JPMorgan Expands in Dubai to Deepen Regional Financial Presence

JPMorgan Chase is significantly expanding its operations in Dubai as it strengthens its presence in the Middle East’s rapidly growing financial hub. The move supports increased demand for institutional banking, wealth management, and capital markets services. By scaling its footprint, JPMorgan aims to capture new regional business and capitalize on accelerating cross-border capital flows. Dubai’s regulatory landscape and strategic location make it attractive for global banks. The expansion reinforces JPMorgan’s long-term commitment to the region and positions it ahead of competitors. It also underscores the UAE’s rise as a global financial center.

Video of the Day

Insight of the Day

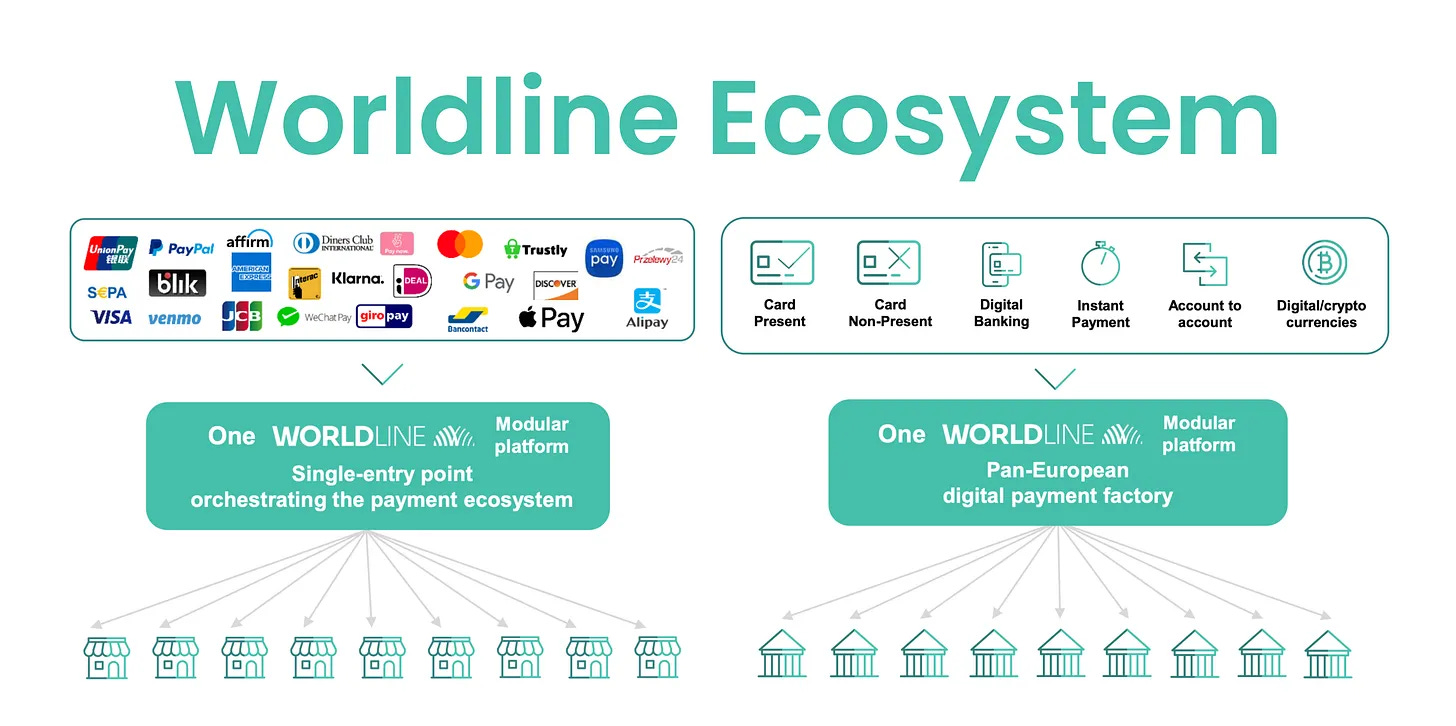

How Worldline Is Trying to Rebuild — Without a Full Recovery (Yet)

I’ll admit, the first half of 2025 wasn’t kind to Worldline’s reputation. Back in June, an investigative series dubbed “Dirty Payments” accused the French payment giant of covering up fraudulent merchants to protect its revenue – including allegedly onboarding questionable clients in porn, gambling, and sketchy dating sites, then shuffling them between divisions to avoid detection. Multiple media outlets piled on, and the fallout was immediate: Worldline’s stock plunged ~20% in a single day. Even Belgian prosecutors opened a money-laundering probe into the company’s local unit. In boardrooms and Slack channels across fintech, the question was whether Europe’s “trusted” payments provider had been playing fast and loose with compliance.

Worldline’s response was equal parts damage control and mea culpa. Management claims that since 2023 they’ve tightened merchant risk controls, terminated high-risk clients (purging merchants representing about €130 million in annual revenue) and maintain a “zero-tolerance” stance on non-compliance. To “restore trust,” the company even commissioned an external audit of its merchant portfolio and risk processes, and it clarified some opaque cash pooling arrangements that had raised eyebrows. In other words, Worldline brought in the auditors to exorcise its demons. (The irony of a firm long touted as a compliance-first European player having to prove it wasn’t the next Wirecard was not lost on anyone.)

