Lloyds Buys Curve for £120M in Major Shift Toward Super-App Banking

Lloyds Banking Group has acquired Curve for £120 million, marking one of the most significant UK banking–fintech deals of the year. The move accelerates Lloyds’ ambitions to deliver a unified money-management experience and signals growing consolidation across European fintech. Curve stakeholders reportedly voiced concerns about governance and execution, but the acquisition gives the platform a renewed path for scale. For Lloyds, it offers instant multi-account aggregation, card-stacking, and spend-insights capabilities that could help defend market share against neobanks. The deal also raises competitive pressure on incumbents to modernize UX and product offerings. Overall, this acquisition could influence the next wave of banking-fintech partnerships across the UK.

Video of the Day

Insight of the Day

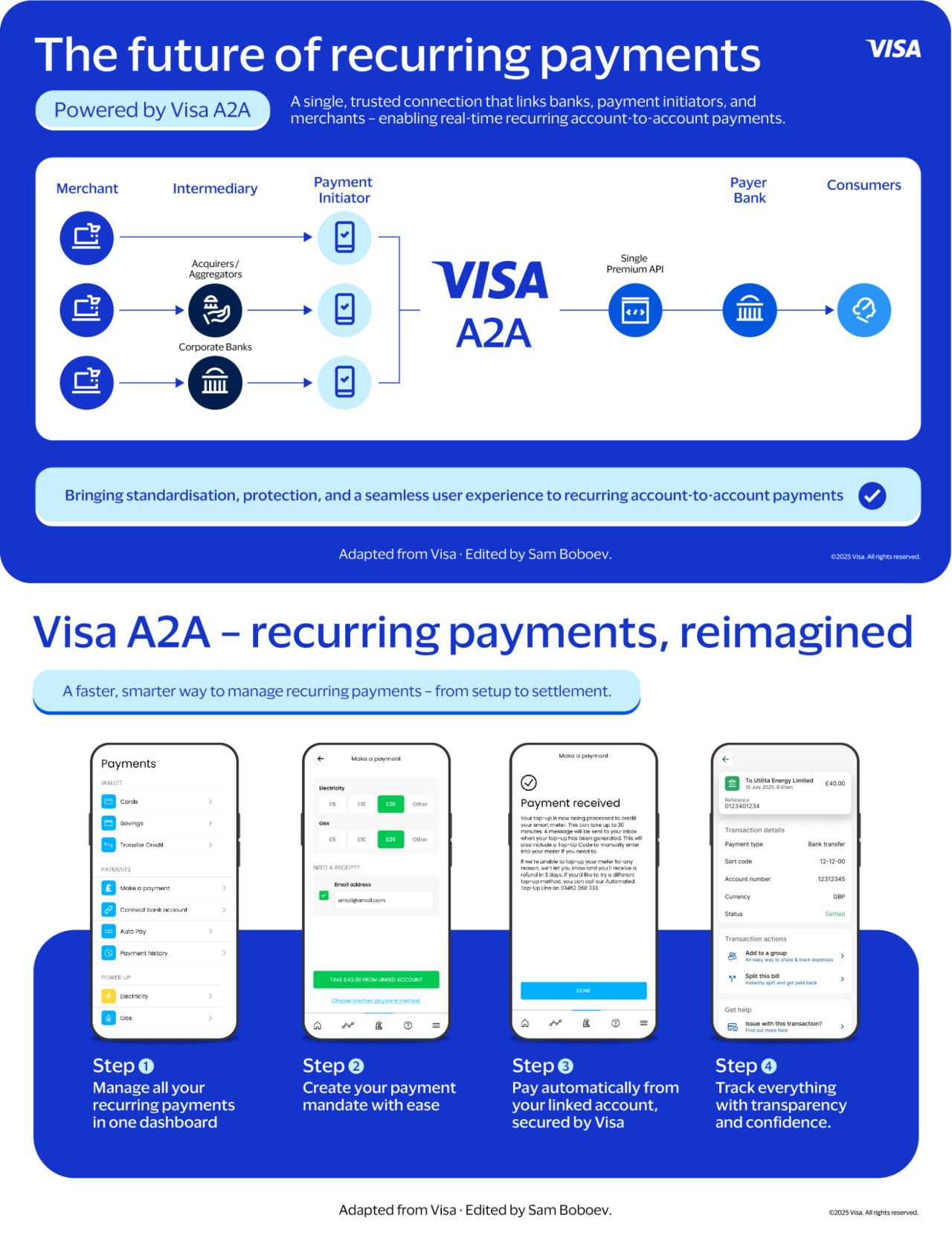

𝐓𝐨𝐝𝐚𝐲, 𝐕𝐢𝐬𝐚, 𝐊𝐫𝐨𝐨 𝐁𝐚𝐧𝐤, 𝐓𝐢𝐧𝐤, 𝐚𝐧𝐝 𝐔𝐭𝐢𝐥𝐢𝐭𝐚 𝐪𝐮𝐢𝐞𝐭𝐥𝐲 𝐦𝐚𝐝𝐞 𝐩𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐡𝐢𝐬𝐭𝐨𝐫𝐲

They completed the first commercial Variable Recurring Payment (cVRP) powered by Visa A2A - ahead of its rollout across the UK.

If you’ve ever wondered how “smart” recurring payments will work in the open banking world — here’s the explainer 👇

👉 𝗪𝗵𝗮𝘁’𝘀 𝗮 𝗰𝗩𝗥𝗣?

Think of a cVRP as the next evolution of Direct Debits — but powered by open banking.

Instead of giving merchants permanent pull access to your account…

You grant them controlled, variable access (e.g., “you can take my monthly bill, but cap it at £150”).

That means you stay in control — you can set limits, revoke permission anytime, and see every transaction in real time.

👉 𝗛𝗼𝘄 𝗩𝗶𝘀𝗮 𝗔𝟮𝗔 𝗳𝗶𝘁𝘀 𝗶𝗻

