Mastercard Launches Commercial Connect API

Mastercard has unveiled its Commercial Connect API, a new solution aimed at streamlining commercial payments by connecting businesses, financial institutions, and partners through a unified platform. The API simplifies access to Mastercard’s data and services, allowing for faster onboarding, improved reconciliation, and enhanced automation for B2B transactions. This move underscores Mastercard’s commitment to driving efficiency and innovation across the commercial payments ecosystem. By empowering developers and enterprises with flexible integration options, Mastercard is positioning itself as a central player in the evolution of embedded finance and API-driven infrastructure. The launch further reflects the global trend of open finance and the growing demand for real-time, data-enabled payment solutions.

Insight of the Day

Using Data and AI to Combat Instant Payments Fraud

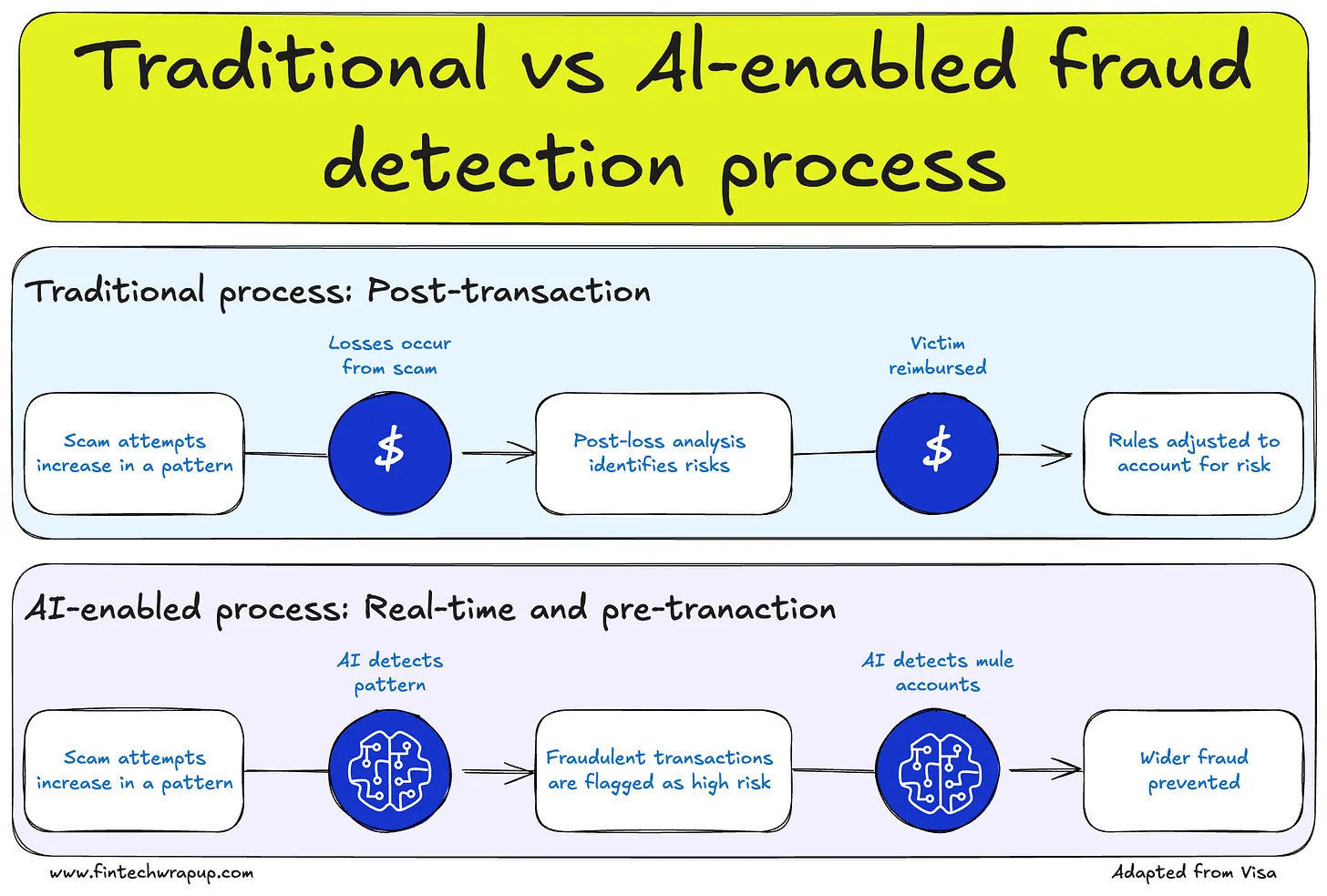

The rise of instant payments has made AI-powered fraud detection a necessity. Unlike traditional rules-based systems, AI can spot subtle behavioral patterns across vast datasets in real time—vital for detecting complex, fast-moving fraud.

Yet, as AI becomes central to fraud prevention, its responsible and transparent use is just as important. Consumers must be protected not only from fraud but also from the unintended harm of biased or opaque AI models. The stakes are high: an estimated 42.5% of fraud attempts now use AI, and nearly a third are successful.

Criminals are evolving too, leveraging deepfakes and generative AI to bypass controls. The global market for deepfake detection is projected to grow 42% annually, from €4.73B in 2023 to €13.5B by 2026. Businesses are responding—three-quarters plan to adopt AI-driven fraud prevention tools—but fewer than a quarter have begun implementation, exposing a gap between awareness and action.

