Mastercard Nears $2B Deal to Acquire Crypto Firm ZeroHash

Mastercard is reportedly close to finalizing a $2 billion acquisition of ZeroHash, a leading crypto infrastructure provider. The deal would mark one of the largest traditional finance moves into digital assets to date, expanding Mastercard’s footprint in crypto settlement and tokenization services. By integrating ZeroHash’s crypto-as-a-service tech, Mastercard aims to strengthen its digital asset offerings for banks and fintech partners. Analysts see this as a signal of renewed institutional confidence in the crypto sector after regulatory clarity improved across major markets. The acquisition could reshape how Mastercard bridges blockchain and fiat networks globally, reinforcing its reputation as a digital payments innovator.

Video of the Day

Insight of the Day

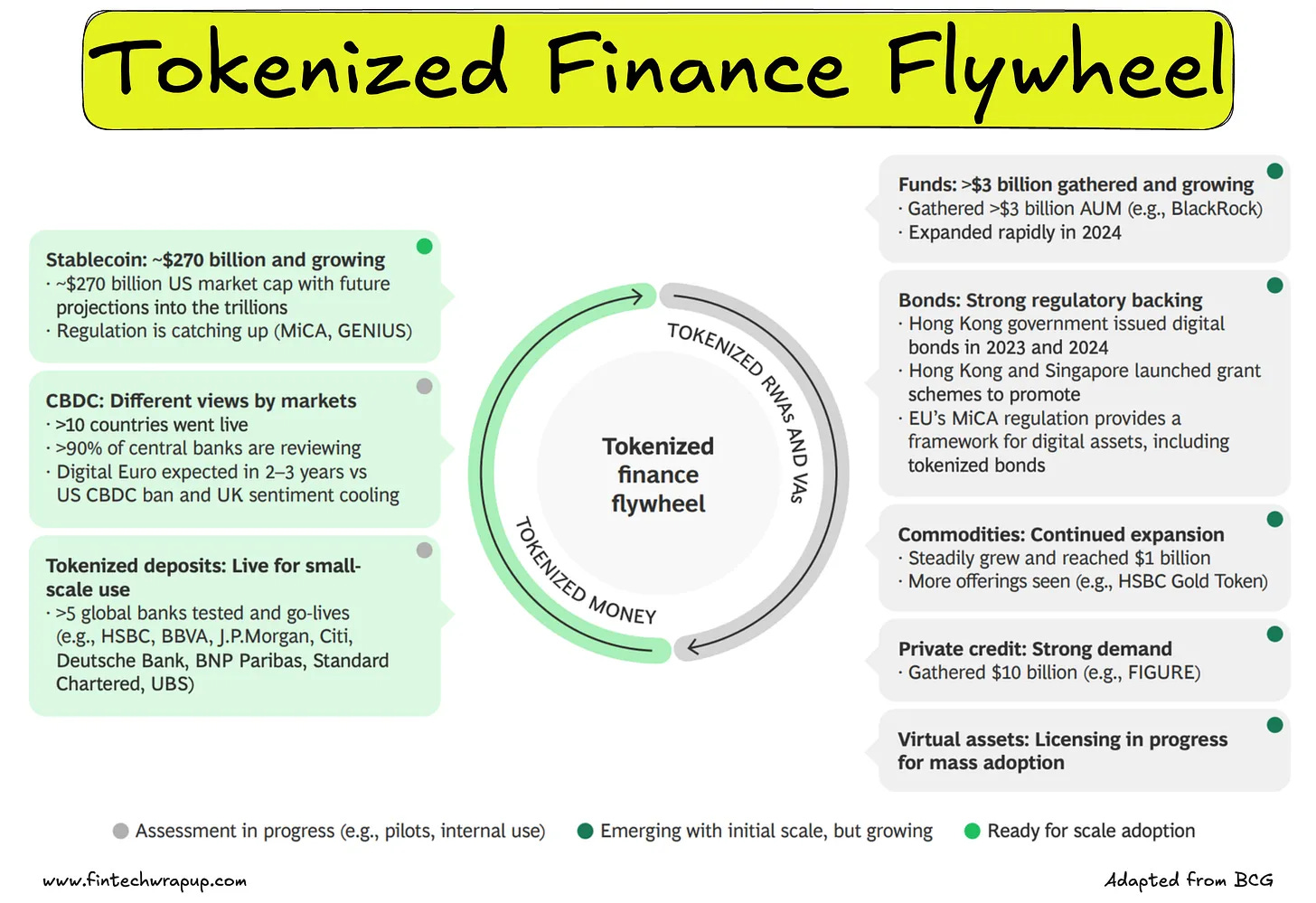

The Tokenized Finance Flywheel Is Here

The financial system is entering a new era — one where money, assets, and value exist as digital tokens moving seamlessly across programmable networks. What once felt like theoretical innovation is now rapidly materializing into a functioning ecosystem — a tokenized finance flywheel that’s spinning faster than many expected.

🔹 From Stablecoins to Tokenized Deposits

It all starts with money — and stablecoins are leading the charge. With a combined market cap nearing $270 billion, stablecoins are now the largest and most mature form of tokenized money. Regulation is catching up, too: the EU’s MiCA and the U.S. GENIUS Act are setting clearer frameworks for compliant issuance and usage. What began as a crypto-native experiment is now evolving into institutional-grade infrastructure.

Meanwhile, tokenized deposits are gaining traction as banks test blockchain rails for traditional money. More than five global banks — including HSBC, BBVA, J.P. Morgan, Citi, and Deutsche Bank — have launched pilots or limited rollouts. While these are still small-scale, they mark a crucial shift: regulated money moving on tokenized systems.

