JPMorgan to Allow Crypto as Collateral

JPMorgan is preparing to accept cryptocurrencies as collateral for financing arrangements, marking a major step in traditional finance adopting digital assets. The move reflects increasing institutional confidence in tokenized value and blockchain-based risk management. For corporate and institutional clients, this unlocks new liquidity strategies while expanding the types of assets considered within prime brokerage. It places JPMorgan in a leadership position as banks race to adapt to crypto infrastructure. Regulatory clarity will be crucial as the bank scales the service. If successful, it could reshape collateral markets and accelerate Wall Street’s crypto integration. Other major banks are likely to follow.

Video of the Day

Insight of the Day

How Stablecoin Issuers Can Manage Treasury Operations Across Chains

Here’s a breakdown of what stablecoin treasury teams can learn from traditional finance — and what’s entirely new in the multichain world.

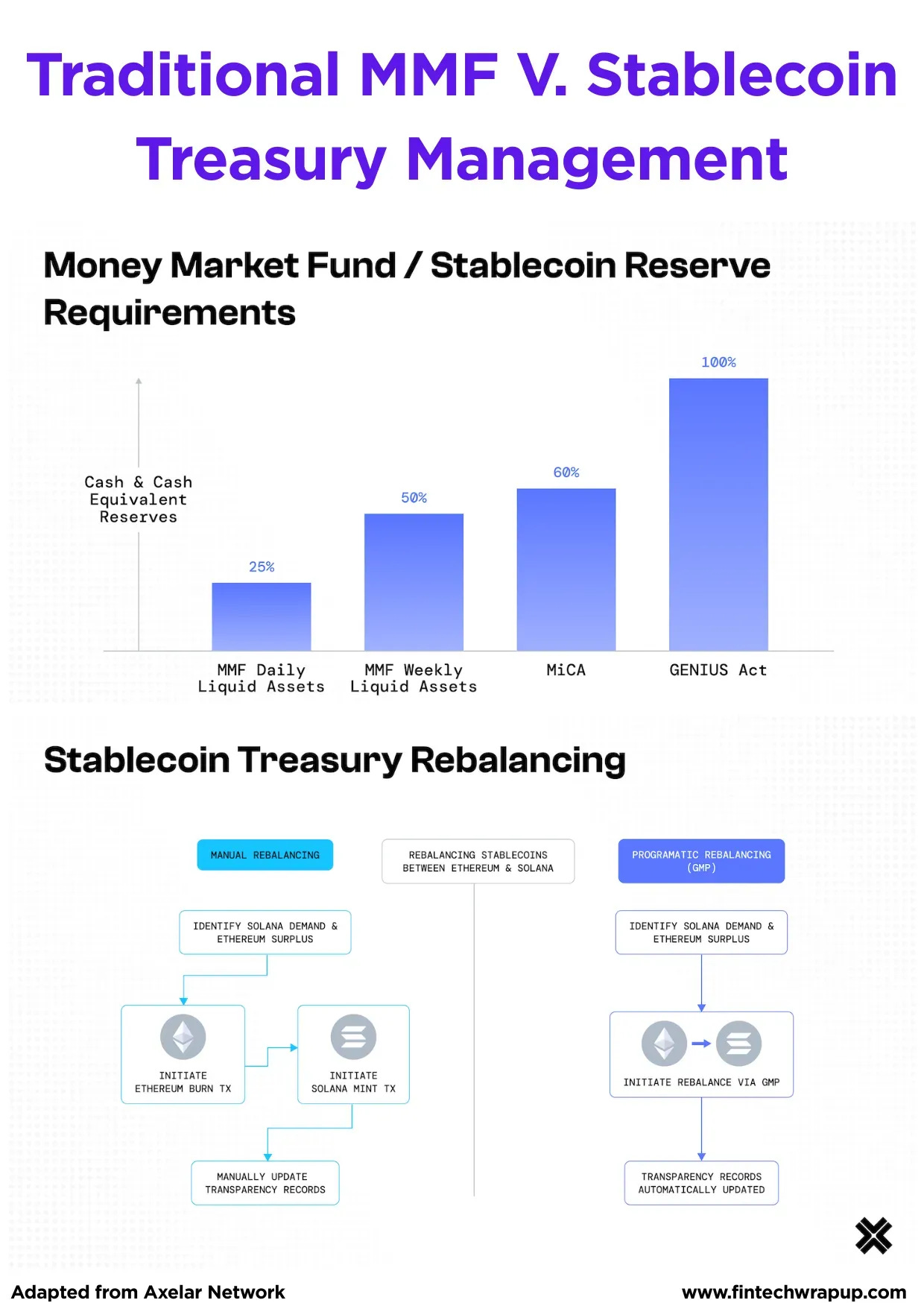

1. Understand How Treasury Management Differs from Money Market Funds

Money market funds (MMFs) aim for a stable $1.00 share price by investing in short-dated, high-quality assets. When their Net Asset Value (NAV) dips below $1, they “break the buck.”

Stablecoins face a parallel problem: losing the peg.

While MMFs are centralized and single-pool, stablecoins distribute liquidity across several blockchains. Each chain acts like a separate market, and managing this fragmentation is a core treasury function. Issuers typically hold reserves offchain in T-bills or bank deposits but must rebalance onchain liquidity to meet real-time demand.

