Kraken Quietly Files for U.S. IPO, Signaling a New Chapter for Crypto & Fintech

Kraken has reportedly filed confidentially for a U.S. IPO, marking what could become one of the most significant public listings in fintech and digital-asset history. The move signals renewed confidence among mature crypto institutions—even amid regulatory uncertainty and volatile markets. A successful listing would provide a powerful benchmark for the entire industry, potentially encouraging more crypto-native firms to enter public markets. It may also trigger a new wave of institutional adoption, with increased scrutiny and transparency improving trust. The IPO would further establish Kraken as a long-term, regulated financial player rather than a purely crypto exchange. For fintech leaders, this represents a pivotal moment where digital asset firms move firmly into mainstream capital markets.

Video of the Day

Insight of the Day

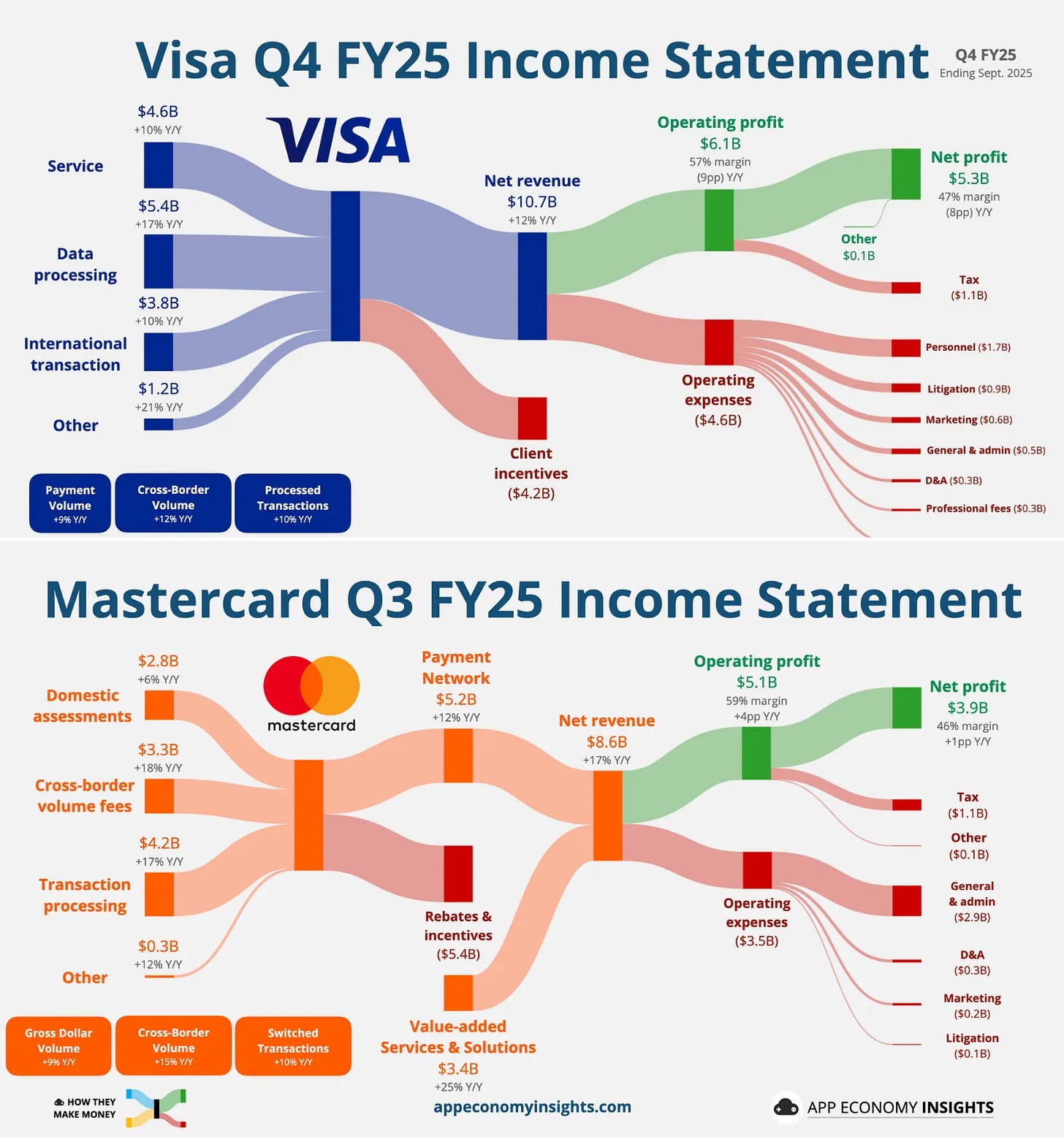

𝐌𝐚𝐬𝐭𝐞𝐫𝐜𝐚𝐫𝐝 𝐯𝐬 𝐕𝐢𝐬𝐚 - 𝐐𝐮𝐚𝐫𝐭𝐞𝐫𝐥𝐲 𝐅𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐑𝐞𝐬𝐮𝐥𝐭𝐬

What company do you think is leading? Do you think new technologies e.g. AI, stablecoins and etc will disrupt these giants?

✅ Visa

- Fiscal Fourth Quarter Net Revenue: $10.7 billion, up 12% year-over-year.

- Full Year Net Revenue Growth: 11% year-over-year.

- Fiscal Fourth Quarter EPS: Up 10% year-over-year.

- Full Year EPS Growth: 14% year-over-year.

- Total Full Year Payments Volume: $14 trillion, up 8% year-over-year in constant dollars.

- Processed Transactions: 258 billion, up 10% year-over-year.

