JPMorgan Accelerates Tokenization With Galaxy Debt Issuance on Solana

JPMorgan has taken another major step into blockchain-based finance by supporting a tokenized debt issuance for Galaxy Digital on the Solana network. The move builds on the bank’s growing on-chain strategy, extending beyond private blockchains into public networks. By using Solana, JPMorgan is signaling confidence in scalable, low-cost infrastructure for institutional-grade financial products. The transaction highlights how tokenization is moving from experimentation to real-world capital markets use cases. It also underscores increasing collaboration between traditional banks and crypto-native firms. For the fintech sector, this marks a pivotal moment in bridging legacy finance and decentralized infrastructure.

Video of the Day

Insight of the Day

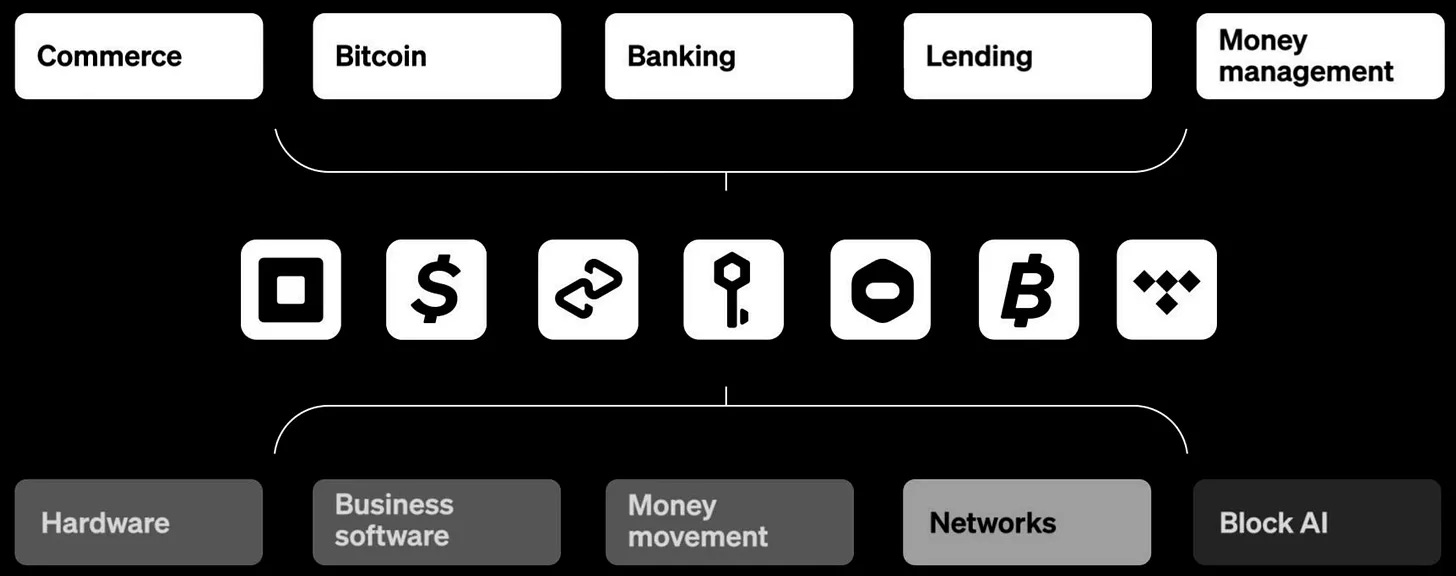

Inside Block’s Product Strategy

Block has been easy to overlook in the broader fintech discourse. But the company has been steadily assembling a product architecture that pushes well beyond traditional payments. After going through the 2025 Investor Day presentation, I see a clear pattern: Block is building networks, financial primitives, and agent interfaces across Cash App and Square. I want to break down how those pieces fit together and why the strategy matters for anyone building in fintech.

Curated News

💳 Payments

Orange Money and Visa Expand Virtual Card Access

Orange Money and Visa are expanding their partnership to roll out virtual cards across more African markets. The initiative aims to boost secure online payments and support e-commerce growth in underbanked regions.

Source

Mollie Acquires GoCardless to Strengthen Payments Stack

European payments firm Mollie has acquired GoCardless, significantly expanding its account-to-account and recurring payment capabilities. The deal positions Mollie as a more comprehensive payment provider for merchants across Europe.

Source

Exotic Auto Finance Modernizes Bill Pay With ACI Worldwide

LLP Exotic Auto Finance has selected ACI Worldwide to automate and modernize its bill payment operations. The upgrade is expected to eliminate up to 90% of manual processes, improving efficiency and customer experience.