The biggest blocker for cVRPs so far? No commercial model. No trustmark. No consumer protection.

Visa A2A fixes that by combining:

✅ Open banking rails (instant payments via Faster Payments)

✅ Card-like protections (dispute resolution + “Secured by Visa” trustmark)

✅ Standardised rules across banks and payment initiators

So you get the speed of open banking with the safety of Visa — something the industry has been waiting for.

👉 𝗛𝗼𝘄 𝘁𝗵𝗲 𝗳𝗶𝗿𝘀𝘁 𝗰𝗩𝗥𝗣 𝘄𝗼𝗿𝗸𝗲𝗱

Here’s what happened in the first transaction 👇

1. Tink initiated the payment request and verified funds.

2. Kroo Bank authenticated the user and approved the transfer, sending the payment in real-time

3. Visa A2A facilitated liability, risk, and dispute frameworks.

4. Utilita Energy (the energy provider) demonstrated how customers connect their bank account to the Utilita app, set up a payment mandate, and how payments are received in real-time.

End result: a real-time, secure, recurring bill payment — no direct debit delay, no surprises.

👉 𝗪𝗵𝘆 𝘁𝗵𝗶𝘀 𝗺𝗮𝘁𝘁𝗲𝗿𝘀

For consumers → more control, visibility, and get your money back when things go wrong.

For merchants → faster settlement, easier reconciliation, protection for their business. .

For banks & fintechs → a scalable open-banking use case with trusted rails.

It’s a small step — but one that could finally make open banking mainstream.

🚀 𝗪𝗵𝗮𝘁’𝘀 𝗻𝗲𝘅𝘁?

Visa plans to roll out Visa A2A across ecommerce, bills, subscriptions, and beyond. If successful, it might soon transform how we manage recurring payments — making them as transparent, flexible, and user-friendly as the everyday digital experiences we already rely on.

𝗧𝗟;𝗗𝗥:

cVRPs = Smart Direct Debits.

Visa A2A = Open banking with a safety net.

