LSEG and OpenAI Partner to Power Secure Financial AI Access

The London Stock Exchange Group is collaborating with OpenAI to bring secure, compliant AI tools into financial institutions. The partnership focuses on safely delivering AI access to traders, analysts and wealth professionals, while addressing strict data governance and industry regulations. It signifies accelerating adoption of AI in capital markets, where efficiency and data intelligence are competitive necessities. By integrating advanced models with vetted financial datasets, the initiative aims to modernize workflows such as research, reporting, and compliance. The move positions LSEG as a key gatekeeper for enterprise-grade financial AI. It also reflects growing regulatory pressure on AI transparency across finance.

Video of the Day

Insight of the Day

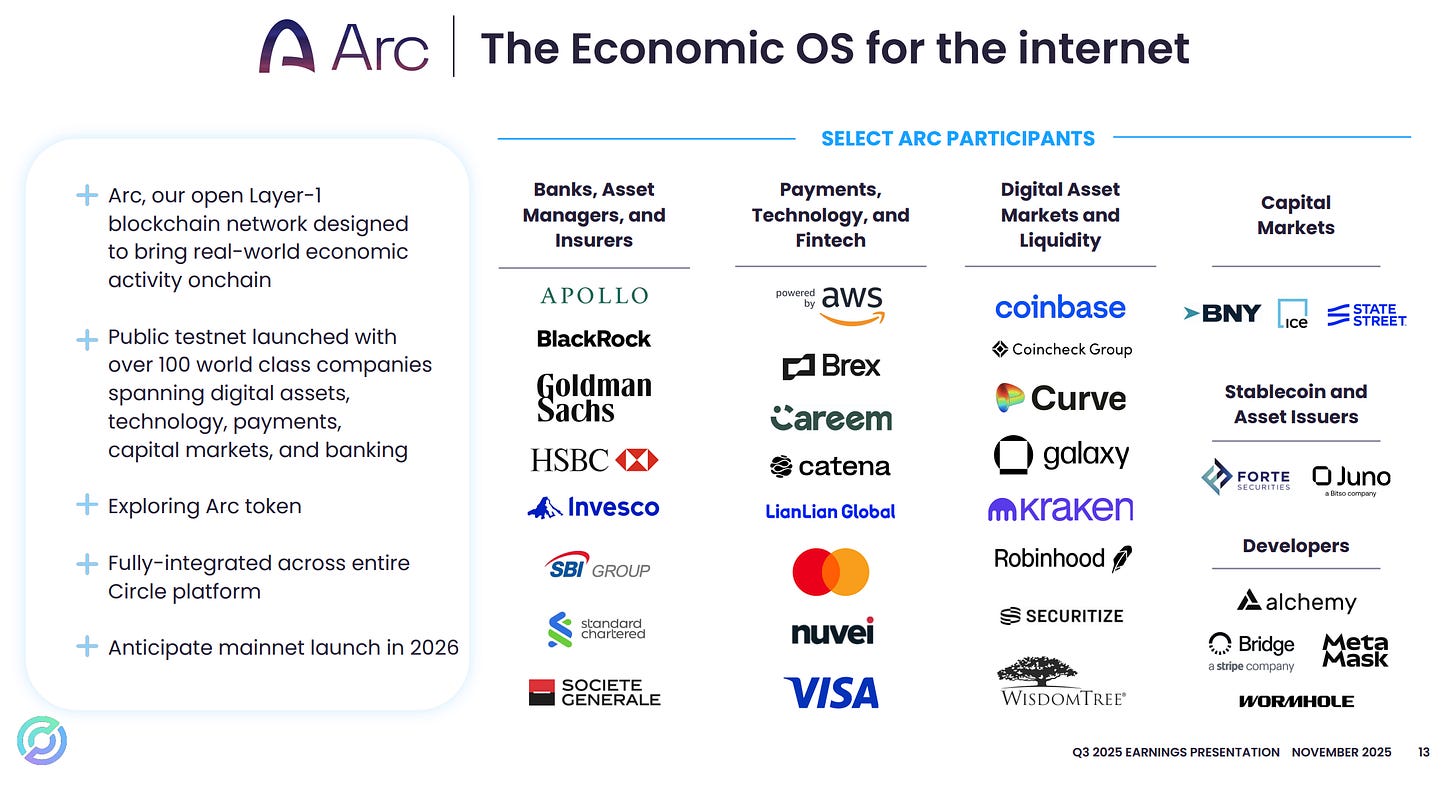

Why Circle Built Arc and How It Changes Payments

“Another new blockchain? Really?” That was my first reaction when Circle announced Arc, their very own Layer-1 network. As a fintech person who’s seen every buzzword from DeFi to CBDCs come and go, I approached Arc with skepticism and curiosity in equal measure. But after digging in, I realized Arc isn’t just another me-too crypto project. It’s Circle basically saying: “Hey, if you want something done right, build it yourself.” In this article, I’ll break down what Arc is, why it exists, and how it could reshape payments, all in plain English. Let’s dive in.