Source

🏦 Banking

Enova Agrees $369M Acquisition of Grasshopper Bank

Fintech lender Enova has agreed to acquire Grasshopper Bank in a $369 million deal. The acquisition strengthens Enova’s banking infrastructure and expands its regulated footprint in the US market.

Source

Gatehouse Bank Expands Community Sports Fund

UK-based Gatehouse Bank has expanded its community sports fund to support more grassroots initiatives. The move reinforces the bank’s focus on social impact alongside its core financial services.

Source

🧠 Fintech

BBVA Deepens OpenAI Partnership With ChatGPT Expansion

BBVA is doubling down on its alliance with OpenAI to embed ChatGPT more deeply across internal operations and customer services. The bank aims to boost productivity and improve digital customer engagement using generative AI.

Source

martini.ai Launches Voice-Based Credit Risk Analysis

martini.ai has introduced voice typing capabilities for real-time credit risk analysis. The feature allows faster data input and decision-making for financial institutions managing complex credit assessments.

Source

Harness Raises $240M to Advance AI Beyond Code

Harness has secured $240 million in funding led by Goldman Sachs Alternatives to accelerate its “AI for everything after code” vision. The investment highlights growing enterprise demand for AI-driven software delivery and operations.

Source

🪙 Crypto

OCC Approves Crypto Firms for National Trust Bank Charters

The US Office of the Comptroller of the Currency has approved national trust bank charters for Circle, Ripple, and Paxos. The decision marks a significant regulatory milestone for crypto firms seeking deeper integration with the banking system.

Source

Coinbase Selects Chainlink for $7B Cross-Chain Initiative

Coinbase has chosen Chainlink to support a $7 billion crypto bridging project. The partnership aims to enhance interoperability and security across blockchain ecosystems.

Source

Ripple Payments Gains First European Bank Customer

Ripple Payments has secured its first European bank client with Switzerland-based AMINA Bank. The adoption signals growing institutional interest in blockchain-powered cross-border payments.

Source

Standard Chartered and Coinbase Expand Digital Asset Collaboration

Standard Chartered and Coinbase are deepening their partnership to better serve institutional digital asset clients. The collaboration focuses on custody, trading, and broader crypto market access.

Source

Klarna Eyes Mainstream Crypto Adoption via Privy Partnership

Klarna has partnered with Privy to simplify crypto onboarding for everyday users. The move reflects Klarna’s ambition to bridge traditional payments with digital asset experiences.

Source

Tether Explores Tokenized Stocks Amid $20B Fundraise

Tether is considering tokenizing equities as part of a reported $20 billion fundraising effort. The move could expand its role beyond stablecoins into broader tokenized financial assets.

Source

Do Kwon Sentenced to 15 Years Over Terra Collapse

Terraform Labs founder Do Kwon has been sentenced to 15 years in prison for his role in the $40 billion Terra ecosystem collapse. The ruling underscores increasing global enforcement against crypto-related fraud.

Source

📊 WealthTech

Truist Wealth Launches Digital Platform With InvestCloud

Truist Wealth has unveiled a new digital platform built with InvestCloud to enhance advisor and client experiences. The platform modernizes portfolio management and wealth planning capabilities.

Source

Wealthfront IPO Values Robo-Advisor at $2B

Wealthfront has raised $486 million in its IPO, valuing the company at $2 billion. The milestone highlights renewed investor confidence in digital wealth management platforms.

Source

Robinhood Shares Slide After Trading Volume Drop

Robinhood shares fell 8% following a sharp decline in November trading volumes. The drop raises concerns about retail trading engagement amid volatile market conditions.

Source

⚖️ Regulation

Nationwide Fined £44M for Weak Financial Crime Controls

UK building society Nationwide has been fined £44 million for deficiencies in its financial crime controls. The penalty reinforces regulators’ focus on governance and compliance standards.

Source

UK Lawmakers Warn Stablecoin Rules Could Drive Activity Offshore

Lawmakers have warned that the Bank of England’s proposed stablecoin framework may hinder adoption and push innovation overseas. The debate highlights tensions between regulation and competitiveness.

Source

📌 Other

Masayoshi Son Reduces Pledged SoftBank Shares by $2.1B

SoftBank founder Masayoshi Son has cut the value of shares pledged as collateral by $2.1 billion. The move signals balance sheet caution amid ongoing market uncertainty.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.