Together = A serious contender for the future of UK payments.

Curated News

💳 Payments

Visa Executes First Recurring A2A Payment in the UK

Visa completed its first recurring account-to-account transaction using open banking rails, a milestone that could reshape subscription and billing models. The achievement strengthens A2A as a card-alternative for merchants seeking cost-efficient payments.

Source

PayQuicker Partners with dLocal to Expand Global Payouts

PayQuicker is integrating dLocal to enhance its Global Payout Orchestration platform across Africa, the Middle East, Asia, and Latin America. The partnership boosts cross-border reach for businesses supporting gig workers, creators, and global vendors.

Source

Mastercard Move Powers Félix Cross-Border Remittances

Remittance provider Félix will use Mastercard Move to speed up and expand its international payouts. The upgrade aims to improve payment reliability and reduce friction for migrant workers sending money home.

Source

PayPal Becomes Liverpool FC’s Official Digital Payments Partner

PayPal has been announced as LFC’s new digital payments partner, giving fans enhanced checkout options and faster digital commerce experiences.

Source

Forbo Adds DailyPay for Employee Earnings Access

Forbo Movement Systems is adding DailyPay, giving workers access to earned wages and improving financial wellness.

Source

🏦 Banking

Deblock Raises €30M to Expand On-Chain Banking Across Europe

Deblock secured €30M Series A to scale its on-chain banking infrastructure across Europe, reflecting rising demand for blockchain-native financial services.

Source

Critical Tech Suppliers to Banks Placed Under Regulatory Oversight

UK regulators have designated 13 major tech vendors as critical third parties, bringing them under direct supervision due to systemic risk concerns.

Source

💡 Fintech

Stratiphy Returns to Crowdfunding for Growth Capital

Stratiphy is turning once again to its investment community to raise fresh capital for personal portfolio automation tools.

Source

Intuit Signs $100M AI Partnership with OpenAI

Intuit has inked a $100M deal with OpenAI to integrate new AI capabilities across its tax, accounting, and financial tools.

Source

LG & LSEG Launch AI-Based Equity Forecasting Tool

LG and LSEG jointly launched an AI tool designed to enhance equity predictions and investment insights across global markets.

Source

Yubi Raises $46.4M to Expand Credit Infrastructure Globally

Indian fintech Yubi raised $46.4M to expand its credit marketplace into Southeast Asia and the United States.

Source

AI Fintech Dost Launches in UK with £6M Series A

Dost launched in the UK offering AI-driven financial support tools, aiming to help consumers budget, manage debt, and save more effectively.

Source

Agentero Debuts AI Carrier-Matching Tool

Agentero introduced an AI system to help insurance agents find the best-fitting carrier for each client more efficiently.

Source

Maxima Raises $41M for Agentic AI Accounting Platform

Maxima secured $41M across Seed and Series A rounds to automate accounting workflows using agentic AI.

Source

🪙 Crypto

Kraken Valued at $20B After $800M Raise

Kraken raised $800M to fund global expansion and enhance its institutional-grade crypto infrastructure.

Source

Bullish Shares Decline Despite Record Q3 Revenue

Bullish posted record quarterly revenue but saw its stock drop as investors questioned market sustainability.

Source

New Hampshire Announces $100M Bitcoin-Backed Municipal Bond

New Hampshire unveiled a $100M municipal bond backed by Bitcoin, a first-of-its-kind move in U.S. public finance.

Source

BlackRock Bitcoin ETF Records $523M Daily Loss

BlackRock’s Bitcoin ETF suffered a record $523M one-day loss amid a sharp downturn in cryptocurrency markets.

Source

📜 Regulation

FCA Opens Tender for UK Equity Consolidated Tape

The FCA is seeking suppliers to build and operate the UK equity consolidated tape to improve trading transparency and data access.

Source

🧾 Other

Basware Launches InvoiceAI for Smarter AP Automation

Basware launched InvoiceAI, a tool designed to accelerate invoice processing and reduce manual accounts payable tasks.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.