Malaysia Unveils Ringgit-Backed Stablecoin to Power APAC Payments

Malaysia’s royalty has announced the launch of a ringgit-backed stablecoin aimed at improving cross-border payments across the Asia-Pacific region. The initiative signals growing sovereign and institutional interest in compliant, fiat-backed digital currencies for real-world transactions. By tying a stablecoin directly to the national currency, the project positions itself as a bridge between traditional finance and blockchain-based payment rails. It also reflects a broader shift among emerging markets toward regulated digital assets as payment infrastructure. For fintechs, this opens the door to faster settlement, lower FX friction, and new regional payment use cases. The move could set a precedent for other countries exploring state-aligned stablecoins.

Video of the Day

Insight of the Day

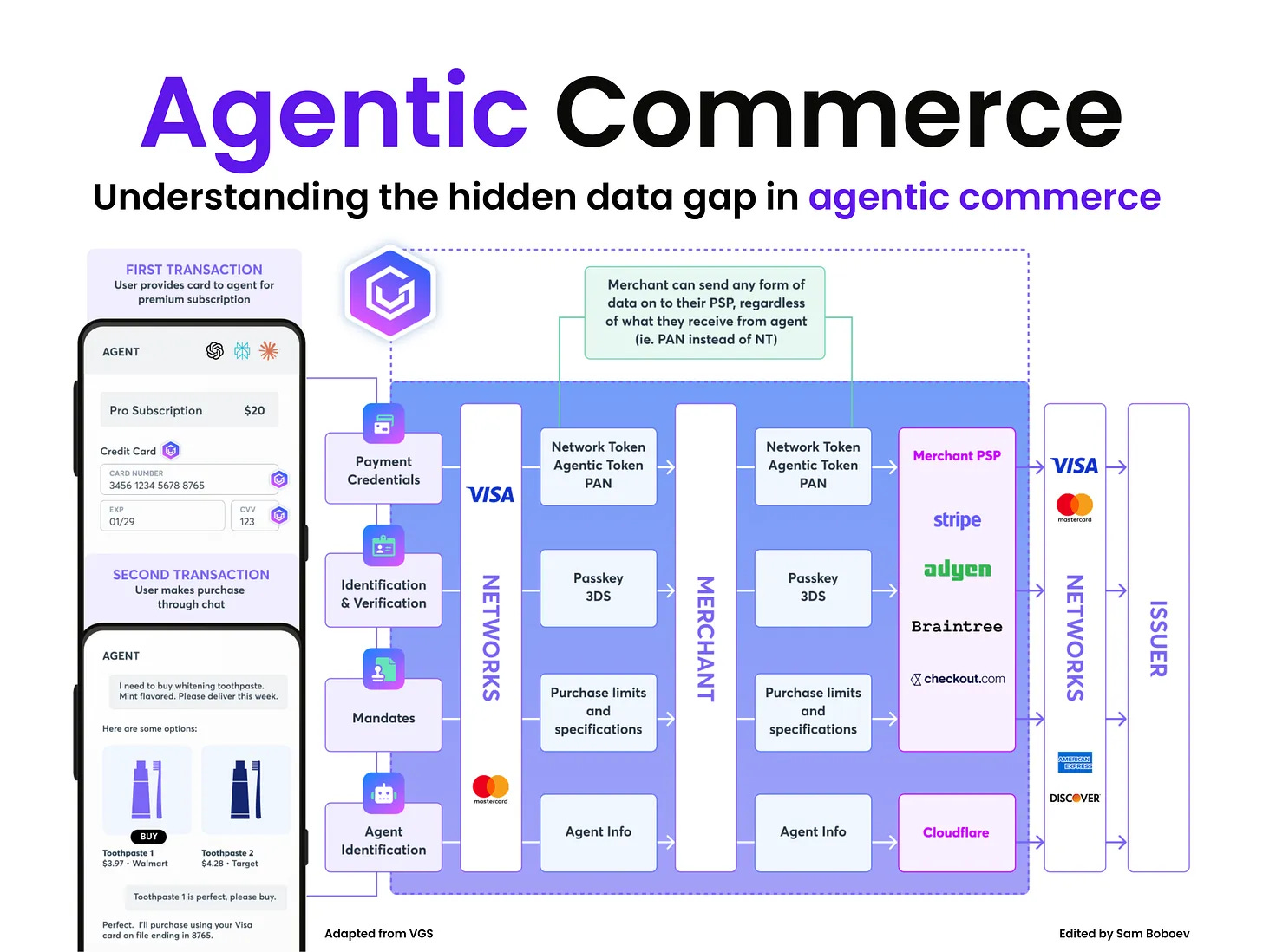

𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐭𝐡𝐞 𝐡𝐢𝐝𝐝𝐞𝐧 𝐝𝐚𝐭𝐚 𝐠𝐚𝐩 𝐢𝐧 𝐚𝐠𝐞𝐧𝐭𝐢𝐜 𝐜𝐨𝐦𝐦𝐞𝐫𝐜𝐞

I have been spending a lot of time studying how agentic commerce works in real payment flows. The more I dig into it, the clearer one thing becomes.

We are entering a world where agents handle the entire customer journey, but merchants receive less data than ever before.

The diagram above illustrates the core issue.

- Agents collect everything needed to initiate a transaction.

- Networks validate and tokenize it.

- PSPs authorize it.

But somewhere in the middle, the merchant loses the context that used to fuel fraud prevention, approval intelligence, customer understanding, and loyalty strategies.

