JPMorgan Pays $330M to Settle Malaysia 1MDB Claims

JPMorgan has agreed to pay $330 million to Malaysia to resolve claims linked to the massive 1MDB corruption scandal. The payout underscores lingering accountability for one of the largest global financial frauds, which previously ensnared Goldman Sachs and other financial institutions. Malaysia has been pursuing restitution from firms that facilitated billions siphoned from the fund. For JPMorgan, the settlement allows the bank to move past the case without admitting wrongdoing, while regulators continue scrutinizing Wall Street’s role in international scandals. The deal reflects a broader push by governments to hold major financial players responsible for compliance failures. This development highlights the high stakes of global anti-corruption enforcement in the financial sector.

Insight of the Day

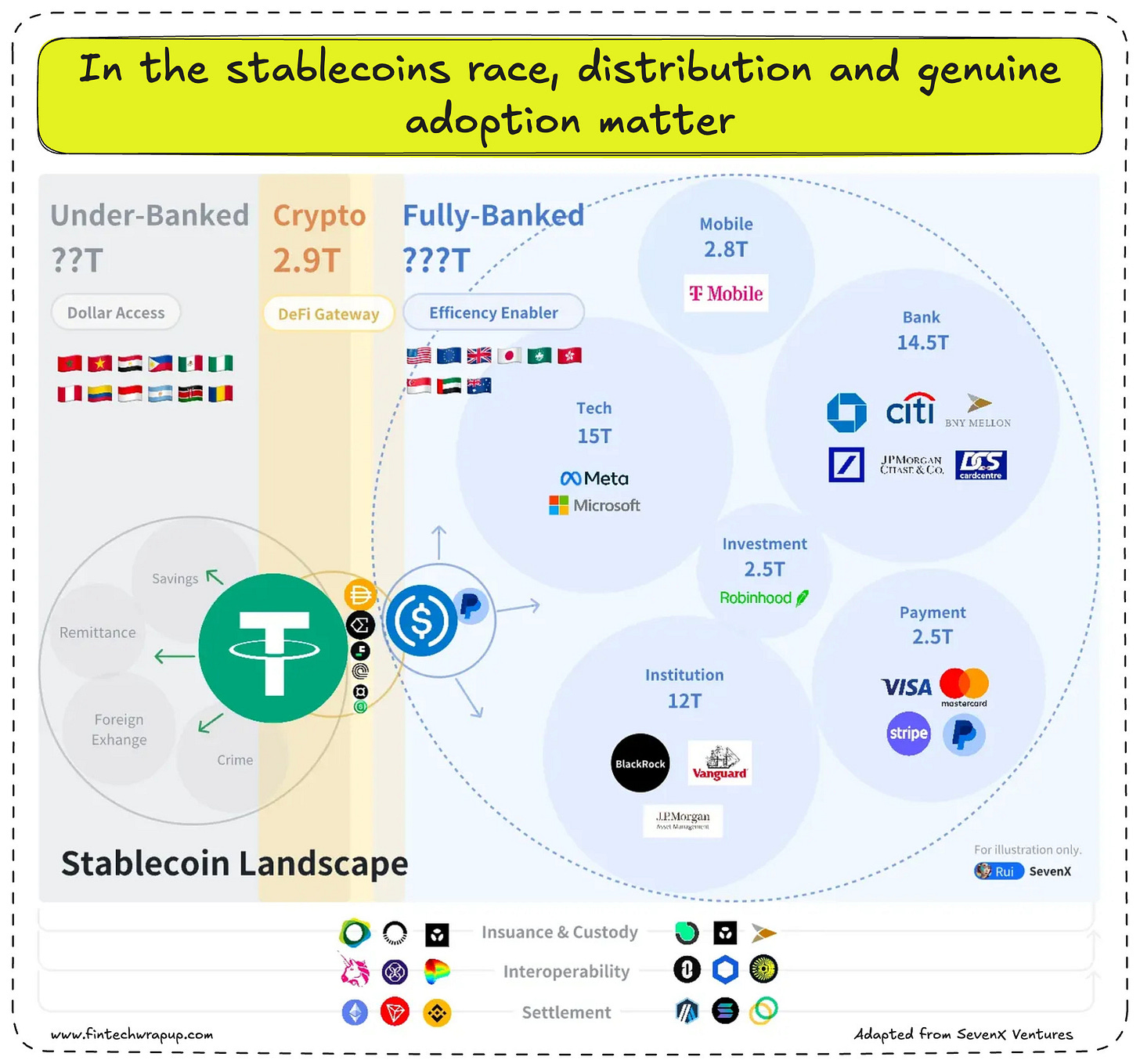

Stablecoins: It’s about distribution and real-world adoption

For younger generations—true digital natives—money is no longer paper in a wallet. It’s code, moving as seamlessly as a message over the internet. And increasingly, that “code” is stablecoins.

With AI and IoT driving billions of automated micro-transactions, finance needs a money format that’s programmable, instant, and borderless. Stablecoins fit perfectly, acting as a “Currency API” that moves value like data. In 2024, stablecoins hit $4.5 trillion in transaction volume. Tether alone booked $5.2 billion in profit in H1 2024 from investing its reserves—making stablecoins one of the most lucrative business models in finance.

