JP Morgan Launches Kinexys — a Blockchain Network to Revolutionize Fund Flows

JP Morgan has unveiled Kinexys, a blockchain-based platform designed to modernize how institutional fund flows are tracked and managed across multiple banks. The tool uses distributed ledger technology to boost transparency, speed, and efficiency in complex fund movements — a longstanding friction point in capital markets. Kinexys represents one of the most tangible enterprise blockchain deployments by a major global bank, moving blockchain from proof-of-concept to production-grade finance infrastructure. This initiative underscores how incumbents are reshaping operations with Web3 tools to enhance trust and automation in traditional systems. The launch could pave the way for broader institutional adoption of blockchain for real-time settlements and liquidity management.

Video of the Day

Insight of the Day

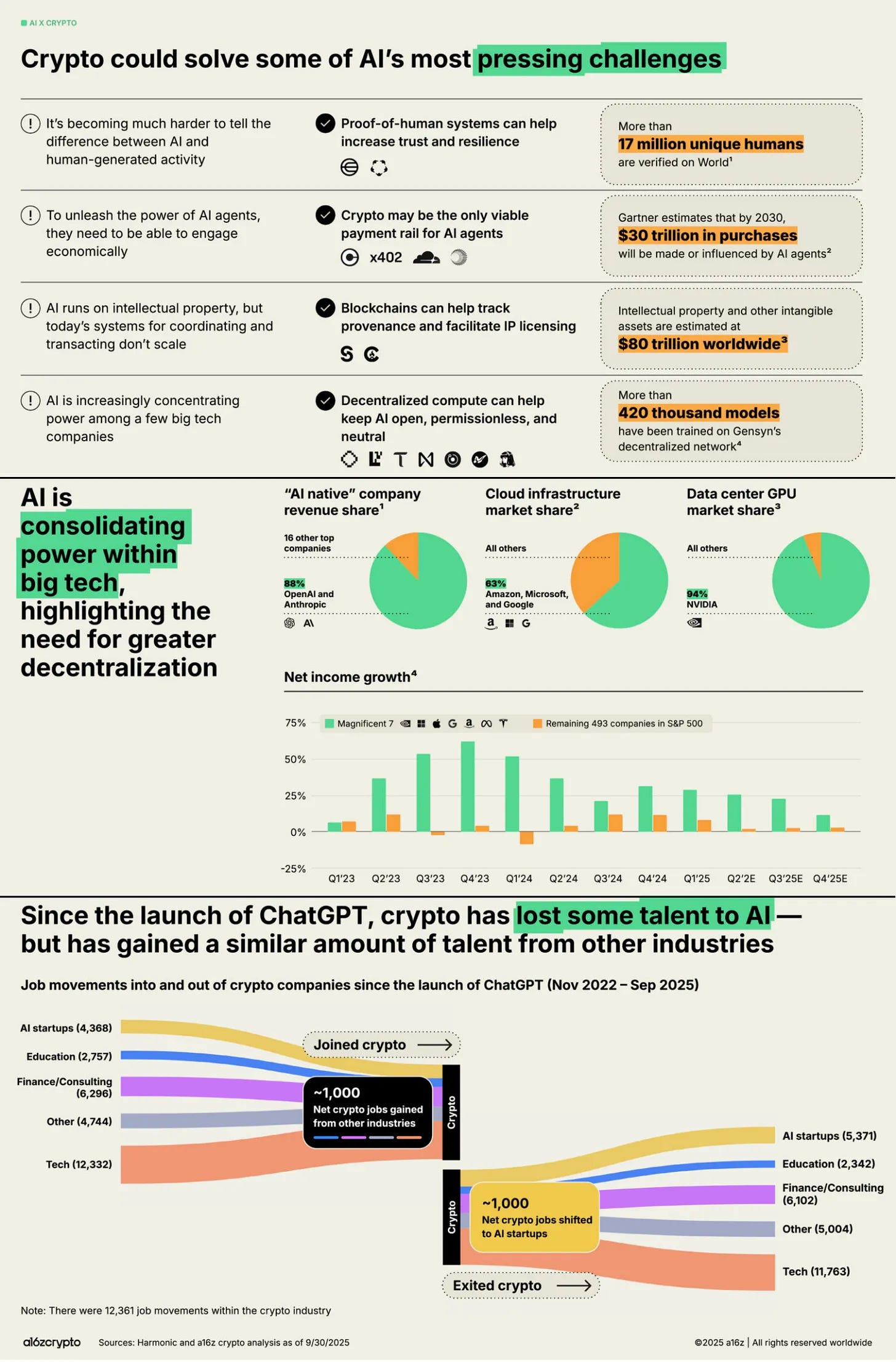

AI and Crypto Are Converging — and It Might Redefine the Internet Itself

The line between human and machine is blurring — fast. AI can write, trade, and even negotiate contracts. But as agents grow more autonomous, the real question becomes: how do they transact, verify, and trust each other in a world without humans in the loop?

That’s where crypto comes in.

At its core, crypto solves the same problems AI will soon face — trust, coordination, and value exchange in digital environments. Today, the internet has no built-in “proof of human” layer, no native payment rail for machines, and no scalable system for tracking ownership of digital work. AI exposes all of these gaps — and blockchain might be the fix.

Take identity. The rise of deepfakes and bots has made it nearly impossible to tell who’s real online. Projects like World, which has verified over 17 million people through biometric proof-of-personhood, could become the foundation of a new “human layer” for the internet. Instead of endless CAPTCHA tests and centralized KYC databases, you could have a privacy-preserving cryptographic proof that you’re, well, you.

