Japanese Banks Unite to Launch Yen-Pegged Stablecoin

In a landmark collaboration, a group of major Japanese banks has launched a yen-backed stablecoin designed to modernize domestic settlements and prepare for the digital finance era. The initiative aims to enable instant, low-cost transactions between institutions while remaining fully compliant with Japan’s evolving crypto regulations. This move marks one of the most significant integrations of traditional banking and blockchain technology to date. Analysts say it could set a new standard for regulated stablecoin issuance globally. With Japan’s central bank already exploring a digital yen, the project underscores the country’s determination to lead in financial innovation.

Video of the Day

Insight of the Day

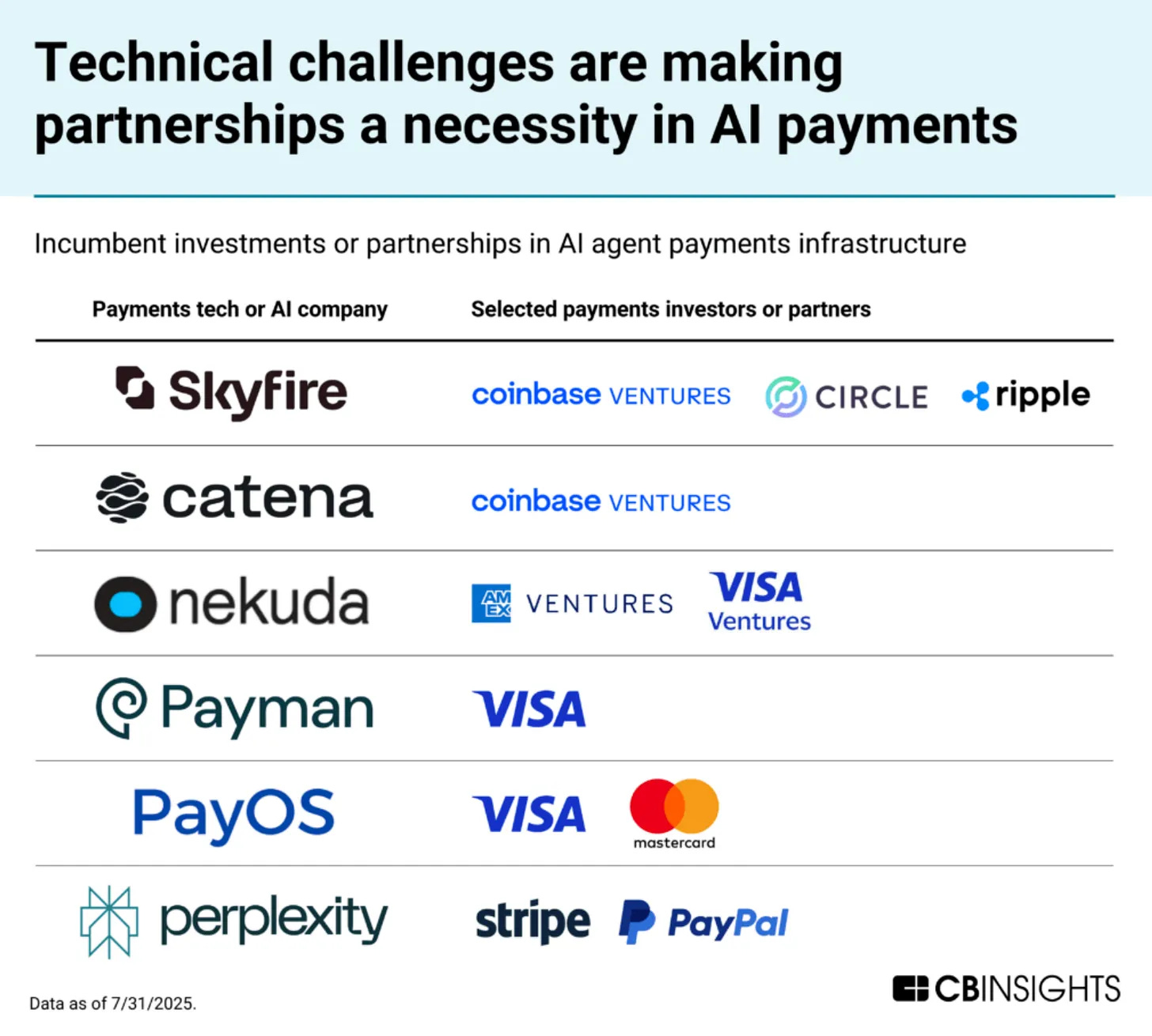

Agentic payments are quickly moving from concept to infrastructure

One of the biggest barriers to fully autonomous shopping is enabling secure, real-time transactions. A new class of startups is tackling this challenge head-on, building AI-native payment rails and digital wallets that let users authorize — and limit — spending by AI agents.

But solving agentic payments goes beyond infrastructure. It requires seamless

authentication, fraud detection, and above all, consumer trust that these agents can transact safely on their behalf.

These hurdles have accelerated collaboration between fintech incumbents and startups. Strategic investments and partnerships are laying the foundation for the next phase of agentic commerce.

Skyfire, the second-highest ranked company by Mosaic score, raised $1M in October 2024 from Coinbase Ventures, with prior backing from Circle and Ripple. Its platform gives AI agents dedicated digital wallets, allowing users to preload funds for controlled purchasing.

