JPMorgan Launches Tokenized Money Market Fund, Signaling Institutional Shift to Onchain Finance

JPMorgan has launched a tokenized money market fund, allowing institutional investors to access traditional cash-management products through blockchain-based infrastructure. The move highlights how major banks are increasingly using tokenization to improve settlement speed, transparency, and operational efficiency. By bringing regulated money market funds onchain, JPMorgan is bridging traditional finance and digital assets rather than positioning them as competitors. The initiative builds on the bank’s broader blockchain strategy, including Onyx and JPM Coin, which already support tokenized deposits and intraday liquidity. This development also reflects growing institutional demand for low-risk, yield-bearing digital assets. For fintech and capital markets, it marks a significant step toward mainstream adoption of tokenized real-world assets. Overall, it reinforces the idea that tokenization is becoming a core financial infrastructure, not an experimental side project.

Video of the Day

Insight of the Day

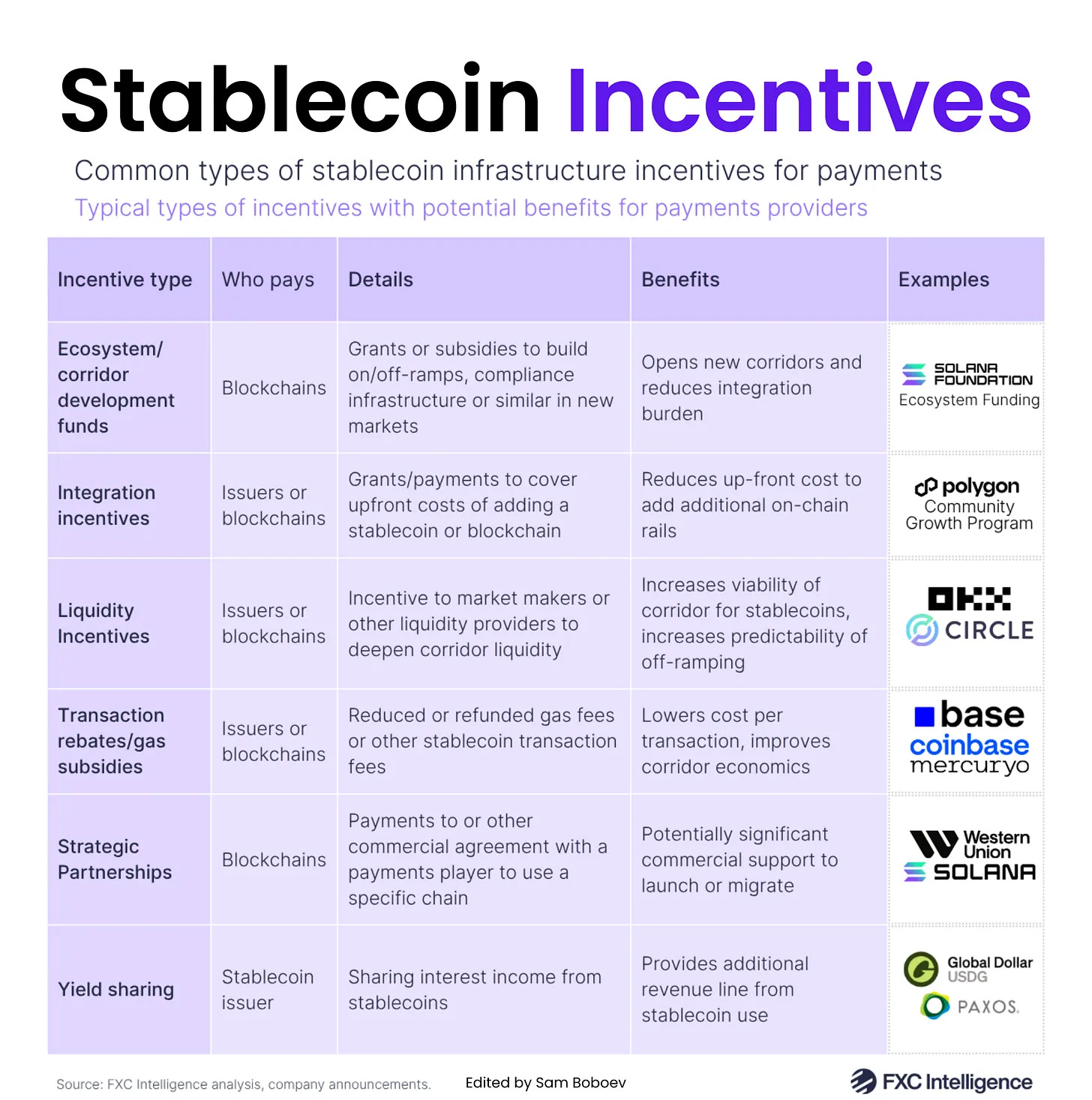

𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐡𝐨𝐰 𝐢𝐧𝐜𝐞𝐧𝐭𝐢𝐯𝐞𝐬 𝐬𝐡𝐚𝐩𝐞 𝐬𝐭𝐚𝐛𝐥𝐞𝐜𝐨𝐢𝐧 𝐢𝐧𝐟𝐫𝐚𝐬𝐭𝐫𝐮𝐜𝐭𝐮𝐫𝐞 𝐜𝐡𝐨𝐢𝐜𝐞𝐬 𝐛𝐲 𝐅𝐗𝐂 𝐈𝐧𝐭𝐞𝐥𝐥𝐢𝐠𝐞𝐧𝐜𝐞

I have been spending a lot of time looking at how companies choose which stablecoins and blockchains to build on. The interesting part is that the decision is rarely only about speed or fees. Incentives play a bigger role than most teams admit.

𝐇𝐞𝐫𝐞 𝐢𝐬 𝐡𝐨𝐰 𝐲𝐨𝐮 𝐜𝐚𝐧 𝐭𝐡𝐢𝐧𝐤 𝐚𝐛𝐨𝐮𝐭 𝐢𝐭.

______

𝟏. 𝐓𝐡𝐞 𝐦𝐚𝐫𝐤𝐞𝐭 𝐢𝐬 𝐬𝐭𝐢𝐥𝐥 𝐜𝐨𝐧𝐜𝐞𝐧𝐭𝐫𝐚𝐭𝐞𝐝, 𝐰𝐡𝐢𝐜𝐡 𝐬𝐡𝐚𝐩𝐞𝐬 𝐥𝐢𝐪𝐮𝐢𝐝𝐢𝐭𝐲

Right now, 82% of the entire stablecoin market sits in two assets: USDT at 59% and USDC at 23%.

But it gets even more concentrated when you look at where these assets live.

• 47% of USDT and 66% of USDC sits on Ethereum

• 42% of USDT sits on Tron

This means almost one third of all stablecoin value is a single stablecoin on a single chain. Two thirds sits across two stablecoins on two chains.