- Commercial Payments Volume: $1.8 trillion, up 7% year-over-year in constant dollars.

- Visa Direct Transactions: 12.6 billion in full year 2025, up 27% year-over-year.

- Value-Added Services Revenue Growth: 25% in constant dollars to $3 billion in Q4.

- Operating Expenses Growth: 13% in Q4.

- Stock Buyback: Approximately $4.9 billion in Q4.

- Dividends Distributed: $1.1 billion in Q4.

- Remaining Buyback Authorization: $24.9 billion at the end of September.

- Q1 2026 US Payments Volume Growth: 7% through October 21.

- Q1 2026 Processed Transactions Growth: 9% year-over-year through October 21.

- Q1 2026 Cross-Border Volume Growth: 12% year-over-year through October 21.

✅ Mastercard

Curated News

💳 Payments

Klarna Expands Deeper Into $447B U.S. Gift Card Market

Klarna is expanding its partnership with Blackhawk Network to tap into the growing U.S. gift card market. This move strengthens Klarna’s retail footprint and positions it to innovate around BNPL-powered gifting.

Source

SBS Upgrades SBP Platform to Enhance Digital Payments

SBS has updated its SBP platform to deliver faster, more reliable digital payments. The upgrade aims to support growing transaction volumes across banks and fintechs.

Source

Indonesia to Extend Digital Payments to China & South Korea

Indonesia will expand its domestic digital payment system to China and South Korea by 2026. The initiative should improve cross-border spending for travelers and boost regional commerce.

Source

Sequence Launches “Trails” to Simplify Crypto-Based Payments

Sequence introduced Trails to make integrating crypto payments simpler for developers. The tool reduces technical complexity in building blockchain-based payment flows.

Source

Thrivory Raises Funding for Real-Time Healthcare Payments

Thrivory raised $3.5M in equity and secured up to $25M in credit to expand its healthcare payment platform. The funding will accelerate adoption of real-time reimbursement tools for clinics and hospitals.

Source

🏦 Banking

Bank of Ireland Expands Hybrid-Work Network With New Hub

The Bank of Ireland is opening a new hybrid-working hub in Sligo to enhance flexible work options. The expansion supports regional talent and modernizes the bank’s workplace infrastructure.

Source

Lloyds Faces Call for ICO Probe Over Staff Data Use

A union has requested an ICO investigation into Lloyds’ alleged use of staff bank-account data during pay negotiations. The case could shape future standards around data privacy and employer oversight.

Source

💼 Fintech

FICO Integrates Plaid for Real-Time Cash-Flow Insights

FICO and Plaid are partnering to incorporate real-time cash-flow data into FICO’s risk models. This enhances lenders’ ability to make more accurate credit decisions.

Source

Kaaj Raises $3.8M to Automate Credit Risk With AI

AI startup Kaaj raised $3.8M to improve automated credit-risk assessment. The platform aims to help lenders analyze borrowers faster and with greater precision.

Source

Capital on Tap Secures £500M to Expand SMB Credit

Capital on Tap secured £500M in funding to strengthen its SMB financing products. The company plans to grow card products and credit lines for small businesses.

Source

Qantas Business Money Rolls Out Yield Product With Airwallex

Qantas Business Money introduced a high-yield treasury product for businesses powered by Airwallex. It aims to provide SMEs with secure, high-return cash-management options.

Source

Cash App Pilot Launches Near Real-Time “Cash App Score”

Block launched a pilot for Cash App Score leveraging near real-time financial behavior data. The product aims to expand access to credit for underserved consumers.

Source

CFIT Coalition to Digitize UK Homebuying

The UK’s CFIT coalition is starting a project to digitize the homebuying process end-to-end. The initiative targets reduced friction, better transparency, and faster completions.

Source

Zopa Launches New Investment Product for Savers

Zopa launched a new investment product designed to help customers grow savings with confidence. It expands the fintech’s move deeper into consumer wealth solutions.

Source

eToro Introduces Cash ISA for UK Clients

eToro unveiled a Cash ISA offering tax-free returns to UK investors within the eToro ecosystem. This strengthens its competitive position in wealth and savings.

Source

🪙 Crypto

Naver to Acquire Dunamu, Operator of Upbit

Naver is reportedly acquiring Dunamu, operator of Upbit, South Korea’s largest crypto exchange. The deal would substantially expand Naver’s capabilities in digital assets.

Source

Tether Invests in Parfin to Boost Institutional USDT Adoption

Tether invested in Parfin to enhance enterprise-grade crypto infrastructure across Latin America. The partnership aims to grow institutional stablecoin usage.

Source

Crypto Markets See Nearly $1B in Liquidations

A sharp decline in Bitcoin, Ethereum, and XRP followed fading expectations for rate cuts. The downturn triggered nearly $1B in liquidations, highlighting continued macro sensitivity.

Source

⚖️ Regulation

U.S. Senate Targets Vote on Major Crypto Bill Next Month

The U.S. Senate Banking Chair plans to advance a long-awaited crypto regulatory bill. If passed, it could bring clearer rules for exchanges and digital-asset issuers.

Source

🧩 Other

ClearToken Adopts Nasdaq Eqlipse for Digital Asset Clearing

ClearToken is integrating Nasdaq Eqlipse to strengthen institutional clearing and settlement. The upgrade focuses on reducing risk and improving transparency.

Source

Taurus & Kaiko Form Partnership on Digital Asset Infrastructure

Taurus and Kaiko announced a strategic partnership combining custody, tokenization, and data capabilities. The collaboration aims to improve infrastructure for institutional digital-asset adoption.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.