𝐇𝐨𝐰 𝐀𝐈 𝐈𝐬 𝐂𝐡𝐚𝐧𝐠𝐢𝐧𝐠 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧 𝐛𝐲 IXOPAY

Everyone’s talking about AI — but for payment teams, the real question is: how does it actually make your job easier?

👉 Let’s break it down.

Global payments remain messy. Merchants rely on multiple PSPs, acquirers, and local payment methods — each creating a flood of fragmented data.

Payment orchestration helped by unifying these connections — routing transactions efficiently and centralizing visibility.

But as connectivity expands, so does the data overload. Without intelligence layered on top, teams risk drowning in information instead of using it.

That’s where AI payment analytics comes in.

Here’s what it actually does:

🔹 Detects the why behind failed transactions, latency spikes, or rising fees.

🔹 Identifies patterns across PSPs, regions, and payment methods.

🔹 Suggests actions to improve approval rates and reduce costs.

🔹 Provides instant insights so payment and data teams can focus on strategy, not spreadsheets.

Imagine asking, “Why did my authorization rate drop in Germany?”

An AI-driven orchestration layer doesn’t just answer — it recommends what to fix next.

This shift marks the next phase of orchestration: from connectivity (unifying systems) → to intelligence (optimizing performance).

AI isn’t replacing payment teams — it’s helping them see, decide, and act faster.

Video of the Day

Insight of the Day

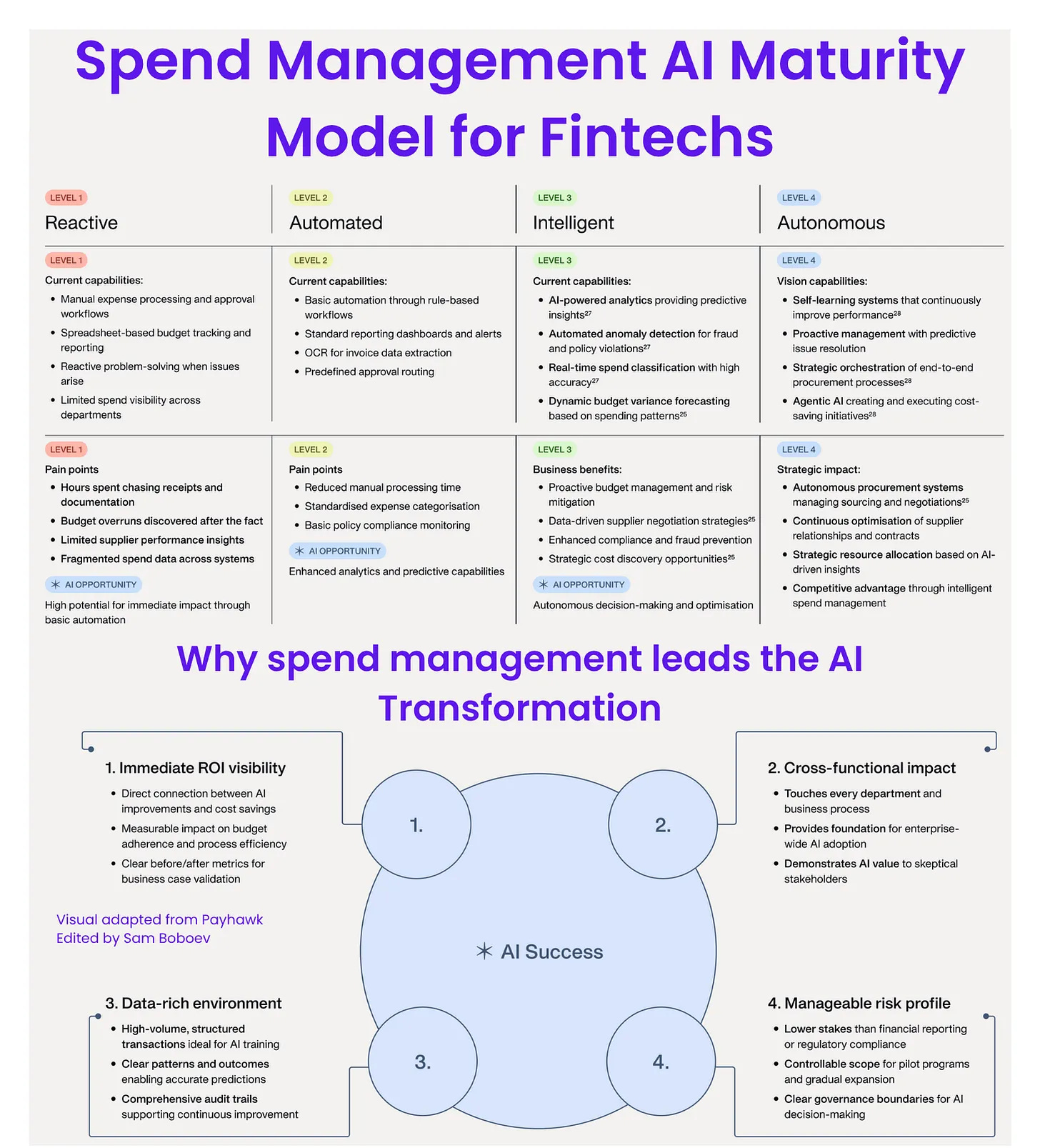

The Spend Management AI Maturity Model

According to Payhawk’s CFO AI Playbook, AI adoption in spend management evolves across four levels, transforming finance from manual control to strategic orchestration.

🔹 Level 1: Reactive

Manual processes, spreadsheet tracking, and constant firefighting.

Teams chase receipts, uncover budget overruns after the fact, and operate with fragmented data.

👉 AI opportunity: Automate data capture, streamline approvals, and centralize visibility.

