JPMorgan Retires Nutmeg Brand in Wealth Rebrand Strategy

JPMorgan is phasing out the Nutmeg brand, integrating the UK digital wealth manager fully under the Chase umbrella. The move marks the end of Nutmeg’s independent identity since its acquisition in 2021 and signals JPMorgan’s intent to streamline branding across its UK digital banking and wealth offerings. The rebrand is part of a broader strategy to unify customer experience and strengthen Chase’s competitive positioning in the UK market. By retiring Nutmeg, JPMorgan aims to consolidate customer trust under one globally recognized name. Analysts suggest this could simplify product offerings while boosting Chase’s visibility. The change reflects a trend of global banks absorbing fintech brands into their core identity once market presence is secured.

Insight of the Day

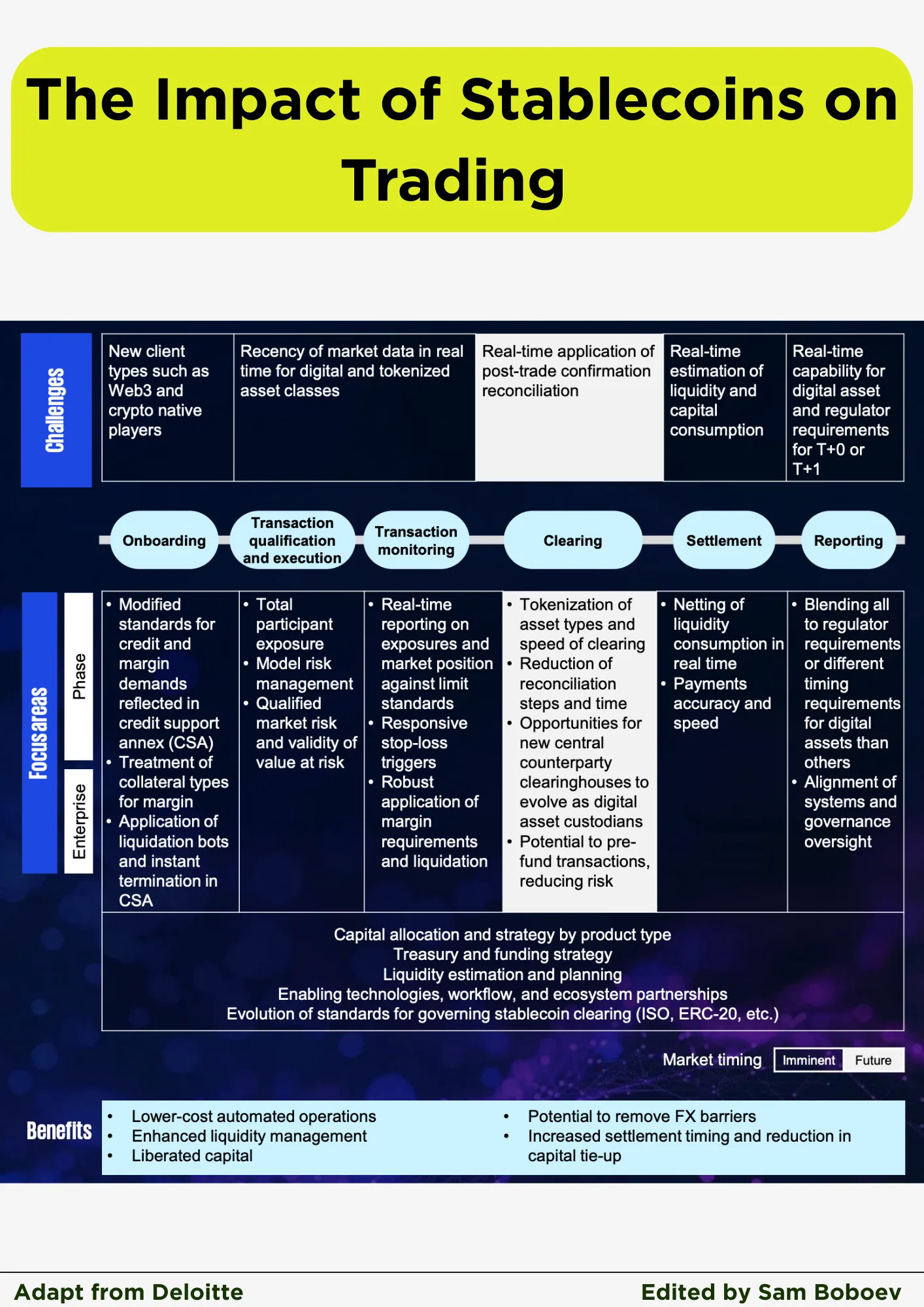

The Impact of Stablecoins on Trading

Stablecoins are increasingly being recognized not just as a payments tool, but as a fundamental innovation capable of transforming capital markets. With the potential for real-time settlement, tokenized assets, and blockchain-based reconciliation, stablecoins could accelerate the migration from traditional settlement cycles like T+2 to T+1—or even to true real-time settlement. This shift would have far-reaching implications across the entire trading lifecycle.

At the heart of the change is the ability to move value as fast as information. Traditionally, post-trade processes involve multiple intermediaries, reconciliations, and delays. Stablecoins collapse much of this friction, allowing instant confirmation, liquidity estimation, and capital allocation. This means firms can not only trade faster but also free up tied capital, reduce operational risk, and improve liquidity planning.

