Kraken & Deutsche Börse Forge Landmark Partnership Bridging Traditional and Digital Markets

Kraken and Deutsche Börse have announced a strategic partnership that represents one of the most significant moves yet in uniting traditional finance with digital asset infrastructure. The collaboration will see Kraken supplying digital asset liquidity and expertise while Deutsche Börse brings regulatory-grade market infrastructure and institutional access. Together, they aim to create a seamless bridge for investors moving between traditional securities and digital assets. This marks a major step toward institutionalizing crypto markets within Europe’s tightly regulated financial ecosystem. The partnership could accelerate adoption among asset managers, banks, and corporates seeking compliant digital-asset exposure. For fintech audiences, this is a strong signal that digital and traditional markets are converging much faster than anticipated.

Video of the Day

Insight of the Day

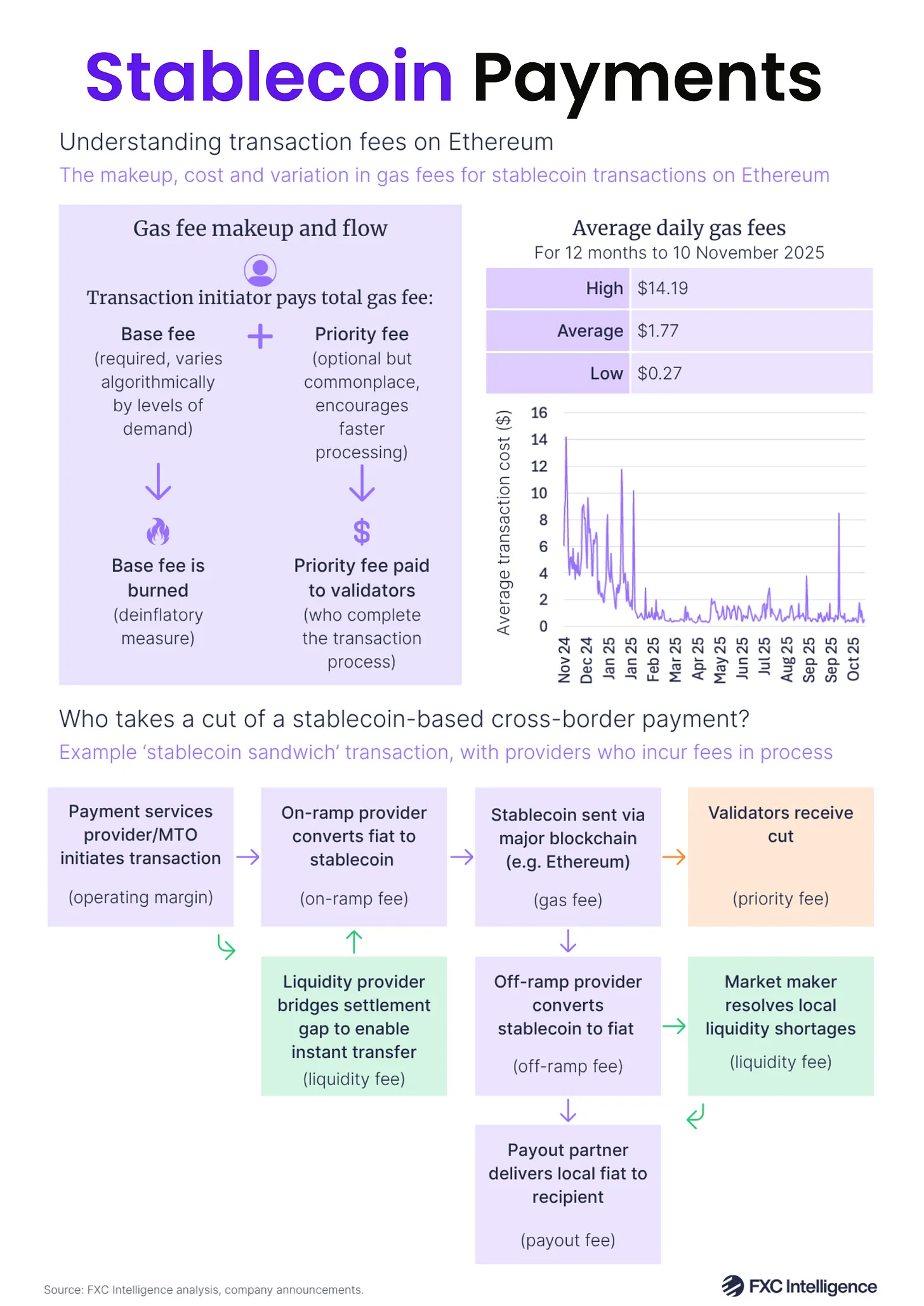

𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐓𝐡𝐞 𝐑𝐞𝐚𝐥 𝐂𝐨𝐬𝐭 𝐨𝐟 𝐒𝐭𝐚𝐛𝐥𝐞𝐜𝐨𝐢𝐧 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐛𝐲 𝐅𝐗𝐂 𝐈𝐧𝐭𝐞𝐥𝐥𝐢𝐠𝐞𝐧𝐜𝐞

For years, people in crypto kept repeating the same line: “stablecoin payments are far cheaper than fiat.”

Meanwhile, people in payments kept shaking their heads. Now that I spend my days comparing both worlds for Fintech Wrap Up, I finally understand why.

Here is the truth: the on-chain part can be cheaper, but the real cost sits in the entire stack around it. Let me break it down.

🔹 𝐓𝐡𝐞 𝐠𝐚𝐬 𝐟𝐞𝐞 𝐦𝐲𝐭𝐡

When people say stablecoin transfers are cheap, they usually talk about gas fees.

On Ethereum, gas has two parts:

• Base fee: automatically set by the network.

• Priority fee: the “tip” that helps your transaction get in faster, often set by wallet algorithms.

