Klarna Launches Membership Programme

Klarna has unveiled its first-ever membership programme, offering exclusive benefits, personalized deals, and early access to new features for loyal users. The move aims to strengthen customer engagement and boost retention amid intensifying competition in the payments and BNPL space. By layering rewards onto its shopping and credit services, Klarna is positioning itself closer to lifestyle-driven fintech ecosystems like Revolut and PayPal. The programme also underscores Klarna’s push to evolve from a pure payments provider into a broader financial super app. Early adopters are expected to gain special perks tied to their spending behaviour and merchant preferences. This launch signals Klarna’s ambition to deepen its value proposition and create recurring engagement loops that drive sustained growth.

Video of the Day

Insight of the Day

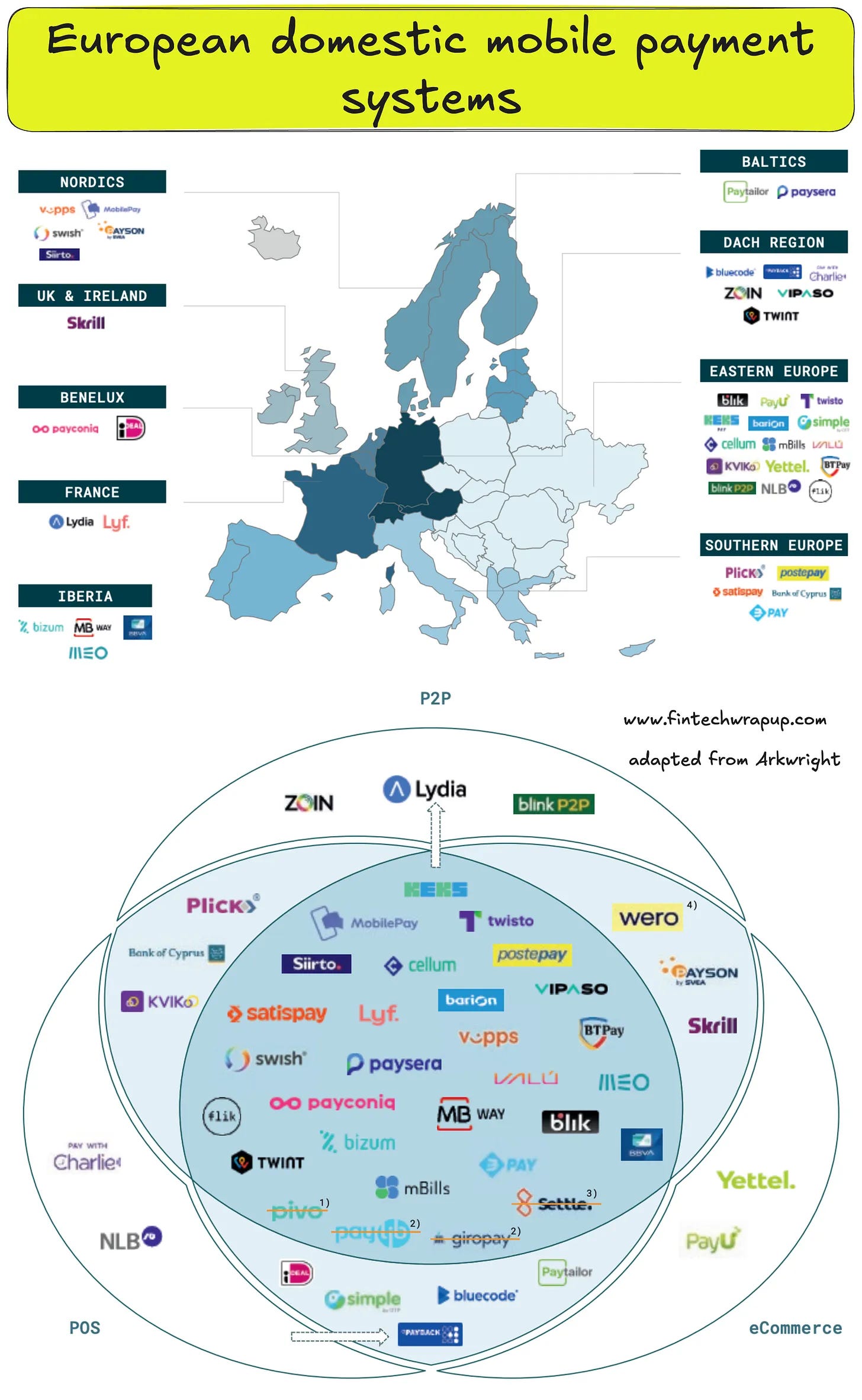

European domestic mobile payment systems and “local heroes”

More than 43 domestic payment solutions remain active in Europe. Following the introduction of EPI’s mobile payment wallet Wero, several solutions have been discontinued. At the end of 2024, it was announced that the German domestic solution giropay was suspended by the owner banks, paving the way for Wero as its successor. In France, Paylib users are gradually migrated to the Wero platform, initially for P2P payments. Additionally – unrelated to Wero – the Finnish scheme Pivo was closed in September 2024. Providers OP and Nordea have formed a joint venture focusing on the solution Siirto. Most domestic systems are omni-channel propositions. Notably the French solution Lydia has returned to its P2P roots – the e-commerce and POS services have been transferred to the mobile banking app Sumeria and are now card-based.

Many systems continue to evolve and expand their service offerings. Following the opening of Apple’s NFC interface, mandated by the European Commission since summer 2024, several domestic systems have launched or announced tap-to-pay alternatives. More providers are expected to follow, as the shift from QR code payments to tap-to-pay significantly improves usability, emulating the OEM wallet experience. Next to usability improvements, some domestic payment systems are already partnering or are planning to partner with other payment providers to enhance their cross-country acceptance, which we cover in following chapters.

