Klarna and Google Ink AI Deal

Klarna has partnered with Google to integrate its AI capabilities across shopping and payments, marking a significant collaboration between fintech and Big Tech. The deal enables Klarna to use Google’s Gemini Enterprise AI to enhance personalized recommendations and streamline customer interactions. Google will also leverage Klarna’s transaction insights to refine its commerce tools. This partnership highlights how AI is rapidly becoming central to consumer finance and retail ecosystems. It signals a growing convergence of search, payments, and intelligent automation in the fintech space.

Insight of the Day

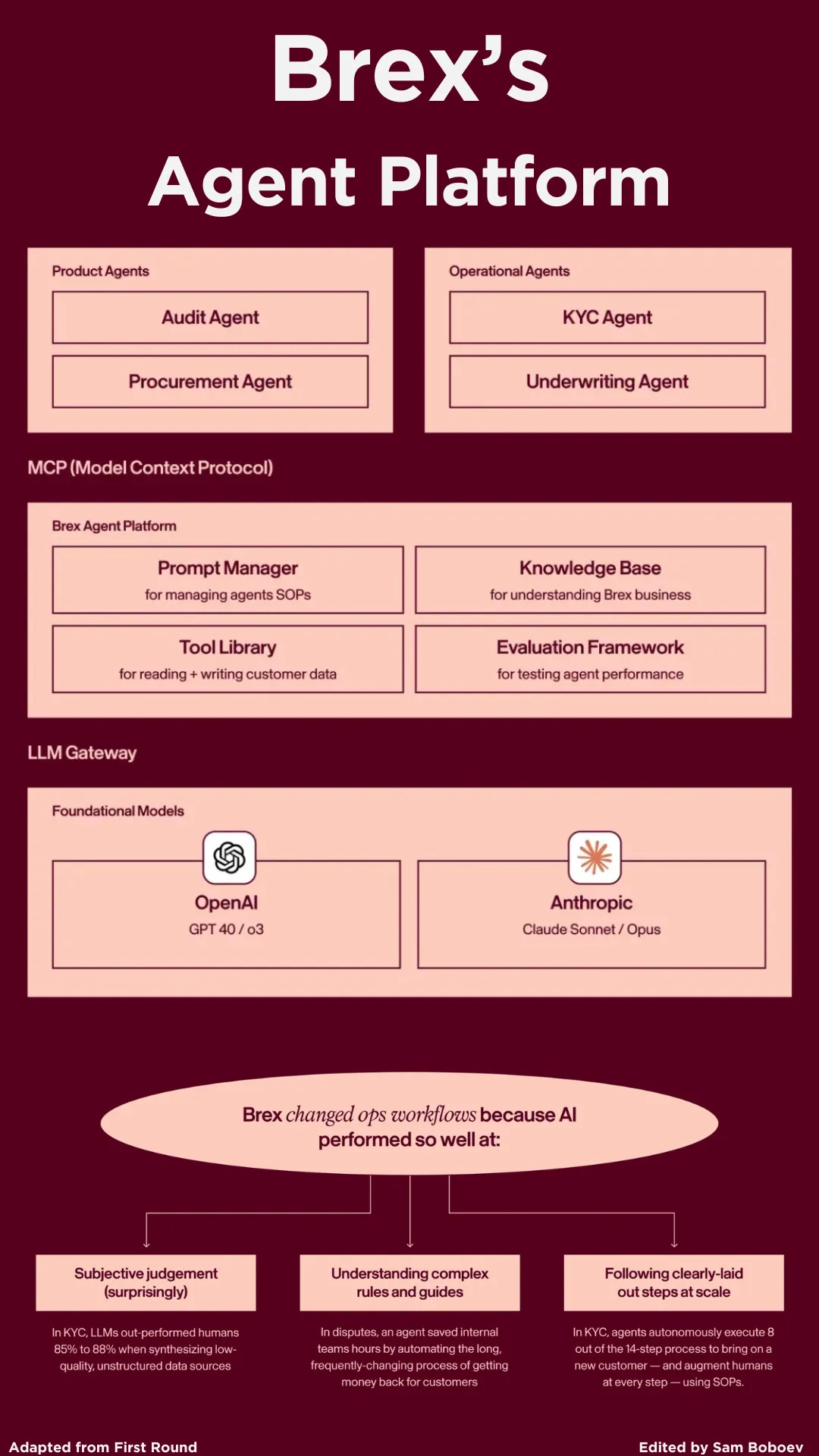

Brex’s AI Playbook: Key Insights for Building AI-Native Companies

Brex isn’t just adding AI features. It’s redesigning itself to be AI-native — from product to operations to hiring. Here are the biggest takeaways from how Brex is doing it.

1. Treat internal operations like products.

Brex built an internal “agent platform” — essentially an AI sandbox where employees can test, refine, and deploy agents safely. By treating this with the same rigor as customer-facing features, Brex eliminated legal bottlenecks, streamlined procurement, and created a feedback loop: improvements in internal tools fuel product innovation, and vice versa.

2. Redesign roles around managing agents, not tasks.

In the old model, operations relied on specialists — credit analysts, KYC experts, payments managers. With AI, repetitive processes map neatly onto agents. That means fewer specialists and more generalists who can oversee agents, review prompts, and optimize workflows. Performance reviews now look like prompt reviews.