2. Build an Active Rebalancing Framework

In traditional finance, rebalancing happens across accounts; in crypto, it happens across blockchains.

When one network (say, Ethereum) is short on liquidity and another (say, Solana) has excess, the issuer must burn tokens on the source chain and mint them on the destination — maintaining overall supply while redistributing liquidity.

This “burn-and-mint” model requires precision and transparency. Manual execution across chains is slow and error-prone, often involving multiple operational checks and updates to attestation records.

Curated News

💳 Payments

Zelle Explores Stablecoins for Cross-Border Transfers

Zelle’s parent company is evaluating the use of stablecoins to enable international transfers — a significant expansion beyond its U.S.-only network. This could transform Zelle into a serious competitor in the global payments ecosystem and reduce cross-border friction.

Source

Juspay Brings Mastercard Click to Pay to Brazil

Juspay has launched plug-and-play Click to Pay support, enabling Brazilian merchants to adopt secure, one-click checkout more easily. The move aims to improve conversion and reduce checkout abandonment in a fast-growing eCommerce market.

Source

U.S. Bank Avvance Launches Embedded Financing Portal

A new developer portal allows merchants and fintechs to integrate lending options directly into online shopping experiences. This will help sellers provide better purchasing flexibility and increase customer purchasing power.

Source

Clerq Raises $21M to Modernize High-Ticket Payments

Clerq is reinventing large-value payments using bank-to-bank settlement to cut card fees and speed up funds movement. The funding will accelerate product development as merchants seek more cost-efficient alternatives.

Source

Zip Expands Stripe Partnership in the U.S.

The expanded integration allows more merchants on Stripe to seamlessly offer BNPL at checkout. This partnership strengthens Zip’s reach while helping retailers boost conversions and order values.

Source

Finix Adds Interac Support in Canada

Finix now supports Interac payments, a staple of Canadian transactions. This gives merchants a more localized payment experience and supports Finix’s expansion across North America.

Source

Thunes Supports Colombia’s Instant Payment System

Thunes is contributing to Colombia’s new national real-time payments network by enabling wider interoperability. The initiative aims to improve financial access and speed up money movement across the country.

Source

Affirm & Worldpay Expand Global BNPL Access

More merchants using Worldpay can now activate Affirm’s installment products, giving shoppers greater affordability options. This expands both companies’ reach into international markets.

Source

Ant International & Krungthai Boost Cross-Border Payments

The partnership enhances cross-border transactions across Southeast Asia, benefiting travelers and expanding regional digital commerce. It also strengthens the digital wallet acceptance footprint in key markets.

Source

Proof + Visa Strengthen Digital Transaction Security

Proof’s technology will enhance fraud prevention and security across Visa’s digital payment ecosystem. This collaboration aims to streamline customer verification while reducing risk.

Source

🏦 Banking

Treasury Prime Joins U.S. Bank Embedded Finance Network

This partnership expands Banking-as-a-Service capabilities to more fintechs, enabling faster deployment of accounts, cards, and payments. It gives developers greater flexibility to innovate inside banking experiences.

Source

Pave Bank Raises $39M for Programmable Banking

Pave Bank is building a platform designed for digital-asset-friendly financial services. The investment will support product development and regulatory scale-up as demand grows for more programmable money infrastructure.

Source

🪙 Crypto

Fireblocks Acquires Dynamic to Expand Wallet Tech

Fireblocks is strengthening its enterprise wallet infrastructure by acquiring Dynamic, a specialist in developer-focused tools. The deal enhances the ability to support secure and scalable web3 applications.

Source

📈 WealthTech

Prospero.ai + Finimize Partner to Empower Retail Investors

The collaboration brings Prospero.ai’s predictive analytics to the Finimize community of millions. It reinforces the rise of AI-assisted investing for everyday users seeking better insights.

Source

🏛 Regulation / Policy

UK Sets Plan to ‘Supercharge’ Fintech Growth

The UK government is rolling out new measures to help innovative financial firms scale faster and attract more investment. It’s part of a wider push to reinforce Britain’s reputation as a global fintech hub.

Source

Ondato Launches AML Automation Platform

Ondato’s AML Ranger introduces real-time monitoring and screening to reduce compliance workload and improve risk detection. Financial institutions can process checks faster while maintaining robust oversight.

Source

💡 Fintech / Technology

EBAday 2026 Opens Fintech Zone Applications

The program gives emerging fintechs access to major financial institutions and decision-makers at Europe’s premier industry event. It supports companies seeking visibility and partnerships at scale.

Source

IBM + Groq Accelerate Enterprise AI Rollouts

IBM and Groq are teaming to deliver faster and more scalable AI performance for large organizations. The collaboration could benefit financial firms deploying high-throughput AI use cases.

Source

Majesco Launches On-Demand MGA Model Office

Majesco introduced a production-ready platform for insurance MGAs, helping them modernize operations without lengthy deployments. It aims to improve speed-to-market and operational efficiency across underwriting workflows.

Source

PayNearMe Adds AI Virtual Agent to Bill Pay

The AI agent automates customer support and payment assistance for billers, improving customer experience and reducing call center burden. The upgrade strengthens PayNearMe’s position in intelligent payments technology.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.