Curated News

💳 Payments

Prometeo Adds Ownership Verification for ACH Transactions

Prometeo launched a new ownership-check feature designed to prevent fraud and ensure account holder authenticity in ACH payments. It strengthens security for banks and businesses dealing with rising payment-risk exposures.

Source

Green Check & Lüt Launch Cannabis-Focused Payment Platform

A new compliance-first payments system aims to reduce cash reliance for cannabis businesses, which face limited banking access. The solution increases transparency and regulatory alignment in a high-risk industry.

Source

Trulioo Joins Google’s Agent Payments Protocol

Identity-verification leader Trulioo will support Google’s emerging agent payments ecosystem, improving authentication for automated digital transactions. This enhances trust and reduces fraud for autonomous commerce.

Source

Coinstar & Lithic Launch Card Turning Loose Cash Into Digital Money

Coinstar will issue a general-purpose reloadable card powered by Lithic, helping users convert physical coins into spendable digital funds. It supports financial inclusion for the cash-reliant population.

Source

Quality Automotive Services Increases Tenure with DailyPay

DailyPay’s earned-wage access solution led to a 32% improvement in employee retention at Quality Automotive Services. Flexible pay continues to gain traction as a workforce benefit.

Source

🏦 Banking

Visa Moves European HQ to Canary Wharf

Visa will relocate its European headquarters to London’s Canary Wharf, signaling long-term commitment to the UK fintech hub. The move aligns with increasing investment in payments innovation in the region.

Source

ECB Expands Team for Digital Euro Roll-Out

The European Central Bank is growing its internal digital euro workforce to support development and policymaking around a CBDC. This escalation shows the EU moving from research into preparation for deployment.

Source

💼 Fintech

Fuse Rebrands as Lorum to Modernize Institutional Clearing

Fintech Fuse is now “Lorum,” with a mission to rebuild outdated institutional clearing infrastructure. The rebrand aligns with its expanding platform strategy across capital markets.

Source

Plaid & ClearBank Join Forces + Add AI Categorization

Plaid is partnering with ClearBank to enhance bank-to-fintech connectivity in the UK while introducing AI-driven transaction categorization. The upgrade promises cleaner financial data for apps and lenders.

Source

Flex Raises $60M to Scale AI-Native Finance Platform

Flex secured a $60M Series B to automate financial operations with AI at the core. The company aims to modernize billing, reconciliation and cash-flow management for businesses.

Source

63% of SMBs Get First-Ever Funding via Embedded Finance: Liberis

New data shows embedded financial products are driving capital access for small businesses that previously struggled to secure funding. It underscores fintech’s role in boosting SMB economic growth.

Source

Nuuvia Secures $4M from Credit Unions to Scale CUSO Platform

VyStar and Desert Financial invested in Nuuvia’s fintech platform designed for credit union service organizations. The funding supports digital modernization across cooperative financial institutions.

Source

🪙 Crypto

Komainu Brings Collateral Wallet Services to UAE

Digital asset custodian Komainu is expanding to the UAE, offering secure collateral wallets for institutions. It strengthens the region’s crypto-infrastructure ambitions.

Source

Robinhood Enters Indonesian Market with Crypto Acquisition

Robinhood will buy a local exchange and broker to access the fast-growing Indonesian crypto market. The deal marks a deeper expansion into international digital asset trading.

Source

South Korea Tightens Rules for Crypto Exchanges

New regulations planned in South Korea will raise compliance requirements for exchanges amid ongoing investor-protection concerns. The move may trigger consolidation in the market.

Source

Crypto Markets Sell Off After $500M Liquidations

Major coins including Bitcoin, Ethereum and XRP fell sharply as leveraged positions were wiped out in mass liquidations. The downturn contrasts with rising traditional equities.

Source

Securitize CEO: Tokenized Assets Need Liquidity to Survive

Securitize warns that tokenization cannot scale without meaningful trading liquidity and institutional market access. It highlights the challenge of turning digital assets into functioning capital-market instruments.

Source

🛡️ Regulation

FinCEN: Ransomware Payments Spiked 77% in 2023

US financial crime data reveals ransomware-related payments surged during 2023 but later declined in 2024. Authorities are tightening controls as cyberattacks remain a key threat to financial infrastructure.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.