Then there’s the economy of AI agents. Analysts like Gartner predict that by 2030, AI agents will control or influence $30 trillion in purchases. But how will these agents pay, receive, and settle microtransactions autonomously? Traditional rails like Visa or SWIFT can’t handle millions of real-time, low-value transactions between machines. Protocols like x402, pioneered by Coinbase, are an early glimpse of what that future could look like — an interoperable crypto standard enabling agents to transact, tip, or trade data with one another, instantly and permissionlessly.

Curated News

💳 Payments

Affirm Deepens Capital Partnership with New York Life

Affirm has expanded its long-term capital partnership with New York Life to boost access to transparent and flexible payment options. The move strengthens Affirm’s funding base while extending its consumer reach in responsible lending.

Source

Unlimit Enables Apple Pay for Disbursements

Unlimit now supports Apple Pay for payout transactions, enhancing digital payment flexibility for businesses and consumers. This feature integrates Apple Pay’s secure wallet functionality into disbursement processes, streamlining settlements and customer experience.

Source

Snapmint Raises $125M to Expand EMI Financing in India

Snapmint secured $125 million to scale its EMI-based consumer finance platform, fueling the company’s mission to make installment payments more accessible across India. The funding supports tech innovation and new partnerships in the fast-growing BNPL sector.

Source

🏦 Banking

Monmouthshire Building Society Partners with Phoebus for 5-Year Deal

The building society signed a five-year agreement with Phoebus to enhance its account servicing capabilities. The collaboration will modernize back-office efficiency and support future digital transformation.

Source

Lloyds Expands MyPocketSkill Partnership to Boost Financial Literacy

Lloyds Bank is expanding its partnership with MyPocketSkill to further youth financial education. The initiative aims to improve money management skills and support early financial empowerment in the UK.

Source

Shawbrook Surges After Biggest UK IPO in Two Years

Shawbrook’s shares jumped following its £2.58 billion IPO, marking the largest UK listing on the London Stock Exchange in two years. The success signals renewed confidence in the UK banking sector and public markets.

Source

Fed’s Bowman Plans 30% Cut to Bank-Supervision Unit

A leaked email revealed that Federal Reserve Governor Michelle Bowman intends to downsize the bank-supervision unit by about 30%. The move could reshape regulatory oversight amid efficiency and accountability debates.

Source

💰 Fintech

SavvyMoney Lands $225M Investment from PSG and Canapi Ventures

SavvyMoney raised $225 million in a minority investment round led by PSG and Canapi Ventures to expand its credit score and financial wellness tools for banks and credit unions. The funding underscores investor appetite for embedded finance solutions.

Source

Alkami Names Cassandra Hudson as New CFO

Alkami has appointed Cassandra Hudson as Chief Financial Officer, effective November 1. Her leadership will guide the company’s next phase of growth as it scales digital banking solutions for mid-market financial institutions.

Source

Drip Capital Secures $50M Credit Facility for B2B Trade Finance

Drip Capital received a $50 million credit facility to bolster its cross-border trade financing solutions for SMEs. The funds will enhance liquidity support and transaction capacity in global trade ecosystems.

Source

Navan Founders Net $25M Each in IPO Share Sale

The founders of U.S. fintech Navan each earned $25 million through the firm’s IPO share sale, highlighting strong investor confidence in corporate travel and expense management platforms.

Source

Pine Labs to Launch $234M IPO on November 7

Indian fintech Pine Labs is set to open its $234.3 million IPO, signaling a major milestone for the region’s payments and merchant tech ecosystem. The listing could further strengthen investor sentiment in Asian fintech markets.

Source

Polygraf AI Closes $9.5M to Scale Secure AI Solutions

Polygraf AI raised $9.5 million to expand its suite of secure artificial intelligence solutions for financial institutions. The funding will help accelerate adoption of privacy-first, explainable AI in compliance-heavy sectors.

Source

🪙 Crypto

Coinbase and Tink Enable Pay-by-Bank Crypto Purchases in Germany

Coinbase and Tink have partnered to allow German users to buy crypto directly through Pay-by-Bank transfers. The integration simplifies fiat-to-crypto conversion and expands Coinbase’s footprint in Europe.

Source

Trust Wallet Partners with Onramper for Global Expansion

Trust Wallet teamed up with Onramper to broaden its global reach and improve crypto onboarding infrastructure. The move enhances access to digital assets through more seamless fiat onramp integrations.

Source

Court Denies Custodia Bank’s Bid for Fed Master Account

A U.S. court rejected Custodia Bank’s request to obtain a Federal Reserve master account, dealing a blow to crypto-focused banking access. The decision underscores ongoing regulatory hurdles for digital-asset banks.

Source

Coinbase CEO Faces Mixed Reaction Over Prediction Market Comments

Coinbase CEO Brian Armstrong drew both praise and criticism after endorsing on-chain prediction markets during the firm’s earnings call. His comments spotlight growing debate around the future of decentralized prediction tools.

Source

💸 WealthTech

Wealthsimple Raises $750M, Reaches $10B Valuation

Wealthsimple announced a $750 million equity round valuing the firm at $10 billion, as it looks to accelerate growth and expand product offerings. The funding highlights strong investor confidence in digital wealth platforms.

Source

⚖️ Regulation

U.S. Judge Blocks CFPB’s Open Banking Rules (For Now)

A U.S. judge temporarily halted the Consumer Financial Protection Bureau’s new open banking rules, delaying implementation amid legal challenges. The decision could slow the rollout of data-sharing mandates across U.S. financial services.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.