3. Focus on partial automation, not perfection.

Brex doesn’t chase 100% automation. Instead, it targets high-confidence wins: automating 8–10 steps of a 14-step KYC flow, or letting AI handle straightforward fraud checks while humans review edge cases. This incremental approach delivers immediate value and compounds over time.

4. Use AI where it clearly outperforms humans.

AI shines in structured, high-volume processes — but also in surprising areas requiring judgment. For instance, AI beat humans at adverse media checks in KYC (85% vs 88% accuracy) and generated more effective delinquency emails than staff, improving recovery rates.

Curated News

💳 Payments

G20 to Miss 2027 Cross-Border Payments Deadline

The G20’s ambitious plan to make cross-border payments faster and cheaper is expected to fall behind schedule, raising concerns over coordination among regulators and industry stakeholders. The delay underscores ongoing infrastructure and compliance challenges in global payments reform.

Source

Wise Launches India’s First Travel Card

Wise has introduced India’s first travel card, targeting the country’s fast-growing outbound travel market. The card offers competitive forex rates and aims to challenge traditional banks and fintechs in the foreign exchange segment.

Source

PayCaptain and ClearBank Partner on Real-Time Payroll Payments

UK-based PayCaptain has teamed up with ClearBank to deliver instant payroll transfers and embedded savings tools. The integration enhances payroll efficiency while promoting employee financial wellbeing.

Source

Single-Paycheck Panic: Gen Z Turns to “Income Stacking”

A new survey finds that 67% of Gen Z workers rely on multiple income streams to feel financially secure. The trend highlights the growing role of digital payment and gig platforms in shaping modern financial behavior.

Source

🏦 Banking

Navri Simplifies Digital Bank Launches

Navri unveiled a new platform designed to make launching a digital bank as easy as building a website. The solution offers end-to-end infrastructure, lowering entry barriers for startups and financial institutions entering digital banking.

Source

Lumin Digital Partners with Ent Credit Union

Lumin Digital has been selected by Ent Credit Union to enhance its members’ digital banking experience. The collaboration focuses on improving personalization, security, and speed in member engagement.

Source

Prometeo Unveils Agentic Banking Platform

Latin American fintech Prometeo has launched an AI-driven “Agentic Banking” system that allows autonomous financial infrastructure. The innovation promises smarter, self-operating processes across compliance, lending, and payments.

Source

💰 Fintech

Zilch Eyes Hot IPO Market Amid Product Expansion

UK buy-now-pay-later startup Zilch plans to go public as it rolls out new products. The move positions Zilch among the next wave of fintechs seeking to capitalize on renewed investor interest.

Source

Austin’s Routefusion Raises $26.5M

Austin-based fintech Routefusion secured $26.5 million to scale its cross-border payment platform. The funding underscores investor confidence in B2B payment infrastructure solutions amid global fintech growth.

Source

Happy Money Expands Hive Lending Platform

Happy Money announced enhancements to its proprietary Hive platform, enabling faster credit decisions and improved lender integrations. The updates aim to streamline lending partnerships and consumer credit accessibility.

Source

Creditspring Tops Industry in Customer Trust

Creditspring has outperformed peers in satisfaction and complaint metrics, reflecting growing consumer trust in subscription-based credit services. The recognition may strengthen its brand in the UK lending market.

Source

🪙 Crypto

Citi Backs Stablecoin Firm BVNK

Citigroup has invested in BVNK, a crypto payments and stablecoin infrastructure firm, as Wall Street’s interest in tokenized assets grows. The move indicates traditional finance’s deeper integration with blockchain-based settlement systems.

Source

Block Street Raises $11.5M for Tokenized Stocks

Trading startup Block Street raised $11.5 million to expand its platform for tokenized equity trading. The funding supports its mission to make digital securities more accessible and compliant with global standards.

Source

📊 WealthTech

Carta Acquires Private Credit Administrator Sirvatus

Carta has acquired Sirvatus to enter the private credit administration market. The acquisition diversifies Carta’s product offering and strengthens its position in the alternative assets ecosystem.

Source

⚖️ Regulation

US Shutdown Could Spark Regional Bank Crisis, Warns Fintech CEO

A leading fintech executive warned that a prolonged U.S. government shutdown could destabilize regional banks due to liquidity strain and delayed funding flows. The warning underscores how macro-political risks increasingly affect fintech and banking sectors.

Source

SmartSearch Acquires Credas to Boost Compliance

SmartSearch has acquired digital verification firm Credas to expand its UK presence in regulatory tech. The deal aims to strengthen anti-money laundering (AML) and Know Your Customer (KYC) offerings.

Source

🧠 Other

Bank of England Warns of AI Market Risks

The Bank of England cautioned that inflated valuations in AI-related sectors could trigger market instability. Policymakers are assessing exposure across banks and fintech firms to prevent systemic shocks.

Source

Google to Verify EU Accounts from Lithuania

Google will begin offering account verification services for European clients via its new Lithuanian entity. The move strengthens compliance with EU financial and data regulations.

Source

HYPE and Cleafy Partner on Fraud Prevention

Italian neobank HYPE has partnered with cybersecurity firm Cleafy to integrate its FxDR platform for advanced fraud detection. The alliance aims to boost customer protection in digital banking.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.