a tool designed to make advanced anti-financial crime capabilities accessible to all organizations. It aims to democratize financial crime prevention with scalable AI technology.

Source

TransUnion Finds $3.3B Synthetic Identity Fraud Risk

TransUnion research highlights how public data can expose synthetic identity fraud, a $3.3 billion threat. The findings emphasize the critical role of data intelligence in fraud detection and prevention.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a "Source: [Name]" attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.