Klarna Launches Stablecoin

Klarna has introduced its own stablecoin, becoming one of the first major consumer fintechs to issue a digital currency. The stablecoin is designed to speed up checkout settlement, reduce foreign exchange friction, and support instant merchant payouts globally. This move positions Klarna not only as a BNPL pioneer but as a major payments infrastructure innovator. It could accelerate mainstream stablecoin adoption by embedding digital assets directly into everyday consumer transactions. The launch also raises the bar for other fintechs evaluating their digital asset strategies and has potential regulatory implications. Klarna’s entrance may reshape how consumers and merchants interact with cross-border digital payments.

Video of the Day

Insight of the Day

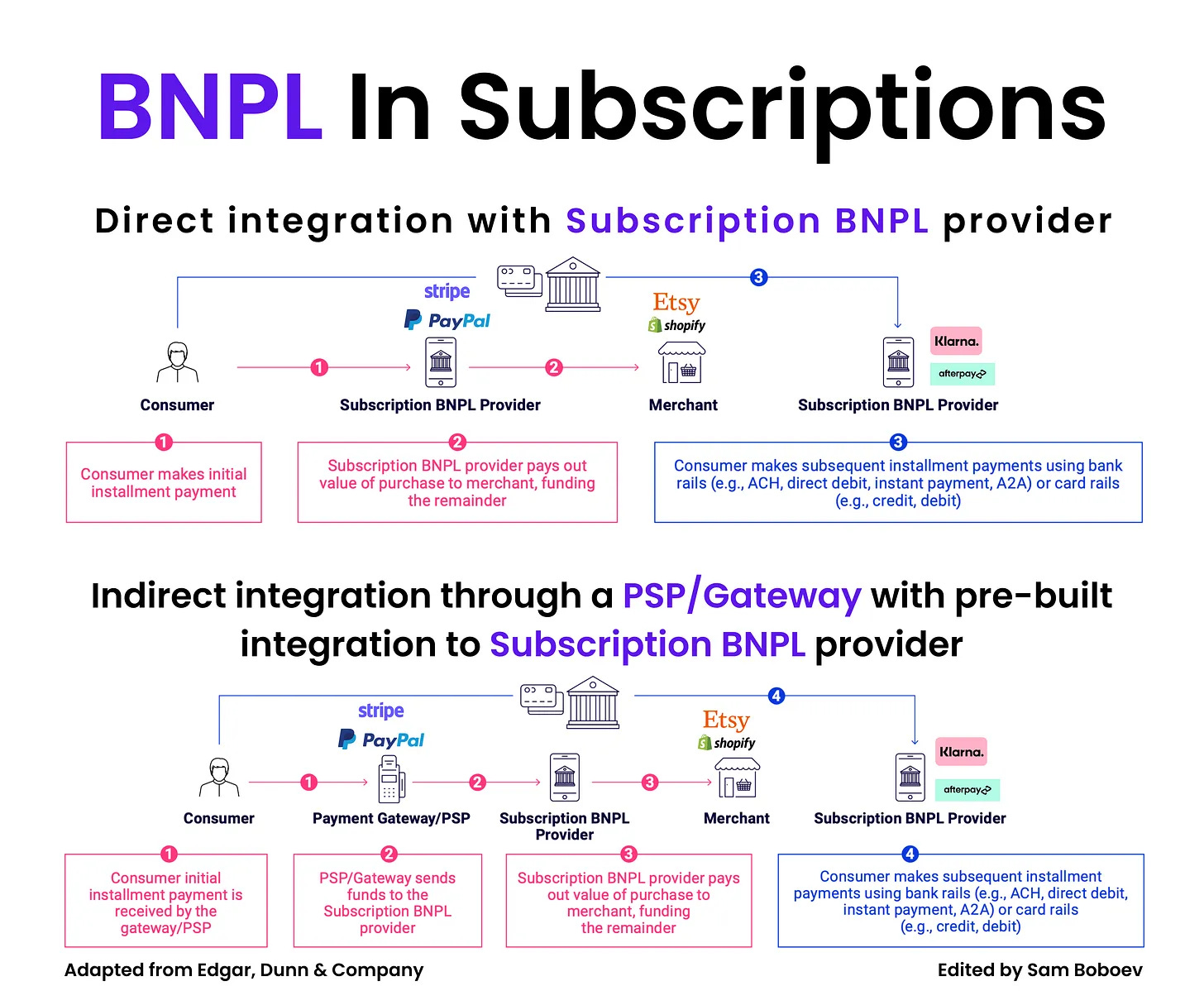

𝐁𝐍𝐏𝐋 𝐈𝐬 𝐄𝐱𝐩𝐚𝐧𝐝𝐢𝐧𝐠 𝐈𝐧𝐭𝐨 𝐒𝐮𝐛𝐬𝐜𝐫𝐢𝐩𝐭𝐢𝐨𝐧𝐬 — 𝐇𝐞𝐫𝐞’𝐬 𝐖𝐡𝐚𝐭’𝐬 𝐂𝐡𝐚𝐧𝐠𝐢𝐧𝐠

Buy Now, Pay Later (BNPL) is evolving beyond retail. The next big frontier? Subscription services.

While only 11% of subscription merchants offered BNPL in 2023 (up from ~5% in 2022), the momentum is real — and the potential, untapped.

As the subscription economy matures, consumers want more flexibility in how they pay. In fact, 17% of subscribers say BNPL availability is a key factor when choosing a service. For merchants, it helps convert those tricky free-trial users — where conversion rates currently hover around 26%.

But the biggest shift is how fintechs and banks are extending BNPL beyond one-off retail purchases into recurring digital services — think wellness apps, streaming, education, or even B2B SaaS subscriptions.

