JPMorgan Spends $2B a Year on AI, Saves the Same Amount — Dimon

JPMorgan CEO Jamie Dimon revealed the bank invests approximately $2 billion annually in artificial intelligence, achieving equivalent savings through automation and efficiency gains. The firm’s AI initiatives span fraud detection, customer service, and portfolio management, underlining how large financial institutions are scaling AI to drive measurable ROI. Dimon emphasized that AI adoption is now core to JPMorgan’s competitive strategy, not an experimental add-on. The move highlights how traditional banks are positioning themselves as technology leaders to stay ahead of fintech disruption. Analysts view this as a blueprint for AI-driven cost transformation across global finance.

Insight of the Day

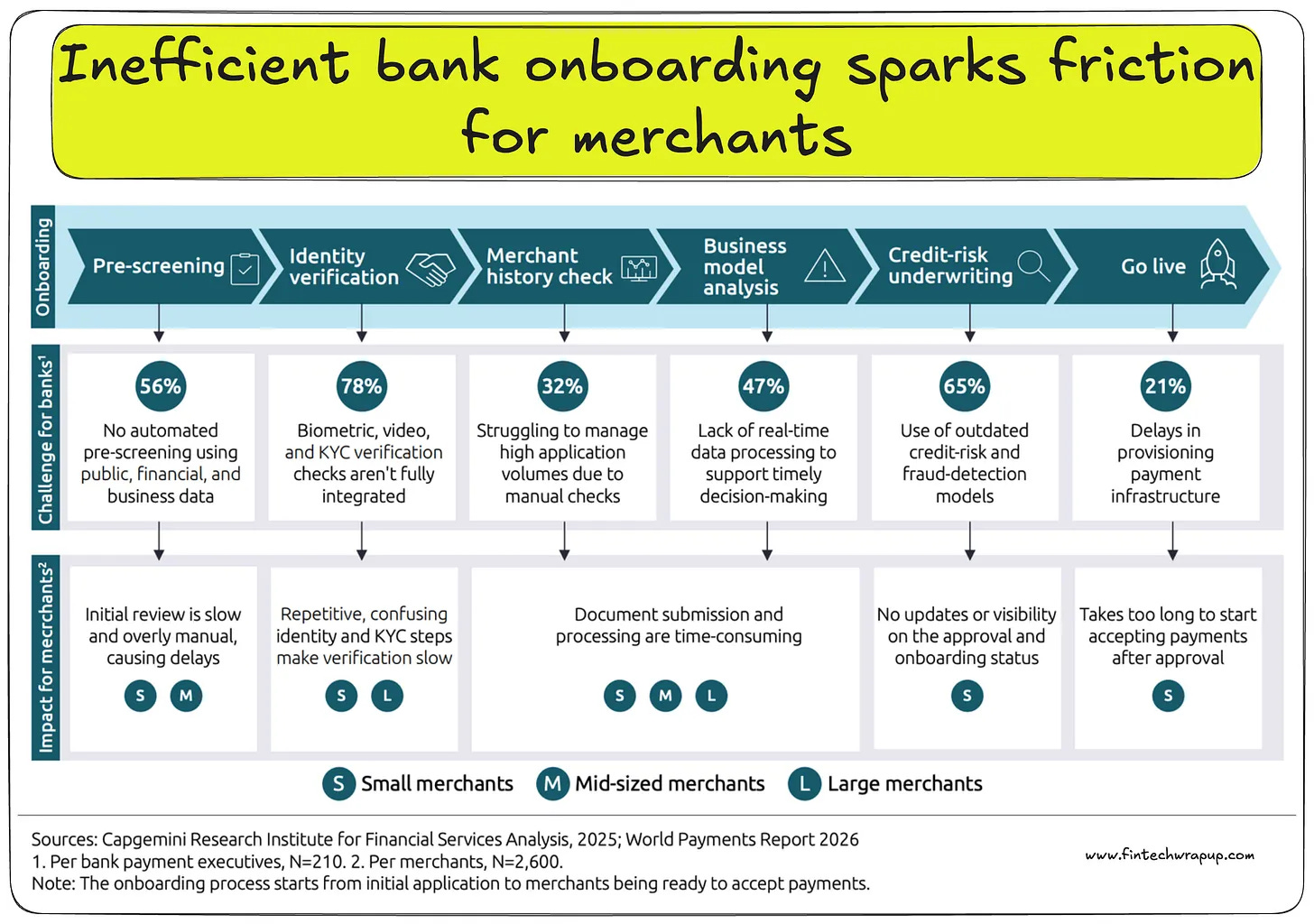

Inefficient bank onboarding sparks friction for merchants

Onboarding is the initial interaction between a merchant and their merchant servicing partner. It establishes the tone for the relationship and often influences whether the merchant will stay or leave. But banks struggle to make this first impression count. As the figure shows, the process is riddled with inefficiencies at every step, creating friction and frustration for merchants, especially those that are small or mid-sized.

🔹 Pre-screening is where the onboarding process begins, where many banks still depend on manual or semi-automated methods. Without intelligent filters, applications pile up, and merchants face long wait times before their profiles are even reviewed.

🔹 Identity verification is the next hurdle. Despite the availability of biometric, video, and digital KYC tools, most banks haven’t fully integrated these technologies into their workflows. The result is a disjointed experience, where merchants must submit documents multiple times, deal with inconsistent verification standards, and face lengthy back-and-forth communication.

🔹 Merchant history checks and business model analysis expose additional rigidity. With banks lacking real-time data processing, their processes are slow and error prone. Merchants in newer or less traditional formats, such as social commerce sellers, subscription platforms, influencerled storefronts, and hyperlocal delivery services, often face delays or are left uncertain – not because of their viability, but due to system limitations.