👉 Key Challenges and Opportunities

The adoption of stablecoins introduces new client types, such as Web3-native firms and crypto players, who expect instant execution and real-time market data. Regulators are also pressing for accelerated timelines, pushing firms toward T+1 reporting requirements. The challenge is to integrate these new capabilities without disrupting risk management or compliance standards.

Across the trading lifecycle, stablecoins touch every phase:

🔹 Onboarding & Execution - Firms will need modified credit and margin standards, updated treatment of collateral types, and automation through bots for liquidation and contract support.

🔹 Transaction Monitoring - Real-time reporting of exposures, robust application of margin requirements, and automated stop-loss triggers will become the norm.

🔹 Clearing - Tokenization of asset types can reduce reconciliation steps and create opportunities for clearinghouses to act as digital custodians.

🔹 Settlement - Stablecoins enable real-time netting of liquidity, more accurate payments, and the potential to pre-fund transactions, reducing counterparty risk.

🔹 Reporting - Regulatory frameworks will require harmonization, with systems aligned to handle digital assets and traditional securities under different timing requirements.

Curated News

💳 Payments

Mastercard Expands Into Commerce Media

Mastercard launched a new network to capture a bigger share of commerce media dollars, leveraging transaction data to drive more targeted advertising opportunities. This expansion positions Mastercard beyond payments, tapping into a fast-growing digital ad market.

Source

Viamericas Raises $113.6M for Remittance Growth

U.S.-based Viamericas secured $113.6M to expand its global remittance operations, reflecting continued demand for cross-border payments innovation. The funding will help scale infrastructure and reach underserved markets.

Source

Google Play Adds Branded Payments Channel

Google Play has introduced a new branded payments channel, enabling businesses to engage users more directly with custom payment options. This move strengthens Google’s footprint in embedded finance.

Source

Mesta Secures $5.5M to Redefine Cross-Border Payments

Fintech startup Mesta raised $5.5M in seed funding to modernize cross-border payments. The company aims to cut costs and improve transaction speed with new infrastructure.

Source

LSEG & AWS Launch World-Check Verify

The London Stock Exchange Group introduced World-Check Verify, powered by AWS, to streamline instant, embedded compliance and payment screening. The solution is designed to improve frictionless onboarding while strengthening security.

Source

Nexi and RBNZ Modernize RTGS System

Nexi and the Reserve Bank of New Zealand successfully upgraded the country’s real-time gross settlement system to align with SWIFT standards. This strengthens payment efficiency and global interoperability.

Source

PhotonPay Partners with Thredd on Card Products

PhotonPay teamed up with Thredd to enhance its card capabilities, supporting more robust product features for global businesses. The partnership aims to increase flexibility for digital-first companies.

Source

Visa Pilots Pre-Funded Stablecoins for Cross-Border Payments

Visa is testing the use of pre-funded stablecoins to improve the efficiency of international transactions. The pilot highlights the growing role of blockchain in traditional payment networks.

Source

🏦 Banking

BBVA and Kyndryl Form Joint Ventures in Spain and Mexico

BBVA renewed its service agreement with Kyndryl and launched new joint ventures to accelerate digital transformation in Spain and Mexico. The collaboration will boost cloud, AI, and cybersecurity capabilities.

Source

BBVA Introduces AI-Powered Card Personalization

BBVA became the first bank to enable Apple Intelligence-powered card personalization directly through its app. Customers can now customize card designs instantly, reflecting the growing trend of hyper-personalized banking.

Source

Nubank Applies for U.S. National Bank Charter

Nubank has filed for a U.S. national bank charter, signaling its ambition to expand deeper into the American market. The move would allow Nubank to broaden its product suite under direct U.S. regulation.

Source

🪙 Crypto

Ignyte and Binance Partner on Blockchain Innovation

Ignyte and Binance announced a strategic alliance to accelerate blockchain adoption across industries. The partnership will focus on driving enterprise use cases and scaling Web3 solutions.

Source

Chainlink & Swift Team Up for Onchain Fund Transfers

Chainlink integrated with Swift to allow funds to process transactions onchain. This milestone brings traditional finance closer to blockchain interoperability at scale.

Source

Brex to Accept Stablecoins as Payment

Brex will soon allow businesses to make payments using stablecoins, reflecting growing corporate adoption of digital currencies. The move could lower costs for global companies.

Source

📊 Fintech

BVNK Surpasses $20B in Revenue

BVNK, a digital payments and banking platform, announced revenues exceeding $20 billion. This milestone underscores rapid growth and rising demand for digital-first financial services.

Source

Revolut Tops UK Fraud Complaint List Again

Revolut remains the most complained-about UK firm for fraud cases, according to consumer group Which?. The finding raises concerns over the fintech’s fraud prevention measures.

Source

Love Finance Secures £45M for SME Lending

UK-based Love Finance raised £45 million in debt financing to expand SME lending. The capital will help boost access to funding for small businesses.

Source

Indonesian Fintech Honest Raises $100M Equity

Honest, an Indonesian fintech startup, increased its total equity funding to $100M. The funding will be used to scale its lending and financial services across Southeast Asia.

Source

⚖️ Regulation

Interpolitan Secures UAE Licenses for Expansion

Interpolitan Money obtained DFSA Category 3C and 4C licenses to expand its operations in the UAE. The move supports its global growth strategy while meeting local compliance standards.

Source

UK Prepares National Digital ID ‘Brit Card’

The UK government is preparing a compulsory digital ID card, dubbed the “Brit Card,” for all adults. Officials say it will support immigration control and identity verification, but it raises privacy concerns.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.