At its core, AI’s strength lies in pattern recognition—automatically identifying relationships and anomalies in data. Just as a human analyst might, AI detects shifts such as unusual geolocation, new devices, or behavioral changes. In money-laundering cases, for example, mule accounts often move funds in chains; AI’s ability to view the network as a whole helps uncover these linked transactions.

Curated News

💳 Payments

Trustly Enables Recurring A2A Payments for seQura Eyewear Subscriptions

Trustly has introduced recurring account-to-account (A2A) payment capabilities for seQura’s eyewear subscription service, allowing customers to manage regular payments directly from their bank accounts. This marks another step forward in A2A adoption across consumer markets, reducing reliance on cards and improving payment efficiency.

Source

PayPoint and NoteMachine Partner to Support 3,000+ ATMs

PayPoint has partnered with NoteMachine, a Brink’s company, to enhance ATM access across the UK, supporting over 3,000 machines nationwide. The collaboration aims to improve cash availability and financial inclusion amid declining bank branch networks.

Source

U.S. Faster Payments Council Releases State of Play Report

The U.S. Faster Payments Council has published its latest State of Play report, assessing the adoption and challenges of faster payment systems nationwide. The findings highlight progress in real-time payment infrastructure while calling for greater interoperability and fraud mitigation efforts.

Source

🏦 Banking

Tech-Focused Erebor Bank Secures Conditional OCC Approval

Erebor Bank has received conditional approval from the U.S. Office of the Comptroller of the Currency (OCC) to launch operations as a tech-driven financial institution. The move marks a significant milestone in the ongoing digital transformation of the U.S. banking sector.

Source

Santander Merges Openbank With Consumer Finance Unit

Santander has announced the merger of its digital bank Openbank with its consumer finance division to create a unified retail platform. The integration will streamline operations and expand the bank’s digital offerings across Europe.

Source

Lunar Secures EU License as First Scandinavian Challenger Bank

Lunar has become the first Scandinavian challenger bank to obtain a new EU banking license, enabling broader expansion across the region. The move strengthens Lunar’s positioning as a leading digital-native financial institution in Northern Europe.

Source

💰 Fintech

SBS Reinvents Itself to Lead in Digital Finance

SBS has rebranded and modernized its operations to shed its legacy image, embracing innovation to compete with leading fintechs. The transformation includes digital product enhancements and strategic partnerships to deliver faster, tech-driven services.

Source

bunq Accelerates Global Growth With Premium Rewards

Digital bank bunq is expanding its global reach with a new premium rewards program powered by Ascenda. The offering aims to enhance user engagement and loyalty through exclusive travel and lifestyle benefits.

Source

Sonder Partners for Invoicing, Reports Q2 Results

Sonder has entered a new invoicing partnership while revealing its second-quarter financials, underscoring operational progress amid sector challenges. The partnership enhances corporate travel payment capabilities.

Source

Supermicro Expands Into Data Center Construction

Supermicro is launching a data center construction arm to complement its server business as it continues its recovery on the stock market. The initiative aims to capture growing demand for AI and cloud infrastructure solutions.

Source

🪙 Crypto

Coinbase Invests in India’s CoinDCX at $2.45B Valuation

Coinbase has backed India’s leading crypto exchange CoinDCX in a new funding round valuing the firm at $2.45 billion. The move highlights renewed investor confidence in India’s regulated digital asset market.

Source

YZi Labs Leads $50M Round for Stablecoin Network

YZi Labs has led a $50 million investment in Better Payment Network, a stablecoin-focused infrastructure startup. The funding will accelerate the development of global payment rails using blockchain technology.

Source

Bitget Wallet Launches Crypto Card Across Asia-Pacific

Bitget Wallet has introduced a new crypto-linked payment card across Asia-Pacific markets, allowing users to spend digital assets seamlessly in local currencies. The move signals growing mainstream crypto adoption in the region.

Source

Police Seize $34M From NextTech Founder in Crypto Fraud Case

Authorities have confiscated $34 million from the founder of NextTech following a large-scale crypto fraud investigation. The seizure underscores regulatory vigilance and the crackdown on illicit crypto schemes.

Source

Telcoin Raises $25M to Launch Regulated Digital Asset Bank

Telcoin has raised $25 million to establish a regulated digital asset bank, bridging crypto services with traditional banking. The move aims to strengthen compliance and mainstream blockchain-based financial services.

Source

M2 Capital Invests $21M in AVAX Digital Asset Treasury

M2 Capital has announced a $21 million investment in AVAX One, a new digital asset treasury built on Avalanche. The initiative enhances institutional access to decentralized asset management tools.

Source

📈 WealthTech

SS&C Acquires Calastone, Clover Emerges From Stealth

In a wave of wealthtech developments, SS&C has acquired fund network Calastone while fintech startup Clover emerged from stealth with a new digital investing platform. These moves signal increased M&A and innovation across the wealth management space.

Source

⚖️ Regulation

Bank of England Explores AI, DLT, and Quantum Computing

The Bank of England has released a comprehensive report outlining its strategy toward artificial intelligence, distributed ledger technology, and quantum computing. The paper emphasizes responsible innovation while maintaining financial stability and resilience.

Source

🤖 Other

Allianz UK Appoints Head of AI to Drive Growth

Allianz UK has named a new Head of AI to advance its innovation strategy and improve operational efficiency. The appointment reflects the insurer’s focus on data-driven transformation and smart automation.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.