🔹 Credit-risk underwriting, which should ideally be dynamic and data-driven, remains slow and conservative. Without adaptive scoring mechanisms, even creditworthy merchants are subjected to lengthy approval cycles. This is especially problematic for small merchants that often operate with limited financial history or informal credit footprints, making them more vulnerable to delays and rejections under rigid evaluation models.

🔹 Go-live for some merchants may still be elusive, even after clearing all hurdles. Delays in provisioning payment infrastructure – often due to internal coordination issues – mean that merchants, despite being approved, can’t start accepting payments immediately. For small and mid-sized merchants, these delays translate directly into lost revenue and a weakened perception of the bank’s reliability

Curated News

💳 Payments

Revolut Expands to India, Targets 20 Million Users by 2030

Revolut is launching a payments platform in India, aiming to reach 20 million users within five years. The expansion signals the company’s broader push into emerging markets as digital payments surge across Asia.

Source

Tillo and Honeyfund Launch Fee-Free Wedding Gift Mastercard

Gift card network Tillo and honeymoon funding platform Honeyfund have partnered to offer a prepaid Mastercard for flexible, fee-free wedding gift redemption. The product simplifies the gifting process and enhances user control over how funds are spent.

Source

Alipay+ Expands Ecosystem to Boost Inclusive Growth Through Mobile Wallets

Alipay+ is broadening its payment ecosystem to support new travel and spending patterns driven by mobile wallets. The initiative aims to make cross-border payments more accessible while promoting financial inclusion globally.

Source

GoCardless Goes Green and Hits Profitability for the First Time

UK payments firm GoCardless announced it has reached profitability while advancing its sustainability goals. The milestone underscores how scaling payment firms are balancing growth with environmental responsibility.

Source

🏦 Banking

East West Bank to Offer Worldpay Solutions to Commercial Clients

East West Bank has partnered with Worldpay to provide advanced payment and merchant solutions for its business customers. The collaboration enhances digital banking capabilities and expands options for commercial clients.

