Klarna Eyes $14 Billion IPO Amid Fintech Revival

Klarna is reportedly preparing to go public next month with a target valuation of up to $14 billion, according to sources. This move marks a major milestone for the Swedish buy-now-pay-later giant, which had seen its valuation slashed during the 2022 fintech downturn. An IPO at this scale would signal renewed investor confidence in the sector and could spark momentum for other fintech listings. Klarna’s growth has been driven by strong U.S. adoption and expansion into new markets. However, questions remain around profitability and competition in the BNPL space. If successful, Klarna’s listing could become one of the biggest European fintech IPOs in recent years and a bellwether for the market’s appetite for consumer finance disruptors.

Source

Insight of the Day

Understanding Value Creation in Financial Services

How do financial services create value?

Very interesting article by Mason Reeves

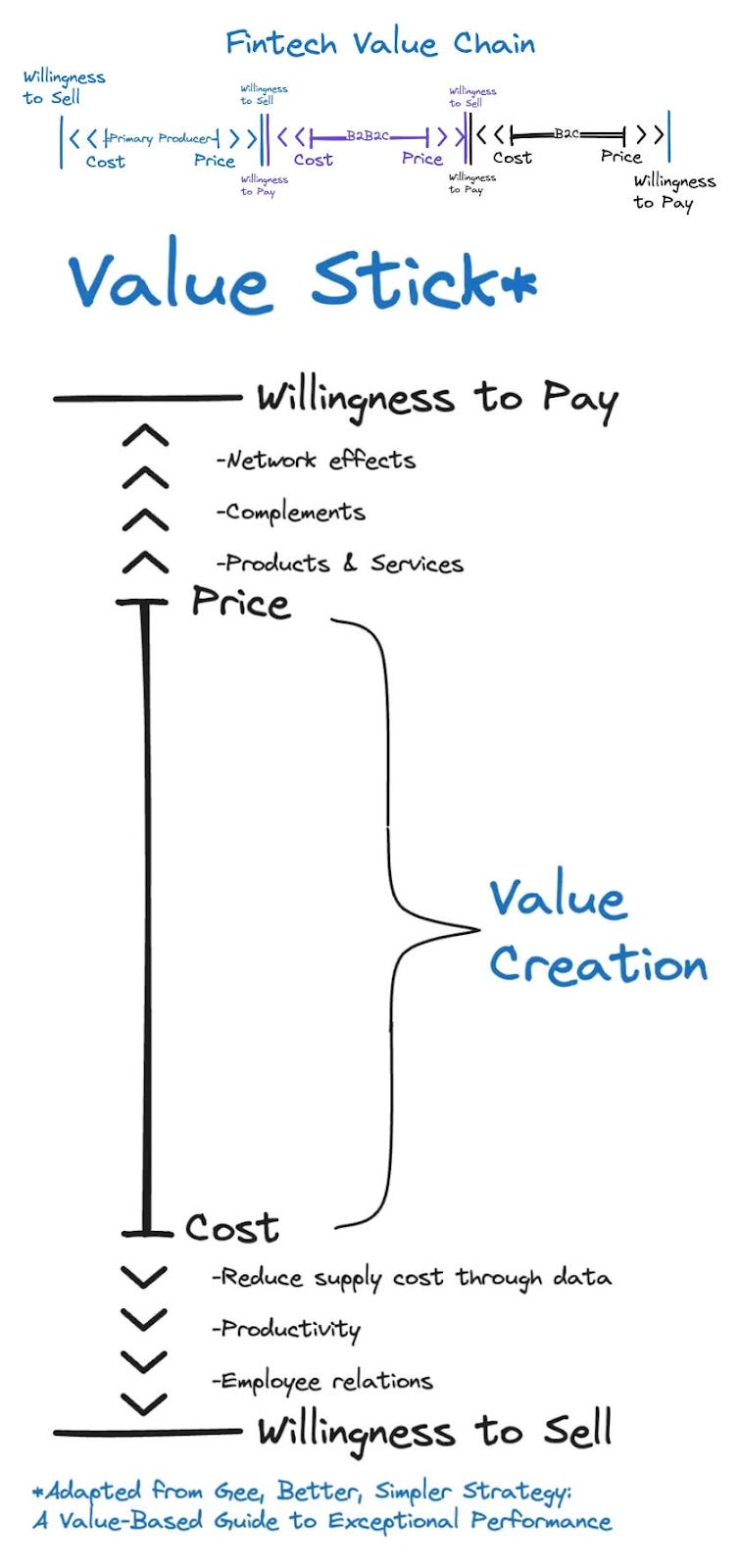

👉 The Value Stick Framework

At the top of the stick is the user’s willingness to pay (WTP) — the maximum amount they’re willing to spend on a product or service. At the bottom is the willingness to sell (WTS) of suppliers, employees, and investors — essentially, the costs of providing that service.

