JPMorgan Acquires WealthOS, Deepening Its Push Into Pensions Technology

JPMorgan has acquired pensions technology platform WealthOS, strengthening its position in the rapidly evolving retirement and wealth infrastructure space. The move highlights how global banks are prioritising technology-led control of long-term savings and pension administration. WealthOS provides modern digital tools that help pension providers and advisers manage complex retirement products more efficiently. For JPMorgan, the acquisition supports its broader wealth and asset management strategy by embedding fintech capabilities directly into core offerings. The deal reflects growing institutional demand for scalable pension tech amid ageing populations in the US and Europe. It also signals increasing consolidation between incumbents and specialist fintech platforms. Overall, the acquisition underscores how pensions are becoming a strategic battleground for financial innovation.

Video of the Day

Insight of the Day

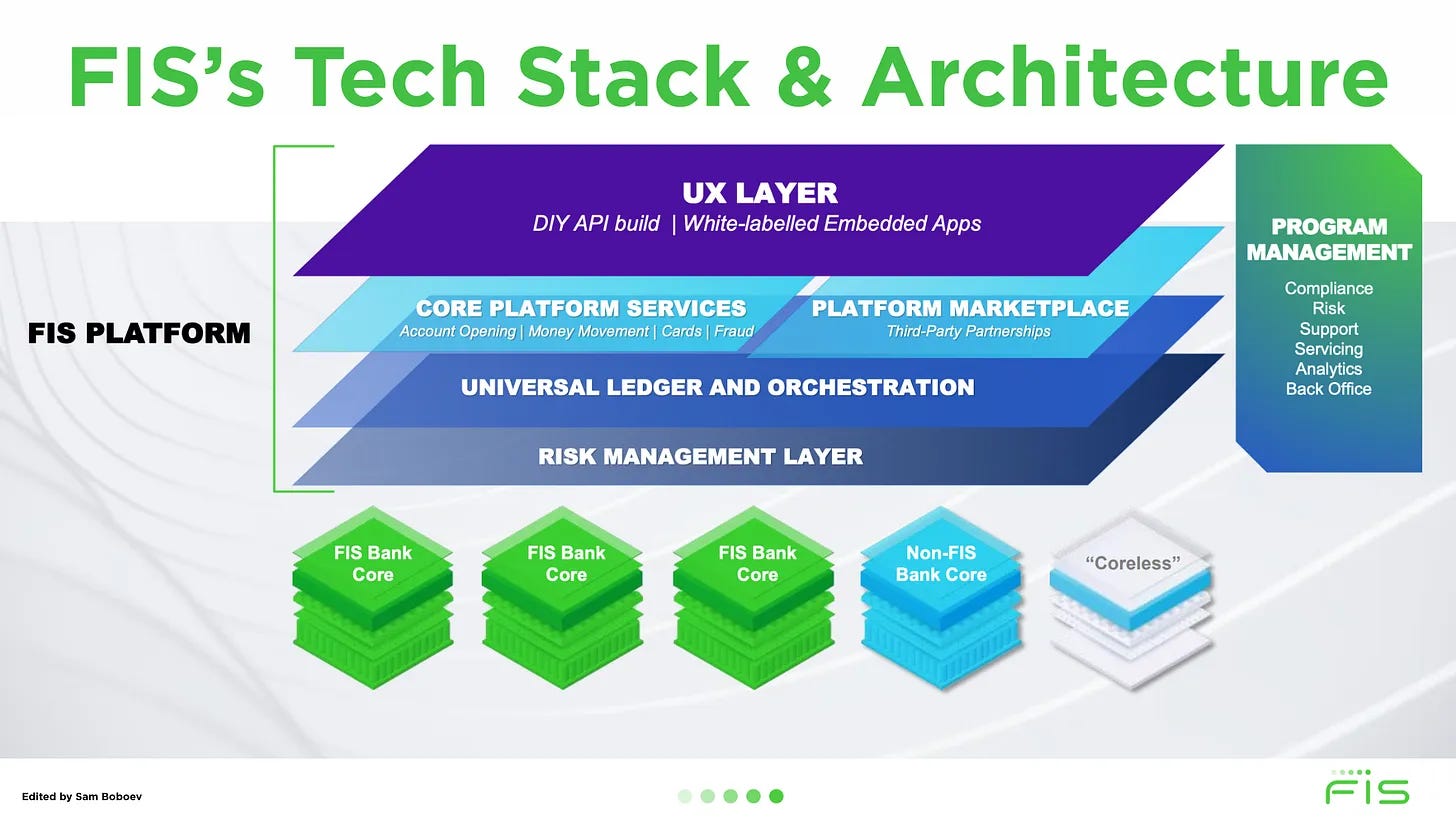

Unwrapping FIS’s Technology Stack and Architecture

FIS is building a banking platform that treats the bank like a set of interoperable services, not a monolithic core. The stack is structured in layers: cloud-native infrastructure, a common data and AI layer, componentized product modules, and a unified API access layer that abstracts the underlying cores. The architectural goal is simple: decouple channels from processing, decouple products from the core, and make integration the default state. If you want to understand where FIS is going, ignore product names and follow the mechanics: a universal ledger and orchestration layer, reusable platform services for account opening and money movement, a marketplace for third parties, and delivery tooling designed to ship changes safely at a global scale.