Investor sentiment remained skittish. Notably, SIX Group – the Swiss stock exchange operator that once was a key Worldline shareholder – essentially noped out. SIX reclassified its 10.5% stake from “strategic” to merely a “financial investment,” pointedly indicating it wouldn’t throw good money after bad. It even took back control of one Worldline unit (an electronic data management business) as part of the divorce. That left Worldline leaning heavily on friendly French banks for support. In a show of solidarity (or perhaps nationalism), Bpifrance, Crédit Agricole, and BNP Paribas agreed to anchor a €500 million capital raise to bolster Worldline’s balance sheet for its turnaround. With fresh cash and a renewed executive team, Worldline set out to win back confidence.

Curated News

💳 Payments

Coins.ph & FinFan Launch Cross-Border Payments Corridor

Coins.ph and Vietnam’s FinFan have partnered to streamline remittances across Southeast Asia, enabling faster and more secure transactions. This partnership expands interoperability between regional payment providers.

Source

Liquid Group & TerraPay Advance Global QR Interoperability

The two companies signed an MoU to unify QR payment rails across Africa, Asia, and additional markets. The goal is to simplify merchant acceptance and reduce fragmentation in QR-based payments.

Source

Sunday Raises $21M to Scale Restaurant Payment Platform

Sunday secured $21M to expand its QR-powered restaurant checkout system used by 80M diners worldwide. The funding will support global growth and deeper integrations with POS providers.

Source

Enfuce Completes Avida’s Card Migration

Enfuce finalized the migration of Avida’s card portfolio, enhancing stability and scalability for its card programs. The move strengthens Avida’s digital financial services infrastructure.

Source

🏦 Banking

XTransfer & Maybank Form Regional Strategic Partnership

The partnership aims to expand cross-border financial services and support Shariah-compliant solutions for SMEs in Southeast Asia. It enhances digital banking capabilities across the region.

Source

Bank of America Introduces ‘401k Pay’

Bank of America launched a new automated retirement contribution feature, enabling employees to route part of their paycheck directly into their 401(k). The tool aims to boost retirement readiness and financial wellness.

Source

🤖 Fintech

Finextra & Cloudera Publish Global AI Adoption Report

The report highlights how financial institutions are accelerating AI deployment, noting gains in efficiency and risk management. It also identifies persistent implementation challenges.

Source

Ant International’s AI Platform Adopted by Easypaisa & TNG Digital

Both digital wallets will use Ant’s AI-as-a-Service tools to enhance fraud detection, analytics, and operational efficiency. The rollout marks a major AI advancement in Asian fintech.

Source

iDenfy Launches Instant License Verification for KYC

iDenfy’s new feature enables instant license checks to streamline onboarding processes and reduce compliance friction. It supports safer and more efficient identity verification.

Source

Trulioo Expands KYB Suite With Credit Decisioning

Trulioo is adding credit decisioning tools to its KYB platform, allowing businesses to better assess counterparties and manage risk. The update enhances compliance and underwriting functions.

Source

Adclear Raises $2.75M for AI Compliance Monitoring

Adclear received funding to expand its AI tools that ensure financial promotions meet regulatory standards. The solution helps fintechs stay compliant with increasingly strict marketing rules.

Source

🪙 Crypto

Czech Central Bank Becomes First to Add Bitcoin to Reserves

The Czech central bank purchased Bitcoin, becoming the first national monetary authority to include BTC in its reserves. The move may influence other central banks considering digital assets.

Source

Discovery Bank Integrates Crypto Trading With Luno

Discovery Bank customers in South Africa can now trade crypto directly through the bank’s app via Luno. This integration expands mainstream accessibility to digital asset investing.

Source

BingX Debuts Token Listing FastTrack

BingX launched a streamlined FastTrack program to simplify and speed up new token listings. The initiative promotes transparency and supports early-stage crypto projects.

Source

Fake Bitcoin Sale Rumor Creates 10x Gains

A false rumor about a major Bitcoin sale triggered rapid market volatility, enabling some traders to secure 10x profits. The incident highlights how misinformation can dramatically impact crypto markets.

Source

Singapore Plans Tokenized Bills Trial in 2026

Singapore is preparing a pilot to tokenize treasury bills in 2026, broadening its digital asset experimentation. The initiative aims to enhance settlement efficiency and support institutional blockchain use.

Source

💼 WealthTech

Mantle & Modulr Modernize Pension Payroll Systems

The partnership aims to improve payroll automation for pension schemes, enhancing accuracy and member experience. It supports more efficient retirement administration.

Source

N2G Deploys Insurity’s Policy Decisions Evolution

N2G has gone live on Insurity’s policy management platform, improving underwriting efficiency and digital operations. The deployment supports greater scalability across its insurance offerings.

Source

INSTANDA & Insevo Boost Nordic Insurance Innovation

The collaboration focuses on modernizing digital infrastructure for Nordic insurers, enabling faster product launches and improved operational agility.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.