Liquidity follows concentration. So if you operate outside the big two chains or the big two stablecoins, you need incentives to make your asset or network more attractive.

______

𝟐. 𝐈𝐧𝐜𝐞𝐧𝐭𝐢𝐯𝐞𝐬 𝐞𝐱𝐢𝐬𝐭 𝐛𝐞𝐜𝐚𝐮𝐬𝐞 𝐦𝐨𝐬𝐭 𝐜𝐡𝐚𝐢𝐧𝐬 𝐚𝐫𝐞 𝐬𝐭𝐢𝐥𝐥 𝐬𝐦𝐚𝐥𝐥

Most blockchains and most stablecoins want more volume, more users and more builders. Incentives help accelerate all three.

I tend to put them into two buckets.

-> Direct adoption incentives

These are the simple, front door tactics.

• Grants to early stage builders that commit to building on a chain

• Ecosystem funds for tooling, on-ramps and off-ramps

• Rebates or discounted transaction fees for a set period of time

Solana, Polygon and Stellar all run these kinds of programmes. Coinbase and Mercuryo are doing it right now with USDC on Base.

-> Indirect adoption incentives

These incentives make the stablecoin or chain more appealing to use.

One example is yield sharing. Some issuers keep the full treasury yield for themselves. Others, like Paxos with its Global Dollar Coin, share a portion of it with partners. That creates an economic reason for payment providers to integrate.

______

𝟑. 𝐋𝐢𝐪𝐮𝐢𝐝𝐢𝐭𝐲 𝐢𝐧𝐜𝐞𝐧𝐭𝐢𝐯𝐞𝐬 𝐦𝐚𝐭𝐭𝐞𝐫 𝐟𝐨𝐫 𝐜𝐫𝐨𝐬𝐬-𝐛𝐨𝐫𝐝𝐞𝐫 𝐮𝐬𝐞 𝐜𝐚𝐬𝐞𝐬

Curated News

💳 Payments

BPI’s BanKo Partners with ACI Worldwide to Modernize Payments

BPI’s digital bank BanKo is teaming up with ACI Worldwide to upgrade its payments infrastructure. The partnership aims to improve real-time processing, scalability, and reliability for retail transactions. It underscores how digital banks in emerging markets are investing in modern rails to support growth.

Source

Sunrate Launches Walmart Seller Payment Tool

Sunrate has introduced a new payment solution designed specifically for Walmart marketplace sellers. The tool streamlines cross-border collections and settlement, reducing friction for global merchants. This highlights rising demand for embedded payments in e-commerce ecosystems.

