Kraken Eyes $300M Raise Ahead of IPO at $20B Valuation

Crypto exchange Kraken is preparing a $300 million funding round that could value the firm at $20 billion, as it gears up for a highly anticipated IPO. The raise comes amid renewed institutional interest in digital assets and strong market momentum in 2025. Kraken’s move highlights a broader wave of crypto firms seeking public listings to cement credibility and tap fresh capital. With Coinbase’s IPO serving as a benchmark, Kraken’s strategy will be closely watched by both retail and institutional investors. Analysts say the timing reflects rising optimism in crypto markets following regulatory clarity in key jurisdictions. The raise, if successful, would be one of the largest pre-IPO financings in the sector this year.

Insight of the Day

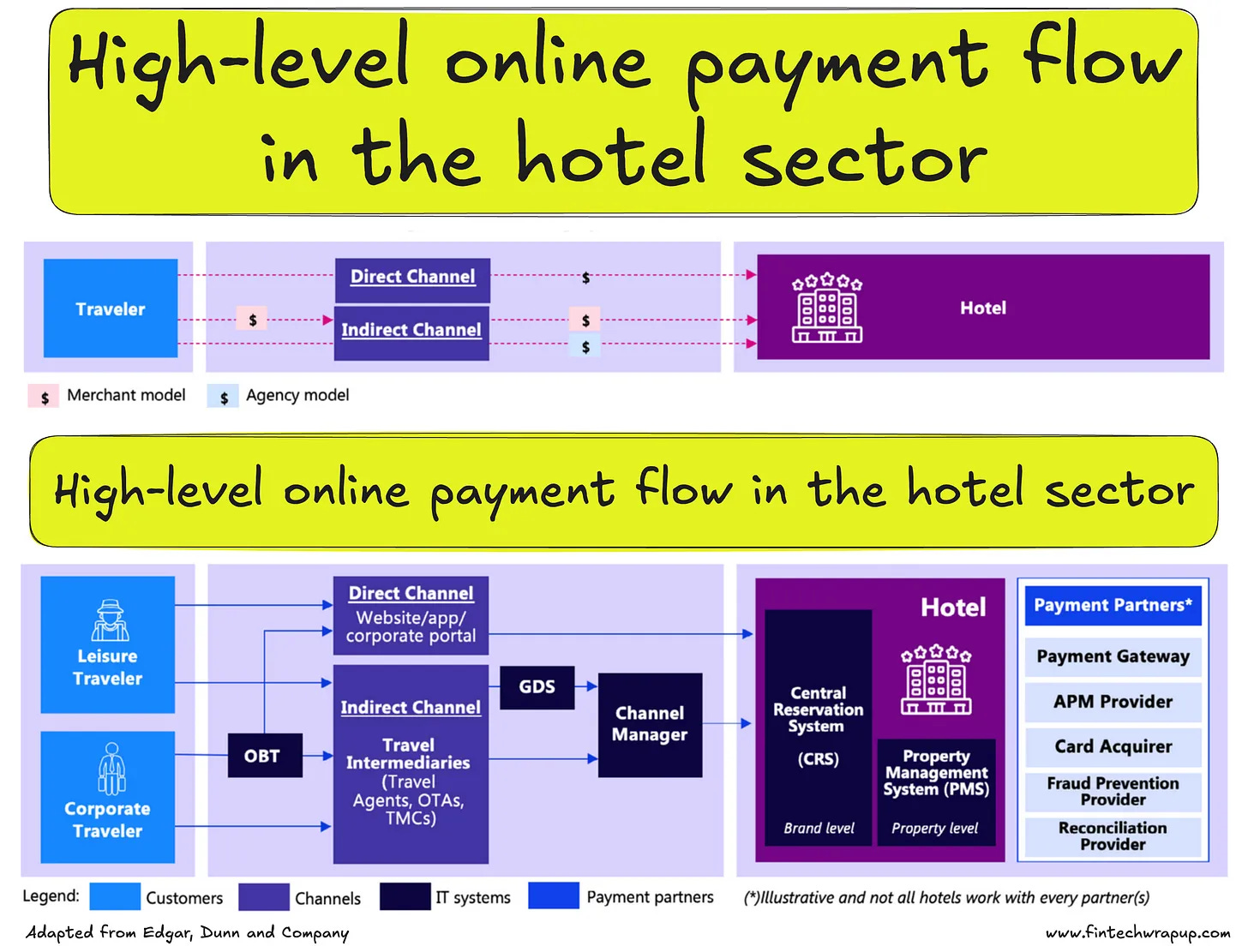

Hotel Payments – Distribution and Flows

The hotel industry’s approach to payments is shaped by its ownership structure. Unlike airlines with direct control, hotels operate under various models. Franchise arrangements dominate 93% of the U.S. market, management contracts account for much of the rest, and fully owned properties are increasingly rare.

👉 This structure creates a decentralized payment model where:

🔹 Individual properties act as the merchant of record

🔹 Properties manage their own PSP/acquirer/bank relationships

🔹 Each location handles payment processing, fraud, chargebacks, and reconciliation

Even with brand-wide partnerships, hotels often choose their own providers. Many chains confirmed that branded websites only collect payment details before passing them to properties for processing. This fragmentation causes inconsistent customer experiences, higher costs, and limited data visibility.

Without consolidated payment data, reporting, reconciliation, and fraud management become more difficult, and hotels lose leverage on commercial terms.

✅ Distribution and Payment Flows

The industry has shifted toward digital distribution, with online bookings making up 63% of chain revenue in 2023. Indirect channels (mainly OTAs) dominate, but direct bookings via websites and apps are rising—up 9 points in 2023 to 29% of all bookings.

