Klarna Launches Debit Card Across Europe

Klarna has rolled out its debit card in Europe, expanding its presence beyond BNPL into everyday payments. The move positions Klarna to compete more directly with banks and neobanks by embedding its services deeper into consumer spending habits. Customers can now use Klarna’s debit card for in-store and online purchases, enjoying seamless integration with the company’s app. This diversification strengthens Klarna’s revenue streams at a time of growing pressure on BNPL providers. Industry experts see it as a bold step to increase customer loyalty while boosting Klarna’s long-term profitability. The launch underscores a broader trend of fintechs moving toward mainstream financial services to secure their place in daily consumer finance.

Insight of the Day

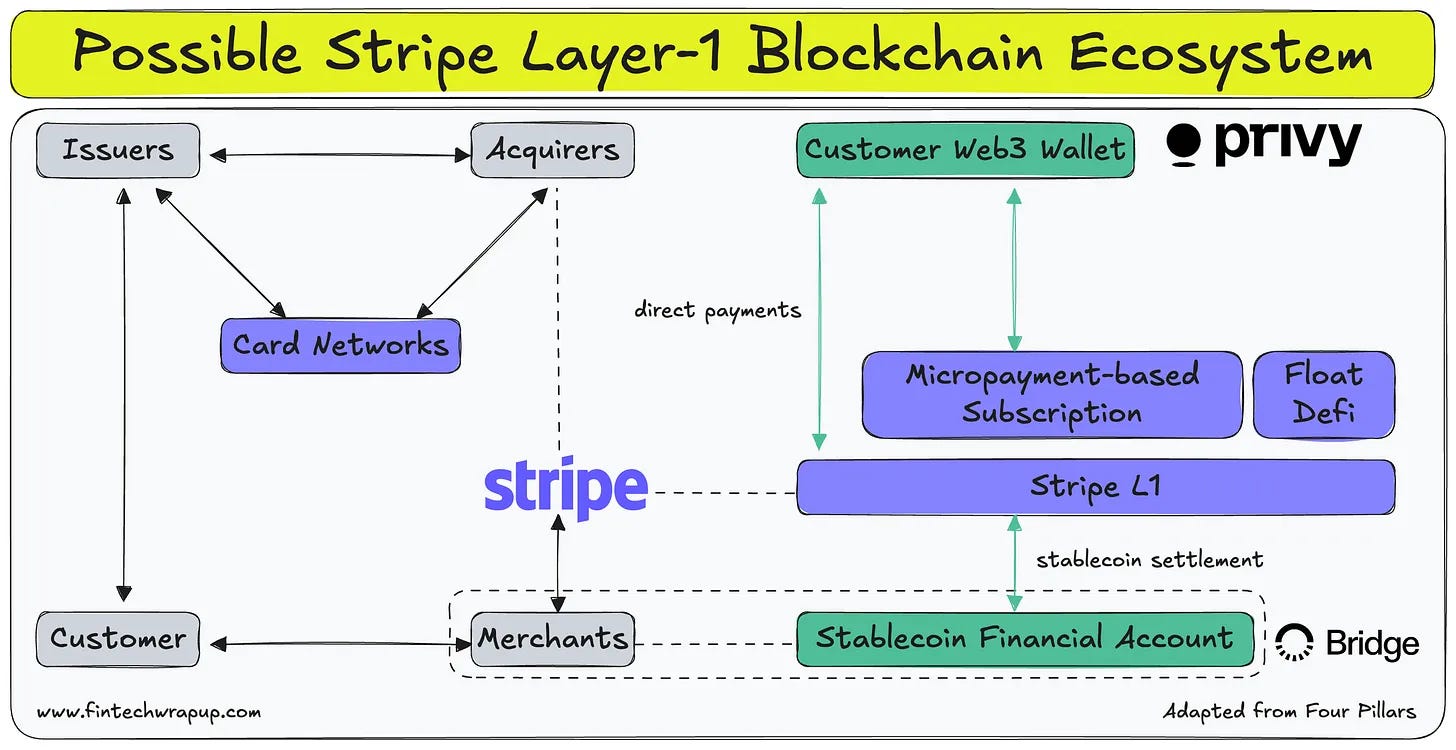

What Changes Could Stripe L1 Blockchain Bring?

If Stripe does launch an L1, how could it improve existing services, and what new ones might it enable?

👉 Base Case

🔹 Integration of Merchant Stablecoin Accounts with Stripe L1

Stripe offers stablecoin financial accounts to merchants in 101 countries, letting them hold USDC/USDB and move funds via ACH, SEPA, and multiple blockchains. If Stripe L1 launches, deposits and withdrawals could also flow through it, with merchants using balances for on-chain financial activities.

🔹 Stablecoin Settlement for Merchants

Stripe, as a PSP or acquirer, settles merchant proceeds. With Stripe L1, merchants may choose settlement in dollar-based stablecoins—a major benefit for those with high dollar demand but limited access.

