JPMorgan Chase to Launch Digital Bank in Germany

JPMorgan Chase is expanding its European footprint with the launch of a digital bank in Germany, marking its most significant retail push in the region to date. The move comes as competition intensifies among global banks and neobanks targeting European customers with low-cost, app-first services. By entering Germany, JPMorgan aims to tap into one of Europe’s largest retail banking markets and leverage its scale to challenge incumbents. This expansion also demonstrates the growing importance of digital banking channels in an era of shifting consumer preferences. JPMorgan has already found success with its UK digital bank, which gained traction faster than expected. With Germany as its next target, the bank is positioning itself as a long-term player in Europe’s evolving retail banking landscape.

Insight of the Day

Stablecoins: the commercial opportunity

👉 The business model: a guide

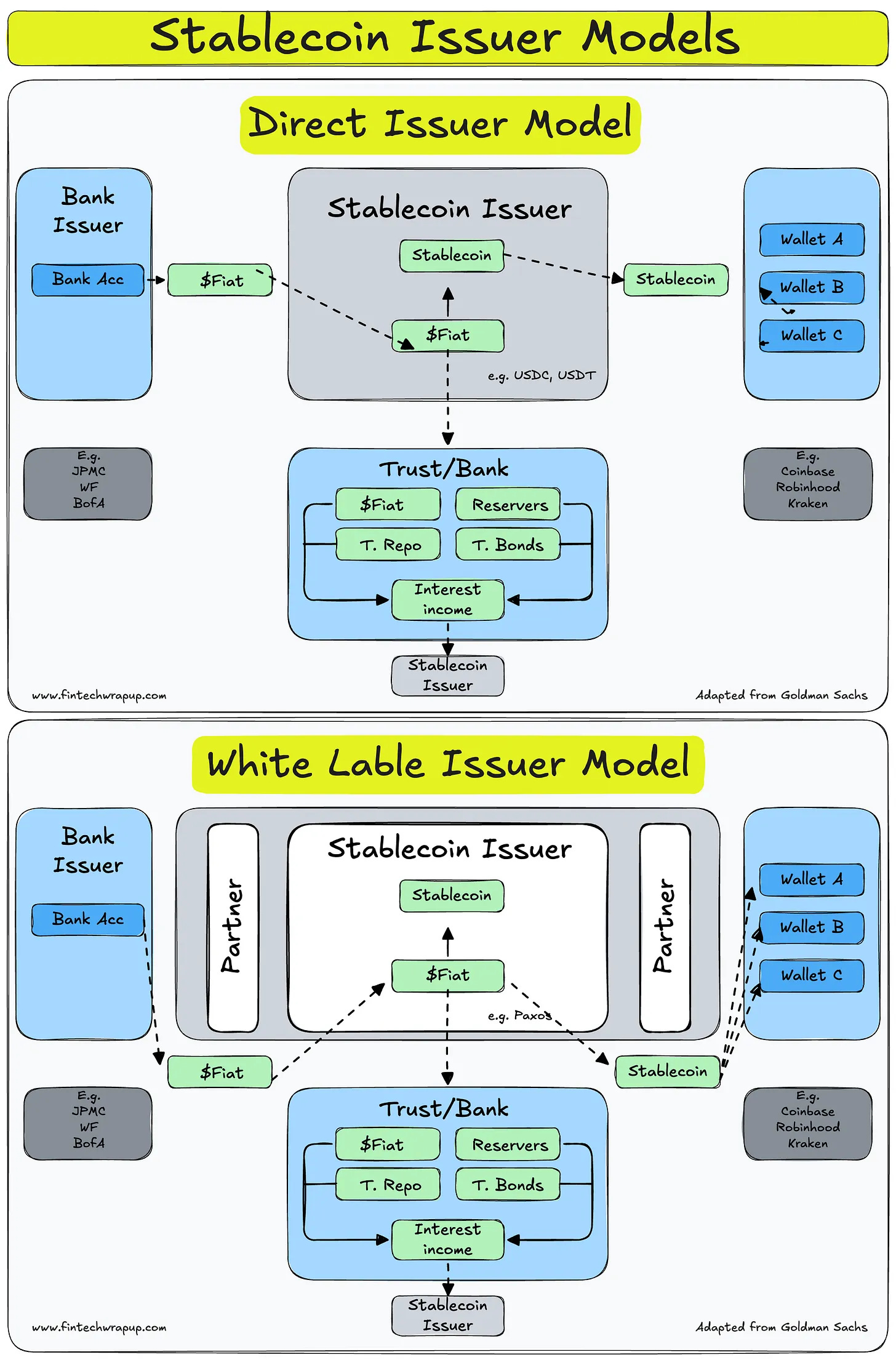

Stablecoin issuers employ one of two primary business models: (1) outright issuance and creation of stablecoins and (2) “white label” stablecoins.

🔹 In the outright issuance model, an issuer “mints” their own stablecoin. Minting is the process of creating a new coin. Customers deliver dollars to the issuer, who then creates an equivalent amount of stablecoins and delivers them to the customer. The proceeds of minting are deployed into highquality liquid assets, which, in the case of some stablecoins, are assets without credit, market, or interest rate risk. These assets, or reserves, typically consist of a mix of US Treasuries, US Treasury repo, and bank deposits, often at globally systemically important banks. The high quality of such reserves means that stablecoin issuers can easily liquidate them to provide dollars to customers who wish to sell their stablecoins, a process known as “redemption”. Tether (which issues USDT) and Circle are the two largest direct stablecoin issuers.