_____

👉 𝐇𝐞𝐫𝐞 𝐢𝐬 𝐭𝐡𝐞 𝐩𝐫𝐨𝐛𝐥𝐞𝐦 𝐢𝐧 𝐬𝐢𝐦𝐩𝐥𝐞 𝐭𝐞𝐫𝐦𝐬:

- Agents know who triggered the purchase

- Networks know how the token was created

- Merchants only see the final token and amount

That missing context is the blind spot.

_____

Why this matters for the ecosystem

👉 𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭𝐬 𝐧𝐞𝐞𝐝 𝐦𝐨𝐫𝐞 𝐭𝐡𝐚𝐧 𝐚 𝐭𝐨𝐤𝐞𝐧 𝐭𝐨 𝐨𝐩𝐞𝐫𝐚𝐭𝐞 𝐞𝐟𝐟𝐞𝐜𝐭𝐢𝐯𝐞𝐥𝐲. 𝐓𝐡𝐞𝐲 𝐧𝐞𝐞𝐝:

- Identity and verification signals

- Purchase mandates

- Agent identification

- Purchase limits and intent

- Payment credential metadata

Without it, fraud gets harder, approvals suffer, and personalization becomes guesswork.

_____

👉 𝐖𝐡𝐚𝐭 𝐭𝐡𝐞 𝐯𝐢𝐬𝐮𝐚𝐥 𝐡𝐢𝐠𝐡𝐥𝐢𝐠𝐡𝐭𝐬

Curated News

💳 Payments

Alipay+ QR Payments Surge in South Korea

Alipay+ reported an 18% increase in QR-code transaction volume in South Korea in 2025, reflecting rising adoption among merchants and travelers. The growth highlights strong momentum for cross-border digital wallets in Asia’s retail payments ecosystem.

Source

Aspire Expands Fast, Low-Cost Cross-Border Payments in Hong Kong

Aspire has launched faster and cheaper international payments in Hong Kong through an expanded partnership with Wise Platform. The move strengthens Aspire’s value proposition for SMEs operating across borders.

Source

ClearBank and Finseta Partner on Multicurrency Payments

ClearBank has partnered with Finseta to power multicurrency accounts and cross-border payment services. The collaboration enhances ClearBank’s infrastructure offering for fintechs and global businesses.

Source

🏦 Banking

Fifth Third Teams Up With Brex for AI-Powered Commercial Cards

Fifth Third Bank is partnering with Brex to bring AI-driven commercial card solutions to mid-market and enterprise customers. The collaboration aims to modernize expense management and corporate payments.

Source

Shawbrook Acquires Playter to Expand SME Financing

UK challenger bank Shawbrook has acquired Playter to broaden its SME lending capabilities, especially revenue-based financing. The deal strengthens Shawbrook’s position in alternative business finance.

Source

PAObank Partners With Citi on FX Services in Hong Kong

PAObank has teamed up with Citi to introduce a new foreign exchange service for retail customers in Hong Kong. The partnership blends digital banking with institutional FX infrastructure.

Source

🧠 Fintech

Finextra Launches Market Intelligence App

Finextra has rolled out a new market intelligence app aimed at fintech professionals and financial institutions. The app delivers real-time insights across payments, banking, and regulation.

Source

Abu Dhabi Launches New Fintech and Digital Assets Cluster

Abu Dhabi has unveiled a new financial services cluster focused on fintech and digital assets. The initiative aims to attract global investment and accelerate regional innovation.

Source

SG’s MetaComp Raises $22M Pre-A Round

Singapore-based digital payments and settlement firm MetaComp has secured $22 million in a pre-A funding round. The capital will support product expansion and regulatory scaling.

Source

FinBox Launches AI Tool for Bank Statement Fraud Detection

FinBox has introduced an AI-powered transaction intelligence platform aimed at improving bank statement fraud checks. The tool clusters transaction behavior to detect anomalies faster and more accurately.

Source

🪙 Crypto

Circle Secures UAE Approval as Money Services Business

Circle has received regulatory approval in the UAE to operate as a money services business. This strengthens Circle’s foothold in the Middle East’s rapidly growing digital asset market.

Source

IREN Raises $2.3B in Major Balance Sheet Overhaul

Crypto infrastructure firm IREN raised $2.3 billion and repurchased debt as part of a balance sheet restructuring. The move improves financial flexibility amid volatile market conditions.

Source

Canton Network Advances On-Chain U.S. Treasury Financing

The Canton Network showcased the next phase of tokenized U.S. Treasury financing through its industry working group. This marks progress toward institutional-grade on-chain finance.

Source

Pye Finance Raises $5M Seed Backed by Coinbase Ventures

Pye Finance has raised a $5 million seed round led by Variant and Coinbase Ventures. The funding backs its crypto-native financial products and early platform development.

Source

HashKey IPOs, Mining Crackdowns, and Cardano Volume Surges

HashKey launched IPO activity in Hong Kong as Malaysia intensified its crackdown on Bitcoin mining. Meanwhile, Cardano saw a surge in on-chain volume, pointing to renewed market momentum.

Source

💼 WealthTech

EIB Invests €70M in Italian BNPL Unicorn

The European Investment Bank has invested €70 million in an Italian buy-now-pay-later unicorn. The move supports consumer finance innovation while backing regulated credit models.

Source

Tiger Global Raises $2.2B for Cautious New Venture Fund

Tiger Global is launching a $2.2 billion fund with a more conservative investment strategy. The shift reflects ongoing recalibration in global venture capital markets.

Source

Japan IPOs Hit $7.7B in 2025

Japanese IPOs raised $7.7 billion in 2025, the highest total since 2018. The rebound points to improved market confidence and stronger public listings.

Source

Granite Asia Raises $350M+ for Private Credit Fund

Granite Asia has secured over $350 million for a new private credit fund, anchored by Temasek. The fund targets growth-stage companies across Asia.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.chwrapup.com.