🔹 Level 2: Automated

Rule-based workflows, OCR for invoices, and dashboards enter the picture.

Work gets faster — but decisions remain reactive.

👉 AI opportunity: Move beyond automation into analytics and prediction.

🔹 Level 3: Intelligent

AI starts connecting dots — forecasting spend, detecting anomalies, and flagging risks in real time.

Finance begins operating proactively, not reactively.

👉 AI opportunity: Build systems that learn and adapt with every transaction.

Level 4: Autonomous

Self-learning systems manage sourcing, negotiate contracts, and optimize budgets on their own.

Finance leaders shift from approving spend to orchestrating strategy.

👉 AI opportunity: Autonomous agents that execute cost-saving initiatives — freeing humans for strategic creativity.

Curated News

💳 Payments

Thunes Partners with WeChat Pay HK for Cross-Border Transfers

Thunes has joined forces with WeChat Pay HK to enable users in Hong Kong to send money to over 80 countries via Thunes’ global payment network. The partnership strengthens both companies’ roles in simplifying and expanding access to cross-border digital payments.

Source

Worldline and Fipto Explore Stablecoin Payments for the Future

Worldline is collaborating with Fipto to explore stablecoin-based payment solutions aimed at providing faster and cheaper international transfers. The initiative reflects growing institutional interest in blockchain-enabled payment infrastructure.

Source

Marqeta Expands Klarna Debit Card Across Europe

Marqeta is powering Klarna’s debit card expansion throughout Europe, offering customers greater flexibility and access to Klarna’s payments network. The move reinforces both companies’ growing footprint in the continent’s digital payments ecosystem.

Source

Afriex and Visa Partner for Real-Time Cross-Border Payments

Afriex and Visa have announced a partnership to deliver real-time cross-border payments across 160 markets. This collaboration aims to make remittances faster and more accessible in underserved regions.

Source

Nexi and Zucchetti Strengthen Partnership for Integrated Merchant Payments

Nexi and Zucchetti are expanding their collaboration to deliver integrated payment solutions for merchants across Europe. The partnership aims to simplify transaction management and boost operational efficiency for retailers.

Source

ACI Worldwide Acquires Payment Components to Boost A2A Fintech Capabilities

ACI Worldwide has acquired Payment Components, a specialist in account-to-account and open banking technologies. The deal enhances ACI’s capabilities in real-time payments and regulatory compliance.

Source

Stream Raises $4M to Modernize B2B Payments in MENA

MENA-based fintech Stream has raised $4 million to enhance business payment infrastructure across the region. The funding will accelerate the rollout of efficient payment rails for SMEs.

Source

🏦 Banking

Experian Overhauls Credit Scoring System

Experian is redesigning its credit scoring model to incorporate real-time and alternative data sources. The change aims to make credit assessments more inclusive for consumers and small businesses.

Source

QNB Partners with TransferMate for Global B2B Multicurrency Collections

Qatar National Bank has teamed up with TransferMate to enhance B2B multicurrency collections for corporate clients. The partnership enables faster and more transparent international payment flows.

Source

💡 Fintech

Airwallex Hits $1B in Annualized Revenue

Airwallex has reached $1 billion in annualized revenue, marking a significant milestone for the cross-border payments company. The achievement underscores Airwallex’s momentum in serving SMEs globally.

Source

Pine Labs Targets $2.9B Valuation in IPO

Pine Labs is planning an IPO targeting a $2.9 billion valuation. The offering highlights investor confidence in India’s booming digital payments ecosystem.

Source

Brits Bank on Tech: 28 Million Use AI Tools to Manage Finances

Over 28 million UK adults now use AI tools for personal finance management. The trend reflects the growing trust in automation for budgeting and wealth tracking.

Source

Napier AI Joins FCA’s Supercharged Sandbox

Napier AI has been selected for the UK FCA’s Supercharged Sandbox to test advanced AML and compliance technologies. The program supports innovation in regulatory tech and risk management.

Source

🪙 Crypto

AMINA Becomes First Crypto Banking Group to Receive MiCA License

AMINA’s Austrian subsidiary is the first crypto banking group authorized under the EU’s MiCA framework. The license marks a key step for compliant digital asset services in Europe.

Source

Ripple Acquires Crypto Custody Firm Palisade

Ripple has acquired Palisade, strengthening its custody and institutional crypto infrastructure. The move bolsters Ripple’s positioning in the growing tokenized assets market.

Source

Donut Labs Raises $22M to Build AI-Powered Web3 Browser

Donut Labs raised $22 million to create an AI browser integrating Web3 payments and digital identity features. The project aims to redefine user experience and privacy in crypto browsing.

Source

Nasdaq Reprimands TON Treasury Over $558M Stock Sale

Nasdaq has reprimanded TON Treasury for an unapproved $558 million stock sale linked to crypto purchases. The case highlights increasing scrutiny of crypto-related capital activities.

Source

💰 WealthTech

Wealthsimple Raises $750M at $10B Valuation

Wealthsimple secured $750 million in fresh funding, valuing the company at $10 billion. The capital will drive expansion and accelerate innovation in retail investing products.

Source

Groww Raises $336.7M Ahead of IPO

Indian investment firm Groww has raised $336.7 million in pre-IPO funding. The financing highlights investor appetite for India’s fast-growing digital investing ecosystem.

Source

eToro Launches Club Subscription for Platinum Users

eToro has launched its Club subscription program offering exclusive Platinum-tier benefits. The move strengthens customer loyalty and adds a premium layer to its wealth management services.

Source

⚖️ Regulation

Financial Sector Urged to Better Support Neurodivergent Consumers in Debt

A report finds 73% of neurodivergent people in debt feel overwhelmed, calling for greater support from financial institutions. The findings may influence new consumer protection and inclusion policies.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.