Both go up when the network gets busier, and that can take the total from cents to several dollars. None of this fee stays with the network. The base fee is burned. The priority fee goes to validators.

And yes, you must keep ETH to pay these fees even if you are sending USDC. That alone adds operational friction for companies processing transactions at scale.

🔹 𝐄𝐭𝐡𝐞𝐫𝐞𝐮𝐦 𝐢𝐬 𝐧𝐨𝐭 𝐜𝐡𝐞𝐚𝐩, 𝐢𝐭 𝐢𝐬 𝐥𝐢𝐪𝐮𝐢𝐝

Ethereum still handles most USDC and USDT volume. Not because it offers bargain pricing, but because liquidity is deep. If you move large amounts, liquidity matters more than headline fees.

But other chains are fighting back with lower fees and incentives. You see this especially across emerging markets where stablecoin rails have real margin opportunities.

🔹 𝐋𝐚𝐲𝐞𝐫 𝟐𝐬 𝐜𝐡𝐚𝐧𝐠𝐞 𝐭𝐡𝐞 𝐞𝐪𝐮𝐚𝐭𝐢𝐨𝐧

Layer 2 networks like Base or Arbitrum charge three different fees:

• Execution fee

• Layer 1 data fee (to post data back to Ethereum)

• Sequencer fee

Even with this, the total cost is often far lower because transactions are bundled into rollups before hitting Layer 1. I expect most stablecoin volume to shift here over time.

🔹 𝐓𝐡𝐞 𝐬𝐭𝐚𝐛𝐥𝐞𝐜𝐨𝐢𝐧 𝐬𝐚𝐧𝐝𝐰𝐢𝐜𝐡

Curated News

💳 Payments

Record $2.97T Day for The Clearing House

The Clearing House processed a record $2.97 trillion in a single day, underscoring surging demand for high-value and real-time payments infrastructure. The milestone reflects strong institutional activity and the ongoing modernization of U.S. payments rails.

Source

OwlTing Joins Circle’s Global Payments Network

OwlTing has integrated with Circle to enable stablecoin-based payments across fast-growing international markets. The move aims to streamline merchant settlement and reduce cross-border transaction friction.

Source

QuickBooks Payments Launches to Accelerate SMB Cash Flow

Intuit launched QuickBooks Payments to help small businesses get paid faster through integrated invoicing and payment acceptance tools. The solution targets common SMB pain points around slow receivables and cash-flow gaps.

