Mastercard and Coinbase Battle for Stablecoin Pioneer BVNK

Mastercard and Coinbase are reportedly in a bidding war to acquire BVNK, a leading stablecoin payments infrastructure firm. The move underscores the growing convergence between traditional finance and crypto payments, as both companies aim to strengthen their foothold in digital assets. Mastercard’s interest signals deeper integration of blockchain technology into mainstream finance, while Coinbase seeks to expand its institutional payment capabilities. The deal could redefine how stablecoins are used for cross-border payments and settlements. BVNK’s platform has been a major driver of stablecoin adoption across global markets, making it a strategic acquisition target for both giants.

Insight of the Day

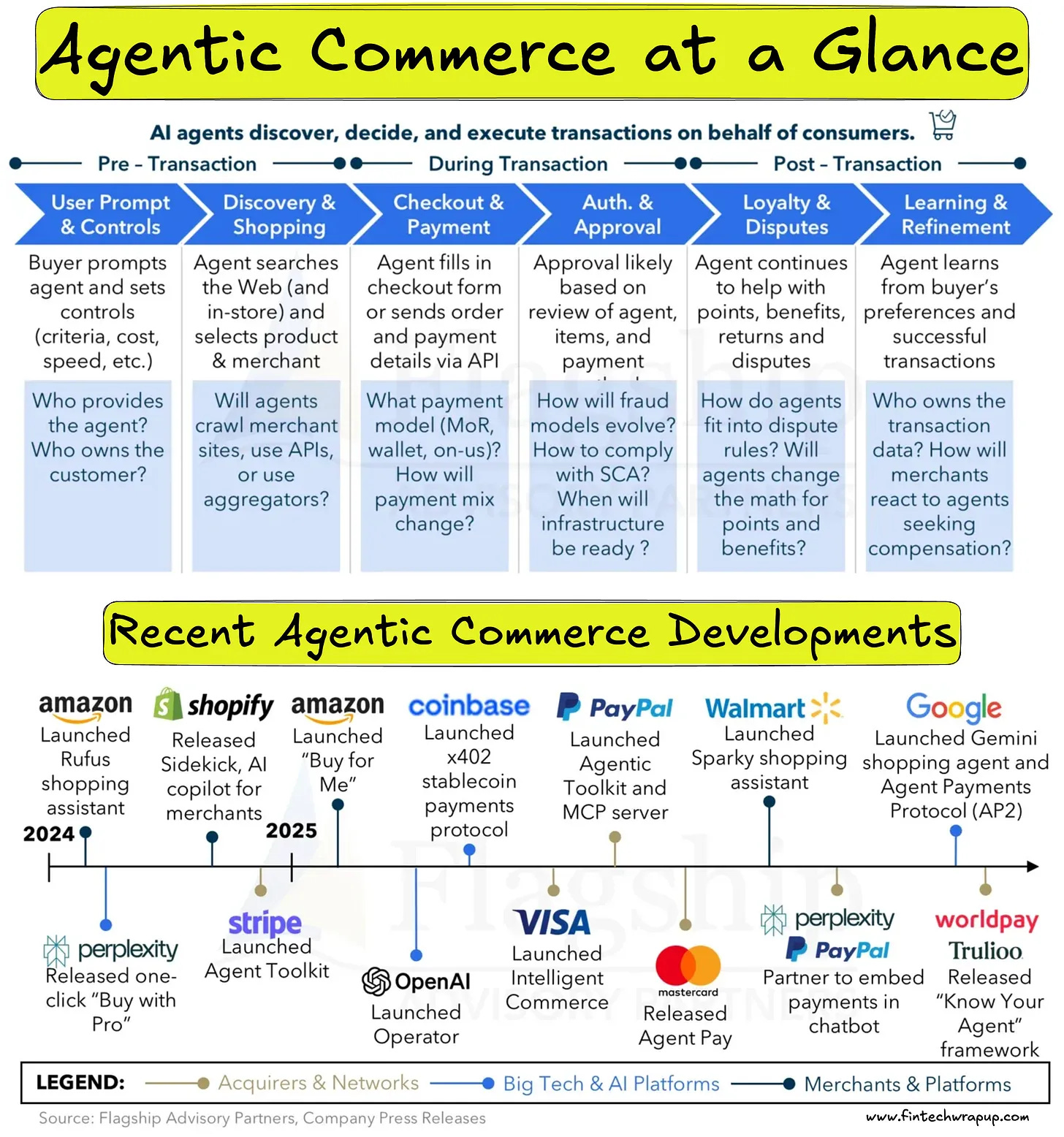

Agentic Commerce: Mobile or the Metaverse

Key Insights:

1. ARK Invest forecasted that AI agents could facilitate nearly $9 trillion in payments by the end of the decade (25% of ecommerce), growing from basically zero today.

2. However, for agentic commerce to achieve that level of success, it must be trusted by customers and supported by merchants, which will require robust and accessible technology, fair and sustainable economics, and updates to the fundamental rules that govern digital payments today.

3. If agentic commerce scales, it will fundamentally alter behavior across the customer journey: how people search for products, make purchasing decisions, pay for goods, and interact with loyalty programs. It is far more than an evolution of the checkout experience.

It’s still a fair question to ask, at this early stage, will agentic commerce turn out like Mobile (transformative) or the Metaverse (mostly hype)?