🔹 Wallet Services for Customers

Stripe acquired Privy, a wallet infrastructure provider. While Stripe has focused on merchants, Stripe L1 could let individuals create wallets, use stablecoins for payments, and participate in financial activity within its ecosystem.

Curated News

💳 Payments

Visa and Ample Earth Team Up for Sustainable Spending

Visa has partnered with Ample Earth to enable consumers to align spending with sustainability goals. The partnership leverages data insights to help cardholders make more eco-conscious purchasing decisions.

Source

Edenred Powers Hnry’s UK Expansion

Edenred Payment Solutions is supporting Hnry’s entry into the UK market, offering solutions to empower sole traders with simplified tax and payments services. The partnership strengthens Edenred’s role in the growing freelance economy.

Source

MoonPay Adds Interac e-Transfer in Canada

MoonPay has expanded its payment options by integrating Interac e-Transfer, making it easier for Canadian users to buy and sell crypto. The update enhances accessibility in a key North American market.

Source

TrueLayer Expands to Poland with Instant Payouts

TrueLayer has entered Poland, rolling out instant payouts powered by open banking. This marks the company’s latest step in broadening its European presence.

Source

hunes and Ripple Strengthen Cross-Border Payments

Thunes has expanded its partnership with Ripple to accelerate cross-border payments for financial institutions worldwide. The move combines Thunes’ global network with Ripple’s blockchain-based solutions.

Source

🏦 Banking

Bank of England Renews RTGS with Accenture

The Bank of England has renewed its partnership with Accenture to modernize the UK’s Real-Time Gross Settlement (RTGS) system. The upgrade is expected to bolster resilience and efficiency in the nation’s payments infrastructure.

Source

Innovance Drives Cloud Banking Transformation in Germany

Innovance is leading the digital transformation of OYAK ANKER Bank GmbH, enabling a full migration to cloud-based operations. The shift is designed to enhance efficiency, scalability, and customer experience.

Source

Wise Eyes UK Banking Licence

Wise is considering applying for a UK banking licence to strengthen its global payment network and expand into more regulated financial services. This move could position Wise as a stronger challenger to traditional banks.

Source

Warba Bank Launches Youth Digital Banking Platform

Warba Bank has introduced “Wave Banking,” a youth-focused digital banking service offering a fully integrated experience. The initiative aims to capture younger demographics with tailored financial tools.

Source

💰 Fintech

Embedded Finance Powers Business Outcomes

A new report highlights how embedded finance is driving major brands to shift focus from technical adoption to customer-centric excellence. This trend underscores the growing strategic value of financial services integration.

Source

Aryza Acquires Bravure

Aryza has acquired Bravure, strengthening its portfolio of financial technology solutions. The acquisition is expected to enhance Aryza’s service offerings across lending and financial management.

Source

Wedbush Partners with Broadridge

Wedbush has selected Broadridge’s technology platform to drive growth and streamline operations. The partnership aims to enhance efficiency in capital markets services.

Source

🪙 Crypto

El Salvador Splits Bitcoin Reserve for Security

El Salvador has divided its bitcoin reserve into multiple wallets to mitigate risks from future quantum computing threats. The move highlights the government’s proactive approach to safeguarding national digital assets.

Source

Gemini Files for IPO

Crypto exchange Gemini has confidentially filed for an IPO, seeking to raise capital for global expansion and product growth. The move signals increased maturity in crypto markets despite regulatory headwinds.

Source

Sygnum Expands Crypto Asset Management to Germany

Swiss crypto bank Sygnum is entering the German market with new asset management services. The expansion strengthens Sygnum’s role as a regulated crypto financial institution in Europe.

Source

BNB Whale Loses $13.5M in Phishing Attack

A BNB whale has lost $13.5 million in a phishing attack linked to North Korean hackers. The incident underscores persistent security risks in crypto markets.

Source

📈 WealthTech

OpenDialog AI and Adrian Flux Transform Insurance Buying

OpenDialog AI has partnered with Adrian Flux to enhance the insurance buying process with conversational AI. The collaboration aims to deliver more personalized and efficient customer experiences.

Source

📜 Other

CyberCube Launches Exposure Manager

CyberCube has introduced Exposure Manager, a platform designed to standardize cyber health and exposure data across the insurance value chain. The tool aims to improve risk assessment and resilience for insurers.

Source

MobiKwik Shares Rebound After Slump

Shares of MobiKwik’s parent company jumped 12% after a six-day decline, signaling renewed investor confidence. The rebound reflects optimism around the fintech’s growth trajectory in India.

Source

Elev8 Closes $160M India Fund

Elev8 Venture Partners has closed a $160 million fund to back startups in India. The fund will focus on scaling innovative ventures in fintech and adjacent sectors.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a "Source: [Name]" attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.