Source

One Inc & Benekiva modernize claims payouts

One Inc and Benekiva have partnered to deliver a fully digital claims payment experience for insurers. The integration aims to eliminate manual processes and improve customer satisfaction through faster disbursements.

Source

🏦 Banking

KTVA Credit Union Partners With NCR Atleos for Cash Deposit Upgrades

Knoxville TVA Employees Credit Union will deploy NCR Atleos technology to modernize its cash-deposit infrastructure. The rollout is expected to improve member experience and reduce operational strain on branches.

Source

Revolut to Launch Titan Ultra-Premium Business Card

Revolut is preparing to introduce Titan, a high-end business card aimed at larger companies and high-spending professionals. The product will expand Revolut’s B2B financial toolkit with premium rewards and deeper financial controls.

Source

Circle Asia to Launch AI-Driven PayLater Card in Vietnam

SEA neobank Circle Asia plans to debut an AI-powered PayLater card in Vietnam, a fast-growing market for digital consumer credit. The card will use machine learning to personalize credit decisions in real time.

Source

💡 Fintech

Scottish Widows Trials AI for Marketing Compliance

Scottish Widows is piloting AI tools to automate marketing compliance reviews and reduce manual approval cycles. The initiative aims to speed up oversight while maintaining regulatory accuracy.

Source

Scottish Widows Expands AI Compliance With Adclear

The company is deepening its AI adoption through a new partnership with Adclear to enhance automated compliance scanning. This reflects growing industry demand for AI-enabled oversight.

Source

Flex Raises $60M for AI-Native Private Bank

Flex has raised $60M in Series B funding to scale its AI-led private banking platform for high-net-worth business owners. The round will fuel product expansion and enhanced automation across wealth tools.

Source

Pine Labs Reports First Profit With 18% Revenue Growth

Pine Labs reported its first profit since launch alongside strong 18% revenue growth, driven by expanding merchant payments and improved operating efficiency. The milestone marks a turning point for the APAC fintech giant.

Source

Nexus Venture Partners Raises $700M for AI & Fintech Startups

Nexus Venture Partners closed a $700M fund focused on AI, fintech, and consumer technology. The fund signals continued investor conviction in AI-driven financial innovation.

Source

Fintech Wales Publishes Annual Report, Announces First Fintech Festival

Fintech Wales released its 2024/25 annual report and confirmed Wales’ first fintech festival, aimed at boosting regional innovation and investor engagement. The initiative strengthens Wales’ position as a growing fintech hub.

Source

PensionBee Pushes for Reform of Pension Transfer Delays

PensionBee criticized severe delays in pension transfers, calling the situation “broken beyond excuse” and urging government action. The company argues that delays undermine consumer trust and financial mobility.

Source

Nada Raises $10M to Grow Home-Equity Investment Platform

Nada secured a $10M Series A to scale its fractional home-equity investment platform. Funding will support product expansion and broaden access to real-estate investing alternatives.

Source

🪙 Crypto

Europol Busts €700M Crypto Fraud Network

Europol dismantled a large crypto fraud ring laundering over €700 million, marking one of the biggest coordinated crackdowns in the space. The case highlights increasing law-enforcement focus on cross-border crypto crime.

Source

Ripple CEO Says Bitcoin Could Reach $180K by 2026

Ripple’s CEO predicts Bitcoin could climb to $180,000 by 2026, pointing to rising institutional activity and supply constraints. The bullish outlook aligns with a broader wave of optimistic market forecasts.

Source

📜 Regulation

ECB Expands Digital Euro Team

The European Central Bank is staffing up for its digital euro project as it advances further into design and testing. The hiring push indicates accelerating momentum toward a potential retail CBDC rollout.

Source

💼 WealthTech

SmartStream Launches Agentic AI Smart Agents

SmartStream introduced new agentic AI “Smart Agents” to automate investigations and exceptions handling in post-trade processes. The technology aims to cut manual workloads and boost operational efficiency for financial institutions.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.