4. Agentic Commerce Market Cap

A. Visa Intelligent Commerce

🔹 Two net-new capabilities (payment instructions and signals) supported by three pre-existing capabilities (authentication, tokenization, and personalization (data tokens))

🔹 Authenticated users can create agent-specific tokens, which are locked until users describe payment instructions

🔹 At point of purchase, agent shares purchase characteristics with Visa, which validates those signals against the instructions and unlocks the token

🔹 With user opt-in, buyer insights can be shared with agents’ context window for personalization

Curated News

💳 Payments

Payroc Acquires BlueSnap to Expand Global Reach

Payroc has completed its acquisition of BlueSnap, enhancing its global payment capabilities and merchant service offerings. The merger strengthens Payroc’s cross-border payment infrastructure and positions it to better serve international businesses.

Source

Visa’s Scam Disruption Unit Hits $1B Milestone

Visa’s fraud prevention division has successfully prevented $1 billion in scams, including $260 million in Europe alone. This milestone reflects Visa’s ongoing commitment to fighting financial fraud through AI-driven monitoring and global partnerships.

Source

False Declines Costing Merchants More Than Fraud, Says Chargebacks911

A new study warns that false declines — legitimate transactions wrongly rejected — are now costing merchants more revenue than fraud itself. The findings call for smarter fraud detection systems that balance security and customer experience.

Source

ACI Survey: Payment Flexibility Drives Retail Growth

According to ACI Worldwide, nearly two-thirds of global retailers say offering multiple payment methods boosts revenue. The report highlights the growing consumer demand for diverse payment options including digital wallets and BNPL services.

Source

Routefusion Raises $26.5M to Expand Global Payments

Routefusion secured $26.5 million in new funding to enhance its international payments infrastructure. The capital will be used to expand into new markets and streamline cross-border money movement for fintech clients.

Source

Nuvei to Power In-Vehicle Payments for Volkswagen Brazil

Nuvei has partnered with Volkswagen Brazil to enable in-car payments, letting drivers make purchases directly from their vehicles. The partnership highlights growing innovation in connected commerce and mobility payments.

Source

🏦 Banking

Major Banks Explore Blockchain-Based Digital Money

A consortium of leading global banks is piloting blockchain-based digital money systems aimed at improving settlement efficiency. The initiative reflects the financial sector’s growing interest in distributed ledger technology for institutional use.

Source

Bank of Singapore Deploys AI for Wealth Source Checks

The Bank of Singapore is leveraging AI to automate its source-of-wealth verification process, reducing manual reviews and enhancing compliance. The initiative demonstrates how AI can streamline regulatory operations in private banking.

Source

Lumin Digital Partners with Ent Credit Union

Lumin Digital has been selected by Ent Credit Union to modernize its digital banking experience. The partnership aims to improve member engagement and provide more personalized online banking services.

Source

FIS Brings AI to Personalized Digital Banking

FIS has introduced new AI-powered tools to enhance digital banking, offering seamless and personalized experiences for users. The innovations aim to help banks meet rising expectations for tailored digital financial services.

Source

💰 Fintech

Klarna and Google Cloud Partner on AI-Powered Shopping

Klarna and Google Cloud have formed a strategic AI partnership to deliver more engaging and creative shopping experiences. The collaboration will use generative AI to enhance product discovery and personalization for millions of users.

Source

PicPay Targets $500M US IPO

Brazilian fintech PicPay is reportedly preparing for a U.S. IPO that could raise up to $500 million. The move underscores growing investor appetite for emerging-market fintechs with large user bases and payments ecosystems.

Source

Happy Money Expands Hive Lending Platform

Happy Money has expanded its proprietary Hive platform to speed up credit decisions and strengthen partner integrations. The upgrade aims to enhance lending efficiency and drive customer acquisition.

Source

Yodlee Launches Credit Reporting Subsidiary

Yodlee has launched a Consumer Reporting Agency division to expand credit access and enable fairer lending decisions. The new unit integrates financial data analytics with credit reporting infrastructure.

Source

🪙 Crypto

Ripple Partners with Bahrain Fintech Bay

Ripple has teamed up with Bahrain Fintech Bay to promote digital asset innovation and support local startups. The collaboration aims to advance blockchain adoption in the MENA region.

Source

BCP Launches Criptococos, Peru’s First Crypto Bank

Banco de Crédito del Perú (BCP) has launched Criptococos, the country’s first crypto banking platform, in partnership with BitGo. The platform will allow customers to manage both fiat and digital assets securely.

Source

Cake Wallet Unveils xStocks for Tokenized Investing

Cake Wallet has launched xStocks, a feature enabling users to invest in tokenized stocks and ETFs directly from their crypto wallets. The update bridges the gap between traditional investing and decentralized finance.

Source

📉 WealthTech

SoftBank Seeks $5B Loan Backed by Arm Stock

SoftBank is in talks for a $5 billion margin loan backed by its Arm shares, as it looks to raise capital amid tech market volatility. The move highlights the company’s ongoing efforts to unlock liquidity from its investment portfolio.

Source

⚖️ Regulation / Other

JP Morgan Mandates Biometric Access for Staff

JP Morgan Chase is requiring employees to submit biometric data, such as facial recognition, to enter its Manhattan headquarters. The policy, which raises privacy questions, aims to enhance workplace security.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.