Value creation occurs in the space between these two points. Specifically, when you can:

🔹 Sell your product at a price that exceeds all of your costs

🔹 Increase users’ willingness to pay

🔹 Lower the price at which suppliers and employees are willing to sell to you

Curated News

💳 Payments

Authvia Integrates Visa Direct for Instant Text-to-Pay

Authvia has integrated Visa Direct into its TXT2PAY platform, enabling customers to make real-time payments via SMS. The move strengthens text-based payments as a fast, convenient alternative to traditional checkout.

Source

Rappi and AstroPay Launch Super-App Wallet in Latin America

Rappi has partnered with AstroPay to launch the region’s first integrated super-app wallet, combining e-commerce, delivery, and digital payments. The integration highlights Latin America’s rapid fintech adoption and growing appetite for all-in-one financial apps.

Source

Hungry Jack’s Partners with Adyen for Purpose-Driven Payments

Hungry Jack’s is teaming up with Adyen to embed charitable donations at checkout, allowing customers to support social causes while paying. This partnership shows how payments innovation can blend commerce with impact.

Source

PayQuicker Rolls Out Same-Day ACH Transfers

PayQuicker has launched a same-day ACH feature to speed up disbursements for its clients. This upgrade addresses growing demand for instant and flexible payment options.

Source

Payment Labs Secures $3.25M to Scale Payout Solutions

Payment Labs has raised $3.25 million in seed funding to expand its payout infrastructure for creators and businesses. The funding will support further development of its compliance-first payments network.

Source

Buylo Raises €640K for RFID Checkout Tech

Czech startup Buylo has raised €640,000 to scale its RFID-powered checkout system, aimed at making in-store retail faster and more automated. The company will use the funding to expand operations across Europe.

Source

🏦 Banking

Thread Bank Taps Finxact to Power Embedded Finance

Thread Bank has chosen Fiserv’s Finxact platform to deliver embedded banking services, positioning itself as a model for other community banks. The partnership will expand digital offerings and customer reach.

Source

ANZ Rolls Out ‘Digital Padlock’ to Combat Fraud

ANZ has launched a “Digital Padlock” feature to strengthen customer security against cybercrime. The tool allows customers to lock and unlock their banking profiles for enhanced protection.

Source

Zimperium Unveils Advanced Hook Banking Trojan Variant

Cybersecurity firm Zimperium has identified a new, highly sophisticated variant of the Hook banking trojan. The malware represents an elevated threat to mobile banking users worldwide.

Source

🪙 Crypto

Bitpanda Rejects UK Listing Over Liquidity Concerns

Crypto broker Bitpanda, backed by Peter Thiel, has reportedly turned down a potential UK listing citing low liquidity in London markets. The move highlights challenges for exchanges eyeing traditional market entry.

Source

Kindly MD Bets $5B on Bitcoin, Risks Altcoin Market

Investment firm Kindly’s managing director has announced a $5 billion allocation into Bitcoin, potentially shifting capital away from altcoins. Analysts warn this could reshape crypto investment flows.

Source

Gemini Expands Staking to Ether and Solana in the UK

Gemini has rolled out staking for Ether and Solana to all UK customers, broadening its crypto yield offerings. The move reflects growing competition among exchanges to attract staking users.

Source

Digital Euro Tests Ethereum and Solana Blockchains

EU officials are exploring a digital euro that could run on Ethereum or Solana, sparking debate over monetary sovereignty. Such a move could give Europe a cutting-edge CBDC but raises governance questions.

Source

📊 WealthTech

Carlyle to Acquire Intelliflo for $200M

Private equity giant Carlyle is set to acquire digital wealth platform Intelliflo for up to $200 million. The deal underlines continued investment interest in digital advice and wealth management tools.

Source

Wells Fargo Adds Alternatives to Unified Managed Accounts

Wells Fargo now offers alternative investments within its Unified Managed Accounts platform, expanding access to institutional-grade products for retail investors. The move reflects growing appetite for diversification.

Source

⚖️ Regulation

UK Regulator Flags Nearly 5,000 Fake Scam Reports in 2025

The UK’s Financial Conduct Authority (FCA) has warned of nearly 5,000 fake scam reports in the first half of 2025. The surge highlights growing challenges in consumer protection and fraud prevention.

Source

Amartha Secures Wallet License from Bank Indonesia

Indonesian fintech Amartha has obtained a digital wallet license from the country’s central bank. The approval strengthens its position in Southeast Asia’s fast-growing digital finance sector.

Source

🧩 Other

Martini.ai Introduces AI Autonomy Framework for Finance

Martini.ai has launched a six-level autonomy framework for financial institutions, designed to guide adoption of AI-driven decision-making. The framework could accelerate safe and structured AI integration in finance.

Source

Liberis and Elavon Team Up for Small Business Funding

Liberis has partnered with Elavon to offer faster funding solutions for small businesses in the U.S. The collaboration aims to improve access to capital for underserved entrepreneurs.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a "Source: [Name]" attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.