👉 Today’s distribution relies on:

🔹 Global Distribution Systems (availability)

🔹 Channel Managers (connecting booking channels)

🔹 Central Reservation Systems (inventory)

🔹 Property Management Systems (operations)

Curated News

💳 Payments

Citi & Dandelion Partner on Near-Instant Global Wallet Payments

Citi has teamed up with Dandelion to enable near-instant payments to digital wallets worldwide, aiming to simplify cross-border transactions for businesses and consumers. The partnership underscores growing demand for faster, more accessible payment solutions.

Source

Solidgate Joins Forces with EBANX for LatAm Expansion

Solidgate announced a partnership with EBANX to accelerate its expansion across Latin America and other emerging markets. The collaboration will provide local payment infrastructure to better serve global merchants.

Source

EBA Clearing Scales Verification of Payee Service

EBA Clearing is scaling its Fraud Pattern and Anomaly Detection (FPAD) Verification of Payee service to help financial institutions improve payment accuracy and reduce fraud. The move reflects heightened industry focus on payment security.

Source

Faster Payments Council Warns on Instant Payments Readiness

The Faster Payments Council emphasized that proper planning is key for banks and institutions looking to implement instant payments successfully. The group highlighted risks of rushing deployments without adequate infrastructure.

Source

Finextra & ACI Launch Research on Next Era of Payments

Finextra and ACI Worldwide unveiled new global research on payment innovation, focusing on real-time rails, AI, and cross-border trends. The study aims to guide financial institutions in adapting to shifting customer expectations.

Source

Katz’s Delicatessen Partners with Square for Scale

New York’s iconic Katz’s Delicatessen is partnering with Square to modernize payments and scale its operations. The move highlights how even heritage brands are leveraging fintech to enhance customer experience.

Source

🏦 Banking

Backbase & Akkuro Launch End-to-End Banking Transformation

Backbase has partnered with Akkuro to deliver integrated banking transformation solutions. The collaboration will help banks modernize digital platforms and improve customer journeys.

Source

Fiserv Acquires Smith Consulting to Expand Advisory Services

Fiserv announced the acquisition of Smith Consulting Group to enhance its advisory services for banks and financial institutions. The deal strengthens Fiserv’s role as a comprehensive service provider.

Source

🪙 Crypto

DBS & Franklin Templeton Launch Tokenised Money Market Fund Solutions

DBS and Franklin Templeton will launch trading and lending products powered by tokenized money market funds and Ripple’s RLUSD stablecoin. The initiative blends traditional finance with blockchain infrastructure.

Source

PublicSquare to Offer Crypto Treasury-as-a-Service

PublicSquare will roll out a crypto treasury service for merchants in its ecosystem, enabling businesses to manage digital assets more efficiently. The move signals increasing merchant adoption of crypto tools.

Source

TeraWulf to Raise $3B in Google-Backed Debt Deal

Crypto miner TeraWulf is raising $3 billion through a Google-backed debt deal to expand its data centers. The financing reflects strong institutional support for energy-intensive mining infrastructure.

Source

💡 Fintech

SG Fintech Surges to $1B in H1 2025

Singapore’s fintech funding hit $1 billion in the first half of 2025, driven by growth in payments and AI-powered solutions. The milestone underlines Singapore’s position as a leading Asian fintech hub.

Source

SC Ventures & Fujitsu Launch Project Quanta

SC Ventures and Fujitsu are collaborating on Project Quanta, a new incubation initiative aimed at exploring advanced financial technologies. The project will focus on leveraging AI and quantum-inspired computing.

Source

Addi Secures $50M Debt Funding After Strong Growth

Latin American fintech Addi raised $50 million in debt financing after achieving four straight profitable quarters and surpassing $150 million in ARR. The funding will support continued expansion in consumer finance.

Source

⚙️Regulation / Compliance

Kueski Named Mexico’s Most Ethical Financial Company

Buy-now-pay-later firm Kueski was recognized as Mexico’s most ethical financial company, highlighting its governance standards and consumer-focused practices. The award reinforces its reputation in Latin America’s fintech sector.

Source

PBoC Opens Digital Yuan Operation Centre in Shanghai

The People’s Bank of China launched a digital yuan operations center in Shanghai to strengthen infrastructure for its central bank digital currency. The move signals further institutionalization of the e-CNY project.

Source

Mastercard & Smile ID Scale Digital Identity Across Africa

Mastercard and Smile ID announced a partnership to expand digital identity solutions across Africa. The initiative aims to improve financial inclusion and strengthen compliance frameworks in the region.

Source

Ant International Launches AI SHIELD for Financial Security

Ant International introduced AI SHIELD, a solution designed to improve AI security for financial institutions and partners. The tool addresses growing risks associated with AI-powered fintech systems.

Source

📉 Other

Ex-Investree CEO Arrested After Months on the Run

The former CEO of Indonesian fintech Investree has been arrested after evading authorities for months. The case adds to scrutiny of governance practices within Southeast Asia’s fintech sector.

Source

Genpact Reinvents Insurance Buying with Agentic AI

Genpact launched a new AI-powered agentic solution aimed at transforming how consumers buy insurance. The platform promises a more personalized and efficient purchasing experience.

Source

Automat-it Expands AWS Agreement

Automat-it expanded its agreement with AWS to enhance cloud-native solutions for enterprise clients. The deal strengthens its position in infrastructure automation.

Source

Kids’ Side Hustles Push for Financial Freedom

A new report highlights how children are increasingly turning to side hustles to achieve financial independence early. The trend reflects cultural shifts in attitudes toward entrepreneurship and money management.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.