Nekuda, another early mover, raised a $5M seed round in May 2025 from American Express Ventures and Visa Ventures. The company’s tools include secure agent wallets and programmable guardrails that let users set spending limits and authentication protocols.

Incumbents are also building their own capabilities. In April 2025, Mastercard and Visa revealed they were developing agentic payment systems — coinciding with the launch of PayOS, a startup partnering with both companies. While no public solutions have launched yet, the timing signals a major push into AI-native commerce, despite the technical and regulatory complexity.

Curated News

💳 Payments

TrueLayer Acquires Zimpler to Form European Pay-by-Bank Powerhouse

Open banking leader TrueLayer announced its acquisition of Zimpler, creating one of Europe’s strongest pay-by-bank networks. The merger combines API technology and payment rails to drive greater instant payment adoption across the EU.

Source

Edenred and Visa Partner to Accelerate Global Payment Innovation

Edenred and Visa are joining forces to enhance digital payment solutions in employee benefits, mobility, and B2B payments. The strategic partnership aims to modernize corporate transactions and expand Visa’s embedded payments presence.

Source

Salt Edge and Sola Team Up for Europe-Wide Instant Payments

Fintech firms Salt Edge and Sola have partnered to enable instant payments across European markets. Their collaboration enhances cross-border payment efficiency and accelerates adoption of real-time financial infrastructure.

Source

PNC Expands Instant Payment Offerings Through FedNow

PNC Bank has joined the FedNow network to enhance its real-time payments capabilities. The integration supports faster transfers for both businesses and consumers, marking a major step toward U.S. instant payment adoption.

Source

🏦 Banking

Zopa Launches Market-Leading 4.75% Easy Access Savings Account

UK digital bank Zopa unveiled a new easy-access savings product offering a competitive 4.75% rate. The move strengthens Zopa’s position in the savings market amid rising consumer demand for higher-yield accounts.

Source

Zilch Partners with Plaid for Open Banking Repayments

BNPL provider Zilch is teaming up with Plaid to enable seamless open banking repayments. The partnership enhances repayment transparency and reduces friction for millions of users.

Source

Travelex Launches Wholesale Banknote Operations in Canada

Travelex has begun wholesale banknote operations in Canada, expanding its global footprint in cash distribution. The move supports local financial institutions with foreign currency liquidity.

Source

💼 Fintech

Mexican Fintech Plata Hits $3B Valuation

Plata, a leading Mexican fintech, has surpassed a $3 billion valuation following strong investor demand. The milestone highlights Latin America’s growing fintech maturity and investor appetite for regional expansion.

Source

Hong Kong’s Riverchain Raises $5M to Expand Across Southeast Asia

Riverchain, a Hong Kong-based fintech, has secured $5 million in funding to fuel its regional expansion. The company plans to leverage its blockchain-driven infrastructure to enhance financial access in emerging markets.

Source

RTX Fintech Appoints Léger as Chief Product Officer

RTX Fintech has hired former swaps trader Léger as its new Chief Product Officer to accelerate platform innovation. The appointment underscores the firm’s commitment to integrating capital markets expertise into its product vision.

Source

Australian Lender Bizcap Acquires AI-Driven Funding Platform

Bizcap, an Australian non-bank lender, has acquired an AI-based funding platform to enhance credit decisioning. The deal aims to improve speed and accuracy in SME lending.

Source

🪙 Crypto

Coinbase Acquires Echo to Transform Onchain Capital Formation

Coinbase has acquired Echo, a decentralized capital formation platform. The move expands Coinbase’s reach into tokenized fundraising and reinforces its leadership in Web3 infrastructure.

Source

Japanese Banks Collaborate on Yen-Pegged Stablecoin

A consortium of Japanese banks has launched a joint stablecoin initiative to modernize domestic settlements. The project aims to enhance transaction efficiency and regulatory compliance in Japan’s digital currency ecosystem.

Source

💰 WealthTech

AI Agent Startup Raises $15M to Empower Financial Advisers

Streetbeat, an AI-driven wealth management startup, raised $15 million to develop its autonomous advisory tools. The platform helps financial advisers automate client engagement and portfolio optimization.

Source

📜 Regulation

Fed’s Waller Backs ‘Skinny’ Master Account to Boost Innovation

Federal Reserve Governor Christopher Waller proposed a simplified “skinny” master account model to widen access to payment systems. The move could balance financial stability with fintech inclusivity.

Source

Crypto and Fintech Push Back Against Banks’ Open Banking Resistance

Crypto and fintech leaders are uniting against traditional banks’ opposition to open banking. Industry advocates argue that restrictive practices limit innovation and consumer choice.

Source

💡 Other

EBAday 2026 Heads to Copenhagen

The European banking community’s flagship event, EBAday 2026, will take place in Copenhagen. Organizers have opened early registration for the conference, which will spotlight instant payments and digital transformation.

Source

OpenAI Hires Ex-Investment Bankers to Train Financial AI Models

OpenAI is paying former investment bankers up to $150 per hour to refine its AI for financial applications. The move highlights growing crossovers between AI and financial expertise.

Source

AI Could Save Global Economies $3.3 Trillion Annually by Reducing Illicit Flows

A new report suggests AI tools could help detect and prevent money laundering, saving global economies over $3.3 trillion each year. The study underscores AI’s potential for combating financial crime.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.