𝐖𝐡𝐚𝐭 𝐝𝐨𝐞𝐬 𝐢𝐭 𝐦𝐞𝐚𝐧?

1. Recurring Revenue for BNPL Providers

BNPL is no longer just about one-time shopping carts — subscription models mean predictable, recurring income and stronger customer retention.

2. “One-Stop Shop” Opportunity for PSPs

Merchants juggling billing, installments, and subscriptions will look for unified solutions. Payments players that can offer it all — from BNPL to fraud prevention — will become harder to displace.

3. Data-Driven Insights

Subscription BNPL unlocks richer customer data, enabling AI-powered risk modeling and personalized payment experiences.

⚠️ 𝐁𝐮𝐭 𝐓𝐡𝐞𝐫𝐞 𝐀𝐫𝐞 𝐑𝐢𝐬𝐤𝐬

Curated News

💳 Payments

RTGS.global Expands Network With 23 New Currencies

RTGS.global has added 23 new currencies to its real-time settlement network, significantly expanding its global reach. This enhancement strengthens liquidity access and enables faster, safer cross-border transactions for banks and fintechs.

Source

Mastercard Launches Access Pass to Boost Engagement

Mastercard has rolled out Access Pass, offering banks and fintechs curated lifestyle benefits and exclusive rewards. The initiative aims to deepen customer loyalty and differentiate digital payment offerings.

Source

UnionPay Expands Acceptance Across MENA with Amazon Payment Services

UnionPay International is partnering with Amazon Payment Services to increase card acceptance across the MENA region. The collaboration supports rising e-commerce demand and provides merchants with broader payment options.

Source

Wise Becomes First Non-Bank Live on Japan’s Zengin System via API

Wise is the first non-bank to gain direct API connectivity to Japan’s Zengin system, enabling settlement directly with the Bank of Japan. This milestone offers faster and more cost-efficient money transfers into Japan.

Source

Thunes and MoMo PSB Enable Real-Time Payments Into Nigeria

Thunes has partnered with MoMo PSB to deliver instant cross-border transfers into Nigeria. The solution expands financial access and helps cut remittance costs for millions of users.

Source

🏦 Banking

ABN Amro to Cut 5,200 Jobs in Major Restructuring Push

ABN Amro is reducing its workforce by 5,200 roles as it accelerates digitisation and cost efficiency programs. The cuts reflect broader industry shifts toward automation and leaner operating models.

Source

Kinective Acquires Compuflex to Strengthen Cash Automation

Kinective has acquired Compuflex Corporation, expanding its presence in branch technology and cash automation. The acquisition supports banks seeking to modernise branch operations and reduce cash-handling costs.

Source

The Bank of London CEO Steps Down

Christopher Horne has stepped down as CEO of The Bank of London amid ongoing organisational changes. The departure comes as the company refines its strategy in the competitive clearing-bank space.

Source

South Korean Banks Accelerate AI Adoption for Lending and Transfers

Banks in South Korea are rapidly deploying AI to enhance loan assessments and automate everyday transfers. This shift aligns with the country’s broader push toward AI-driven financial infrastructure.

Source

Switzerland Launches National Open Banking Framework

Switzerland has officially launched open banking, enabling secure data-sharing between banks and authorised third parties. The framework is set to boost fintech innovation and competition across the sector.

Source

💼 Fintech

Model ML Raises $75M to Scale AI Workflow Automation

Model ML has raised $75M to expand its AI-powered workflow automation platform. The funding will help improve operational efficiency for highly regulated sectors, including financial services.

Source

Curve Investor Challenges £125M Sale to Lloyds

A Curve shareholder has filed a legal challenge to block its £125 million acquisition by Lloyds Banking Group. The dispute could delay or reshape the trajectory of the deal.

Source

Green Dot Sells Bank and Embedded Finance Divisions

Green Dot has sold its bank and embedded finance units to new owners in a strategic streamlining effort. The move positions the company to refocus on its core fintech service offerings.

Source

Checkout.com Integrates ACP, Backed by OpenAI, for Agentic Commerce

Checkout.com is adopting ACP, a new AI commerce engine supported by OpenAI, to enable autonomous shopping agents and personalised commerce experiences. The integration targets large enterprise merchants seeking advanced automation.

Source

BKN301 Raises £29M and Acquires Planky

BKN301 has secured £29M in funding while acquiring Planky to enhance its AI-driven digital banking and compliance tools. The expansion supports its mission to serve emerging markets with scalable BaaS solutions.

Source

Omnisient Raises $12.5M for Privacy-Safe Credit Insights

Omnisient has raised $12.5M to grow its privacy-preserving data collaboration platform for lenders. The solution helps underserved consumers gain credit access without compromising sensitive data.

Source

Ant Group Expects 10% Profit Growth to $1.2B

Ant Group forecasts a 10% rise in profit, driven by strong performance across payments and digital finance products. The growth underscores its resilience amid continued regulatory pressure.

Source

🪙 Crypto

MoonPay Secures New York Trust Charter

MoonPay has obtained a New York Trust Charter, joining a select group of crypto firms with dual state and federal licensing. The approval expands its ability to custody and process digital assets at scale.

Source

Anchorage Digital Eyes Token Rewards Under GENIUS Act

Anchorage Digital is exploring offering compliant, yield-like rewards on Ethena tokens under the new GENIUS Act. This could signal emerging regulatory clarity for token-based incentives.

Source

Bitcoin Stabilises Near $88K After Selloff

Bitcoin is steady around $88,000 following heavy selling pressure earlier in the week. Markets remain cautious as macro uncertainty continues to drive volatility.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.