🔹 In the white label stablecoin issuance model, an issuer mints and redeems stablecoins on behalf of a partner, who delivers its customers’ dollars to the issuer for minting and delivers the newly-minted stablecoins to customers. The reserve structure and composition in this issuance model resemble that of the outright issuance model. The largest market participant among white label stablecoins, whose usage has recently risen owing to recent expansion of its Global Dollar stablecoin (USDG) across several partners, including Robinhood and Kraken, is Paxos, which issues PayPal Coin (PYUSD) and USDG on behalf of the Global Dollar Network.

Curated News

💳 Payments

BPCE and Mambu Partner to Support Global PSPs Entering EU

BPCE Payment Services and Mambu have joined forces to help global payment service providers expand into the EU. The collaboration aims to simplify market entry with scalable infrastructure and compliance support.

Source

Payroc Partners With CINFED Credit Union for Next-Gen Payments

Payroc is teaming up with CINFED Credit Union in Ohio to deliver advanced payment solutions to local businesses. The partnership focuses on improving transaction speed and reliability for SMEs.

Source

payabl. Launches Checkout Readiness Guide for Holiday Sales

payabl. has introduced a new guide to help merchants optimize checkout flows and boost conversions ahead of the holiday season. The resource provides actionable insights on reducing friction in digital transactions.

Source

🏦 Banking

BBVA and SAP Forge Alliance for Corporate Banking Innovation

BBVA has partnered with SAP to enhance its corporate and business banking services. The alliance will deliver digital solutions aimed at improving efficiency and customer experience for enterprise clients.

Source

U.S. Bank Tackles SMB Cash Flow Crunch

U.S. Bank has rolled out new services designed to help small businesses better manage cash flow. The initiative aims to ease liquidity pressures, a persistent challenge for many SMEs.

Source

💡 Fintech

Revolut Strikes Multi-Million Deal With Google Cloud

Revolut has signed a major partnership with Google Cloud to enhance its global scalability and resilience. The deal will also support AI-driven innovation and security improvements across Revolut’s platform.

Source

Nova Credit Cash Flow Solutions Adopted by Chase

Chase will integrate Nova Credit’s cash flow analytics into its offerings, boosting credit decisioning capabilities. The move supports more inclusive lending by considering alternative financial data.

Source

Atlar and HSBC Back Fast-Scaling Firms Like Liberis

Atlar has partnered with HSBC Innovation Banking to support rapidly growing companies, with Liberis among the first beneficiaries. The collaboration provides streamlined financial infrastructure to scaling firms.

Source

Liberis Launches AI-Powered SMB Funding Platform

Liberis has unveiled an AI-driven platform designed to simplify small business funding. The solution aims to reduce friction and improve access to working capital for SMEs.

Source

Xero Introduces AI Tools for Accountants

Xero has rolled out AI-powered features to improve efficiency and automate routine accounting tasks. The tools are expected to free up time for accountants to focus on higher-value advisory work.

Source

Juniper Square Secures Strategic Investment From Nasdaq Ventures

Juniper Square has received a strategic investment from Nasdaq Ventures to accelerate its private markets technology. The funding will enhance tools for fund managers and investors in the alternative assets space.

Source

Latin American Insurtech 180 Seguros Raises $9M

Brazil-based 180 Seguros has secured $9 million to expand its insurtech offerings across Latin America. The funding will fuel product development and regional growth.

Source

ID.me Hits $2B Valuation Amid AI Fraud Push

ID.me has raised new funding, bringing its valuation to $2 billion, to bolster efforts against AI-driven fraud. The investment highlights rising demand for secure digital identity verification.

Source

Two Partners With Komplett to Combat Fraud

Fintech company Two has teamed up with retailer Komplett to address increasing fraud risks. The partnership will deploy AI-powered fraud detection tools across e-commerce channels.

Source

🪙 Crypto

Boerse Stuttgart Launches Tokenized Settlement Platform

Boerse Stuttgart has introduced a pan-European platform for settling tokenized assets. The initiative strengthens Europe’s digital asset infrastructure and supports institutional adoption.

Source

Kraken Acquires Breakout for Leveraged Bitcoin Trading

Kraken has acquired Breakout to enable leveraged bitcoin trading with funded accounts. This acquisition expands its product suite and caters to traders seeking advanced crypto exposure.

Source

Arbitrum Launches $40M Incentive Program

Arbitrum has kicked off a $40 million incentive plan focused on leveraged looping strategies. The initiative is aimed at driving user engagement and liquidity in its ecosystem.

Source

Sumsub Partners With Binance’s BNB Attestation Service

Sumsub has partnered with Binance’s BNB Attestation Service to streamline Web3 identity verification. The integration enhances security and compliance for blockchain users.

Source

Ripple Expands RLUSD Stablecoin to Africa

Ripple is extending its dollar-backed stablecoin RLUSD into African markets through new partnerships. The expansion reflects growing demand for stable digital assets in emerging economies.

Source

Stripe and Paradigm Launch Tempo Blockchain

Stripe and Paradigm, with support from OpenAI and Visa, have launched Tempo, a new blockchain network. The project aims to advance real-world payments use cases and enterprise adoption.

Source

📈 WealthTech

SoFi Unveils Agentic AI ETF

SoFi has launched an Agentic AI ETF, targeting investors seeking exposure to companies in the AI sector. The move comes despite rising concerns over inflated AI valuations.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a "Source: [Name]" attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.