Curated News

💳 Payments

Wise Handles 12% of Philippine Remittances

Wise has become the first global fintech fully integrated with the Philippines’ payment systems, now processing 12% of all inward personal remittances. This integration strengthens Wise’s position in a country where remittances are a crucial economic lifeline.

Source

TWINT Reaches 6 Million Users in Switzerland

Swiss mobile payment app TWINT now counts over 6 million users, underscoring its dominance in the local payments market. The milestone highlights the app’s role in shifting consumer behavior toward cashless transactions.

Source

🏦 Banking

UK Loses One-Third of Bank Branches in 5 Years

British banks have shuttered nearly a third of their branches since 2020 as customers increasingly shift to digital banking. The closures raise concerns about financial access for rural communities and vulnerable populations.

Source

Japan’s Mizuho & MUFG Chase Overseas Wealth Deals

Japanese banking giants Mizuho and MUFG are aggressively pursuing money manager acquisitions abroad. The strategy aims to diversify revenue as domestic growth slows and competition intensifies.

Source

HSBC Innovation Banking Expands to Australia

HSBC has launched its Innovation Banking division in Australia, targeting startups and fast-growing firms. The move positions HSBC to better serve the country’s expanding tech and venture ecosystem.

Source

💸 Fintech

Pintarnya Raises $16.7M to Power Jobs & Finance in Indonesia

Jakarta-based Pintarnya secured $16.7M in fresh funding to expand its job marketplace and embedded financial services. The startup aims to serve Indonesia’s vast blue-collar workforce with accessible employment and credit solutions.

Source

Philippine Lending Boom Defies Regional Fintech Slowdown

While Southeast Asia’s fintech funding has slumped, Philippine lenders are experiencing a surge in investment. The trend underscores growing confidence in the country’s digital credit sector.

Source

MeridianLink, Jack Henry Deepen Reseller Partnership

MeridianLink and Jack Henry are expanding their strategic reseller relationship to include MeridianLink One platform solutions. The partnership will broaden offerings for community banks and credit unions.

Source

HSBC Innovation Banking Expands to Australia

(Also listed under Banking, relevant for fintech expansion.)

🪙 Crypto

Australia Orders Binance AML Audit

Australian regulators have mandated Binance to undergo an independent audit amid money laundering concerns. The probe underscores ongoing global scrutiny of crypto exchanges.

Source

DOJ Eases Money Transmitter Crackdown Backed by Crypto Industry

The U.S. Department of Justice will scale back aggressive enforcement of money transmitter cases, a shift welcomed by the crypto sector. The move signals a more balanced regulatory stance toward digital assets.

Source

Ethereum Treasuries Surge, Bitcoin ETFs See $1B Outflows

Ethereum treasuries are climbing while Bitcoin ETFs have bled over $1 billion in outflows. The trend reflects shifting investor sentiment and speculation about upcoming crypto IPOs.

Source

💼 WealthTech

Turkish Platform Midas Nears $1B Valuation

Istanbul-based investment app Midas is approaching a $1 billion valuation following strong user and revenue growth. The milestone underscores Turkey’s growing appetite for retail investing platforms.

Source

Kruncher Brings AI to Private Market Investors

Singapore-born Kruncher has launched AI-driven tools for private market investors, aiming to enhance portfolio insights and deal sourcing. The solution targets the fast-growing alternative investments sector.

Source

⚖️ Regulation

CFPB Sues Synapse Over Mishandled Customer Funds

The CFPB has filed suit against fintech infrastructure provider Synapse, accusing it of mismanaging client money. The case underscores rising regulatory scrutiny over embedded finance players.

Source

FTC Chair Warns US Tech Giants on UK/EU Safety Laws

The FTC Chair has warned American tech firms to comply with the UK and EU’s new online safety rules. The comments reflect increasing regulatory alignment across jurisdictions.

Source

Visa Shuts US Open-Banking Unit Amid Data Disputes

Visa has reportedly closed its U.S. open-banking division as tensions mount over consumer financial data access. The move highlights the intensifying battle between banks, fintechs, and regulators over data rights.

Source

📌 Other

OpenAI Warns Against Unauthorized Investment SPVs

OpenAI has cautioned investors against participating in special purpose vehicles (SPVs) and other unauthorized schemes claiming affiliation with the company. The warning follows rising demand for exposure to AI startups.

Source

Verisk Launches New Insurance Fraud Tools

Verisk has rolled out enhanced ClaimSearch tools designed to detect fraudulent digital commerce activities and hidden assets. The upgrade strengthens insurers’ ability to combat complex fraud cases.

Source

CIDC Invests $13.9M in NVT

Hong Kong-based leather manufacturer CIDC has invested $13.9M into NVT, diversifying into technology-driven ventures. The deal signals growing cross-industry interest in tech investments.

Source

Pudgy Penguins Eyes IPO Within 2 Years

Luca Netz, CEO of Pudgy Penguins, said he would be “disappointed” if the NFT brand doesn’t go public within two years. The remark underscores ongoing efforts to bridge Web3 brands with mainstream finance.

Source

GoFibre Nets £125M for Rural Scotland Rollout

GoFibre has secured £125 million to accelerate its rural broadband rollout across Scotland. The announcement came alongside the news of N26 CEO Valentin Stalf stepping down and Doncaster’s emergence as a UK AI hub.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a "Source: [Name]" attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.