As in the previous report, we have identified several “local heroes” across different European markets which continue to show strong growth – a trend that becomes notably clear when viewed cumulatively, highlighting the overall development at the European level.

Between 2017 and 2023, their growth has significantly outpaced the growth of card payments in the same markets. While players such as Blik, Twint and MB Way, continue to experience growth rates beyond 50%, other players, such as Swish and Vipps, which have already achieved high penetration rates in their respective markets are facing a slowdown in their growth.

Curated News

💳 Payments

Mastercard Unveils Threat Intelligence Tool to Tackle Payment Fraud

Mastercard has introduced a global threat intelligence solution designed to detect and mitigate payment fraud at scale. The new platform leverages AI-driven analytics to identify vulnerabilities and share insights across financial institutions.

Source

Uber Chooses Checkout.com to Power Global Payments

Uber has partnered with Checkout.com to streamline its global payments infrastructure, ensuring faster, more reliable transactions across its enterprise network. The collaboration aims to enhance scalability and reduce friction for millions of Uber users worldwide.

Source

Liberis Enters BNPL Market with “Pay With Liberis”

Liberis has launched its first Buy Now, Pay Later product, partnering with salon software provider Vagaro. The move marks Liberis’s expansion into consumer lending, offering flexible payment options to small businesses and their customers.

Source

🏦 Banking

Bunq Secures U.S. Broker-Dealer Licence

European neobank Bunq has obtained a U.S. broker-dealer licence as part of its expansion strategy into the American market. The licence enables Bunq to offer investment services and marks a key step toward becoming a full-service international bank.

Source

UBS Reshuffles Senior Operations Team

UBS has announced a leadership shake-up in its operations division, aligning its structure to improve efficiency and support ongoing digital transformation. The changes reflect UBS’s continued focus on streamlining processes following the Credit Suisse integration.

Source

BMG Money Secures $360M Facility from Hudson Cove

U.S. lender BMG Money has closed a $360 million financing deal with Hudson Cove Capital Management. The funding will support the firm’s mission to expand access to affordable credit for underserved borrowers.

Source

Pave Bank Raises $39M to Build Programmable Digital Bank

Pave Bank has raised $39 million to scale what it calls the world’s first programmable bank, designed for digital assets and the AI era. The platform aims to merge traditional banking with blockchain-based programmability for greater financial automation.

Source

💡 Fintech

Uptiq Launches Qore: The AI Builder for Financial Teams

At Money20/20, Uptiq unveiled Qore, an AI-powered platform enabling financial services teams to build, deploy, and scale customized tools without coding. The launch underscores AI’s growing role in transforming internal fintech operations.

Source

HSBC Highlights Credit Score Confusion Among Britons

A new HSBC study found that one in four UK consumers don’t understand how their credit scores are calculated. The findings underscore a pressing need for greater financial literacy initiatives across the UK market.

Source

SaaS Platforms Eye Banking Amid Small Business Struggles

As small businesses grapple with tighter margins, SaaS providers are increasingly moving into financial services to capture new revenue streams. The trend highlights a growing convergence between fintech and enterprise software.

Source

Trulioo Reports Record U.S. Growth Amid Identity Verification Boom

Global verification provider Trulioo has achieved record-breaking U.S. growth, fueled by enterprise demand for unified digital identity solutions. The surge reflects a broader trend toward compliance-driven identity innovation.

Source

🪙 Crypto

Citi and Coinbase Partner on Global Digital Asset Payments

Citi and Coinbase have joined forces to enhance cross-border digital asset payments for institutional clients. The collaboration aims to bridge traditional finance and blockchain infrastructure, streamlining digital transactions globally.

Source

Modern Treasury Acquires Stablecoin Paytech Beam

Modern Treasury has purchased Beam, a startup specializing in stablecoin-based payments. The acquisition strengthens Modern Treasury’s position in programmable payments and signals growing institutional interest in blockchain-native settlement solutions.

Source

Custody Banks Embrace Tokenisation

A growing number of custody banks are adopting tokenisation technologies to digitize traditional assets and improve settlement efficiency. The shift reflects accelerating institutional confidence in blockchain’s long-term role in finance.

Source

🤖 AI & Innovation

LSEG and Anthropic Partner to Bring Financial Data to Claude

The London Stock Exchange Group is integrating its financial datasets into Anthropic’s Claude AI, enabling users to access real-time market insights conversationally. The partnership enhances AI’s role in professional financial research and analytics.

Source

JPMorgan Uses AI for Employee Reviews

JPMorgan has rolled out an AI-driven performance review system, part of CEO Jamie Dimon’s broader push to integrate AI across operations. The move reflects how banks are embedding generative AI into HR and workflow management.

Source

Bottomline Debuts AI Agent for Treasury Management

Bottomline Technologies has launched an embedded AI agent aimed at automating treasury and cash management processes. The solution helps finance teams improve accuracy and decision-making through intelligent automation.

Source

Mastercard and PayPal Build Trust in Agentic Commerce

Mastercard and PayPal are collaborating to ensure transparency and security in agentic AI-driven commerce ecosystems. The initiative aims to establish ethical and trusted standards as AI agents begin transacting autonomously online.

Source

🛡️ Regulation & Risk

BMO and Affirm Stress Crisis-Ready Culture Amid Deepfake Threats

At the AFP conference, BMO and Affirm leaders highlighted the rising dangers of deepfakes and system downtime in financial operations. They called for stronger crisis management and digital resilience frameworks.

Source

📈 WealthTech

Robinhood Launches Futures Trading in the UK

Robinhood has introduced futures trading for its UK users, expanding its range of investment products beyond equities and crypto. The move strengthens its appeal to active traders and diversifies its global revenue base.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.