Source

PayTabs Egypt Partners with Edita to Streamline Distributor Collections

PayTabs Egypt has partnered with FMCG company Edita to digitize distributor payment collections. The solution improves cash flow visibility and reduces reliance on manual processes. It reflects the continued digitization of B2B payments in the Middle East.

Source

ViaBill Launches Pay Later Instalments on Apple Pay in Denmark

ViaBill has rolled out buy-now-pay-later instalments directly through Apple Pay in Denmark. The integration simplifies BNPL adoption at checkout while leveraging Apple’s ecosystem. It signals continued convergence between wallets and alternative credit.

Source

EBANX Advances Credit Cards in LatAm with Network Tokenization

EBANX is using network tokenization to enhance cross-border credit card transactions in Latin America. The approach improves approval rates and security for international payments. It demonstrates how tokenization is reshaping traditional card infrastructure.

Source

🏦 Banking

Tieto Banktech Wins Five-Year Core Banking Deal with Cultura Bank

Tieto Banktech has secured a five-year agreement to provide core banking services to Norway’s Cultura Bank. The deal supports Cultura’s sustainability-focused banking model. It shows continued demand for modern, flexible core platforms among niche banks.

Source

German Regulator Imposes Tighter Oversight on N26

Germany’s financial watchdog has ordered stricter controls and oversight for digital bank N26. The measures aim to address governance and risk-management concerns. This highlights the increasing regulatory scrutiny faced by fast-growing neobanks.

Source

HSBC Advances Proposed Privatisation of Hang Seng Bank

HSBC and Hang Seng Bank have issued a scheme document outlining the next steps toward privatisation. The move would simplify HSBC’s structure and deepen control over its Asian operations. It reflects broader consolidation trends in global banking.

Source

🧠 Fintech

Stripe Launches Agentic Commerce Suite for AI-Led Sales

Stripe has unveiled an Agentic Commerce Suite designed to support transactions initiated by AI agents. The tools enable automated purchasing, billing, and payments across platforms. This positions Stripe at the center of AI-driven commerce workflows.

Source

Klarna Launches Agentic Product Protocol for AI Discovery

Klarna introduced an open protocol that makes over 100 million products discoverable by AI agents. The standard allows merchants to surface products seamlessly in AI-driven shopping experiences. It signals how commerce is being re-architected for autonomous agents.

Source

New Fintech Programme Targets Financial Readiness for Scotland’s Ageing Population

A new fintech initiative in Scotland aims to help older adults better prepare financially for later life. The programme combines digital tools with financial education. It highlights fintech’s growing role in addressing demographic challenges.

Source

🪙 Crypto

Visa Launches Stablecoin Advisory Practice

Visa has launched a dedicated advisory practice to help institutions navigate stablecoin adoption. The initiative focuses on use cases, compliance, and integration with existing payment systems. It reinforces Visa’s view of stablecoins as a mainstream payments tool.

Source

World Launches Super App with Crypto Pay and Encrypted Chat

World has unveiled a super app combining crypto payments, identity features, and encrypted messaging. The platform aims to merge financial and social functionality in one ecosystem. It reflects the continued ambition to build “everything apps” around crypto.

Source

Bitcoin Pullback to $85,000 Hits New Market Entrants

Bitcoin’s retreat to $85,000 has shifted unrealized losses toward newer investors. The move highlights ongoing volatility despite broader institutional interest in crypto. It serves as a reminder of risk as markets mature.

Source

MetaComp Partners with Stablecoin Platform Stable

Singapore-based MetaComp has partnered with Stable to expand stablecoin-based payment capabilities. The collaboration focuses on regulated settlement and institutional use cases. It underscores Asia’s growing role in stablecoin infrastructure.

Source

📜 Regulation

UK Unveils New Crypto Rules to Drive Growth and Protect Consumers

The UK government has announced new crypto regulations aimed at boosting innovation while strengthening consumer protection. The framework targets stablecoins, custody, and market integrity. It signals a more structured and growth-friendly regulatory stance.

Source

SEC Chair Warns Crypto Could Become a Financial Surveillance Tool

The SEC chair has cautioned that crypto technologies could enable large-scale financial surveillance if poorly governed. The comments highlight growing regulatory concerns around privacy and data use. They also foreshadow tougher oversight discussions ahead.

Source

🏗️ Other

Doha Bank Issues $150M Digital Bond with Instant Settlement

In a parallel report, Doha Bank’s digital bond issuance highlights instant settlement as a key innovation. The transaction reduces operational risk and settlement delays. It reinforces momentum behind tokenized securities.

Source

Superbank IPO Draws Massive Retail Demand

Superbank’s IPO attracted over one million orders and was oversubscribed 318 times. The response shows strong retail appetite for digital-first banking stories. It also signals renewed IPO momentum in fintech-linked offerings.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.