🔹 CBDCs: Fragmented Momentum

Central bank digital currencies (CBDCs) present a more fragmented picture. Over ten countries have gone live, and more than 90% of central banks are exploring them. However, the direction differs by region — Europe is actively developing a Digital Euro, while the U.S. has cooled its stance, effectively banning a federal CBDC. The UK, too, is treading carefully. It’s a reminder that while private innovation surges ahead, public policy still hesitates.

🔹 The Other Side of the Flywheel: Tokenized Assets

As tokenized money gains ground, the flywheel turns toward tokenized real-world assets (RWAs) and virtual assets (VAs) — bringing liquidity, transparency, and programmability to everything from bonds to private credit.

Curated News

💳 Payments

Razorpay Expands UPI Reach to Malaysia Through Curlec and NPCI Partnership

Razorpay’s subsidiary Curlec has partnered with India’s NPCI to enable UPI payments in Malaysia, marking the first such cross-border integration for Indian payment rails. This move enhances interoperability and could redefine how Indian travelers and businesses transact across borders.

Source

payabl. Brings Connected In-Store Payments to the UK

Fintech payabl. is introducing connected omnichannel payment solutions to UK merchants, blending in-store and online transactions into a single ecosystem. This launch supports retailers seeking unified customer experiences and better transaction insights.

Source

Mint Payments and Travel Network Group Team Up for Seamless Travel Payments

Mint Payments has joined forces with The Travel Network Group to modernize payment processing for UK travel businesses. The partnership aims to cut costs and simplify settlement processes in a complex travel payments landscape.

Source

🏦 Banking

Monzo Appoints Former Google Executive Diana Layfield as CEO

Monzo’s founder passes the CEO torch to Diana Layfield, a former Google executive, signaling a shift toward AI-driven growth and global scaling. Layfield’s background in tech and finance could strengthen Monzo’s innovation and international strategy.

Source

Infosys Deepens Metro Bank Partnership with Workday Integration

Infosys has expanded its collaboration with Metro Bank to modernize finance operations using Workday solutions. The initiative targets improved efficiency and agility in the bank’s financial management systems.

Source

Shawbrook’s $2.58B IPO Marks LSE’s Biggest in Two Years

UK lender Shawbrook surged after listing in London with a $2.58 billion valuation, marking the largest UK IPO since 2023. The strong market debut signals renewed investor confidence in the financial sector.

Source

💡 Fintech

ESW Unveils Agentic AI Hub for Global Commerce

E-commerce enabler ESW launched its new Agentic Hub, leveraging agentic AI to enhance automation and personalization in cross-border retail. The platform aims to streamline operations and boost conversion rates for merchants worldwide.

Source

Jupiter Money Secures $13M to Fuel Growth in India

Indian fintech Jupiter Money raised $13 million in fresh funding to expand its digital banking platform. The capital will be used to enhance user acquisition and strengthen product offerings in personal finance management.

Source

SavvyMoney Raises $225M to Expand Credit Insights Platform

Credit analytics firm SavvyMoney secured a $225 million minority investment from PSG and Canapi Ventures. The funding will accelerate growth and expand its partnerships with banks and credit unions across North America.

Source

MDT Launches Fintech Partner Program for Credit Unions

Member Driven Technologies (MDT) announced a new partner program to connect credit unions with vetted fintech innovators. The initiative aims to foster collaboration and speed up digital transformation in the credit union sector.

Source

🪙 Crypto

Solana and XRP Futures Become CME’s Fastest-Growing Crypto Products

Solana and XRP futures have emerged as top performers on CME, reflecting rising institutional interest in altcoin derivatives. The surge underscores mainstream appetite for diversified crypto exposure.

Source

Bitcoin Traders Turn Bearish Amid U.S. Government Shutdown Concerns

Bitcoin sentiment has shifted bearish as investors brace for what could be the longest U.S. government shutdown in history. Traders are reducing risk exposure, signaling macro uncertainty spilling into digital assets.

Source

Crypto Gaming and NFT ETF on the Horizon, Says D24 Fintech

D24 Fintech predicts the launch of a Crypto Gaming and NFT ETF, citing strong investor demand for thematic blockchain exposure. The ETF would offer diversified access to emerging Web3 entertainment ecosystems.

Source

🏛️ Regulation

Digital Euro Pilot Expected in 2027 Before Full Launch in 2029

The European Central Bank plans to pilot the digital euro by 2027, with a potential launch in 2029. The move represents a major step toward central bank digital currency adoption in the EU, balancing innovation with regulatory oversight.

Source

💰 WealthTech

Linedata Expands UK Services to Boost Wealth Management Efficiency

Linedata is expanding its global services offering in the UK, enhancing support for wealth and asset managers. The move aims to streamline operations and improve client engagement through data-driven tools.

Source

🤖 Other

UK Startups Lack AI Expertise at the Board Level

A new report reveals that UK startups are falling behind in AI adoption due to limited expertise among board members. The talent gap could hinder innovation and competitiveness across the UK’s growing tech ecosystem.

Source

OpenAI Partners With Nubank to Launch ChatGPT Go in Brazil

OpenAI has debuted ChatGPT Go in Brazil, partnering with Nubank to provide exclusive benefits to users. The collaboration brings generative AI into mainstream banking, signaling a deepening connection between AI and fintech.

Source

R2 and Ant International Expand SME Credit Access in LATAM

R2 has joined forces with Ant International to broaden credit access for Latin American SMEs. The partnership leverages alternative data and digital finance tools to support underserved business segments.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.