Curated News

💳 Payments

Tinaba and Banca Profilo Launch Payment App in China

Tinaba, in partnership with Banca Profilo, has debuted a payment app in China. The launch highlights European fintechs’ ambition to tap into Asian digital payments ecosystems.

Source

Payoneer Receives In-Principle Approval as Payments Aggregator in India

Payoneer has received in-principle authorisation to operate as a cross-border payment aggregator in India. The approval strengthens its ability to serve global freelancers and businesses in a key growth market.

Source

Exactly.com Reports 23% Revenue Growth Focused on Payment Equality

Exactly.com has reported 23% year-on-year turnover growth while reinforcing its commitment to payment equality. The update highlights sustained momentum for alternative payment models across Europe.

Source

8x8 Expands Secure Pay Globally

8x8 has expanded its Secure Pay solution worldwide to automate compliant payments across digital channels. The rollout targets regulated industries seeking frictionless and secure payment experiences.

Source

🏦 Banking

Revolut Drops US Bank Acquisition Plans, Targets Standalone Licence

Revolut has scrapped plans to acquire a US lender, opting instead to pursue a standalone banking licence. The shift reflects regulatory complexity and Revolut’s long-term ambition to operate independently in the US.

Source

BNPL Giant Affirm Applies to Become an Industrial Loan Company

Affirm has applied to establish an industrial loan company, marking a significant step toward deeper integration with the banking system. The move could reshape how BNPL firms fund and regulate their lending operations.

Source

💼 Fintech

Indian Fintech Juspay Raises $50M at $1.2B Valuation

Juspay has raised $50 million in Series D funding at a $1.2 billion valuation. The round underscores strong investor confidence in payments infrastructure across India’s booming digital economy.

Source

ClearScore Acquires Mortgage Platform Acre

ClearScore Group has acquired Acre Platforms, expanding its capabilities in mortgage and home-buying technology. The acquisition strengthens ClearScore’s end-to-end financial marketplace strategy.

Source

Pomelo Raises $55M to Modernise Payments Infrastructure

Pomelo has raised $55 million in Series C funding to accelerate the modernisation of payments infrastructure. The raise reflects continued global demand for scalable issuing and processing platforms.

Source

ZBD Raises $40M to Embed Payments in Gaming

ZBD has raised $40 million in Series C funding to bring real-money payments and rewards directly into video games. The round highlights growing convergence between fintech and gaming ecosystems.

Source

🪙 Crypto

UBS Plans Bitcoin and Ethereum Trading for Wealthy Clients

UBS is planning to offer Bitcoin and Ethereum trading to select high-net-worth clients. The move signals growing institutional comfort with crypto exposure in private banking.

Source

Coinbase Launches $1M Loans Backed by Staked Ether

Coinbase has introduced loans of up to $1 million backed by staked Ethereum. The product highlights expanding use cases for crypto-backed lending within regulated platforms.

Source

SharpLink Positions Itself as a Disciplined Ethereum Treasury

SharpLink has outlined plans to become a highly focused and disciplined Ethereum treasury in 2026. The strategy reflects growing corporate interest in ETH as a balance-sheet asset.

Source

Bitwise Exec Compares Silver Rally to Crypto Altcoin Cycles

A Bitwise executive has drawn parallels between silver’s recent surge and crypto altcoin cycles. The commentary reflects increasing cross-market analysis between traditional assets and crypto markets.

Source

📊 WealthTech

Pave Partners with Fidelity to Scale Automated Wealth Management

Pave has tapped Fidelity to scale its automated wealth management capabilities. The partnership highlights how incumbents and fintechs are collaborating to modernise advisory services.

Source

🧩 Other

Octopus EV Partners with Root and Admiral on Motor Insurance

Octopus EV has partnered with Root and Admiral Pioneer to offer tailored motor insurance solutions. The move highlights innovation at the intersection of EV adoption and insurtech.

Source

Broadridge Named One of Fortune’s Most Admired Companies

Broadridge has been recognised as one of Fortune Magazine’s 2026 World’s Most Admired Companies. The recognition reflects sustained leadership in financial infrastructure and governance solutions.

Source

PayPal to Acquire Cymbio to Accelerate Agentic Commerce

PayPal is acquiring Cymbio to accelerate its agentic commerce capabilities. The deal strengthens PayPal’s push into AI-driven, automated commerce experiences.

Source

Mercuryo Partners with Visa on Global Off-Ramping Expansion

Mercuryo has partnered with Visa to expand Visa Direct off-ramping services globally. The partnership supports faster conversion between digital assets and fiat currencies.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.