Source

NatWest Invests in JS Group to Improve Student Financial Support

NatWest has made a strategic investment in JS Group to improve the delivery and impact of student financial support programs. The partnership reflects growing interest in social-focused banking initiatives.

Source

💸 Fintech

Snowflake Launches Cortex AI Suite for Financial Services

Snowflake unveiled Cortex AI, a suite tailored for financial institutions to harness generative AI for data analytics, risk modeling, and customer insights. The launch strengthens Snowflake’s positioning as a fintech enabler.

Source

Dubai Fintech Optasia Targets $375M in South Africa IPO

Optasia, a Dubai-based fintech specializing in alternative credit and mobile finance, plans a $375 million IPO in South Africa. The move highlights growing investor appetite for African fintech innovation.

Source

RelyComply Launches AI-Powered AML Platform in the UK

RelyComply debuted its AI-driven anti-money laundering platform to help UK financial institutions automate compliance and risk detection. The launch underscores AI’s expanding role in regulatory technology.

Source

Eventus Introduces Frank AI for Compliance and Surveillance Analytics

Eventus launched Frank AI, a compliance-focused analytics platform leveraging AI to enhance market surveillance and fraud detection. The tool is designed for financial institutions seeking more efficient oversight.

Source

🪙 Crypto

Coinflow Raises $25M to Scale Stablecoin Payments

Coinflow secured $25 million in funding from Pantera and Coinbase to expand its stablecoin payments infrastructure. The funding will accelerate the firm’s efforts to bridge crypto and traditional payments.

Source

U.S. Bank to Custody Anchorage Digital’s Stablecoin Reserves

U.S. Bank will provide custody for Anchorage Digital’s payment stablecoin reserves, marking a major partnership between traditional and crypto-native institutions. The move bolsters trust in stablecoin-backed assets.

Source

FCA Lifts ETN Ban but UK Retail Investors Still Wait

The UK’s Financial Conduct Authority has lifted its ban on exchange-traded notes (ETNs) linked to crypto assets, but retail investors remain excluded. The decision reflects a cautious approach to consumer protection.

Source

MoonPay and Axiom Partner to Simplify DeFi Trading

MoonPay has teamed up with Axiom to enable instant crypto purchases and seamless DeFi access. The collaboration aims to make decentralized finance more user-friendly for mainstream adoption.

Source

Jiko Secures Funding from Coinbase and Blockstream

Jiko has received investment from Coinbase and Blockstream Capital to expand its blockchain-based financial infrastructure. The backing reinforces investor confidence in regulated crypto-banking hybrids.

Source

Trump Memecoin Issuer Plans $200M Token Treasury Raise

The issuer of the Trump-themed memecoin announced plans to raise $200 million to establish a token treasury. The move spotlights the growing financialization of political and pop-culture crypto projects.

Source

The Financially Excluded Pay More to Buy Stablecoins

A recent report reveals that marginalized users face higher fees when purchasing stablecoins, exacerbating inequality in digital finance. The findings raise concerns about accessibility in the global crypto economy.

Source

💼 WealthTech

FE Fundinfo Launches Nexus AI to Empower Investors

FE Fundinfo unveiled Nexus AI, a new platform that uses generative AI to enhance investment insights and portfolio personalization. The tool is designed to help investors make more data-driven decisions.

Source

Nasdaq eVestment Introduces AI Data Infrastructure for Asset Managers

Nasdaq’s eVestment launched an AI-ready data framework to support agentic workflows for institutional investors. The platform aims to modernize asset management through automation and intelligent analytics.

Source

📜 Regulation

Bank of England Warns of Rising AI Bubble Risk

The Bank of England cautioned that an “AI bubble” could soon burst as market valuations for AI-driven firms soar. Regulators are urging financial institutions to balance innovation with risk management.

Source

Two-Thirds of Bank Staff Use Unapproved AI Tools, Survey Finds

A new survey shows that 66% of banking employees use unapproved AI tools, raising security and compliance concerns. The findings highlight the growing challenge of shadow AI in regulated sectors.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.